Take advantage of June tax loss selling and pick up bargains of a decade.

Key Points

- Gold

- Another painful month of sideways decline for US$ gold

- But gold in Yen, Euros, and Sterling still looking strong

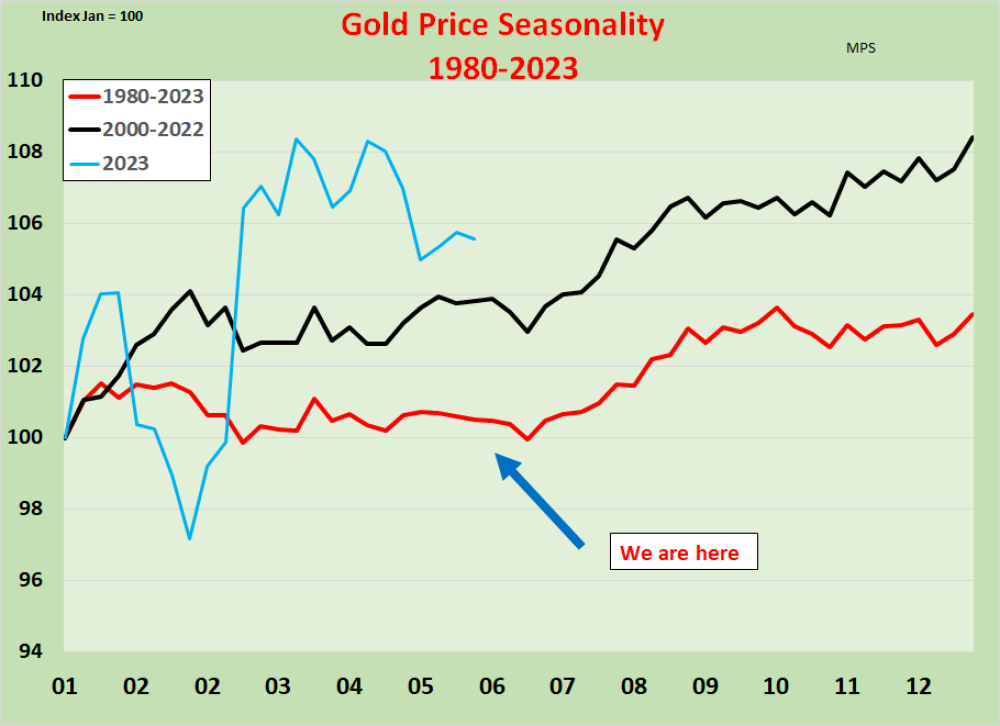

- Seasonally slow in May-June but stronger into July and beyond

- The sentiment is falling away

- Another painful month of sideways decline for US$ gold

US$ Gold has been on the decline now for over six weeks, reflecting whatever you would like. Strong US$, weak US$, disasters in the Biden regime, Ukraine Offensive/Not Offensive, brinkmanship in the U.S. bond markets, arrant stupidity in the energy markets.

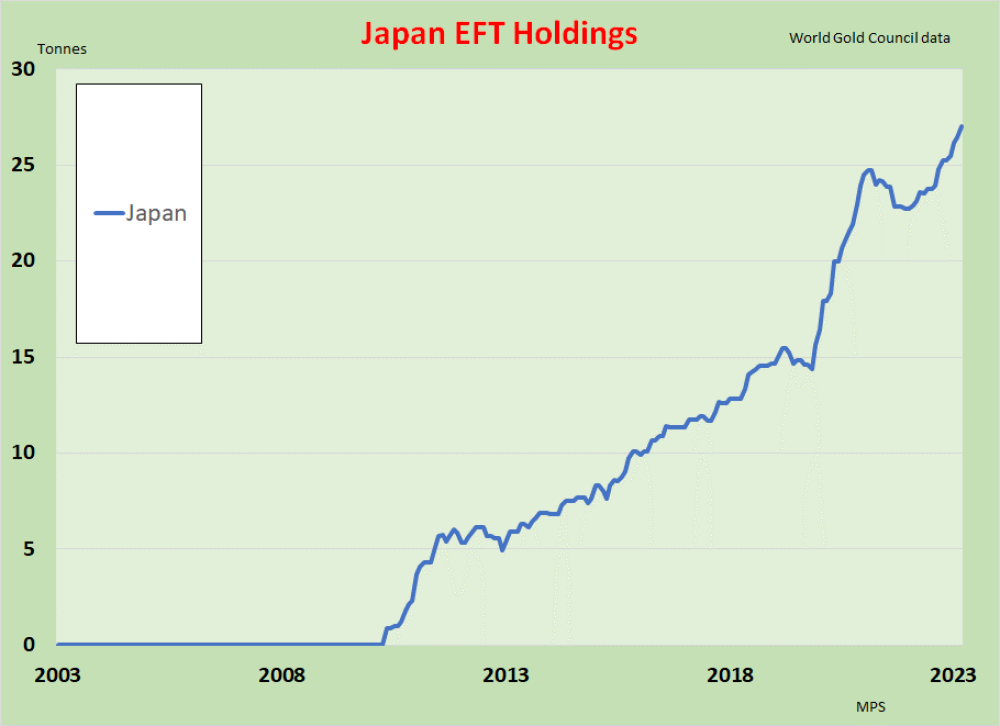

Central banks are still buying record amounts of gold. ETF gold purchases are rising again.

So many issues. Equity markets rallied but overbought. Oil prices are declining but bottoming.

There has to be an end in sight.

Gold here could be getting ugly, but just remember the seasonal aspects.

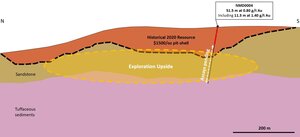

Gold in US$ is still in this declining wedge formation and is coming into some other long-term support.

And gold is still hanging on here with that long-term support and the parabola underneath.

So we are back to having no idea what is next.

Don't forget this.

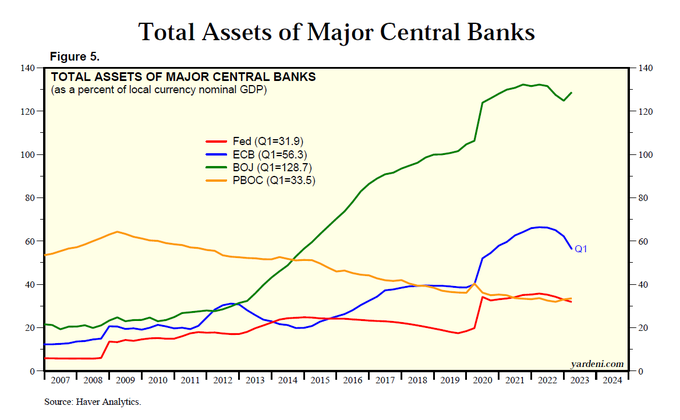

And while looking at the US$ this is a different graphic showing the debt levels in the central banks.

- The U.S. has only 31.9% of U.S. GDP.

- Europe has 56.3% of Eurozone GDP.

- Japan has 128.7% of its GDP.

Yen

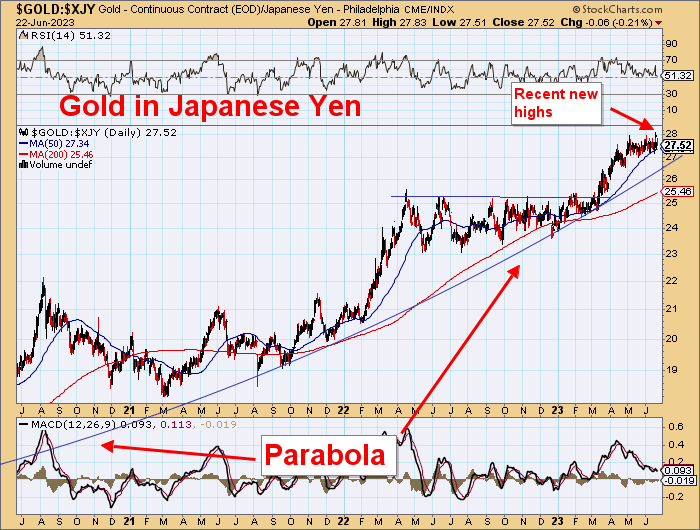

Very clear what is happening here in Japan, though. World's third-largest economy and about 16% of the U.S.

The death of a currency is unfolding. The 50-year uptrend vs. US$ was broken about 18 months ago.

New lows are coming.

10 Year Bond yields are sub 0.5%.

How long can this continue without a massive rise in yields?

Gold prices in yen are rising and at near all-time highs.

The next move will be a strong surge.

Gold demand is soaring.

The stock market is also soaring.

AU$ vs. Yen will soon rise strongly.

Just keep in mind that the Euro is next.

Timing is everything.

Heed the markets, not the commentators.

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.