The United Auto Workers (UAW) union strike, which began on September 15 with 12,700 of Detroit's Big Three automakers' 146,000 workers taking to the picket line, threatens to become even more widespread by Friday. Though Ford, General Motors (GM), and Chrysler parent Stellantis are countering work stoppages by laying off thousands of workers and draining inventories, the UAW entered the dispute with $825 million in its strike fund to help workers make do without pay should they walk off the job.

The Washington Post notes that full-time employees at the Big Three make an average of $18 to $32 per hour, or $720 to $1,280 per week. This puts a rough estimate of the UAW's weekly expenditure of strike pay somewhere between $9.1 million and $16.2 million at its current scale. That means the UAW purse could sustain payments to striking workers for more than 51 weeks (356 days) — immensely longer than the most protracted UAW strike in U.S. history at just over 16 weeks (113 days) back in the 1940s. That glut of cash suggests that the UAW has significant capacity to scale up its action against the automakers if common ground cannot be found soon.

The plants currently targeted by the union produce the Ford Bronco, Jeep Wrangler, Chevrolet Colorado, and some other popular models. Firms and employees outside of the Big Three are also feeling the impact of the strike, as Reuters reports that Detroit-based LM Manufacturing has temporarily furloughed 650 workers who produce seats for the Ford Bronco because of the impact of the assembly plant closure. Auto production itself amounts to just 2.9% of GDP, suggesting that any direct economic impact from the strikes is likely to be negligible if it does not grow much larger. Even at full scale, with all 146,000 UAW workers striking for a full month, RSM estimates this effort would create only a -0.2% drag on annualized growth of U.S. GDP for the quarter. However, the potential expansion of the strike, which appears likely, begins to raise more risks in the consumer economy. The more workers that strike, the faster already slim auto inventories will need to be drawn down.

The Bureau of Economic Analysis pegged domestic auto inventories at roughly 151,000 units in July. That's up 82.9% from a series low of just under 82,000 in July of last year but still very thin by historical standards. From August 2012 to September 2017, auto inventories never dropped below the 1-million-unit mark. Since then, inventories have diminished severely. As these inventories are thinned out by new vehicle demand, prices will have to rise. CBS News reports that hikes in vehicle prices could be anywhere from 10.0% to 20.0%, compounding prohibitive financing pressure already dampening auto sales. The prospect of a decline in car sales is a much more consequential factor for economic growth than the auto strike. In the 50-plus years of available data from the Commerce Department, The Wall Street Journal notes that there has never been a recession in the U.S. without a decline in new vehicle sales.

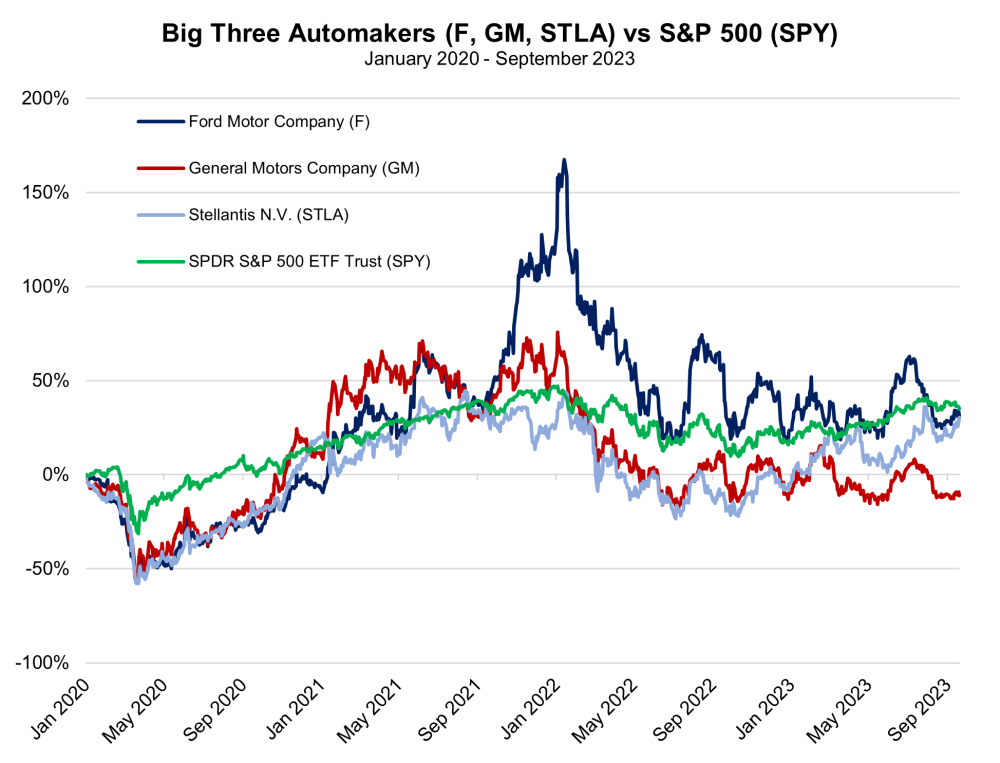

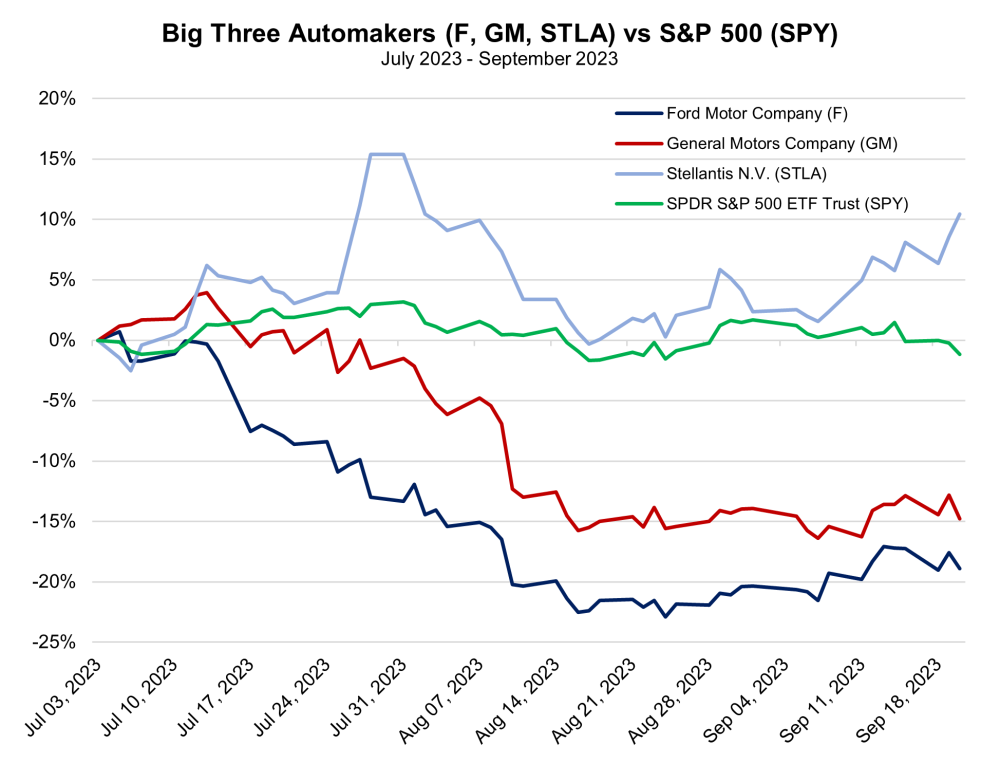

Surging profits and, more specifically, benefits for shareholders have been heavily criticized by the UAW. In the past twelve months, the Big Three have utilized excess profits to authorize $5 billion in stock buybacks over the past twelve months alone. While this has been criticized by many as "greed," share prices of Ford and GM remain well off of highs reached in years past, and repurchasing stock at lower prices could be justified as bolstering the firm's capital and looking toward future expansion.

In addition to rising profitability, the UAW says its rationale for pay hike demands is rooted in steep raises in executive compensation. The union began its negotiations demanding a 46.0% boost through 2027 (with 20% of the wage increase up front), which is claimed was only asking for employees to be on par with CEOs. According to the UAW, the Big Three's CEO pay increased by 40.1% from the time of the union's last contract negotiation in 2019, while autoworkers have only seen pay rise by 6.0%. However, the claims of such pay increases for executives over the past four years appear to be misleading, as ABC reporting shows they may be simply inaccurate, tied to previously granted equity that vested during the reporting period, or performance incentives. UAW's pay raise demands have shifted down a bit to 36.0% (with 18% upfront), but remain well off what automakers are yet willing to offer.

Only recently have U.S. wages begun rising faster than inflation, following two years of non-stop declines in Americans' purchasing power. Per the U.S. Census Bureau, real median household income fell by -4.7% between 2019 and 2022. That has undoubtedly put the screws on all workers, rationalizing demands for greater pay raises. But it wasn't necessarily a lack of pay raises that diminished the purchasing power of workers, so much as rampant price inflation that is just now being reined in by Federal Reserve policies. If labor costs begin to grow more aggressively in months to come, following the emergence of several union disputes in American manufacturing and logistics industries, there could be more inflationary implications ahead – potentially re-igniting a wage-price spiral, wherein rising wages become costs that are passed onto consumers and feed into aggressively rising prices.

While the UAW simultaneously wants to pay hikes and to work fewer hours, demanding a 32-hour workweek, American automaking productivity has only declined over the past decade. Per The Wall Street Journal, motor-vehicle manufacturing productivity plummeted -32.0% from 2012 to 2022. In a broader scope, employee productivity in the U.S. has remained stagnant for more than two years. While the U.S.'s Employee Cost Index is up by 11.5% since Q1 2021, the gauge of the economy's nonfarm productivity has actually declined by -0.6% over the same period. Massively increasing the cost of labor amid declining productivity from that labor could become cumbersome costs when evaluating share prices of Detroit's Big Three down the line.

Charts

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.