Gold

- Gold holding above US$1900

- Ready to break higher

- West losing control over the gold price

- Central banks buying more gold

- Western players selling more gold, but the price is rising!

- Broken out of wedge

- Just <2% below the May downtrend

- Just US$40 will break it!

- Breaking through this will give test of US$2090 for the FOURTH time!

- Clear sky after that!

- Breaking nexus with

- TIPS yields

- US$ (DXY Index)

Gold Stocks

- Gold sector pessimism is extreme!

- Only happens in Wave 2!

- Gold stocks — low-risk entry here

- 60 Year cycle bottoming

- Is it now or waiting until December?

- ASX Gold Index bounces off important support

- Breaks short-term downtrend

Silver

- Looking strong

Iron Ore

- Breaking 18 mth downtrend

Shanghai Market

- Testing 30-year uptrend

- Is still down 50% on 2008 highs

- Long-term large-scale wedge in place

- Resolution to upside likely

Gold

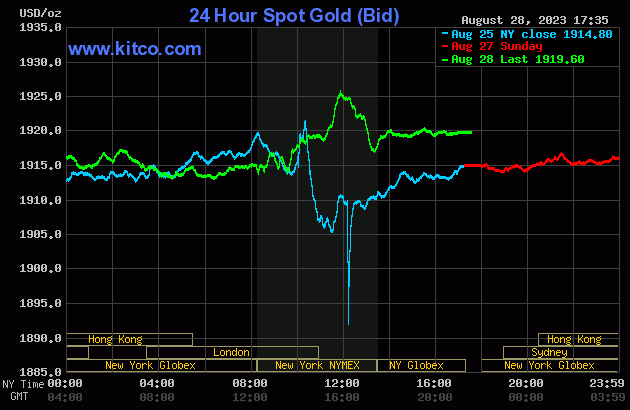

The Jackson Hole Fed talkfest pointed to interest rates staying high to slow the economy and try to wring out inflation, so the gold market had quite a volatile day on Friday but ended about even.

It is amazing to think that these unelected bureaucrats have such control over people's lives.

Gold moved higher as it broke that short-term downtrend.

Gold has broken its downtrend from the wedge and is working out what to do next.

But it won't take much longer for gold to break the downtrend from the May highs.

That downtrend is <2% (<US$40/oz) away.

Gold could be very strong from here once this is broken.

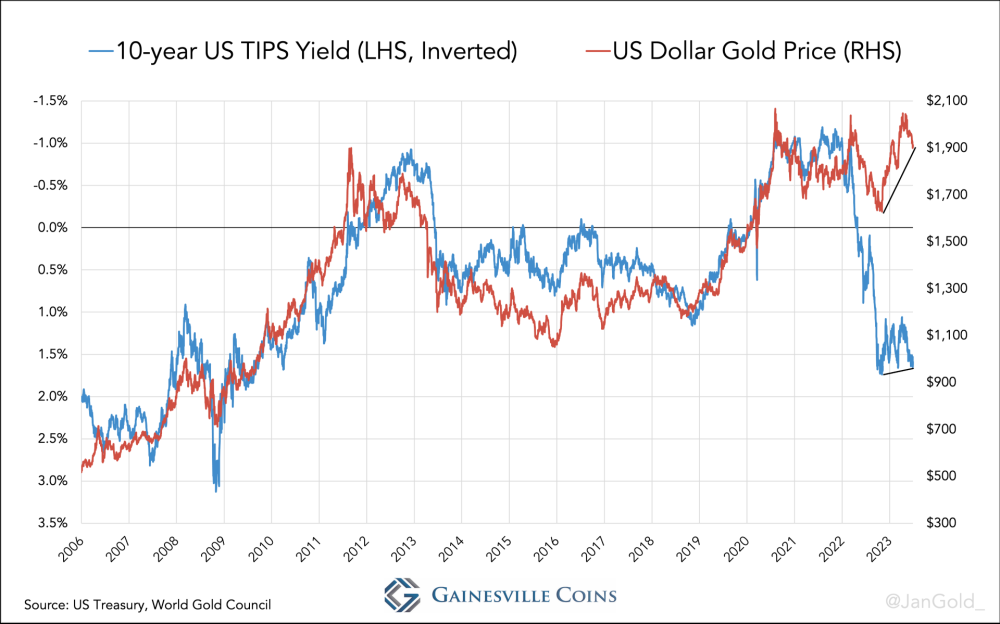

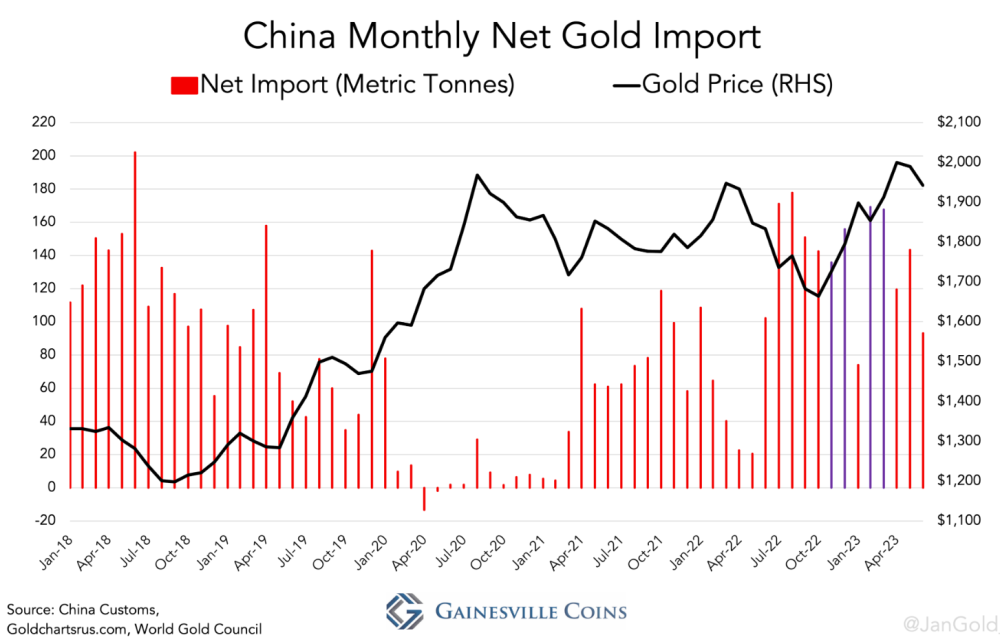

Jan Nieuwenhuijs from Gainesville Coins has written a very useful report on how The West is losing Control of the Gold Price.

His thesis is that Western institutions have bought and sold gold according to the TIPS (Treasury Inflation-Protected Securities) as a measure of real interest rates.

The match over the past 16 years for gold and TIPS yield has been very strong, but in 2023 falling inflation and rising interest rates brought TIPS to a 1.5% real yield.

But gold has simply ignored this.

Gold has also ignored a rising US$ (DXY Index).

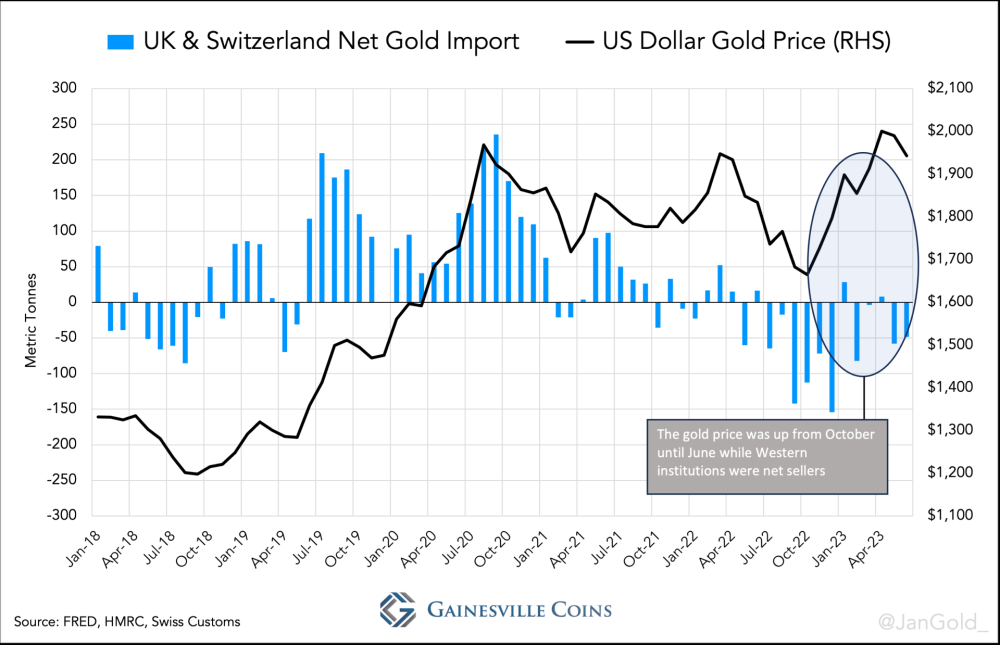

The author has also followed import/export flows of gold and notes that the main suppliers of above-ground gold ( UK and Switzerland) have been selling over the last nine months to match the rise in the TIPS yield.

This shows Western institutions (whoever they are) have been selling.

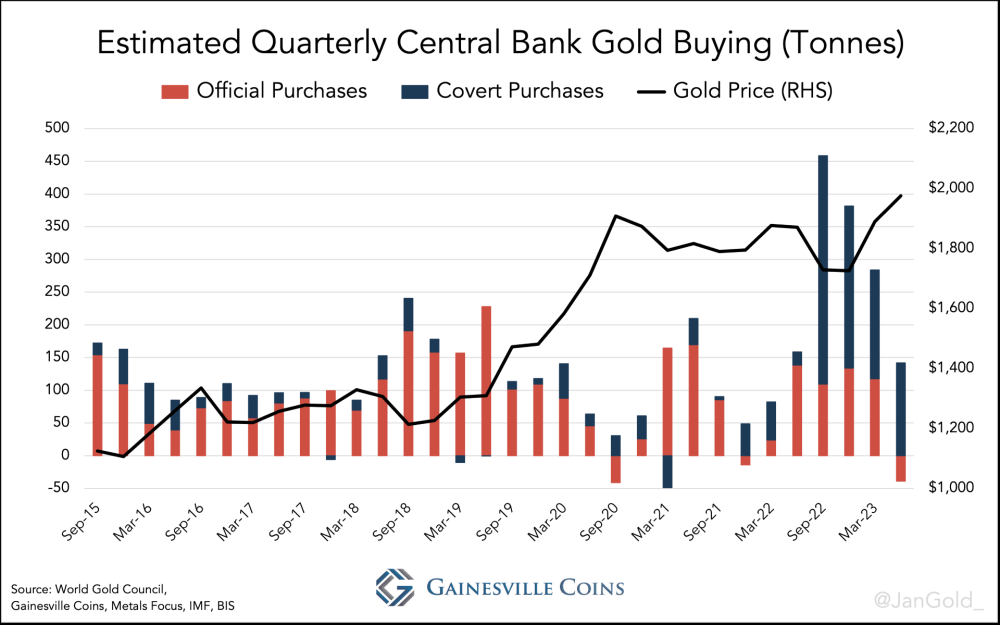

And following through on the import numbers, it appears that central banks have been even bigger buyers of gold over the past year.

It seems China has been doing most of the buying.

The strong underlying demand for gold appears to be overcoming Western institutional trading and could be setting gold up for a reassessment and revaluation.

Gold has been boxed in for over 44 months.

A break of that short-term downtrend will see a test of US$2090 for the FOURTH time!

Nothing will hold it back after making a new high.

Gold in AU$ is looking very good.

Gold Stocks

- Nth American gold stocks have bounced off strong support at ~110

- Oversold and unloved

These stocks are now turning up.

21% of stocks are now above 200week Mav.

These turning points are important to follow and anticipate the changes.

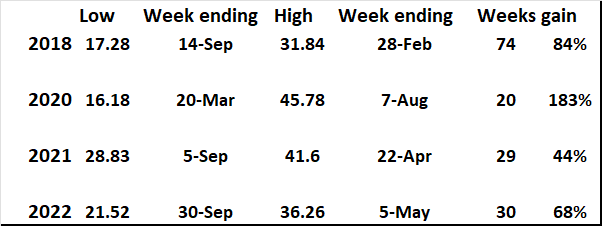

The AVERAGE is a 95% gain in this GDX ETF with a range of 44-183%.

The rally length range was 20-74 weeks, and the average was 38 weeks.

Most of these upturns started in August-September, with the resumption of interest after the northern hemisphere summer holidays.

GDX Gold Stock ETF — Recent bottoming at lows and subsequent rallies.

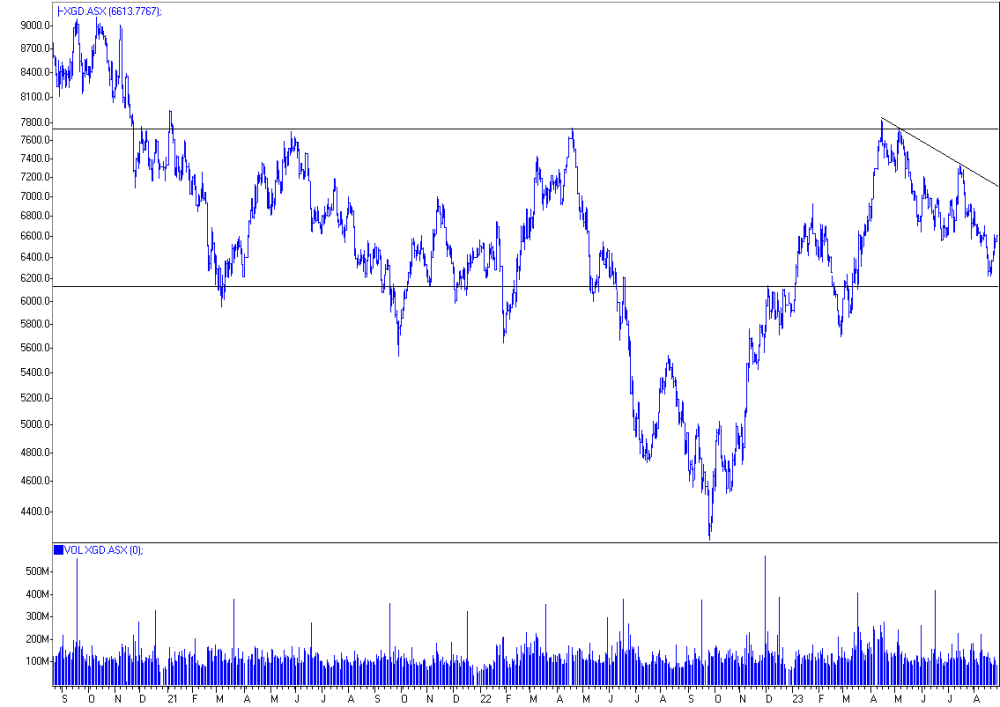

The ASX gold index low point — are we there yet?

Yes, I think so.

Very low-risk entry point.

Downtrend broken.

There is a massive Head and Shoulders reversal developing here!

XGD vs. Gold is at a turning point.

ASX gold stocks are very cheap!

Silver

- Looking strong!

China

There is a lot of negative commentary on China at present.

But heed the markets and not the commentators!

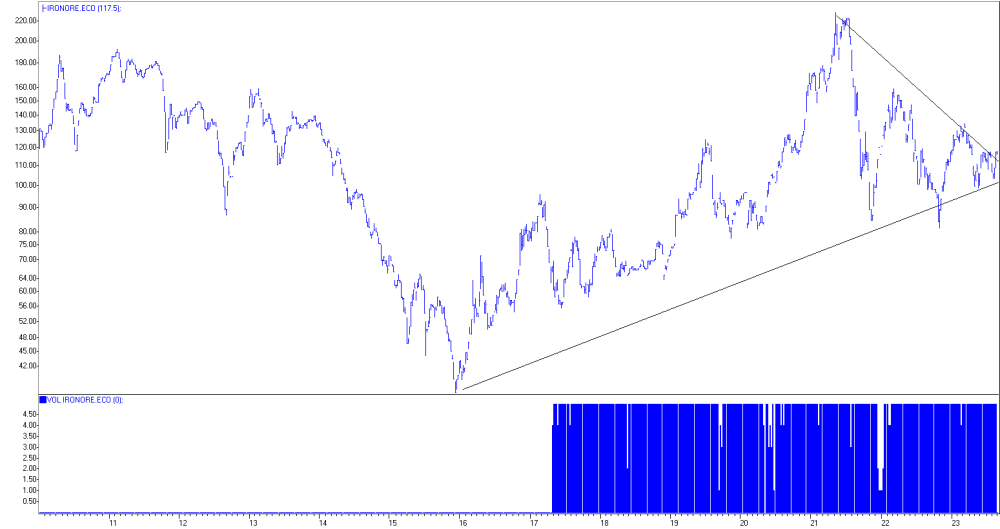

Note that iron ore is breaking its downtrend.

Shanghai

The Shanghai market is at a very critical point in testing its +30-year-long uptrend.

It is oversold and ready to bounce.

This might even be a capitulation low in China stocks.

Market commentary is still about banking sector and property ready to collapse.

Commentary might be more hot air than reality.

Shanghai has underperformed since 2008 and is still down 50% from those highs.

- Still at the same level as 2015

- Commentary bearish, but the reality might be quite different

- Note the wedge that has been narrowing for the past 15 years

- These patterns are often the precursor to a strong move

- In this case, higher

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold, Special Situations and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.