On Wednesday, I listened to the Fed Chairman Jerome Powell drone on and on about being "data dependent" and "deeply committed" (to curtailing inflation) as the Dow Jones roared ahead for its thirteenth straight advance with the NASDAQ up 34% YTD and the shares of artificial intelligence poster child Nvidia (NVDA:NASDAQ) posting a 203% return YTD while sporting a P/E ratio of 229.80.

Professional money managers are now in serious jeopardy unless they pull out all the stops and go uber-leverage overweight stocks, and the riskier, the better in having any chance of matching or beating their benchmarks for the year. The pungent aroma of panic is in the air that will surely change to that of soiled diapers if, for any reason, this FOMO stampede reverses in the third and fourth quarters.

Recession?

What irks me is that the economists at the Fed are now dismissing any notion of a recession this year, which was the primary purpose of jacking interest rates up and clearly stated in late 2021. Flailing demand would be a haymaker in the face of inflation as borrowing costs put a crimp into the purchasing intentions of the American consumer, but what Powell & Company forgot to factor in was the Mt. Everest of helicopter money that wound up in the bank accounts of not just the Average Joe but also the burgeoning piggy banks of the service industry employees all of whom are in great shape having kept their jobs all during the shutdown.

They are the souls that are supporting earnings for the companies comprising the S&P 500, and while that is all fine and dandy, that pool of air-dropped ebullience is going to fizzle out at some point, leaving credit card and student loan debt hanging over the cliff in a Wile E. Coyote moment of consumer retrenchment.

Forced buying of stocks either through fear of career termination or short squeezes is a particularly nasty enterprise because it not only rarely ends well, it distorts any semblance of fundamental common sense to all valuation models. In a normal market, Fund Manager Jones would take one look at NVIDIA and run for the hills, but when every one of his competitors owns it in size and is crushing it with performance numbers, Jones is forced kicking and screaming to buy it.

Conversely — and this is where the junior resource sector is suffering — Jones can look at the list of precious metals producers and see multiples of earnings and sales completely "in line" while trading at historically-low book values and as much as his training would have him go "ALL-IN MINERS," he simply cannot for fear of being hoofed out onto the street next quarter with the toe of a CIO's hobnail boot in his backside.

The Dow Jones, up 6.28% YTS, is rocking and rolling this month, playing a form of psychotic catch-up with the other major averages (S&P up 18.15%, NASDAQ up 34.07%) despite earnings which are currently just fine but where forward guidance is somewhat mixed.

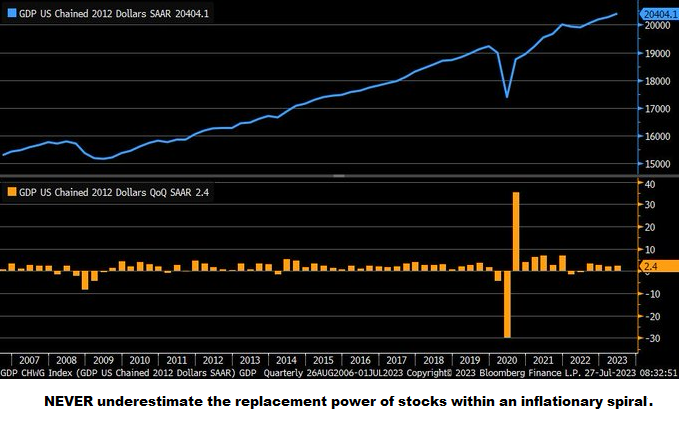

The chart on page three shows the U.S. GDP dating back to just prior to the sub-prime meltdown, and with the exception of the brief dips in 2008 and 2020, it clearly shows how the fiscal and monetary printing presses have rescued growth over the past decade and a half.

Normal economic retracements that work off excesses and cut waste and eliminate unprofitable enterprises are papered over with fresh, wet-inked cash, keeping everyone afloat with a pulse and everything with a stock symbol.

Gold and Silver No Longer a Safe Haven

If you want to try to understand why gold and silver no longer serve as safe havens in storm-like economic periods, it is because the central bankers led by the Fed have trained portfolio managers the world over to believe that hedges such as gold or silver are an unnecessary portfolio component when you have central banks propping up stocks at the slightest hint of turmoil. The replacement power of stocks in a period where central banks are flooding the system with massive liquidity (credit) cannot be measured and cannot be underestimated.

Take the past three years as an example. In October of 2022, everyone and their pet parakeet were lamenting the "Great 2020 Bear Market," where technology stocks got bombed, and crypto became a gathering zone for fraudsters and money launderers from Frankfurt to Nassau. If you look at the SPX from a 3-year perspective, it shows that the market was down 20% (the classical definition of a "bear" market) for a nanosecond in October 2022 before embarking on a meteoric recovery that is today threatening to see all-time highs in the SPX despite weakening macro conditions and crippling debt.

However, just as happened in Weimar Germany 1921-1923 and Zimbabwe in the 1980-1990 period, stocks are reflecting the ever-weakening purchasing power of the domestic currency. Rather than depicting an omen of improving corporate fundamentals and positive domestic growth and employment gains, the rising stock market is proof that it is taking more currency units (dollars) to buy the same number of NVIDIA shares as it did three years ago.

Rising P/E multiples are today the vanguard for "the new bull market," but if you follow the trail of monetary and fiscal behavior since the pandemic meltdown, you see little in the way of improving living standards and quality of life normally attributed to economic expansions telegraphed by rising stock prices.

Inflation is a tax that most affects the needy, and while I am certainly anything but a socialist, I am also firmly opposed to a system that bails out banks that make serious, equity-destroying blunders but allows those same banks to enjoy all the spoils of the inflating currency and rising interest rate structure.

There was a story on the World Socialist website that caters to the anti-capitalist crowd that tells a seriously sordid tale. Workers at freight trucking company Yellow are furious over the ongoing refusal of the company to pay its pension obligations in the Midwest and South.

On July 15, claiming they were on the verge of bankruptcy, Yellow officials refused to pay a contractually obligated US$50 million into the Teamsters' Central States Pension Funds. Yellow retirees are already paid at a three-quarters reduced rate. It seems that the cash normally reserved for the pension fund is being diverted to paying back loans to a trillion-dollar hedge fund, and the government advanced a big pandemic loan to them after the government shut down the economy.

When the populist movement gets back on its feet again, it is stories like these that will remind people (as did Ayn Rand in Atlas Shrugged) that when government gets in the way of the free market economy by favoring certain sociographic classes — like stockholders, it is usually a recipe for unrest at not only the voting booth but also in the streets.

Taking that a step further to the Fed meeting, the increase in borrowing costs hurts only one segment of the populace, and that is the borrowers, which means credit cards and installment lines and home equity loans used by those that cannot carry the ridiculously-large mortgage on that ridiculously-priced home while trying to raise a family on two incomes.

Those with no debt — like stockholders — take their cash, and they get an additional 4.5% on their 2-year note versus the 1% they were getting a year ago. Since their credit cards are paid off every month, the rising APR is a non-event. In other words, the Fed is doing what the Fed always does — it is favoring the elite class of consumers that fought the current 3% inflation rate by owning the NASDAQ up 34% YTD. Compare that with the Yellow Freight driver that has NO common stock but has ample credit card debt on top of that big mortgage and a ravaged pension fund.

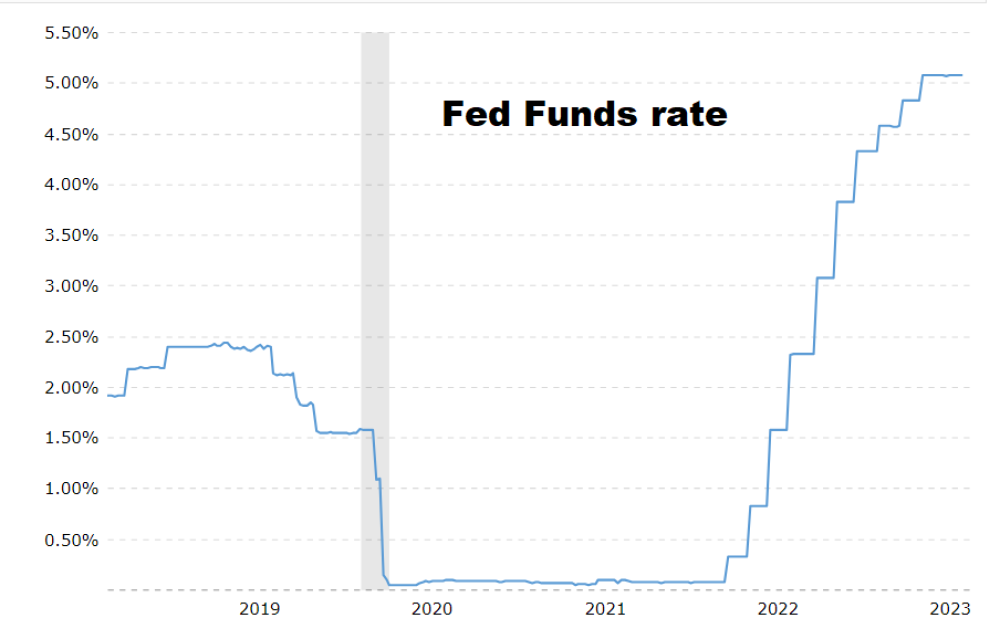

It was a mere two years ago Powell spoke of "transitory inflation" while keeping his foot on the inflationary pedal with a 0.05% Fed funds rate that stayed below the 2019 rate of 2.40% until September 2022, bouncing along the bottom at 0.05%-1.00% for most of 2021 and 2022.

Inflation is a tax that most affects the needy, and while I am certainly anything but a socialist, I am also firmly opposed to a system that bails out banks that make serious, equity-destroying blunders but allows those same banks to enjoy all the spoils of the inflating currency and rising interest rate structure.

The recent period of ZIRP was particularly hard on the profit margins for many banking institutions because it is tough to make any money paying depositors 0.25% and lending to them at 1.75%. However, today, thanks to Uncle Jerome, they are lending at 7% and paying perhaps 0.75-1.25% on deposits.

To wit, the moment that depositors call BS and start to yank their funds out in favor of money markets, REPO action leaps into form, and liquidity — a.k.a. "phony deposits" — abounds, thus fortifying bank reserves and juicing share prices.

I cap off this anti-Fed, anti-bank rant by reminding everyone that it was a mere two years ago Powell spoke of "transitory inflation" while keeping his foot on the inflationary pedal with a 0.05% Fed funds rate that stayed below the 2019 rate of 2.40% until September 2022, bouncing along the bottom at 0.05%-1.00% for most of 2021 and 2022.

In fact, when the stock market bottomed in October 2022 under SPX 3,500, the fund's rate was 3%.

Since then, the SPX is up nearly 30%, with the funds rate up another 2%+ to over 5% . . . and stocks continue to soar, with gold still some US$150 from all-time highs.

Astounding.

SPDR Gold Shares ETF

I use the SPDR Gold Shares ETF (GLD:NYSE) as my proxy for gold trades, and the last time I posted a chart, I made reference to the US$184 resistance zone when GLD was trading at around US$183 and suggested that I wanted a better entry for both gold and silver.

On Thursday, gold was trading at US$1,982 just after London opened but then did a complete, sentiment-zapping nosedive off the high-diving board to rest DOWN US$28 with the GLD down US$2.80 to US$180.47.

Buying "breakouts" in the gold and silver markets is like playing the violin on the Titanic. A sudden spike in the U.S. dollar about two hours before the opening is being used as the reason for the PM reversals, but the PM's got bombed three hours before that, so once again, the "free" FOREX markets that are supposed to be "too big to rig" can be easily blamed for the gold decline which in turn can be confirmation that gold and silver are "inferior asset classes" to stocks like NVIDIA trading at 229 times earnings.

I was looking to acquire gold toward the middle of August, but the late-week reversal might have me reconsidering. I am absolutely convinced that the upcoming BRICS meeting in Johannesburg is going to create some fireworks prompting some serious dollar weakness or oil price advances or both, which in combination should be positive for gold.

I keep reading more and more about a unilateral re-valuing of the U.S. dollar gold price, a forecast I made in the 2020 Forecast issue, and continue to believe. Reassigning the dollar value of the collateral held in Fort Knox (gold) in order to fortify the dollar and thus insulating it in its role as the world's reserve currency is the only means of delaying the inevitable default that is looming on the horizon. Without including the entitlements like Social Security and Medicare, U.S. national debt stood at over US$32 trillion, up from US$25 trillion when I wrote the piece in 2020.

From the MJB technical perspective, I see the US$174-176 zone as an optimum entry point for the GLD, and from the look of the MACD indicator, we could get a "sell signal" by early next week if the weakness continues. If that happens, the 200-DMA will give way to a larger decline right into the seasonally-optimum mid-August period, when gold has seen significant bottoms over the years.

There is also a significant gap that was never filled back at the March lows that represents a vacuum hose for price. One possible scenario is that the legions of gold bugs writing about the "END OF THE PETRODOLLAR!!!" with the upcoming BRICS meeting are confronted with something noticeably less dramatic, resulting in mass disappointment and lower prices.

Such is a lie in the World of Gold. . .

Energy

Energy prices have firmed up, which makes my "Generational Opportunity" call from June 1 look rather brilliant (or terribly lucky). Oil was US$67/bbl. at the time, and I was reading article after article pointing to US$60 oil as the reason the Fed was going to reverse course due to the disinflationary impact of lower energy costs.

I argued that the demand-supply imbalance was so skewed that traders were positioned off the narrative rather than the reality.

To simplify, with the U.S. government releasing over 200 million barrels in order to pistol-whip those nasty Russians and teach the turncoat Saudis a lesson, oil has held up rather well and now sits a hair above US$80, up almost 20% since my note to subscribers on June 1.

I elected to use call options on the Energy Select Sector SPDR Fund (XLE:NYSEARC), and while I bought the ETF in the US$76-78 range, I bought the September US$75 calls for under US$6 that now trade at US$12 and since the ETF is not yet overbought, it is nevertheless APPROACHING overbought so given that I added the September US$80 calls again under US$6 in an email alert to subscribers last week, they are sitting at the US$7.75 level so on the move to the high US$80's with a move to overbought status, I will ring the merry register on the September US$75 calls and hold the US$80's with a zero cost. Mind you, if we see my ETF target of US$90.00, I will dust the US$80 calls as well and call it a day.

The junior resource market is having yet another fitful summer. It seems that interest in junior metals developers is tepid at best while the explorers are in the proverbial doghouse. The blistering action in technology has the new generation of investor/trader absolutely mesmerized with anything "AI" and totally forgetful of the electrification narrative.

That narrative had them inhaling junior lithium explorers and developers sending anyone with a "pegmatite" to hundreds of millions of dollars of market cap. With the explosion in the NASDAQ "AI" juniors, money flow has been diverted away from the TSX Venture Exchange (and the CSE), resulting in a moribundity of volume-less "wannabes."

Volt Lithium

There are a great many juniors out there living on the life support of wickedly-dilutive cheap financings and warrant exercises, but the ones that are actually getting serious money are the ones that are going to soar once the money flow returns to the space. My top holding in the non-PM space is Volt Lithium Corp. (VLT:TSV;VLTLF:US) who this week announced a US$6 million raise led by Canaccord Capital and since the institutional community stepped up, albeit at prices rather depressed from the 52-week high last seen in late-May, the company's Rainbow Lake Project can move ahead with the knowledge that Volt has been selected — in a very difficult funding arena — as one of the "Chosen Few" to receive institutional backing.

There is good reason for this, and given the superb story that is the Volt DLE story, I am encouraged to see that despite the exceedingly-poor sentiment out there for juniors, the quality juniors are forging ahead. The company announced back in May a successful pilot plant processing of brines at a cost of under CA$3,500/tonne of produced lithium. With the CA$ price for lithium hydroxide at CA$42,000/tonne, investors seemed to think that those were "too-good-to-be-true" numbers failing to see that it was internationally-renowned Sproule Inc. that did the third-party assessment with IIROC giving the "thumbs-up" on the news release.

The company expects to produce 1,000 tonnes of lithium hydroxide by the end of June 2025, which is CA$42 million in revenue against < CA$3.5 million in costs, with CA$38.5 million falling out of the equation as pre-tax earnings.

So, the question remains: "What will the fully-diluted capital structure look like by June 2025?"

With the financing announced this week, I extrapolate roughly 170 million, but since there will be more funding required by way of equity and grant money, one must assume that 200 million shares is where they will wind up by the time that lithium hydroxide is available for sale. So, with a Pro-forma pre-tax EPS at US$38,500,000 to June 2025, the per-share number would be US$0.192. At 30 times EPS, which is totally realistic (and probably a tad conservative for being the first in Canada) for a lithium producer, that is over US$5.70 per share in two years.

The stock trades at CA$0.22 / US$0.16, and I have a ball-and-chain hammer aimed at my forehead, trying to ascertain "WHY?".

| Want to be the first to know about interesting Gold, Silver, Cryptocurrency / Blockchain and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Nvidia and Volt lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.