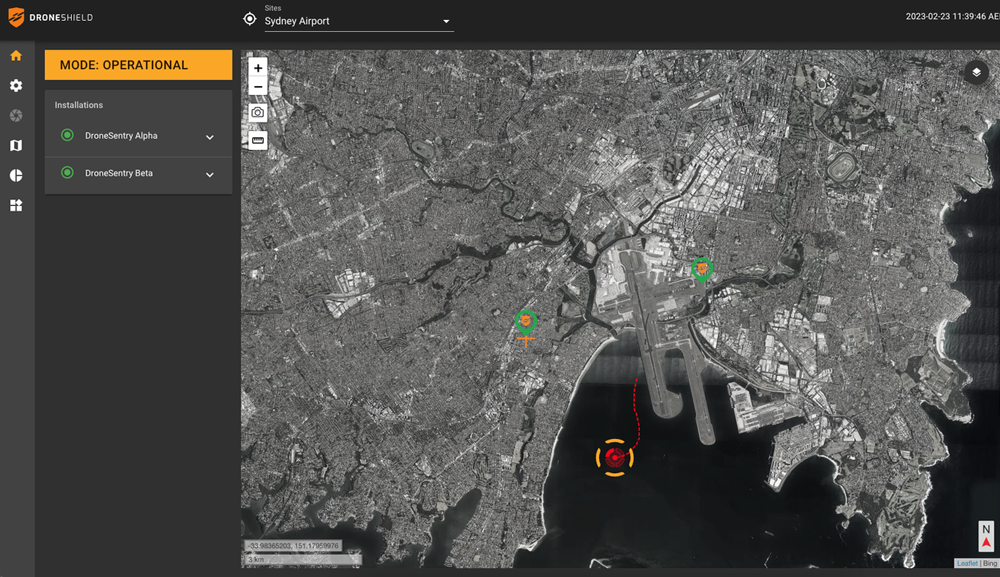

Australian anti-drone company DroneShield Ltd. (DRO:ASX; DRSHF:OTC) announced it is rolling out a major update to its DroneSentry-C2 software platform.

The platform provides counter-unmanned aircraft systems (C-UAS) awareness and reporting capability, integrating both DroneShield and third-party sensors and effectors to give the user an early warning system and detection threat level.

Major enhancements include consolidation of control panels, quicker selection of modes, and improved detail of detection events.

The update will make sure the product's engine "matches with a high-quality user interface to ensure reaction time," Chief Technology Officer Angus Bean said.

"A key challenge for drone security is reaction time," he said. "The speed at which drones can move and their ability to be deployed in close proximity to the target often results in a window of less than 10 seconds. During this time, the system must detect the drone, the operator must assess the situation, and countermeasures or otherwise appropriate responses (must be) deployed."

The company develops technologies to protect people, vehicles, and installations from UAS. It provides artificial intelligence-based platforms for protection against drone threats and other hostile autonomous systems with off-the-shelf products designed for a variety of terrestrial, maritime, and airborne platforms.

DroneShield's customers include military and intelligence community members, governments, law enforcement, critical infrastructure providers, and international airports.

In a March research note, Peloton Capital analyst Darren Odell wrote that the company will be operating cash flow positive by the end of the year and "is an acquisition target."

Peloton Capital analyst Darren Odell rated the stock Buy with an AU$0.84 per share target price.

Odell pointed to cash raised through a recent stock purchase plan and placement, two major new contracts, and the fact that the company has "a robust AU$200 million sales pipeline."

"The recent capital raise has provided DroneShield the ability to build inventory in anticipation of material contracts (and fulfill smaller contracts faster) that are expected to close in the short to medium term," wrote Odell.

Odell rated the stock Buy with an AU$0.84 per share target price.

The Russia-Ukraine war has also heightened interest in products like DroneShield's, Odell said. The U.S. Department of Defense also recommends the company, he pointed out.

The Catalyst: Military Spending on the Rise

After it released the DroneSentry-C2 SFAI (Sensor Fusion Artificial Intelligence) Engine last quarter, the company has worked closely with users to refine the user experience of the platform.

The technology's browser-based monitoring application lets users remotely access DroneShield products to check statuses, configure system settings, monitor threat levels, and respond in real time from anywhere.

The C-UAS market was valued at US$1.34 billion in 2021 and is forecasted to grow from US$1.58 billion in 2022 to US$6.95 billion by 2029 with a compound annual growth rate (CAGR) of 23.55%, Fortune Business Insights reported.

Pentagon Comptroller Mike McCord said the U.S. could be nearing a "watershed moment" as the country moves toward a US$886.3 billion budget for national defense in 2025.

Defense spending continues to increase, with the U.S. eyeing a US$1 trillion defense budget within a few years.

Pentagon Comptroller Mike McCord said the U.S. could be nearing a "watershed moment" as the country moves toward a US$886.3 billion budget for national defense in 2025.

Total military expenditures reached US$2.11 billion last year, the seventh consecutive year that spending had increased, according to the Stockholm International Peace Research Institute. The five largest spenders, accounting for 62% of expenditures, included the U.S., China, India, the United Kingdom, and Russia.

"The rising military spending in North America and Europe will be driven by both regions' need to re-fill weapons and equipment stockpiles that have been heavily drained by their support for the Ukrainian war effort," MRP said.

Unified System is a Major Advantage

Technical analyst Clive Maund of CliveMaund.com wrote in March that the company was a "strong Buy" at AU$0.30 per share and that any short-term drop below that level is an opportunity to add positions. It was AU$0.28 on Monday afternoon.

"With business set to continue to grow, this looks like a good point to buy the stock ahead of a renewed advance," Maund said.

Technical analyst Clive Maund wrote in March that the company was a "strong Buy."

He noted that the company is well-positioned to do well with the Ukraine-Russia war and the increases worldwide in defense spending.

Odell has written that DroneShield should seal more contracts by the end of the year, as many as three larger ones and several smaller ones.

DroneShield has an advantage because it offers a unified system, Chief Executive Officer Oleg Vornik said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

DroneShield Ltd. (DRO:ASX; DRSHF:OTC)

"DroneShield is unique globally, in being both a sensor developer/manufacturer, as well as designer of own Command-and-Control/C2 system," Vornik said. "This enables streamlined end user experience with the DroneShield ecosystem."

Ownership and Share Structure

DroneShield's management and insiders own 11% of the company. Vornik holds 1.4% or 8.18 million shares, according to Reuters. Chief Financial Officer Carla Balanco maintains 1.44% with 8.45 million shares, Bean has 1.26% with 7.39 million shares, and Board member Peter James has 1.09% with 6.40 million shares.

Strategic investors hold 13.99%, while the remaining shareholdings are in retail.

DroneShield has a market cap of US$113.76 million with about 588 million shares outstanding. It trades in a 52-week range of US$0.34 and US$0.10.

Sign up for our FREE newsletter

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield Ltd., a company mentioned in this article.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with DroneShield Ltd .Click here for more information.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.