Sierra MadreGold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) announced through a press release that the company intends to begin a sampling program on its newest program, La Guitarra, located in Estado de Mexico. According to Gregory K. Liller, the CEO and COO of Sierra Madre, "since acquiring the La Guitarra property in March, 2023, we have completed the first-ever district-wide mapping exercise of the Temascaltepec mining district. The data will provide valuable information as we work on interrupting the controls on mineralization, advance our understanding of project-scale systems, and plan future drill programs in the Eastern and Western districts."

According to Sierra Madre, this sampling program will begin as soon as the seasonal rains end, and will provide information that could inform the location of future drill targets, such as the layout of mineralization structures.

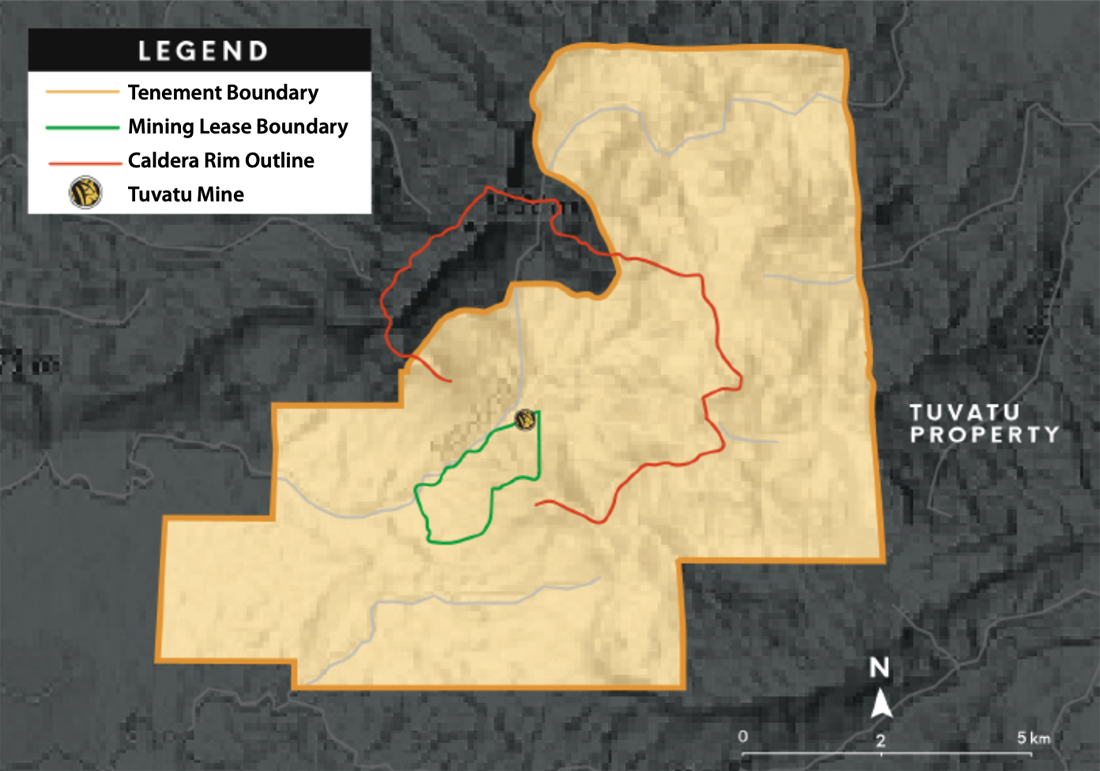

Sierra Madre reports that it has currently mapped roughly 53km of mineralization on the property, with 37.9km of that mineralization residing in the Eastern district, and 15km of mineralization in the West district. The company reports that the cluster of mineralized veins, which has been mined in the past, to the north has not yet been looked at.

Still Value in Gold

Rick Mills of Ahead of the Herd noted that while gold has slowed down somewhat, it has remained largely stable. Mills commented that "the relatively weak performance in recent months is mostly a reflection of inflation being held under control and the global economy leaning away from a recession… However, there is value to be had still, simply because gold, as an investment asset, can offer diversification in the long run." Mills believes that central banks will remain interested in gold, and noted that buying by central banks have picked up since the spring.

A Strong Speculative Buy

Technical analyst Clive Maund rated Sierra Madre as a "strong speculative buy" for investors, citing the company's upside potential and lack of any downsides. According to Maund, Sierra Madre "was effectively reborn at the end of May- early June… what happened is that the company successfully completed a big funding at the end of May and acquired the big La Guitarra gold-silver property in Mexico."

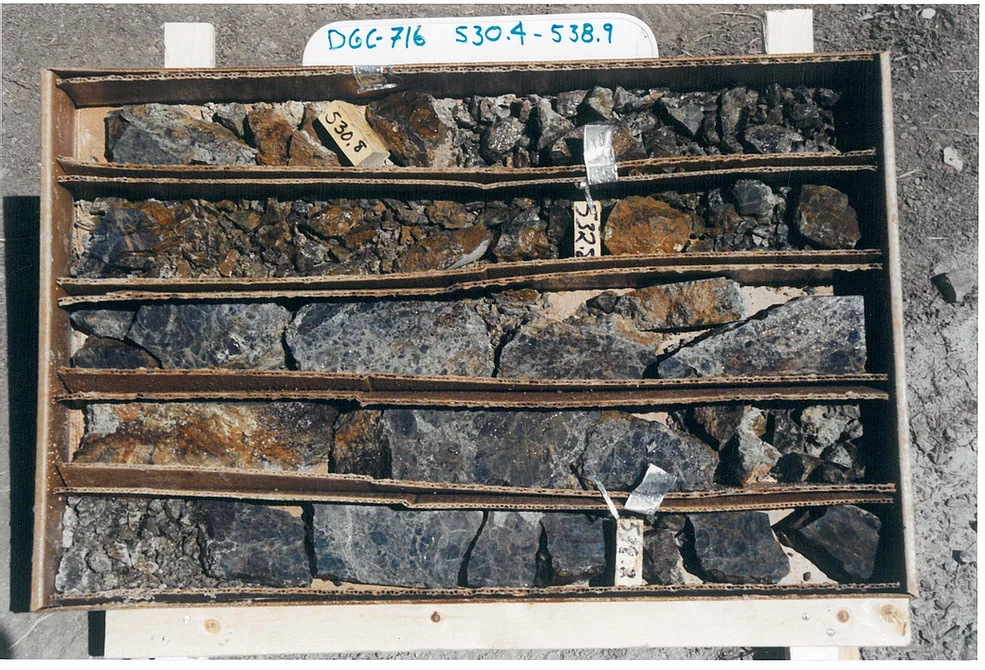

Sierra Madre reports a number of catalysts, including 65 drill holes, a historic silver resource with 7.1 million indicated ounces and 3.1 million inferred ounces, and a strong ownership and share structure.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX)

Reuters has provided a breakdown of the company's share structure, where management and insiders own 5.22% of the company. According to Reuters, CEO Alexander Langer owns 2.06% of the company with 2.94 million shares, Lead Director Jorge Ramiro Monroy owns 1.42% with 2.02 million shares, Director and Country Manager Alejandro Caraveo owns 1.24% with 1.77 million shares, Controller and Corporate Secretary Kerry Melbourne Spong owns 0.32% with 0.46 million shares, and Director Gregory F. Smith owns 0.18% with 0.25 million shares.

According to Reuters institutions own 49.77% of the company, where First Majestic Silver Corp. owns 48.40% with 69.06 million shares, and Commodity Capital AG owns 1.37% with 1.95 million shares.

Sierra Madre reports that it has CA$12 million in the bank, with a monthly burn rate of CA$200k to CA$500k.

The company reports that it has no warrants overhang at the moment, or potential sellers.

According to Sierra Madre, the analyst Oliver Donnel of VSA Capital covers the company, and that it works with the IR Firm Adelaide Capital. The company reports that it does not work with any influencers, but Thibaut Lepouttre, of Caesars Report provides news coverage and analysis of the company.

Reuters reports that the company has 142.7 million shares outstanding, with 66.19 million free float traded shares. According to Reuters, the company has a market cap of CA$41.08 million, and it trades in the 52-week period between CA$0.37 and CA$0.51.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver Ltd.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.