Southern Energy Corp. (SOU:TSX; SOUTF:OTCMKTS; SOUC:AIM) lowered its well drilling and completion costs, but to return to growth it still needs the Henry Hub gas price over US$3 per thousand cubic foot (US$3/Mcf), reported Auctus Advisors analyst Stephane Foucaud in a May 30 research note. The Canadian oil and gas producer can hold off until the price reaches this point.

"With available undrawn credit facilities of about US$14.5 million (US$14.5M) and corporate cash flow break-even of about US$1.80-1.90/Mcf (Henry Hub), the company is well positioned to wait for a rebound in gas prices," Foucaud wrote.

Possible 567% gain

Auctus maintained its target price of £1.60 per share on Southern Energy, currently trading at about £0.24 per share. The difference between these two prices implies a large, potential return for investors of 567%.

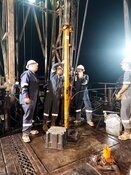

Well costs reduced

Southern has four already-drilled wells ready for completion: two Lower Selma Chalk laterals, one City Bank lateral and one Upper Selma Chalk lateral, Foucaud relayed. Now, after having effected cost efficiencies, it will run the company about US$3.4M to complete each well..

As such, it is expected Southern will hold off until the Henry Hub gas price, currently about US$2.25/Mcf, exceeds US$3/Mcf, purported Foucaud. Completion is now forecasted for potentially Q4/23.

"The acquisition of the Gwinville assets from PetroTx has provided Southern with additional access to the Florida Gas Transmission System that provides access to a market with much higher gas price premium than achieved by Southern in the past," Foucaud pointed out.

First quarter in brief

Also in his report, Foucaud noted that during Q1/23, Southern produced 2,607 barrels of oil equivalent per day, as expected.

As of quarter's end, March 31, 2023, the energy company had about US$12M of cash and $19M of net debt, including working capital.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |