Zero Carbon Technologies Ltd. (ZTC) has been acquired in a strategic move that Shiftcarbon Inc. (SHFT:CSE) intends to strengthen its position with shareholders.

Wayne Lloyd, CEO of Shiftcarbon, commented, "In the midst of our business evolution, we've identified several opportunities that promise not only to enhance our current offerings but also to chart a clear trajectory for our future growth."

The company also hopes that ZTC, which is involved in a variety of green technologies, such as electric vehicle (EV) batteries and battery recycling, will bolster Shiftcarbon's line of products. In a presentation for investors, Lloyd highlighted the company's work addressing very specific markets in the European Union (EU) and said, "We're very bullish on this."

According to Sir Tony Baldry, the chairman of ZTC, "At Zero Carbon, our core mission has always centered on paving the way for a greener, more sustainable future. This merger isn't just a milestone; it's a testament to our dedication and vision. Our team is excited to introduce our groundbreaking approach to battery recycling to shareholders via the [Canadian Stock Exchange]."

The press release stated that the letter of intent (LOI) clarifies that as part of this merger, Shiftcarbon, which is listed on the Canadian Stock Exchange, will incorporate ZTC into its umbrella of assets. According to the press release, as part of the deal, Shiftcarbon will issue 100% of the outstanding and issued stock to ZTC.

According to Wayne Lloyd, "The decision to split the existing publicly listed entity into three independent units will result in every shareholder of Shiftcarbon receiving shares in each of these new entities, effectively amplifying the investor value proposition."

In an investor presentation, Shiftcarbon also acquired TraceSafe Technologies Inc., an Internet of Things (IoT) platform with a focus on the Arabian Internet, and hopes to see it listed on the CSE as a separate public issuer.

Carbon Capture and EV Market

As reported by Markets and Markets, as part of worldwide decarbonization efforts, carbon credits have seen rising demand. It's no wonder, given that, according to the EPA, American economic activities generate much of the country's carbon emissions.

According to the agency, transportation makes up the largest share, with 28%, and energy comes in second with 25%.

Mckinsey Sustainability estimates that demand could increase by 15 times by 2030, a major milestone year for most decarbonization plans. Mckinsey also noted that one of the major obstacles to carbon credit programs is that they are globally disjointed.

ZTC, which Shiftcarbon has acquired, has a hand in the battery market. According to the International Energy Agency, EV sales for 2023 in the United States have reached US$1.6 million but pale in comparison to China's US$8.0 million. This represents a significant increase from 2020, when EV sales in the U.S. amounted to 0.3 million, and sales in China were only 1.1 million.

The White House has stated that it is a goal of the Biden Administration for EV sales to make up half of all new car sales. Additionally, the Inflation Reduction Act grants consumers tax credits for buying EVs, and the administration is seeking to establish EV infrastructure and transition some public vehicles, like school buses, to EVs, further bolstering the market for EV technology.

Connecting Global Carbon Markets

Shiftcarbon Inc. has acquired a number of subsidiaries, including TraceSafe Technologies Inc., TraceSafe Canada Inc., TraceSafe Asia Pacific PTE Ltd., and Wishland Properties Ltd., moving the company toward its goal of linking up global carbon markets.

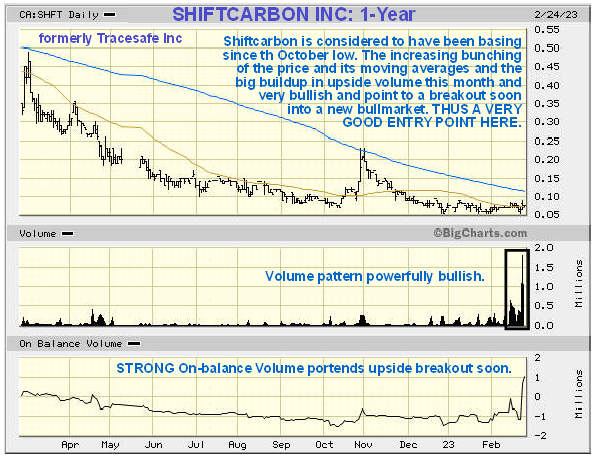

In April of last year, Technical Analyst Clive Maund commented on one of the company's assets, TraceSafe, which he listed as an "Attractive Speculative Play."

He said of the company's involvement with internet products in Saudia Arabia, "This certainly sounds like big news that should get the stock moving."

As for this year, in February, Maund posted an update on the company.

He shared the above chart, saying, "It has been under strong accumulation in recent weeks to the point that it looks like it will break higher into a new bullmarket soon."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE)

Reuters provided a breakdown of the company's ownership and shares. Management and Insiders own 18.09% of the company. James Passin, chairman of TraceSafe, owns 15.20% with 7.58 million shares, CEO and founder Wayne Lloyd owns 2.27% with 1.13 million shares, and director Murray Tevlin owns 0.62% with 0.35 million shares.

In terms of institutions, Reuters reports that Wisilica Inc. owns 6.63% with 3.74 million shares.

According to Reuters, there are 56.36 million shares outstanding and 43.57 million free-float traded shares. The company has a market cap of CA$1.46 million. It trades in the 52-week period between CA$0.03 and CA$0.23.

| Want to be the first to know about interesting Clean Energy and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Shiftcarbon Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.