When I was a (much) younger man, I was always fascinated with the stories about the Haight-Ashbury section of San Francisco because while growing up in Toronto, I used to hear about it while listening to the folk-rock minstrels in Toronto's Yorkville neighborhood, the bastion of artsy-fartsy, longhaired hippies that I used to detest in 1968.

Growing up in the northwest section of Toronto Township in the working-class aircraft factory town of Malton, I idolized gritty rockers like the Stones and the Who rather than the Beatles or the Bee Gees until, of course, I head the first chords in "Whole Lotta Love" by my all-time favorite band, Led Zeppelin, another band that came from the grit of U.K. working-class London in the mid-60s.

As many cities have changed over the years, the city of San Francisco has changed in a manner that I think is synonymous with the plight of the U.S.

However, it was the northern California scene that was always the envy of the rock world back in the 60s, led by the babyboomer mecca of San Francisco and the idolized intersection of Haight-Ashbury.

The cynics would reveal to me over the years that it was not so much a cultural oasis than it was a source for the best drugs one could find anywhere north of the Rio Grande, but that is a story for another day.

The city that hosted that memorable era was one that I have always revered for its natural beauty and the manner in which the engineers linked Oakland and San Francisco with the construction of the Golden Gate Bridge. It was host to superb films such as Bullit with Steve McQueen and Dirty Harry with Clint Eastwood, and the sad story of gay San Francisco city supervisor Harvey Milk, whose actions as mayor were legendary in serving his citizens with aplomb and tenacity before being assassinated by a fellow bureaucrat.

San Francisco and the Plight of the US Dollar

As many cities have changed over the years, the city of San Francisco has changed in a manner that I think is synonymous with the plight of the U.S. dollar. When I first visited the city for an investment conference in the 1990s, I was astonished at the quality of the restaurants and the live music venues but most of all at how clean the city streets were kept and how nice it was to go into the heavily-gay dance clubs (with my wife!) and have an absolute ball laughing and joking with what my wife was later to say was "the finest-looking collection of men I have ever seen in one evening, none of which had the slightest interest in me!" However, I digress. . .

Here in 2023, I see pictures of a different city, a city over-run by homeless people and migrants and those poor souls deluded by a misguided notion that thanks to government largesse, it might be a Cornucopia of (free) sustenance for any and all that arrived. What was purported to be a life-support system for the needy has evolved into a platform for political debate with a multitude of fingers pointed with yet-to-be-determined accuracy at the victors.

For the first time in what feels like a lifetime, I am long futures and options and the SPDR Gold Shares ETF in the hope that I can once again get back "in sync" with it.

Major corporations, many of which are in the technology sector, are abandoning the downtown and leaving the buildings without any tenants, inviting migrants to take "squatter's rights" over the real estate.

The famously gritty Tenderloin District, once known for its underground art spaces, classic concert venues such as the Great American Music Hall, and historic theaters staging Broadway and indie shows, has devolved into a refuge for the homeless.

Nightlife ranged from dark dives slinging beer and shots to speakeasy-style bars mixing craft cocktails, while Little Saigon was known for its Vietnamese eateries. Its funky, colorful streets used to feature a mix of upscale, trendy, and casual restaurants, many of which are now shuttered, while outside, the litter of human tragedy is everywhere. It is an American landmark gone awry, and it pains me. . .

Gold

For the first time in what feels like a lifetime, I am long futures and options and the SPDR Gold Shares ETF (GLD:NYSE) in the hope that I can once again get back "in sync" with it. I have always prided myself in being a decent trader of gold, and the record proves that out.

Unfortunately, I became somewhat "soured" on gold because after getting all of the inputs right — government money-printing, credit creation, helicopter drops during the pandemic, etc. — gold failed to respond, nor did the heavily promoted silver market.

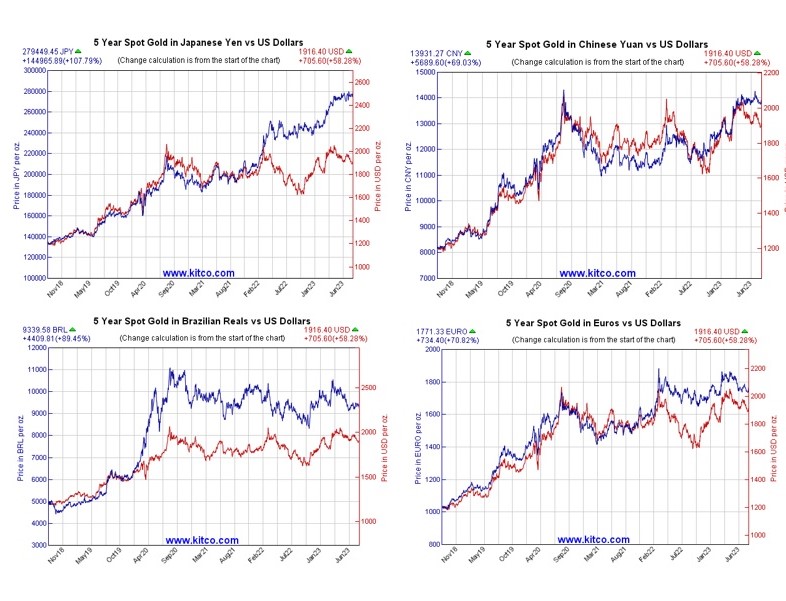

We in North America, who depend on paying our bills in either Canadian or American dollars, have seen ZERO benefit in owning gold.

The four charts shown here show the USD gold price performance versus the Japanese yen, Chinese yuan, the Euro, and Brazilian reals. While it illustrates a symmetrical bull market in all currencies, the underperformer is the USD, and when one considers that the U.S. is the world's largest debtor nation, the evidence of intervention and interference is undeniable. Gold is considered a threat to U.S. national security, and that is why it has been so difficult to reap any real benefits from the domestic U.S. viewpoint. When a currency is defended against gold, its defense against eroding purchasing power is minimalized.

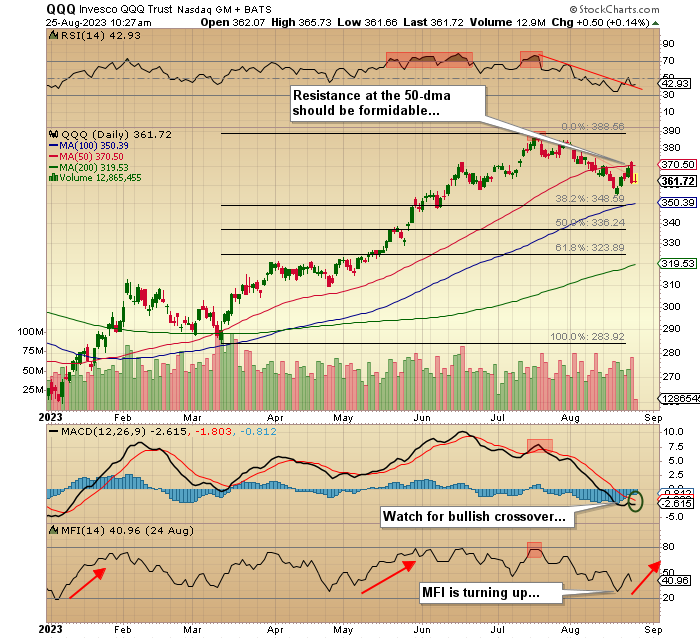

MACD has finally executed a bullish crossover with the Money Flow Indicator now in a full-on "Buy Signal;" gold looks like it could make yet another run at the US$2,000 level, which is the equivalent of around US$183 for the GLD.

This is why any move, such as the BRICS conference in South Africa, is beneficial to the North American owners of precious metals.

There will be a point where the well-populated banks of currency traders at the NY Fed and in the Bank of England will be unable to prevent the revaluation of gold in USD and it is at that point that all h*ll breaks loose. I see that moment on the immediate horizon, and when bolstered by the compelling technical picture, I am now a committed bull.

MACD has finally executed a bullish crossover with the Money Flow Indicator now in a full-on "Buy Signal;" gold looks like it could make yet another run at the US$2,000 level, which is the equivalent of around US$183 for the GLD. It has been quite a few months since I exited the gold trade, which was back in the springtime when the regional banks were imploding and gold failed to respond.

Protecting the USD from a banking crisis meant capping the USD gold price, and cap it they did, with their usual skill and ferocity. It has been straight down since that event — until last week. I bought the dip down into the GLD US$174-176 "Buy Zone," which I identified weeks ago, keeping subscribers out of the gold trade until I got my price.

Silver

In an alarming departure from my 2023 behavior, I also entered the silver trade, which is for me like playing hot potato with a live grenade.

Silver has had me in the crosshairs since 2020, the last time I had a decent trade in that widowmaker of all trading vehicles. It is like it knows when I am about to make a move while the trading gods look down at me and gleefully rub their hands together, laughing all the way to their heavenly bank.

iShares Silver Trust (ETF) (SLV:NYSE) needs to close above US$23 and then US$25 before I get really excited, and I must confess that I am skeptical that it will achieve much above tose two levels. US$30 spot silver is a formidable resistance barrier, having been repelled in Feb/'21 during that ridiculous "#SilverSqueeze" campaign that crippled the Millennials and Gen-Xers that listened to all of the Wall Street Bets and Wall Street Silver nonsense that was intent upon creating a short squeeze with the large bullion banks.

Anyone with more than a decade of trading in precious metals would have known that bankrupting a few gunslinging hedge funds in AMC or Gamestop because they were carrying outrageously large short positions is diametrically different by leaps and bounds from bankrupting the bullion banks, most of whom are in the direct or indirect employ of the U.S. Treasury or the Bank of England.

However, here in 2023, I like the technicals, and I like the seasonality, so armed with a battery of medicinal nerve agents, I took the plunge, hockey helmet strapped on and powerful sedatives at the ready. . .

Nvidia

Stocks appear to be ready to move into "neutral" mode after the blow-out earnings report for market leader Nvidia (NVDA:NASDAQ), which gapped up to over US$500 before closing up a mere US$0.47 to barely unchanged.

If NVDA fails to close out the week on an uptick, the "SELL-THE-NEWS" nightmare for technology bulls may be in play. I closed out my QQQ shorts this week at a good profit, but I am feeling rather naked without them.

This is the time of the year when the market goblins come out of hiding and cast their curses upon unsuspecting portfolio managers whose careers are already in jeopardy due to being underweight equities until the peak in late July. I see a rally into mid-September materializing unless the market views the Jackson Hole central banker lovefest speech by Jay Powell as "hawkish" (which they did). . .

TSX Venture Exchange

On a negative note, the TSX Venture Exchange is approaching a 2023 low this week at 584, down from a 52-week high of 662 and a 2007 high north of 3,300!

In a discussion with a colleague of my vintage (dinosauric), he thinks today's junior resource sector is as bad as he has ever seen it, although the five years of root canal pain from 1997 to 2002 was pure agony of the highest order.

I remember a call from the head of the Fidelity Select division out of Boston in April 1997, right after the late Graham Farquharson of Strathcona Minerals declared the "mighty" Busang gold deposit owned by market darling Bre-X Minerals was "a total and complete fraud."

"It's over, Mike. I'll call you in ten years!" and then slammed the phone down. It turned out to be five years, but a very nasty five years that put dozens of junior resource firms out of business and more than a few dozen brokers out of a job.

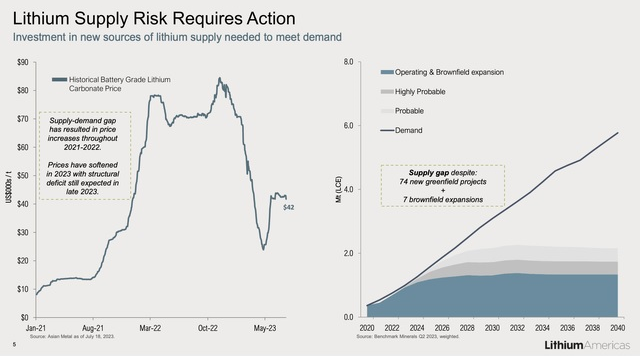

That is the type of market we have had to endure largely since August 2020, but outside of the lithium craze of late 2022, it has been an unenjoyable experience, especially when some of the companies have executed beautifully with absolutely zero reward.

On that point, there is one such company that has done exactly that, and it deserves mention.

Volt Lithium

I have made reference several times in this publication to a junior Canadian lithium developer called Volt Lithium Corp. (VLT:TSV;VLTLF:US), and I draw your attention to their recently completed CA$6.8 million financing, which closed on August 4, in the middle of the summer doldrums and in a period where nobody — and I mean nobody — is raising a dime.

I had a long discussion with CEO Alex Wiley this week, and after over forty years in the corporate finance world interviewing CEO's in need of money, I have to tell you that the one thing that always torpedoed a pitch was if and when the CEO stopped discussing his business opportunity and started to talk about his stock price. If I ever heard the word "undervalued," the interview would be terminated.

Alex Wiley spent the entire forty-five minutes answering my queries about extraction, deal formats, government support, and U.S. expansion opportunities, and nary once did he talk (let alone whine) about the stock price. I found that incredibly "telling" and told subscribers that at CA$0.18, the stock price was "ridiculous."

Suffice it to say, I spent forty-five minutes discussing the business of "direct lithium extraction" ("DLE"), and to say that Alex Wiley "knows his business" is an understatement. The company announced on May 24 (with the stock at an all-time high of CA$0.55) the results of their pilot plant tests on brines located in the Leduc field of Alberta in an area called Rainbow Lake. They told the world that their cost of producing a tonne of lithium from brines at 120 mg/L was under CA$4,000 per tonne.

They also confirmed recoveries at 97% from said brines. When asked to describe in detail the "secret sauce" used in the extraction process, the company simply smiled and declined. That was when the naysayers — mostly Volt's lithium competitors – started the anti-credibility campaign that lasted until August 4, when Volt closed the Canaccord-Paradigm-led deal. It was an oversubscribed offering that was not the first choice for the Volt CEO, but pressure from regulators regarding their CA$100 million shelf prospectus filing made it a "must-do" deal. And good on them for doing it.

The May 5 news release had a sign-off from world-renowned Sproule Inc. and was approved by the normally-picky people at IIROC, so to say that the press release had "credibility problems" was a complete joke. As this is being written, Sproule is completing the Preliminary Economic Assessment ("PEA") which will confirm the model surrounding the processing of over 99 million barrels of brines from Rainbow Lake, beginning with a 1,000-tonne extraction process to commence in June 2024. With their DLE process able to achieve the milestones already approved by Sproule and blessed by IIROC, the company can generate over CA$38 million of pre-tax cash flow by June 2025, assuming lithium prices hold up.

I have been telling subscribers that this is the worst junior market in twenty years, but even in poor markets, companies that execute can yield enormous capital gains for shareholders. With Volt, there are many other developments that are under lock and key right now, but with the PEA coming out in late September, I see fireworks on the horizon.

Technically, it is important to remember that "volume precedes price," and with the massive volume this week (3.25 million shares) and buy signals from the MACD and MFI indicators, the stock has broken out above the downtrend that began when the envy-laden chatrooms began their bashing efforts so with it up 25% on the week, I urge all followers to take the time to do some serious due diligence on the outlook for lithium over the next decade.

It is next-generation lithium suppliers like Volt that will fill the supply void, and if you are able to trust the judgments of both Sproule and IIROC, then you have the foundations for a multi-bagger of staggering potential.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Volt Lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.