Gold

- Still heading to US$2000 and beyond

- Parabola still holding in US$

- New all-time highs in many currencies

- AU$ gold close to AU$3000 again

- Parabolas here holding nicely

- Commercial gold traders have covered shorts

- Speculators have increased shorts!

- Market sentiment is indicative of an important low forming in gold stocks

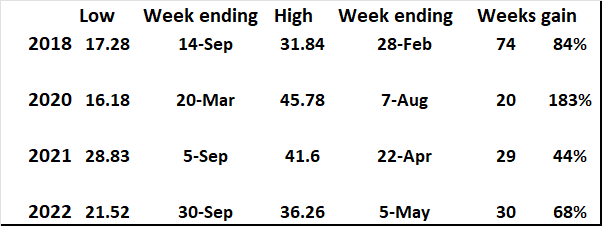

- Subsequent to the previous four occurrences:

- Average gain is 95% for GDX ETF (range 44-183%)

- Average rally is 38 weeks (range 20-74 weeks)

Gold is trading lower below US$1900, along with the rise in bond yields.

The US$ remains strong, so the downward pressure remains.

However, that downward-sloping wedge remains in place, and last week saw some increase in volume.

The Commitment of Traders (CoT) indicates that commercial players have significantly reduced their short positions while the speculators have increased theirs, so a break out from this wedge could occur soon.

The longer-term parabola is holding well, and as pointed out last week, the 2011/12 highs and other more recent trading activities show good long-term support at these levels.

The gold price in AU$ is very close to AU$3000 again, and it's technical position has its own parabola and good support at the July 2020 highs.

This would suggest prices might not be heading much lower from here.

In the shorter term, the AU$ gold price has another even more encouraging parabola setup.

US$ remained in uptrend.

Nth American gold stocks are also declining but into support around 110 on the XAU.

Just 1-2% lower.

Gold stocks have underperformed bullion over the past two years.

This ratio is in an important support zone, so there should not be much more downside.

As noted above, sentiment is very weak and has dropped to a Buying Zone.

The number of stocks above the 200-week moving average is now just 3.57% (probably only one stock in this ETF!).

Note that the four previous times this indicator was here and bottoming in its six-year life, there was a very significant rally in gold stocks.

These turning points are important to follow and anticipate the changes.

The AVERAGE is a 95% gain in this GDX ETF with a range of 44-183%.

The rally length range was 20-74 weeks, and the average was 38 weeks.

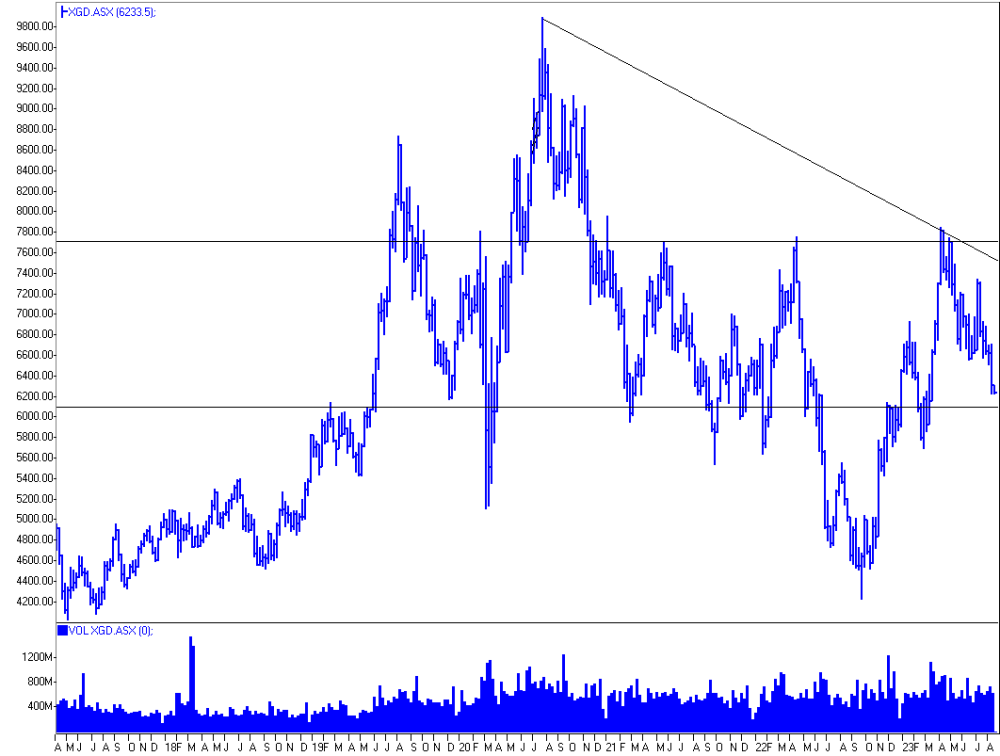

The ASX gold index is already in an important technical support zone with a low possible at 6100, just 2% lower.

And XGD vs. Au$ gold is also an important support.

Timing is everything. Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.