Very strong market setups. It is very unusual to see such strong setups across so many markets. Currencies, equities, bonds, gold, silver, and oil are setting up for strong moves into July and for the next year at least.

The key is a rallying U.S. bond market and equities about to really surge and a rising US$. The other major currencies and their bond markets look woeful. Gold will be running, and silver should really surge.

Take advantage of June tax loss selling and pick up bargains of a decade.

Key Points

- Gold

- Another four weeks of sidewise but very constructive price action for US$ gold

- But gold in Yen, Euros, and Sterling looking very strong

- Seasonally slow in May-June but stronger into July and beyond

- New US$ highs coming soon

- Another four weeks of sidewise but very constructive price action for US$ gold

- Silver about to finally break out higher

- Nth Am Gold stocks starting a Wave 3

- Have completed C Wave for 2

- Nice uptrend formed

- XAU still heading for 165

- ASX Gold Stock Index XGD starting a Wave 3

- Wave 2 pullback complete

- Tax loss selling for 30 June likely to provide bargains over next two weeks

- Bounced off major technical support here

- August 2020 downtrend support

- Oct 2022 uptrend test

- Horizontal support around 6700

- ASX Gold developers look outstanding

- CYL

- NVA

- AUC

- AUT

- BC8

- KZR

- SNG

- SXG

- US$ - heading higher

- Supporting on downtrend

- Rally to 105 soon

- Euro, Yen, Sterling and Swiss Franc, etc. still look awful

- Bond yields in Japan and Germany likely to surge

- U.S. bonds setting up for a strong rally

- U.S. equities

- S&P 500 exceeded 4300

- 4600 coming and much more

- DOW 30 about to surge

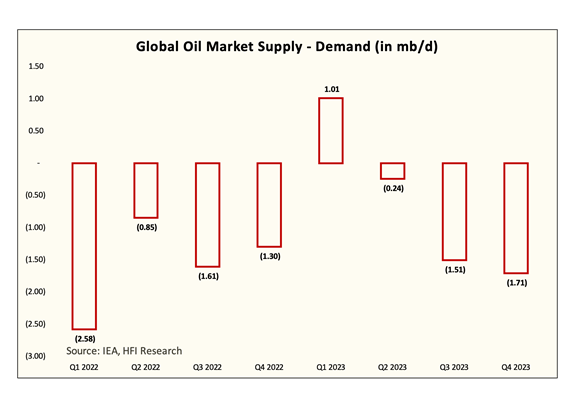

- Oil bottoming

- Market in deficit in Dec Half 2023

- Energy supply cliff ahead

- Bitcoin still looking sick

Heed the markets, not the commentators.

Gold

It has been moving sideways now for over four weeks and, in doing so, has followed a very constructive technical pattern. Intraday moves over the last few weeks have had that+/-US$30 range which would appear to be quite constructive overall.

Gold is still holding above major support, not far from US$2000.

As noted previously, gold is now in a seasonally slow period and has a good record of rallying in the December Half from May-June lows. What is very interesting has been the strength of gold in other currencies, reinforcing gold's internal strength.

But as has been pointed out, gold is technically ready for another sharp move higher.

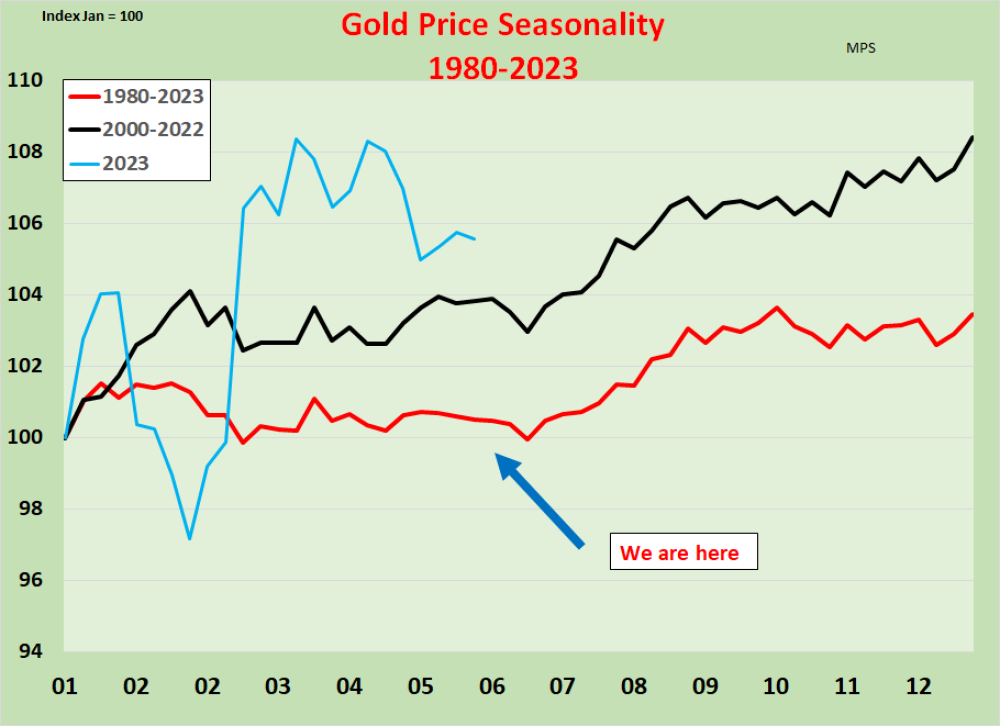

A gold seasonality weekly chart has been generated here for 44 years since 1980, with another covering the 22 years of this century. And so far in 2023, gold is performing above the average.

The key point, of course, is that there is this period of seasonal weakness in May, June, and July end followed by a rising gold price until the end of the year. So often, attendees at the Diggers and Dealers in Kalgoorlie at the end of July have been welcomed by the start of the gold rally.

Gold has traded under this 6-week downtrend but has held above important medium-term support.

The new wedge that has been formed doesn't have much time left before a resolution.

The uptrend is intact, so let's see if seasonal influences push gold higher.

I am still impressed by the way gold has held above this long-term support level.

Silver

- Setting up technically for a strong move

Gold Stocks

- Gold stocks are still holding on to an 8-month uptrend

- Wave 2 completed

- Now starting Wave 3

- Strong support around these levels

- Next stop 165 on the XAU

Strong breakout and pullback here.

- Supporting on May 2022 downtrend

- Picking up Oct 2022 uptrend

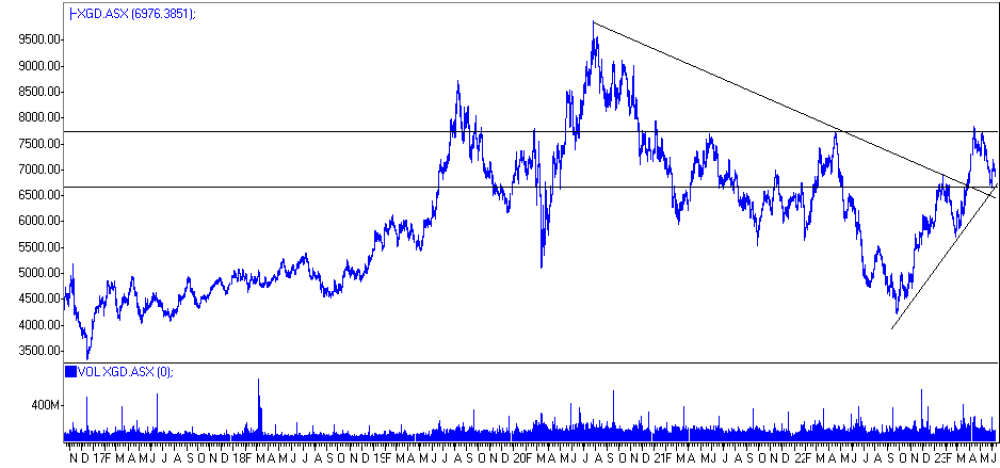

ASX Gold Index

Consolidating on good technical support:

- Sept 2022 uptrend

- July 2020 downtrend

- Horizontal support at around 6700

- Tax loss selling should provide buying opportunities

The XGD is holding up nicely and has been rising faster than the AU$ gold price.

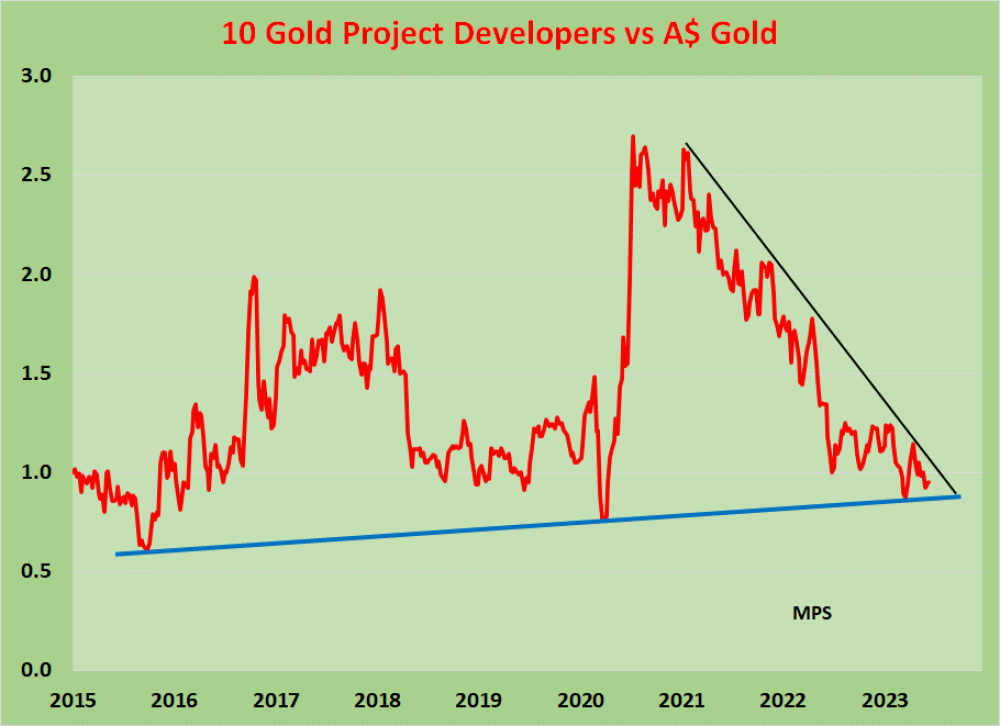

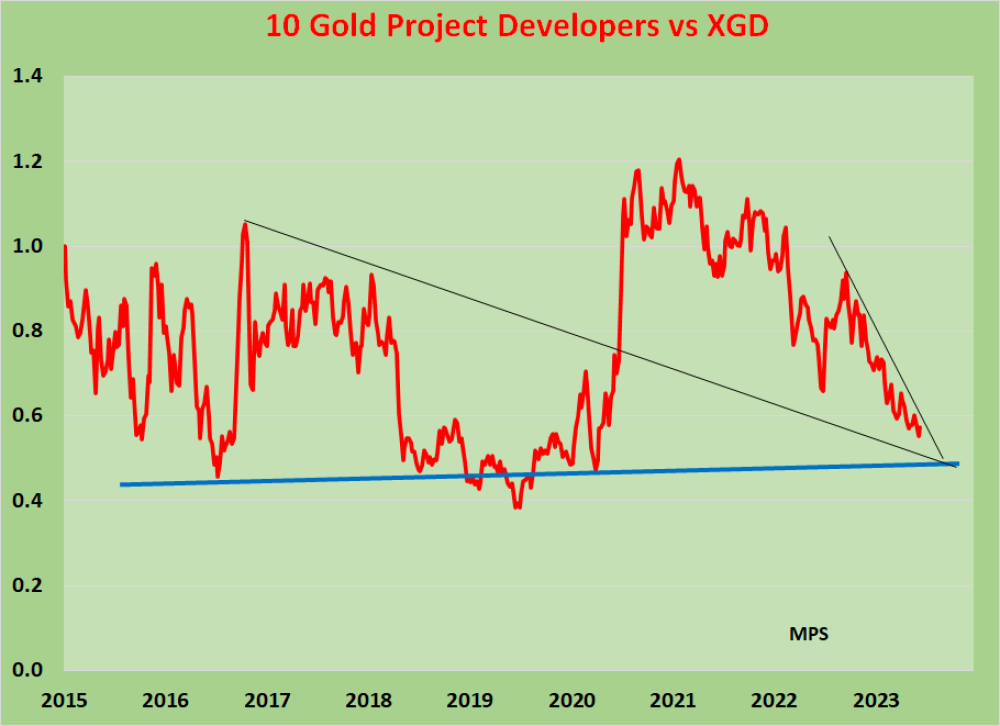

In contrast, the smaller stocks are still battling.

But the wedging pattern is showing a big change is coming.

The decline against the AU$ gold price will soon be over too.

And a massive relative outperformance is coming.

US$

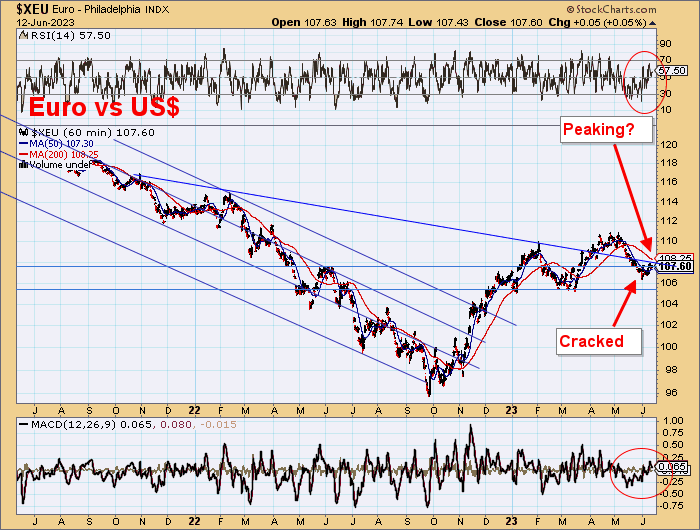

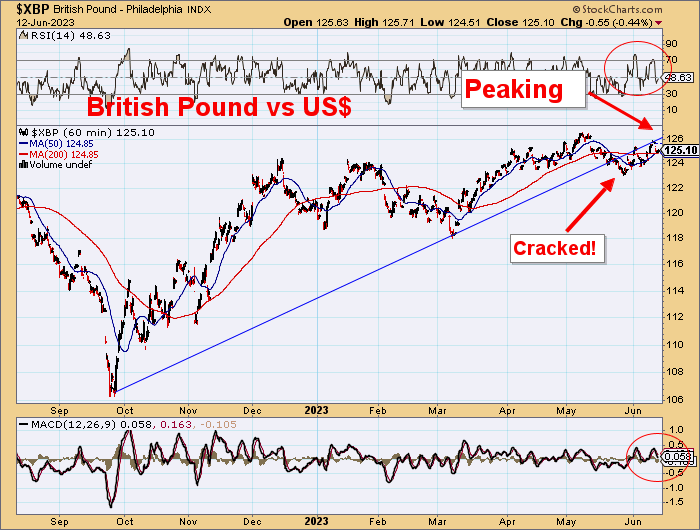

The US$ is supporting a downtrend and probably wedging before rallying to 105. The major currencies have broken those 50-year uptrends, and the Swiss Franc fell back below this after its recent rally.

Big setups here and in their bond markets. Note that the AU$ is not following these other currencies.

A strong currency usually has a strong bond market.

These graphics still suggest a strong rally and a decline in yields.

TLT seems to be setting up very nicely.

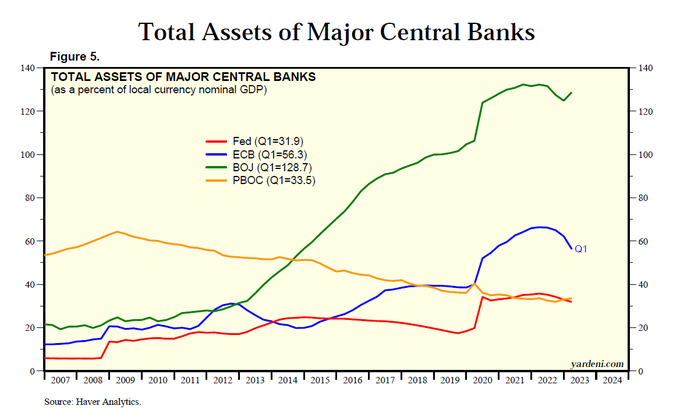

And while looking at the US$ this is a different graphic showing the debt levels in the central banks.

- The U.S. has only 31.9% of US GDP

- Europe has 56.3% of Eurozone GDP

- Japan has 128.7% of its GDP

The currencies reflect this, and their bond markets are about to see a lift in yields.

The Yen is a basket case.

And just a 0.42% yield on a 10-year bond.

UK yield is about to surge, and Sterling will decline.

The AU$ is different and is moving on another flight path.

US equities

U.S. equities have performed very well and have exceeded the 4300 level for the S&P 500.

The Dow has just broken 6-month downtrend it looks to be ready to surge.

- Breakthrough 4300 achieved

- 4600 will be next

- DOW 30 about to surge higher

- Short covering driving

- DOW 30 to move sharply higher

Oil

- Looking to bottom here with deficits expected in the Dec Half

This market seems to be bottoming on good volume.

Bitcoin is still looking soft.

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Special Situations, Gold, Silver, Cryptocurrency / Blockchain and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.