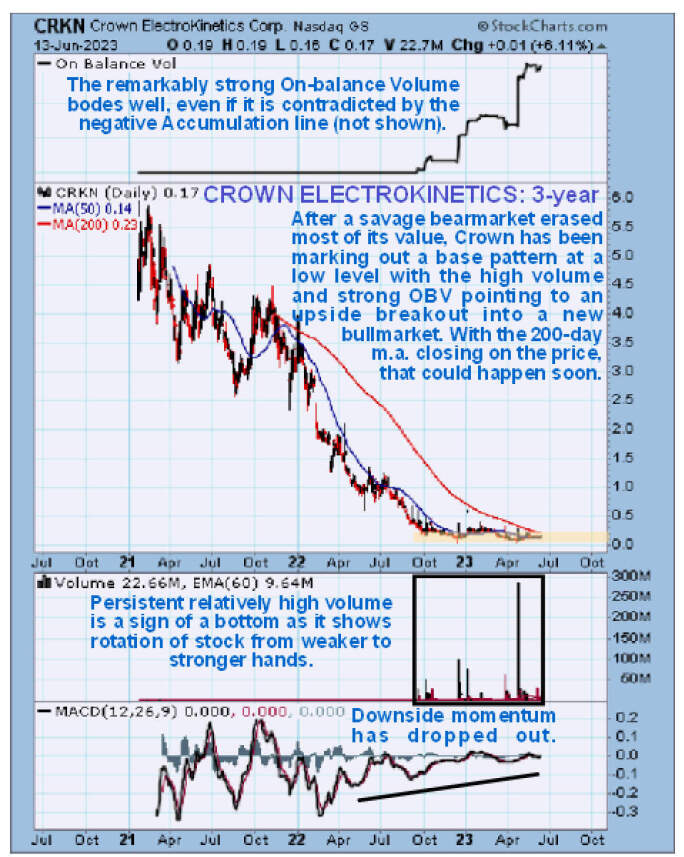

Despite drifting lower in recent months, Crown Electrokinetics Corp.'s (CRKN:NASDAQ) technical setup has continued to improve, and we can see why on its latest 1-year chart. On this chart, we see that the decline into late April brought it down to the low of last December, with which it made a Double Bottom with the sharp rally on huge volume out of this low viewed as bullish.

We had earlier thought that it might be making a Head-and-Shoulders bottom, but it was pressed lower and lower by the falling 200-day moving average bearing down on it from above.

However, it held the lows and has risen off them, giving time for the 200-day m.a. to drop down into the base pattern so that we are now seeing an increasingly tight bunching of price and moving averages in a manner that frequently leads to a reversal into a major uptrend.

The reason that this update is titled "The strange case of Crown Electrokinetics" is because the outstandingly strong On-balance Volume line is contradicted by an equally weak Accumulation line, which is most paradoxical, yet the fact remains that there has been persistent relatively high volume since this potential base pattern started building out, which shows the substantial rotation of stock that is viewed as bullish, since the buyers are clearly smarter than the sellers, who are selling at a low level at a loss, and they are less likely to relinquish their stock until they have turned a profit.

To be honest I am amazed that the stock has not made greater gains in recent days given that the company just secured a US$85 million order for a project that comes hard on the heels of another order about a week before for US$50 million and was the sixth big project won in six months — and this for a company with only about 50.7 million shares in issue.

What appears to be happening is that some investors, apparently completely unaware of the big orders that the company is winning, are continuing to sell onto rallies although the current bunching of price and moving averages strongly suggests that this selling will soon be exhausted and when it is the stock is likely to make big gains.

On the 3-year chart, we can see that the base pattern that has built out since late last year was preceded by a savage bear market that erased most of the stock’s value.

We, therefore, stay long, and Crown is rated a Strong Speculative Buy here.

Crown Electrokinetics' website.

Crown Electrokinetics Corp. closed at $0.17 on June 13, 2023.

Originally published on clivemaund.com on June 13, 2023, at 7:35 pm EDT.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Crown Electrokinetics Corp.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.