Whilst it is generally unwise to go against the prevailing trend when it is still in force, there are exceptions when the volume pattern strongly indicates that reversal is imminent, which is the case with VSBLTY Groupe Technologies Corp. (VSBY:CSE; VSBGF:OTC; 5VS:FSE) and the case for buying Visibility is stronger still because the price of the stock is so close to zero that there is almost no downside — as with an option you can only lose your stake, whereas the upside is relatively unlimited.

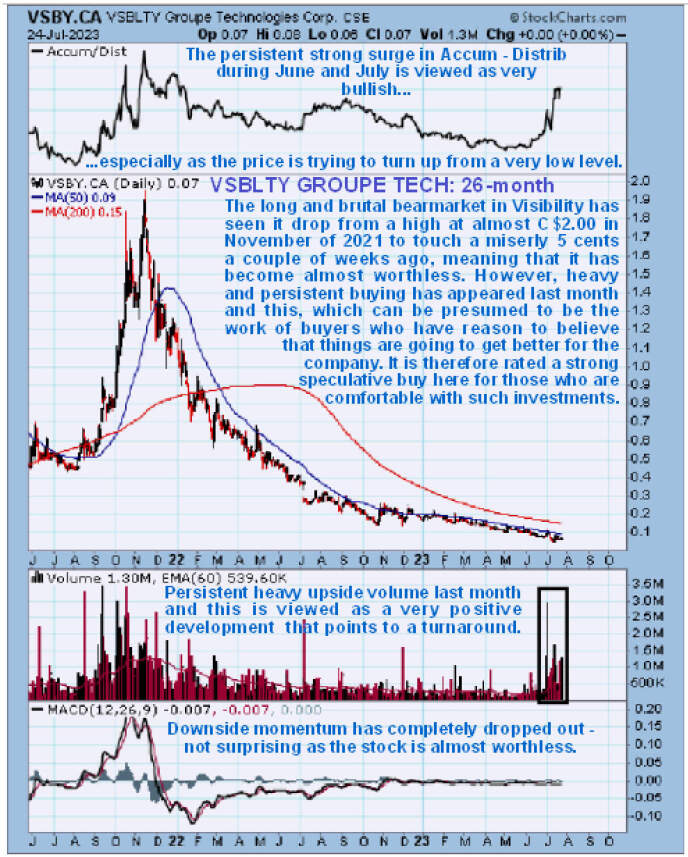

On the 26-month chart, we can see the horrendous bear market in Visibility that has taken it from a peak at almost CA$2.00 in November 2021 to bottom at a miserly 5 cents a couple of weeks ago. The reason that we are interested in it here, apart from the fact that it can't drop much more because it is almost worthless, is the appearance of persistent strong upside volume last month and especially this month that has driven the Accumulation line steeply higher.

This is viewed as evidence of determined Accumulation by a person or persons or an entity who consider(s) the company to be grossly undervalued here and might be the prelude to a takeover.

The 6-month chart shows how the latter part of the bear market has taken the form of an orderly downtrend, and whilst the downtrend remains in force with the price roughly in the middle of it, the heavy upside volume of last month and this month that has driven the Accumulation line steeply higher, which we can see to advantage on this chart, is a strong indication that a reversal is underway that will be confirmed by a clear breakout from the downtrend, but with this evidence before us, we don't have to wait for that to happen and can buy it here at a better price.

VSBLTY is obviously a speculative play here that is only suited to more experienced investors and traders who understand the risk inherent in this setup. Could the flurry of buying interest last month and this be simply a "flash in the pan" that leads to nothing and the downtrend continue?

Well, it could, but that is considered unlikely.

Instead, we recognize that you could lose your stake buying here if it continues even lower and maybe the company goes bust, but at the same time, if it does recover, you could make many times your investment, and since the technicals indicate that the chance of this happening is better than 50:50 it is considered to be a worthwhile calculated risk.

VSBLTY Groupe Technologies is therefore rated a Speculative Buy here for more experienced traders who understand and accept the risks inherent in this setup. It trades in good volumes on the US OTC market, partly because there are 246 million shares in issue, and stock dilution may have been a significant contributary factor in the decline, but continued dilution will risk further damage to credibility and thus looks less likely.

VSBLTY was the subject of an email alert sent out before the open this morning, but the stock has traded very quietly and is unchanged at the time of writing.

VSBLTY Group's website

VSBLTY Groupe Technologies Corp. closed for trading at CA$0.07, $0.05 at 1.00 pm EDT on July 25, 2023.

Originally published on clivemaund.com on July 25, 2023, at 1.35 pm EDT.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of VSBLTY Groupe Technologies Corp.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.