Barsele Minerals Corp. (BME:TSX.V; BRSLF:OTCQB) has provided an update on its continued exploration activities within the Barsele gold-VMS (volcanogenic massive sulfide) project area in Vasterbottens Lan, northern Sweden.

The exploration program is being operated as part of a joint venture project with partner Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE). Agnico Eagle owns 55% of the Barsele project, while Barsele owns 45%.

Top points from the update include the fact that diamond drilling is currently budgeted for a total of 3,000 meters, which will correlate to an estimated 15 holes and will also account for testing for intrusive-hosted orogenic gold and volcanogenic massive sulfides.

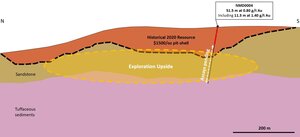

Drilling will start by the Risberget zone, with an aim to test orogenic gold targets in the vicinity of previously intersected gold mineralization, along the southeasterly extension of the 3.6-kilometer Avan Central Skirasen gold trend.

The second principal target will be the Avan zone. High gold grades have been discovered in this area previously.

The company conducted data analysis at various exploration sites between January 1 and May 30, 2023, in preparation for this year's drilling campaign. It included a base of till analysis, geophysical surveys, as well as analysis of previously collected MEFFA (multielement fine fraction analysis) samples.

Ahead of the Herd reports that, since the beginning of the year, gold's price has risen by 8%, which is "the best YTD return of all mainstream metal commodities."

This process involves automated pXRF (portable X-ray fluorescence) scanning combined with laser ablation and ICP-MS (inductively coupled plasma mass spectrometry) and helps to define precious/base metal anomalous areas.

This analysis will be continued into the future to gain more data and insights.

Barsele President, Gary Cope, said he is "very pleased that the 2023 diamond drilling is underway, and I, along with our shareholders, look forward to receiving the results from testing at Risberget, Avan, and Norra."

The company's objective is to define the trends and targets of both base and precious metals in the area. Diamond drilling has been in operation since 2015, for a total of 436 drill holes, with 162,691 meters of overburden penetration and core collection.

Barsele Minerals Corp. is a Canadian junior mineral exploration company managed by the Belcarra Group, with a focus on exploring its flagship Barsele Gold Project, located around 600km north of Stockholm, Sweden. Sweden has long been one of Europe's leading producers of metals and offers the added incentive of a 22% corporate tax rate and no mineral tax, as well as low political risk to mining. Since 1992, there have been no Statutory State holdings for mineral projects, giving easier access to foreign mining investment.

The Barsele project features mineral claim holdings of over 47,000 hectares.

Multiple Upcoming Catalysts

Barsele Minerals has big plans for the Barsele Gold Project, including advancing it to a point where a significant and reputable miner acquires and develops it.

The company's focus is to drill along the 3.6km long gold trend, and there are also plans underway to conduct exploration with the Sámi and other affected peoples. Barsele will also aim to add continuity to the high-grade drill results from the Avan Zone and carry out additional drill testing at the Bastuträsk Zone.

There are also plans for drill testing the most compelling VMS (Volcanogenic Massive Sulfide) targets.

Insight Into Gold

Ahead of the Herd reports that, since the beginning of the year, gold's price has risen by 8%, which is "the best YTD return of all mainstream metal commodities." It also reports that there were several instances where "it came within cents of reaching a new record price of US$2,069.40 per ounce set in 2020."

Founder and CEO of GraniteShares, Will Rhind, recently told ETF Edge that "the story is all about gold" and that "it's the only major metal to remain firmly in the green for this year." Rhind believes the ongoing banking crisis, higher inflation, and the declining dollar are responsible for the uptick.

Technical Analyst Clive Maund said Barsele Minerals is "looking very attractive."

He said, "Gold is really serving its purpose at the moment as a way for people to park money in a noncorrelated asset as they worry about what might happen."

Head of research at VettaFi, Todd Rosenbluth, suggested that "Gold may not continue to be in favor forever."

Technical Analyst Clive Maund said Barsele Minerals is "looking very attractive" and explained that it had "broke out of a Double Bottom base pattern in January with a big move that saw it double in price in about two weeks, after which it formed an intermediate top before having a normal reaction back to strong support in the vicinity of its now bullishly aligned moving averages which reaction served to correct the big January impulse wave."

He went on to say that the "volume pattern is clearly strongly bullish."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Barsele Minerals Corp. (BME:TSX.V; BRSLF:OTCQB)

Ownership and Share Structure

According to Reuters, 6.35% of the company is held by management and insiders. President, CEO, and Director Gary Cope has 1.98%, with 2.72 million shares. Director Arthur Freeze has 1.55%, with 2.14 million. CFO and Director Ross Wilmot has 1.32%, with 1.82 million. Vice President of Exploration Bernard Whiting has 0.93%, with 1.28 million. Director Richard Sayers has 0.31%, with 0.43 million, and Director Henry White has 0.25%, with 0.35 million.

18.97% is with strategic investors. 12.61% is with 683192 B.C. Ltd., with 17.34 million shares.

5.49% is held by institutional investor U.S. Global Investors Inc., with 7.55 million shares.

The rest is with retail.

Headquartered in Vancouver, Barsele Mineral Corp. has a market cap of CA$21.97M. It has 137.3 million shares outstanding.

It trades at a 52-week range of CA$0.16 and CA$0.28.

Sign up for our FREE newsletter

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barsele Minerals Corp. and Agnico Eagle Corp.

- Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.