Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB) and mineral exploration company Zacapa Resources Ltd. (ZACA:TSX.V) have signed an amalgamation agreement, both companies announced Thursday.

A wholly owned subsidiary of Outcrop will amalgamate with Zacapa, and all issued and outstanding common shares of Zacapa will be exchanged for common shares of Outcrop on a 4-to-1 basis. When completed, Zacapa shareholders will hold about 12% of Outcrop's issued and outstanding common shares.

"Due to the non-arms length nature of the Transaction, a special committee . . . has recommended that the Board of Directors of Zacapa . . . approve the Transaction," the companies said in a news release. "The Zacapa Board (excluding conflicted directors), having received the recommendation of the Special Committee, unanimously determined that the Transaction is in the best interests of Zacapa, is fair to the Zacapa Shareholders, and recommends the approval of the Transaction by Zacapa Shareholders."

A special meeting of Zacapa shareholders will be held in October to approve the transaction, which is expected to close shortly thereafter.

The Catalyst: Portfolios Span North, South America

Outcrop is coming off filing a National Instrument 43-101 technical report for the maiden resource estimate (MRE) of its flagship Santa Ana project in Colombia, which showed an initial indicated resource estimated at 1.2 million tonnes grading 614 grams per tonne silver equivalent (g/t Ag eq), containing 24.1 million ounces (Moz) Ag eq. Initial inferred resources were estimated at 966,000 tonnes grading 435 g/t Ag eq, containing 13.5 Moz Ag eq.

Analyst Stuart McDougall of Research Capital Corp. pointed out that the Santa Ana resource's overall grade of 530 grams per tonne silver equivalent (g/t Ag eq) compared favorably to peers, such as Blackrock Silver Corp. (BRC:TSX.V; BKRRF:OTCQX) with 389 g/t Ag eq, Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) with 294 g/t Ag eq, and Vizsla Silver Corp. (VZLA:NYSE American) with 427 g/t Ag eq.

"On a comparable basis, we think the maiden estimates stack up well against similar projects," McDougall wrote, rating the stock a Speculative Buy with a CA$0.75 target price per share.

"On a comparable basis, we think the maiden estimates stack up well against similar projects," McDougall wrote, rating the stock a Speculative Buy with a CA$0.75 target price per share.

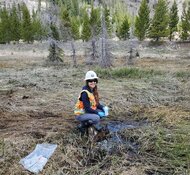

Zacapa holds a portfolio of porphyry copper and epithermal gold projects in the U.S. states of Nevada, Arizona, California, and Idaho, including the Pearl project in Arizona and its South Bullfrog project in the Walker Lane trend of western Nevada.

On May 1, Zacapa announced its acquisition of the highly-regarded Kramer Hills project.

Technical analyst Clive Maund wrote that after that acquisition, "the stock should be free to advance anew, especially as the company is now chaired by its founder, the legendary Ian Slater."

"This is clearly a good point for it to turn higher again now that the news about the acquisition (of Kramer Hills) is out," Maund wrote. "We, therefore, stay long — our losses could quite quickly be made good — and Zacapa is rated an immediate strong speculative Buy here."

Benefits, Details of Transaction

According to the companies, Outcrop will benefit from a stronger exploration and development pipeline, reduced operating and overhead costs, and "increased shareholder liquidity, trading, and capital markets exposure."

Technical analyst Clive Maund wrote that after that acquisition, "the stock should be free to advance anew, especially as the company is now chaired by its founder, the legendary Ian Slater."

Zacapa shareholders will own shares of a larger, more diversified company, the release said. There will be limited conditions and no break fees or expense reimbursement. The companies said a third party, Evans & Evans Inc., has provided an oral fairness opinion that the transaction is fair.

The transaction is expected to be completed when 1433180 B.C. Ltd., a subsidiary of Outcrop, amalgamates with Zacapa. All the issued and outstanding common shares of Zacapa will be immediately exchanged for common shares of Outcrop on a 4-to-1 basis.

Warrants, options, and deferred share units of Zacapa will be exchanged into warrants, options, and deferred share units of Outcrop.

Closing is subject to Zacapa shareholder approval and the receipt of regulatory approvals, including the TSX Venture Exchange.

'A Great Team'

Outcrop's Santa Ana project covers 27,000 hectares, a significant part of the Mariquita District, where mining records date to at least 1585. The district was once the highest-grade primary silver district in Colombia.

Spanish Royal Archives reports said the area historically had 14 mines producing an average of 4,000 g/t silver (Ag) over an average of 1.4 meters, with some mines finding as much as 17,000 g/t Ag.

Recently, the company announced that metallurgical testing confirmed a gold recovery of 97% and a silver recovery of 93% at Santa Ana, including lower amounts of deleterious elements favorable for commercial sale.

"Achieving such high recoveries through flotation alone, combined with the production of a marketable clean high-grade concentrate, underscores the project's immense potential," Outcrop Chief Executive Officer Ian Harris said. "Furthermore, the environmentally conscious test work indicates clean tailings, which aligns perfectly with our commitment to responsible mining."

Ownership and Share Structures

Streetwise Ownership Overview*

Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB)

Mining financier Eric Sprott owns about 14% of Outcrop. Management and directors own about 12%, and the rest is held by high-net-worth investors and retail, the company said.

Major inside shareholders include Zacapa's Slater, with about 10% or 20 million shares, and former CEO Joseph Hebert, with 0.94% or 1.88 million shares, according to Reuters.

Outcrop has a market cap of CA$35.99 million with about 200 million shares outstanding and about 147 million free-floating. It trades in a 52-week range of CA$0.43 and CA$0.15.

Reuters reports that 16.78% of Zacapa is held by management and insiders. Slater said he remains the company's largest shareholder, with very few warrants out. He holds 15%, with 10 million shares. Former Glencore executive, Director Marc Boissonneault, has 1.09%, with 730,000.

Per Reuters, 0.03% is with institutional investors. This is held by Crescat Capital LLC., with 200,000 million shares.

The rest is in retail.

The company has a CA$4.2 million market cap with about 101 million outstanding shares and about 82 million free-floating.

Sign up for our FREE newsletter

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Outcrop Silver & Gold Corp., Dolly Varden, and Zacapa Resources Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.