Owning a home is a huge part of the American Dream and the first step for some to solidify their place in adulthood. In fact, a survey by Bankrate found that "owning a home is still very much a part of the "American Dream," as cited by 74% of U.S. adults. This is more than those who point to being able to retire (66%), having a successful career (60%), owning a car, truck, or other automobile (50%), having children (40%), and getting a college degree (35%)."

Still, most Americans are unable to buy a house outright, making mortgages a key part of achieving this height of American success.

Homebuyers Looking for a Change

As with most things, mortgages come in two categories: There are the old long, held mortgages that have been around for generations, yet they are running into some competition as the new guys usher in a new way to play the game of life.

Some of the long-standing mortgage companies include:

- Wells Fargo & Co. (WFC:NYSE), which announced at the beginning of this year that it intended to scale back mortgages, but last year saw 143,000 loans at a value of US$79 billion.

- Bank of America Corp. (BAC:NYSE), which saw 121,000 loans at a value of US$54 billion.

- JPMorgan Chase & Co (JPM:NYSE), which saw 115,000 loans at a value of US$73 billion, with an average loan amount of US$631,000.

While non-traditional lenders did make gains in 2021, traditional financial institutions won back some ground in 2022, yet, some non-bank lenders did manage to hold on to their advantages.

Loan Depot Inc. was last with 156,000 loans with a value of US$53 billion.

UWM Holdings Corp. saw 348,000 loans with a value of US$127.5 billion.

Rocket Companies Inc. was the top mortgage lender in 2022, with 464,000 loans that generated a value of US$127.6 billion.

It seems clear from these results that homebuyers are looking for change in the market. This may be partly due to the younger crowd gaining interest in home buying. 51.5% of millennials are homeowners as of this year.

This generation increased by 7 million homeowners over the last five years. This generation increased by 7 million homeowners over the last five years, but they are still behind Gen Z, who are becoming homeowners at higher rates than millennials were at the same ages.

Gen Z and Millenial homebuyers are more likely to gravitate toward mobile and online over traditional lenders. According to Chase's Digital Banking Attitudes Study, over 86% of Gen Z and 89% of millennials conduct their banking through apps. 61% of Gen Z and 71% of millennials use apps to transfer money. Managing money through online means is overwhelmingly popular with younger generations due to its convenience. This is where nontraditional lenders come in.

UWM Holdings

On August 9, UWM Holdings Corp. (UWMC:NYSE) released financial results for the second quarter of 2023 (Q223). UWM reported it had US$31.8 billion in total loan-originated volume for this quarter. UWM's net income was US$228.8 million, with a US$24.6 million increase in fair value of MSRs and diluted earnings per share of US$0.08

With this news, Chairman and CEO Mat Ishbia commented, "We will continue to be aggressive in our technology and product investments. We are hiring right now, whereas the industry as a whole is continuing to cut back on capacity. Despite a historic decline in industry-wide origination volume during 2023, UWM remains profitable."

The company is covered by 11 analysts.

Ownership and Share Structure

According to Reuters, 0.96% of the company is with managers and insider investors. CSO Alex Elezaj has 0.30%, with 0.33 million, and Director Robert Verdun has 0.30%, with 0.28 million.

3.47% is with strategic investor Pacific Credit Corp., with 3.23 million shares.

45.01% is with institutional investors. The Vanguard Group Inc. has 9.45%, with 8.80 million shares. Platinum Equity LLC has 5.26%, with 4.89 million. Fidelity Management & Research Corp. has 4.38%, with 4.08 million. BlackRock Institutional Trust Company NA has 3.80%, with 3.54 million, and Victory Capital Management Inc. has 1.85%, with 1.72 million.

Market Watch reports UWM Holdings has a market cap of US$9.56 billion and 93.11 million shares outstanding. It trades in the 52-week range between US$2.84 and US$6.98.

Loan Depot

On August 6, Loan Depot Inc. (LDI:NYSE) released financial results for Q223. Revenue was up by 31% from the first quarter of this year, which the company attributes to higher pull-through weighted lock volume and gain on sale margins for the company. Loan Depot noted it "continues to maintain strong liquidity profile, exiting the quarter with a cash balance of US$719.1 million."

In this release, CEO Frank Martell noted, "“As we move forward in the second half of 2023, we plan to continue maintaining a strong liquidity position and aggressively reduce our costs. Importantly, we are also investing in critical operating platforms, which we expect will deliver higher levels of automation and operating leverage and position us for additional growth and margin expansion in 2024.”

Analyst John Lafferty of PriceTarget Research gave Loan Depot an A rating (the highest given by the research company). Lafferty wrote that the stock was selling well beyond its value at US$2.21, gave the company a target price of US$7, and commented, "Reflecting future returns on capital that are forecasted to be in line with the cost of capital, LDI is expected to be Value Creation neutral. loanDepot has a current Value Trend Rating of A."

Ownership and Share Structure

According to Reuters, 21.93% of Loan Depot shares are held by management and insiders. CIO and Head Economist Jeff DerGuarahian has 7.73%, with 6.10 million shares. President Jeff Walsh has 5.30%, with 4.24 million, and Managing Director of Operations and Servicing Dan Binowitz has 1.01%, with 0.80 million.

29.63% is with institutional investors. Cannell Capital LLC has 5.73%, with 4.52 million shares. The Vangaurd Group Inc. has 5.47%, with 4.31 million. Parthenon Capital Partners has 5.11%, with 4.03 million. Brandywine Global Investment Management has 4.49%, with 3.54 million, and Knightsbridge Wealth Management has 3.33%, with 2.63 million.

The rest is in retail.

Market Watch notes that Loan Depot has a market cap of US$639.89 million and 78.89 shares outstanding. It trades in the 52-week range between US$1.2500 and US$3.0200.

Rocket Mortage

Recently, Rocket Companies Inc. (RKT:NYSE) announced financial results for Q223.. In Q223, Rocket reported net revenue of US$1.236 billion and adjusted revenue of US$1.002 billion. This exceeded the high end of the company's guidance range.

In light of this news, Rocket's Interim CEO Bill Emerson, said, "Rocket's performance in the second quarter demonstrates the strength of our business and our commitment to delivering superior client service through innovation."

Rocket currently has a 4.5 out of 5 on Nerd Wallet, which noted a pro of the company being a "streamlined online process with document and asset retrieval capabilities, as well as the ability to edit your preapproval letter."

The company is also covered by 14 analysts.

On July 18, Morningstar Equity Analyst Michael Miller gave Rocket a US$13 Fair Value Estimate, noting, "In our view, Rocket Companies has established a clear competitive advantage in its core mortgage lending operations that should allow it to continue to increase its market share while still maintaining its strong margins and returns on invested capital."

Then in an August 4 report, James Faucette of Morgan Stanley rated Rocket as Attractive, saying, "As elevated mortgage rates and low housing inventories continued to weigh on industry-wide Purchase and Refi activity during the quarter, RKT sharpened its focus on expense efficiencies across the company."

Ownership and Share Structure

According to Thomson Reuters, 73.50% of the company is held by institutional investors. Fidelity Management & Research Co. has 8.84%, with 11.22 million shares. The Vangaurd Group Inc. has 8.56%, with 10.88 million. Fidelity Investments Canada ULC has 5.77%, with 7.32 million. Caledonia (Private) Investments Pty Ltd. has 4.18%, with 5.30 million. Invesco Advisors Inc. has 3.93%, with 4.99 million, and BlackRock Institutional Trust Companies 3.88%, 4.93 million.

5.44% is with management and insiders. CEO Jay Farner has 4.20%, with 5.33 million shares. Director Matthew Rizik has 0.36%, with 0.45 million. President and COO Robert Walters has 0.26%, with 0.33 million, and CFO Julie Booth has 0.17%, with 0.22 million.

The rest is with retail investors.

Market Watch notes that Rocket has a market cap of US$22.88 billion and 127 million shares outstanding. It trades in the 52-week range between US$5.97 and US$11.68.

Private New Kid on the Block: Beeline Mortage

While public non-traditional lenders have been making waves, there is a private company rising in the industry, Beeline Mortgage.

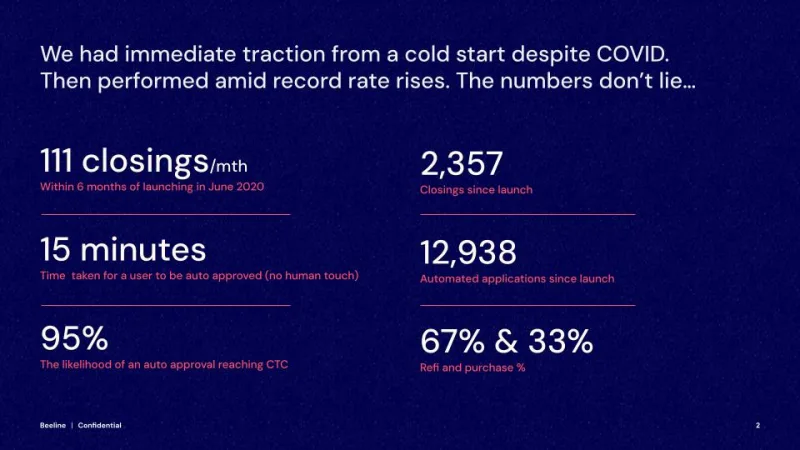

"While other mortgage lenders have been slumping, Beeline is gaining traction," wrote Guy Bennett in an article for Yahoo Finance. You can see this from this image from Beeline.

Beeline is also not stuck with just one type of loan. The company provides FHA, VA, and debt service coverage ratio (DSCR), bank statement, bridge, and fix-n-flip loans.

Bennett noted that "Beeline’s mix of home investors is about 300% higher than the national average." However, this is not the only thing the sets Beeline apart from other online mortgage companies.

Yet, Rocket Mortgage isn't the only innovative online mortgage lender in the ring. With the growing demand for more innovative mortgage lending services, Beeline decides to take things a step further and disrupt the mortgage industry by providing a new model for consumers.

"While other mortgage lenders have been slumping, Beeline is gaining traction," wrote Guy Bennett in an article for Yahoo Finance. You can see this from this image from Beeline.

On April 13, 2013, Robinhood revolutionized the stock-buying industry by fractionalizing stocks. This allowed people who previously were excluded from the stock market into the industry and paved the way for younger generations to get involved. Beeline is now doing for mortgage what Robinhood did for the stock market.

Beeline stands out from the crowd because it has incorporated artificial intelligence into its services with its chatbot, Bob. According to Jay Stockwell, who is in charge of Bob, "It's not too difficult to write a prompt for a chatbot to ask a set of questions to complete 1003. But to build a virtual AI department that navigates a customer's personal financial context and can switch from answering Beeline product questions to running pricing and then to pre-populating and completing an application requires a more sophisticated 'ensemble approach.'

This will build Beeline more differentiation from others who can build a prompt, but not a complete AI platform," Bob also connects to a larger database called The Beeline Brain: "The Brain allows the LLM [large language model] to instantly respond to almost any Beeline-related question through a conversational interface — with Beeline’s signature twist of irreverence and playfulness."

Chris Connelly, the managing director of Ellington Financial Group, also sees promise with Beeline's AI system. "Beeline has built a unique platform which is well suited for the Gig economy."

There are several features that make it attractive to consumers, which are available through its customer portal. It generates its own leads directly instead of buying from aggregators; it has a fully immersive, mobile-friendly, and highly converting proprietary POS experience, pull asset, income, bank statements, and payroll that it uses to generate real-time approvals for customers. 95% of these approvals reach closing. The in-house platform takes customers from Clear to Close on titles at the moment without having to go to land records for 60% of all refinancings.

By June 1, the company hopes to improve the AI system so that it is able to answer complex queries and give detailed quotes at all hours.

"Bob never sleeps," the company noted, "he's busy answering surprisingly complicated questions about Beeline's wide range of conventional and non-QM products with great speed and accuracy, even at 2 am. He then poses highly personalized product-specific questions to generate a quote in real-time.

Chris Connelly, the managing director of Ellington Financial Group, also sees promise with Beeline's AI system. "Beeline has built a unique platform which is well suited for the Gig economy whereby their tech will steer a borrower to conventional or a non-qm loan product based on the data received at the point of sale. Younger home buyers have more options at Beeline vs. traditional mortgage lenders and a better chance to land a loan for a new home," he commented.

Ownership and Share Structure

Beeline is a private company. The largest shareholder is Nick Liuzza, who has US$10 million invested in Beeline. Cavalry Fund, Ellington and Atalaya are all Series A investors.

The company's budget for 2023 is 1,110 loans, 5,994 net loan revenues, and 1,856 net title revenues. The forecast for 2024 is 2,923 loans, 23,969 net loan revenues, and 5,737 net title revenues for a total of 29,705 total net revenues and 20,794 OPEX.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Beeline has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline.

- Amanda Duvall and Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.