The major theme of this week's missive revolves around the primary reason that gold exploded from US$1,881 to US$1,945 per ounce in Friday's session. The answer is — in four words — I have no idea. Notwithstanding the fact that gold was egregiously oversold going into the month of October, I cannot recall a stretch where gold was down every day from September 25 to October 5 — nine consecutive days V shedding US$120 per ounce — with the relative strength index ("RSI") diving from 58.33 to 20.52.

Gold's Sudden Explosion

It might have been "computers gone wild" with some rogue algorithm pressing bearish bets attempting to break the uptrend line drawn off the August 2018 and November 2022 lows. It might have been a long liquidation forced by a margin call on a fund drastically underwater on a leveraged long bond position. It might have been the insiders at the Fed and U.S. Treasury suddenly waking up and realizing that the U.S. is essentially insolvent, with tax revenues sadly lagging expenditures by a trillion dollars or so going into 2024.

It could have been those same insiders after watching the Treasury auctions last week, where paltry demand and burgeoning supply sent the yield on the long bond from 4.65% to 4.85% in a matter of seconds, deciding that since the only collateral backing those bonds is the 8,311 metric tonnes of gold held by the Treasury (allegedly), that maybe — just maybe — the book value price of US$42.22/ounce was a tad "light" and that a larger number — perhaps US$11,256 per ounce — might help alleviate the fears of the bond-buying public.

You see, 8,311 metric tonnes is actually 293,162,214 ounces of gold, and if you take the U.S. national debt and exclude entitlements (like Social Security and Medicare) at US$33 trillion ( and rising daily), that computes to 112,565 U.S. currency units known as "dollars" per ounce of national debt.

If we use the mortgage lenders as an example, they usually want a minimum of 10% as a down payment on a residential transaction. If U.S. Treasury bond buyers (lenders of money to the U.S. government) demanded collateral representing 10% of the national debt, the government would need to re-price the only collateral they have (outside of massive tax increases) — GOLD — at 10% of US$112,564 per ounce or US$11,256 per ounce.

Since the great fear for those re-pricing something arbitrarily is inflation, the government planners and strategists would have little fear of that happening because, along with their hatchet-men on Wall Street and the compromised financial media, U.S. citizens are large bereft of any gold (or silver save with what they eat Sunday dinner) thanks to the 43-year gold-bashing campaign carried out masterfully in markets by the N.Y. Fed and their wingmen at the LBMA.

Accordingly, you could re-price gold to US$11,256 per ounce, thus saving the gold mining industry, many of whom have started to diversify into copper, lithium, and energy due to lack of interest. As for the average citizen, they have their net worth parked in technology stocks, so with the golden windfall suddenly appearing out of nowhere, the less than .5% (yes, that is "point five percent") held in institutional portfolios would not create a sudden explosion in purchasing power (like those cash drops from government helicopters designed to offset the effect of that nasty flu bug that showed up on a Chinese dinner plate back in 2020) and with no monetary bump from the sudden rise in gold prices, inflation would remain "transitory" with the main beneficiaries being the elected spendthrifts in Washington whose brilliant move to collateralize their Treasury market would turn out to be a Michael Dickson punt of the fiscal can taking it so far down the road that one would need a telescope to see where it might land.

So, therein lies my theory on gold's sudden US$60/ounce explosion on Friday. Take it for what it is worth.

SPDR Gold Shares

Subscribers were told after a massive "miss" to the upside in the employment numbers a week ago on Friday that last week I would be executing the "20%-times-5" Rule where I want to buy something but have zero clue as to what price I should pay. SPDR Gold Shares ETF (GLD:NYSE)

So, in order to spread my risk over a series of entry points, I divide my capital into five equal parts (20% per part), and I allocate it over the five-day market week that was last week.

I had to fire off an emergency email pre-opening on Friday morning advising subscribers not to execute the final 20% purchase into what was looking like a US$4 uptick in the SPDR Gold Shares ETF (GLD:NYSE), where I had been slowly accumulating a position in the December US$170 calls in the US$6.50-7.50 range in the Monday through Thursday trading sessions.

Well, that turned out to be a "less-than-stellar" piece of "erudite advice" because the calls opened at US$9.59, traded down to US$9.35, then proceeded to rocket to their closing price of US$11.26 after touching US$11.42.

Brilliant.

New Highs Coming

In the world of investing, there is a fatal flaw called "overthinking" a move. You have a seemingly good idea, well-researched and carefully thought out, and you begin to execute the plan when something or someone triggers uncertainty, and you abruptly change the plan by either quitting or exiting the position, usually over the most trivial of reasons but always caused by runaway emotion — either greed of fear.

Even grizzled veterans of the trading wars like me can be victimized by "overthinking," and while an 80% position costing US$7.23 now ahead over 55% in less than a week might seem acceptable, it is the amateurish move to abandon my plan that bugs me.

The chart at the beginning of this missive showing what happened the last two times gold's RSI plunged below 30 into oversold status is a highly compelling argument for "News Highs by New Year's Day" (which I tweeted out on Friday morning). At those two low points in September 2022 and March 2023, the ensuing recovery rallies took gold up 22% and 15.1%, respectively, but from levels far lower than the low seen on October 5, the day before the NFP surprise arrived.

That was also Day Nine of the waterfall decline. If this recovery rally takes gold up at least as much as did the one in March, then a 15% advance of the October 5th lows around US$1,825 takes us to a closing new high of US$2,098.

If we mirror the 22% advance of the September 2022 lows, we see US$2,226. Either way, the odds favor new all-time highs by New Year's Day.

That is my "call" — new highs coming.

VanEck Gold Miners ETF (GDX:NYSEARCA)

If that turns out to be a correct call, I should point out that the senior and junior Gold miners are still ridiculously cheap by any and all measures.

The Senior Gold Miner ETF, VanEck Gold Miners ETF (GDX:NYSEARCA), topped in August 2020 at US$44 as gold was topping out at US$2,075. That is a 51.7% move from the Friday close, around US$29.

If we mirror the 2022 rally of 22%, GDX:US sees US$50-60 in a N.Y. minute.

Stocks

As I was attempting to execute the "20%-times-5" Rule for the GLD December US$170 calls, I was also doing the same in attempting to position myself for a big year-end rally in stocks. I bought five 20% allotments in the SPY December US$445 calls, averaging US$6.89.

In retrospect, I wish I had been guilty of "overthinking" that trade because the stock market did not take lightly the horrid bond auction of last week that scuppered the big drop in yields that came on the heels of the flare-up in the Middle East.

The flight-to-safety bid in bond prices was replaced by the Get-out-of-Dodge action of the bond vigilantes who were rearing up in protest at the enormous supply of treasuries being actioned off to fund the massive deficits.

The SPY ran into a brick wall at the convergence of the 50-dma and 100-dma lines around US$437, which they did on Thursday before reversing along with bond yields due to the action in the auction.

SPDR S&P 500 ETF (SPY:NYSE)

I continue to maintain that by December, the SPDR S&P 500 ETF (SPY:NYSE) will test the range between the July-September peaks between US$457 and US$452.

However, I cannot totally ignore the dreary action in the bond market, particularly because it was not a Fed Speaker statement or adverse policy decision that triggered the rout.

It was a market function and not an exogenous event, and that is always disturbing for a market purist like me.

Junior Resource Stocks

I draw your attention to the benchmark for junior resource stocks — the TSX Venture Exchange — which hit a yearly low on October 5, ironically the same day that gold bottomed under US$1,825. The 52-week low was 524.42, yet despite Friday's massive uptick in gold bullion, the TSXV went out for the week at a paltry 529.13. As you have all read (ad nauseam) in this column for literally decades, there is a direct correlation between gold bullion and the TSXV. Therefore, if gold sees new all-time highs by New Year's Day, there is enormous upside in the exchange, but more importantly, in some of the beaten-down juniors that have fallen 95% since August 2020.

Since we all "pump up our books," I point to TSXV junior Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB), which has crashed from CA$0.76 in early 2021 to the current price of CA$0.045. The company started out in 2020 with a silver focus as it was decided that silver had the greatest upside given the profligate spending of the global central banks and sovereigns.

With a secondary bullish bent on copper, the company did limited exploration work on a number of sub-par properties in the B.C. interior with zero success and then shifted to a grass-roots exploration probe into the Patagonia region of Argentina along the same Gastre Fault system that produced on the world's largest undeveloped silver deposits, the mighty Navidad deposit bought for over US$600 million by Pan American in 2009.

In severe bear markets in the resource sector, junior explorers get pitched under the bus faster than one can mutter "hole in the ground with a liar at the top." I recall the COVID Crash period when one of my favored juniors traded down to CA$0.08 during the meltdown only to find its footing later in the year and rising to over CA$1.70 later that year.

I recall another one that got killed in the GFC Crash in 2008 (CA$0.75 to CA$0.06 in three months), only to hit CA$1.50 by January 2010. These juniors get crushed because they are a) speculations, b) illiquid, and c) unloved by the regulators.

While there have been scams littered across the junior resource landscape over the years (BRE-X, Cartaway, etc.,), the dollar value of similar scams in the U.S. (and overseas) markets (Enron, Tyco, FTX) dwarfs the dollar value in junior resource stocks.

Norseman is one of those rare jewels with seasoned management teams and a strong Board of Directors that has a highly-prospective property called "Taquetren" located in Rio Negro Province in Argentina located proximitous to the Calcatreu Gold mine and the Navidad Silver project in the Gastre Fault region of Patagonia.

That project, in bull markets, would attract huge exploration dollars either from majors looking to partner up or from investors with an appetite for speculating on a discovery. I spoke with management last week and learned that they are also actively pursuing opportunities in advanced exploration and early development projects related to metals critical to the Electrification Movement, which covers the electrification trilogy of uranium, copper, and lithium.

At CA$0.045, they have been absorbing a large block of stock offered by one of the 2021 property vendors and appear to have finally taken them out.

This is the kind of company that carries the leverage that historically propels trashed juniors to 10-bagger returns once the TSXV stabilizes.

Weighted S&P 500 vs. The Unweighted S&P 500

As we enter the home stretch for the 2023 trading year, we have approximately ten weeks left and many underperforming portfolio managers.

People I know from Baton Rouge to Helsinki keep telling me how their portfolios have either lagged or crushed the S&P 500 this year.

The Albertans I know that only own oil and gas stocks are smiling, while those that have broadly diversified portfolios carrying 40% bond positions are in mourning.

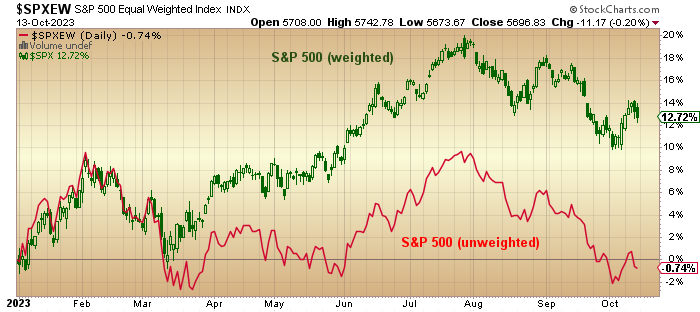

However, one look at the chart of the "weighted" S&P 500 versus the "unweighted" S&P 500 and you see a glaring difference in the annual rates of return because, as you all know too well, the "weighted" S&P 500 assigns heavier allocations for the large-cap stocks (mostly technology).

I only make mention of this because when I drill deeper into the majority of stocks contained in the NASDAQ and Russell 2000 indices, there are a great many tax-loss selling candidates that are going to get pitched between now and year-end. Conversely, there are so few big winners in the TSXV group that tax-loss selling will be largely confined to companies that had any real volume in 2023, which will be a very small number due to the abysmal investor sentiment for the juniors for most of the year.

Whenever I see stocks bouncing along the bottom that I see as having either strong management teams or strong projects (or both, which is rare), I get out my blue pen and begin to accumulate. When my risk is simply one of having "dead money" versus chasing the high-flyers of the S&P 500, I gladly take the former.

Nourishment for contemplation.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Norseman Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.