This morning, NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) released additional high-grade oxide heap-leach gold results from its Nutmeg Mountain gold project in Idaho. NevGold Corp. is a distinguished exploration and development company, that strategically focuses on unlocking the vast potential of expansive mineral systems within the well-established regions of Nevada, Idaho, and British Columbia. NevGold boasts 100% ownership of its Limousine Butte and Cedar Wash gold projects in Nevada, alongside the Ptarmigan silver-polymetallic project in Southeast BC. Additionally, the company holds an option to acquire full ownership of the promising Nutmeg Mountain gold project situated in Idaho, for which this news is about.

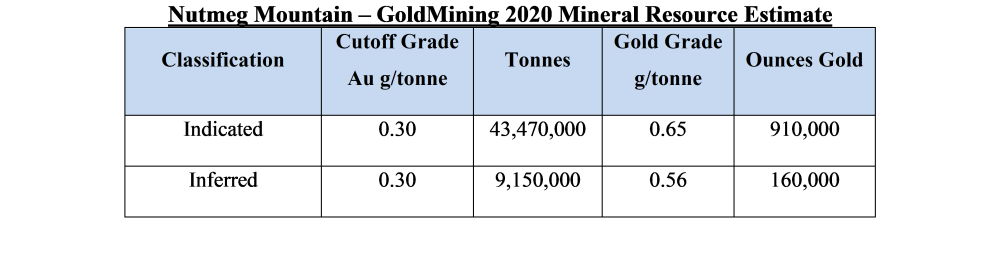

Nutmeg Mountain currently has a 2020 historical mineral resource estimate (MRE) of 910,000 indicated ounces of gold (43.5 million tonnes (Mt) at 0.6 grams per tonne gold (g/t Au)).

Prior to these results, the Caeser's Report Newsletter commented on Nutmeg Mountain as a project, saying in a March 8 release, "It looks like NevGold will hit the ground running this year . . . The company is still scratching the surface at both Nutmeg and Limousine Butte, and there is a lot of resource growth potential after the fully funded 2023 drill programs."

We will see what Caeser's Report writes after today's results, which highlights:

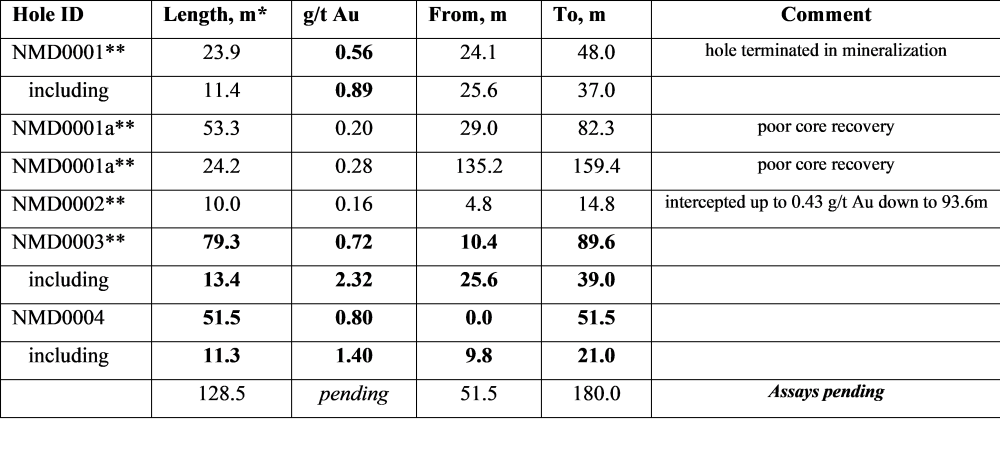

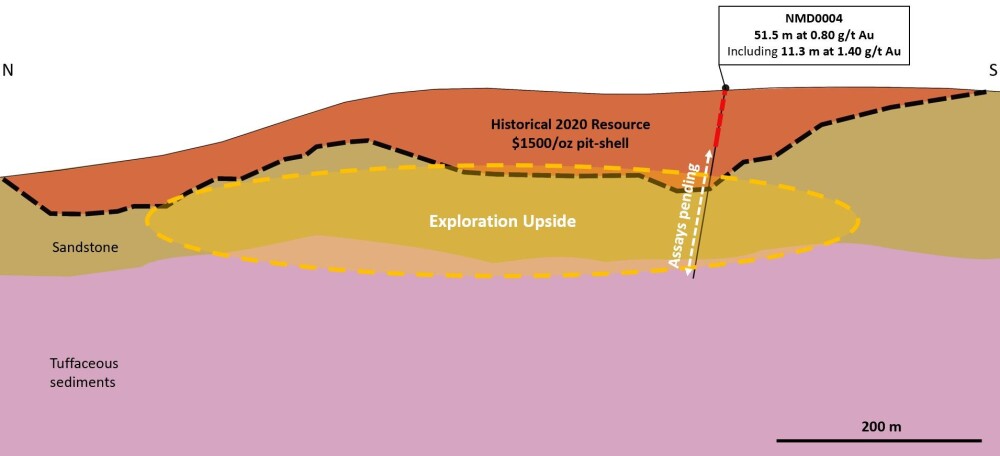

- More High-Grade, Heap-Leachable Gold Intercepted from Surface: the company intercepted 80 g/t Au over 51.5 meters from surface (oxide, heap-leachable), including 1.40 g/t Au over 11.3 meters from 9.8 meters depth (oxide, heap-leachable) (Hole NMD0004). Assays are pending for the remaining approximately 130 meters of this hole.

- Metallurgical Testwork Has Commenced: Hole NMD0004 was drilled to commence metallurgical test work at the Project. The company has engaged McClelland Laboratories out of Sparks, Nevada. The focus of the metallurgical test work is to analyze optimization opportunities related to grinding, comminution, and recovery methods.

- Building Large, Near Surface, Mineralized Footprint: other drill results released from the 2023 drill program include 72 g/t Au over 79.3 meters from 10.4 meters depth (oxide, heap-leachable), including 2.32 g/t Au over 13.4 meters from 25.6 meters depth (oxide, heap-leachable) (Hole NMD0003), and 0.56 g/t Au over 23.9 meters from 24.1 meters depth, including 0.89 g/t Au over 11.4 meters from 25.6 meters depth with 4.33 g/t Au intercepted near the bottom of the hole (Hole NMD0001, hole was lost in mineralization) (See news release from April 13, 2023).

- Current Drill Program Update: the orientated core drilling portion of the drill program is now complete, and the program will shift to reverse circulation (RC) drilling.

- Advancing Mineral Resource Estimate (MRE): the company is advanced in completing an MRE at the Project, with targeted completion in early July.

In light of these results, CEO Brandon Bonifacio commented, "The further results from our inaugural drill program at Nutmeg Mountain continue to highlight the exceptional at-surface, high-grade oxide, heap-leachable gold mineralization at the project. NMD0004 will be utilized for the commencement of metallurgical test work with a focus on optimization opportunities in the grinding and comminution area. We are looking forward to the remaining approximate 130 meters of assays pending from Hole NMD0004, which is at the assay lab undergoing further testwork."

Why Gold?

Gold has historically served as a safe-haven asset during times of economic uncertainty or market volatility, according to Forbes. When other investments falter, gold tends to retain its value, making it a reliable store of wealth.

Additionally, gold stocks provide investors with an opportunity to gain exposure to the precious metal market without physically owning and storing gold, which may offer greater liquidity and convenience. Moreover, gold stocks often have the potential for significant returns when gold prices rise, as mining companies' profitability tends to increase with higher gold prices.

Catalyst: Updated Mineral Resource Estimate

In the latest announcement, NevGold Corp. officially disclosed its collaboration with Global Mineral Resource Services, a prominent North Vancouver-based company. The purpose of this partnership is to undertake a comprehensive update of NevGold Corp.'s 2020 mineral resource estimate (MRE) of NevGold's Nutmeg Mountain site. The anticipated completion date for this critical task is set for the early days of July 2023.

While the 2020 mineral resource estimate (MRE) is considered to have maintained its reliability, it is important to note that no qualified individual has conducted extensive work to classify the previous MRE as up-to-date. Consequently, NevGold Corp. refrains from designating the estimate as current mineral resources or reserves.

However, thanks to ongoing drilling activities and geological assessments, NevGold Corp. is confident that the existing body of work will provide a solid foundation for the completion of a new MRE in collaboration with Global Mineral Resource Services.

Ownership and Share Structure

Streetwise Ownership Overview*

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE)

Management and insiders collectively hold an impressive 30% stake. Prominent among these insiders is Brandon Gennaro Bonifacio, who commands a notable 6.06% ownership with 4.11 million shares. Additionally, Gregory French claims a 1.62% stake with 1.10 million shares, while Victor H. Bradley possesses a 1.33% ownership with 0.90 million shares. Timothy Dyhr maintains a 1.30% interest with 0.88 million shares, followed closely by Morgan Hay, who owns 1.25% with 0.85 million shares. Lastly, Robert T. McKnight retains 0.33% ownership with 0.22 million shares.

In terms of strategic investors, GoldMining Inc. holds a significant 18.54% stake, representing 12.56 million shares, while Palos Management Inc. possesses 0.89% with 0.60 million shares.

The rest is with retail investors.

NevGold Corp. reports a cash reserve of CA$2.0 million, with a monthly burn rate of CA$50k. Furthermore, the company incurs a drilling cost of CA$300 per meter for core drilling and CA$125 per meter for reverse circulation.

According to Market Watch, the company has a market cap of CA$22.86 million and 63.5 million share outstanding. It trades in the 52-week range between CA$0.30 and CA$0.65.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NevGold Corp. is an affiliate and has a consulting relationship with Streetwise Reports and has paid a consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.