Take advantage of June tax loss selling and pick up bargains of a decade.

Bond brinkmanship resolved.

- Yields falling.

- Fed to follow!

Big bond rally to come.

Key Points

-

Gold

-

Marking time for US$ gold

-

But gold in Yen, Euros, and Sterling still looking strong

-

-

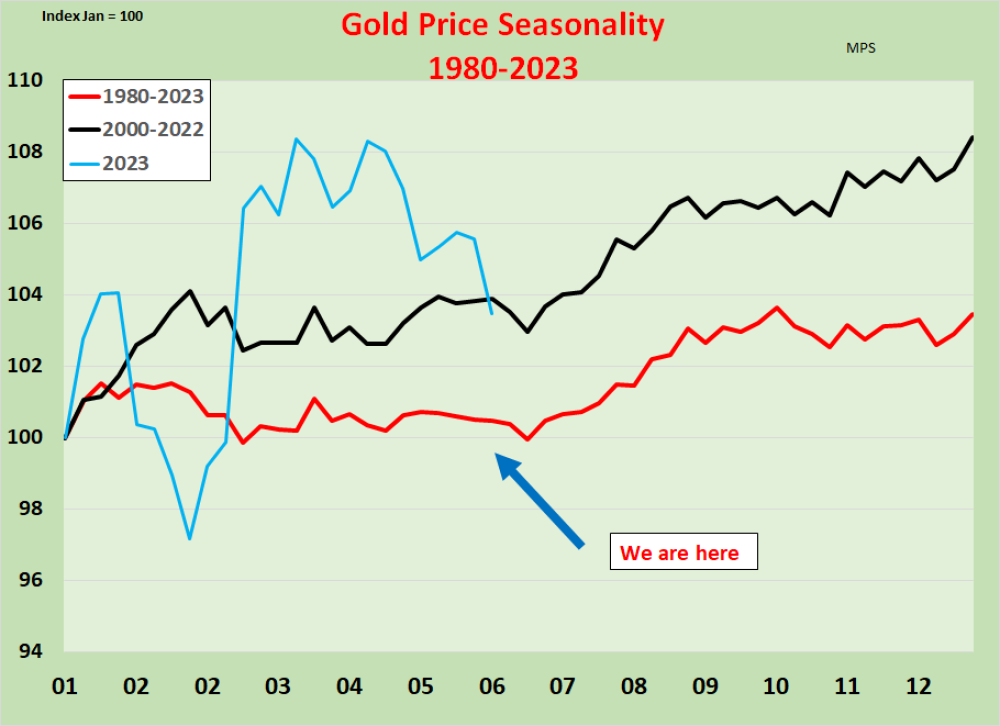

Seasonally slow in May-June but stronger into July and beyond

-

-

Gold Stocks

-

Sentiment falling away

-

Bargains on offer

-

Once in a decade opportunity here in smaller ASX Gold Stocks

-

-

Bonds

-

A major rally coming

-

Fed will follow market

Gold

We have seen good volatility in gold as we reached the end of the June quarter. Gold is seasonally weak at this time, and so should be bottoming soon before rising in the September quarter.

There's certainly a lot going on in U.S. politics, but it is becoming clear that the Biden criminal syndicate is now out in the open and seen for what it is. The criminal acts of the FBI and the DOJ extend into so many other federal and state administrations, and we are seeing that America is saying enough is enough.

Diversions from Russia and Ukraine shenanigans and undersea disasters won't be enough to head this off.

A climax is coming soon, and it will be seen in the bond market, the currency, and the stock market. And, of course, the net effect will be a return to a gold standard to stop all these budget deficits caused by politicians buying votes.

Gold will be a major beneficiary.

Emerging market economies were big buyers of gold in 2022, and the first quarter of 2023 was an all-time record for central bank buying in a March Qtr. At the time of the end of the Bretton Woods Agreement in 1971, the reserves of central banks were made up of about 40% in gold, with the rest being the debt securities of various currencies but mostly US$.

Central banks currently have about 16% in gold and over 50% in US$ debt securities. It's hard to imagine central banks being happy holding Euro debt securities which would have been financial disasters over the past couple of years. And none would enjoy holding Yen.

And then what else to hold?

As noted here before, a move to 40% gold for central bank reserves (currently around 38,000t) would require the purchase of another 4.000 tonnes gold priced around US$7,000/oz. It is coming and with a strong US$.

You saw the comment on the Yen last week. Euro next.

Gold is declining into this seasonal low which, on average, is only two weeks away.

Gold in US$ has been very constructive in this declining wedge formation, so it will be very interesting to see how the seasonal aspects come into play here.

That intraday rally on Friday added to the appeal of this declining wedge which is probably now over three months old.

The longer the period, the more powerful the breakout.

Longer term position for gold still is as powerful as ever.

We know with central bank buying and a pickup in interest in ETF gold that, the underlying demand for gold is strong.

It is only the banksters trying to hold it back.

Gold Stocks

The XAU is back at important support around 118, and whilst the uptrend might be wonky, this has not been your typical unfettered technical market.

Sentiment for gold stocks is falling away toward the end of the Qtr.

So it is buying time.

ASX Gold Stocks

- And it is buying time here

- Tax loss selling provides bargains

- This index is currently down 64% from its high in August 2020

- It is wedging nicely

- The break upwards when it comes will be very strong

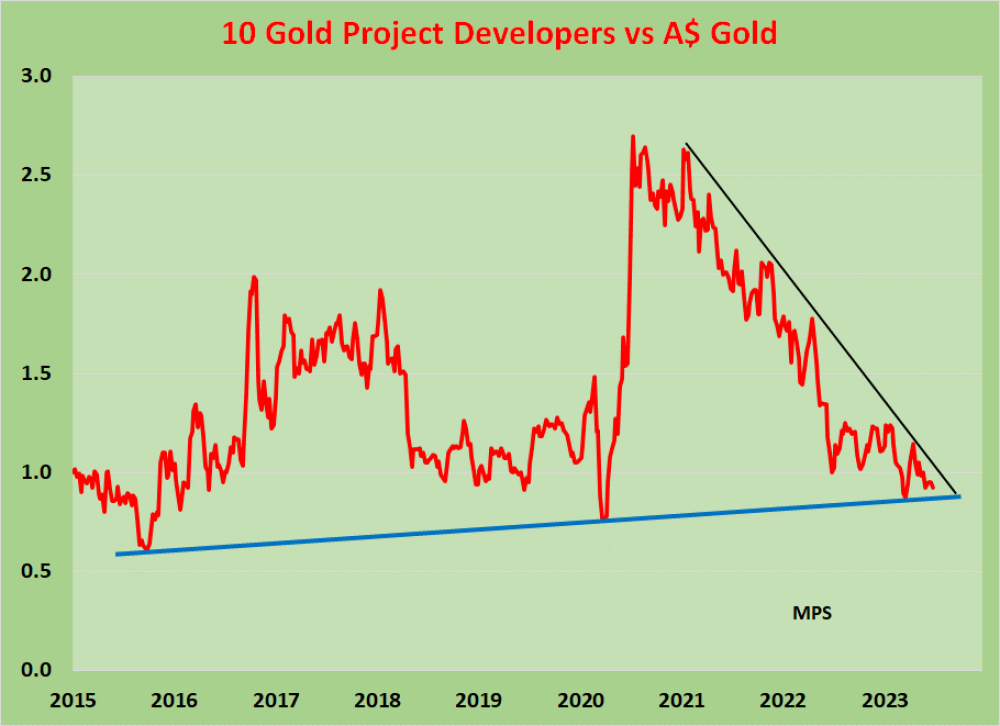

And these developers are down 66% against AU$ gold.

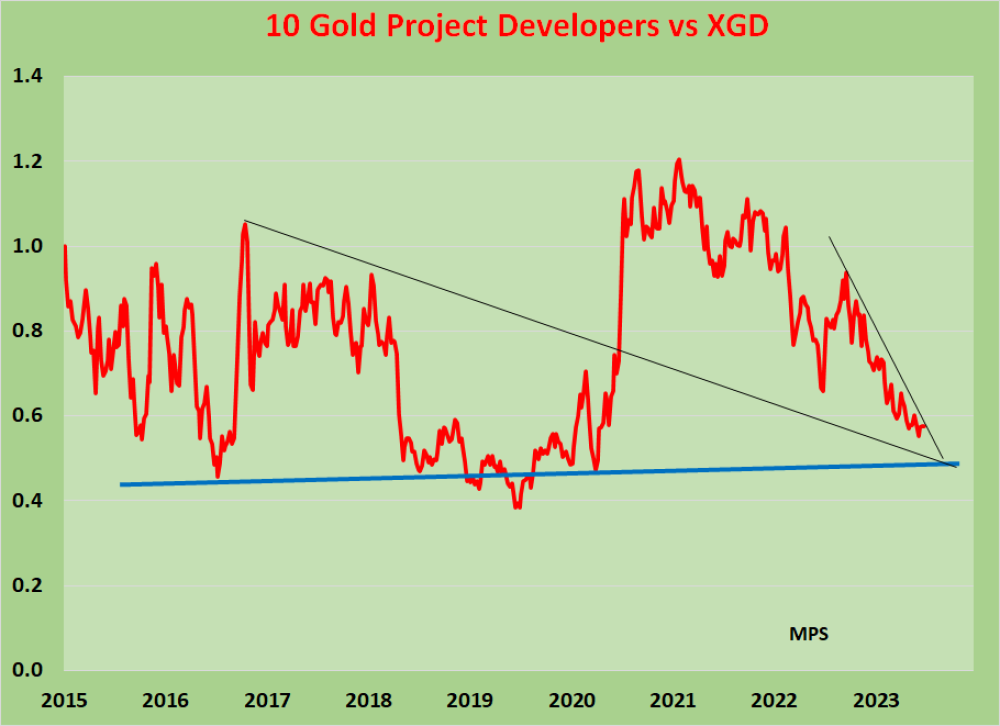

And down 50% against the ASX Gold Index.

All these are wedging with a strong uptrend, and a heavy downtrend suggests the bottom is close and the upturn will be very strong.

Oh, and did I mention that the Euro is next to fall over?

Timing is everything.

Heed the markets, not the commentators.

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.