When I was a youngster, I was taught to believe that Canada, the country of my birth, was blessed largely due to its abundance of raw materials, fresh water, and British heritage. Canada enjoyed a parliamentary democracy and was generally revered for the fighting abilities of its soldiers in WWI and WWII, where famous battles like Dieppe and Vimy Ridge were legendary Canuck victories absent the help (or film studios) of either Britain or the United States.

As I made the transition into adolescence, through my hockey endeavors, I began to get out of the little aircraft manufacturing hometown of Malton, a small village northwest of Toronto that was the home for the province's largest airport, and travel to tournaments in Chicago, Quebec City, Detroit, and other smaller towns in Ontario and Quebec.

Given my firm belief that the gold currently being stockpiled by central banks, the world over-represents collateral designed to underpin debt levels along with the "full faith and credit" in a nation's ability to pay back and service its debt, all Canada has left is the "full faith and credit" which is frightening given the out-of-control behavior of today's leaders.

You always had the sense that living in Malton, you were on the edge of Canadian history with no better memory than having a fierce game of road hockey stopped dead in its tracks, not by the arrival of the oncoming "Car!" but by the ten little towheaded kids with worn-down wooden stick blades all staring up into the sky pointing with awe at the sight of the AVRO Arrow, by then the most advance fighter jet in world history, being chased by a gaggle of CF-105's, the dinosaur-like fighters that comprised the Canadian Air Force for years after WWII.

As proud as we were, it was devastating to learn that under extreme external pressure, the Diefenbaker Conservatives abruptly terminated the Arrow program citing "excessive costs," but what it amounted to was the crippling of the Canadian aerospace industry.

As the years rolled on, with four of them spent studying business in the U.S., I began to get a different opinion of Canada. I started to look at foreign ownership of major Canadian industries prompted by a television commercial during Hockey Night in Canada broadcasts sponsored by "ESSO" and always featuring ice and snow and hockey, and a nice smiling man called Murray Westgate dressed in a gas attendant's military-style uniform urging us to fill up at "ESSO" the station with the "happy motoring sign" song becoming a lilt etched in my memory for decades.

The sad part about the "ESSO" sign was that it was actually the property of the U.S. multinational giant "Standard Oil" who acquired Imperial Oil in 1895, which was pretty much par for the course as the vast majority of Canadian oil reserves are the property of foreign companies, primarily American.

Dovetailing along with the narrative that Canada is a resource powerhouse, ownership of said resources is not largely Canadian-owned, a reason why the recent move to sell Vancouver-based Teck Resources Ltd. to Swiss zinc giant Glencore has met with such resistance. It seems that every time a Canadian company achieves greatness over the last few centuries along comes a deep-pocketed suitor and plucks it away.

Like a river's eroding shoreline openly exposed to boat traffic, Canada's reputation as a fiscally-conservative country, well-protected by its natural resource endowments, is slowly being washed away by flawed government policies that range from immigration to pandemic response to unbridled civil service growth but the major flaw lies in spending, where the rate and volume of inane money printing have become a pandemic unto itself.

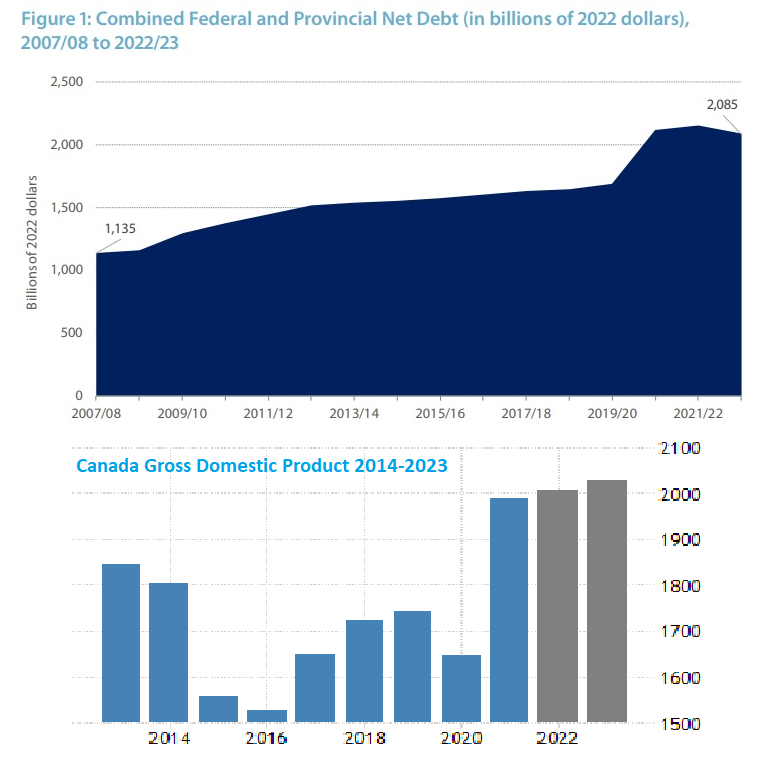

The debt-to-GDP numbers from the post-GFC recession period ranged around 60%, but since the arrival of pandemic-driven handouts of future taxpayer funds to those "in need," it has since ballooned to in excess of 130%. Most actuaries studying the history of countries that sport debt-to-GDP numbers over 100% show that they eventually must default with their currency going to zero.

The debt-to-GDP numbers from the post-GFC recession period ranged around 60%, but since the arrival of pandemic-driven handouts of future taxpayer funds to those "in need," it has since ballooned to in excess of 130%. Most actuaries studying the history of countries that sport debt-to-GDP numbers over 100% show that they eventually must default with their currency going to zero.

What is amazingly ironic about that is that despite Canada being fourth in global gold production behind China, Russia, and the Aussies, there is zero gold being held by the Bank of Canada. Given my firm belief that the gold currently being stockpiled by central banks, the world over-represents collateral designed to underpin debt levels along with the "full faith and credit" in a nation's ability to pay back and service its debt, all Canada has left is the "full faith and credit" which is frightening given the out-of-control behavior of today's leaders.

Foreign investors tend to gravitate toward Canadian resource issues as proxies for inflation-resistant assets, and if one looks back into the history of the Weimar Republic of 1921-1923, its citizens survived the Great Hyperinflation of the "German Papiermark" by owing anything not denominated in their domestic currency. Like Canada, the Weimar central bank had no gold to back its "papier" so owning resource companies and foreign assets protected their net worth as the purchasing power of the currency evaporated.

Never Happen in Canada?

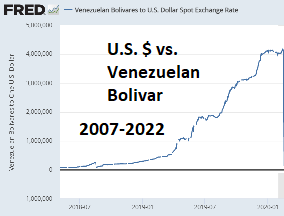

I have a colleague that started a travel agency based in Caracas in 2008 with a lump sum investment of US$400,000 and watched as his revenues, which were forced to be converted to bolivars at the point of deposit, disintegrated under the siege of hyperinflation. His business was absolutely thriving until the cost of buying airline seats with bolivars drove him out of business. And one wonders why Jerome Powell is so terrified of inflation.

This is not designed to be a political manifesto nor a warning to shareholders of Canadian companies; it is a commentary on debt. Debt is out of control and receiving little attention from the financial media anywhere in Canada and around the world. The Americans are going through their predictable and inevitable debate over the debt ceiling, which will always result in a last-minute bipartisan agreement with back-slapping and handshaking that a "cataclysmic collapse" had been avoided. The only thing missing is a picture of Rocky jumping up and down in front of the Philadelphia Museum of Art.

Stocks

Friday opened strong, with everyone pointing to leadership from a handful of tech stocks (all big-cap) pointing the rest of the market northward. Unfortunately, the bearish MACD crossover of a few weeks back is ignoring all of the noise, and stocks have once again reversed and are on the defensive.

I look for a sideways, whipsaw market all through the summer months with 3800-3850 as the maximum downside target and 4,300 as the upside cap.

This market is increasingly reminding me of the 1966-1982 "grind," where the Dow traded for a decade and a half in a 500-point range. The '70's were so maddeningly boring that it forced traders to look to energy and commodities for "action," and that is exactly where we are headed here in 2023.

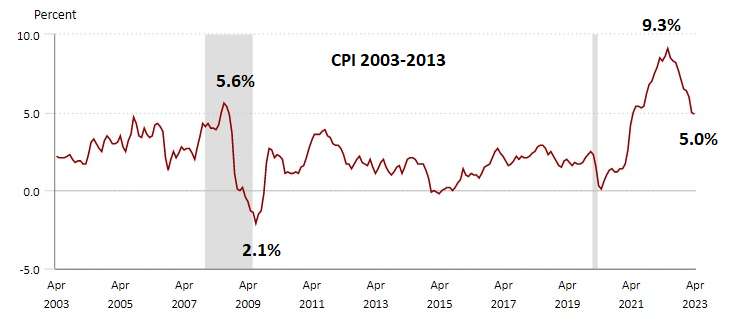

We may be entering a final short-term capitulation phase for the base metals as the "hard landing" narrative hits the cyclical. In fact, the action in copper reminds me of the action last summer when it crashed from an all-time high of US$5.04/lb. to US$3.172/lb. in response to the largest inflation print in forty years at 9.1% in June 2022. It declined due to fear of Fed tightening, which ultimately hit a zenith shortly after that big CPI print and then moderated.

I continue to place my bullish faith in the 2023 January Barometer, which saw a positive Santa Claus Rally, positive First Five Days, and positive mid-month and end-of-month closing prices. This confluence of bullish indicators provides me with an 83.3% probability of 2023 being a "UP" year (based upon data going back to 1952), so with the AAII sentiment readings running in bearish territory for the past twelve straight weeks, the table is set for a decent summer rally developing any day now.

However, I see it as a narrow advance and leaderless unless the commodity stocks light up, which would be a clone of 2020 when the stimulus initiatives kicked in and juiced the "hard asset" trade. I am completely neutral on the equity market with a bearish bias (near-term only) if 4,100 get smoked.

Gold

Last Friday, I tweeted out this picture as yet another Freaky Friday came in, slamming gold down right off the 8:30 a.m. NFP report where a few extra jobs got everyone amped up.

Gold's slam was summarily rejected with a sharp rebound such that the price-pounding by the bullion banks was negated, and prices quickly stabilized.

This does not normally occur in the land of the bullion bank behemoths, but it did, and that was bullish.

Then this morning, we came into a strong-ish U.S. dollar with every financial anchor and guest commentator talking about the impending "hard landing" based upon weakening economic data, which included soft-ish China numbers and while gold had been on the defensive all night and into the wee hours in Asia and Europe, as soon as the 8:30 pit session opened, it was immediately scooped up with a US$22 rebound to US$2,027 from around US$2,005.

Like last Friday, it was "Buy the dip" versus "Sell the Rip," with gold going out for the week down US$10 but well off the weekly lows.

I believe that gold is beginning to react to the reality of what might happen if the U.S. defaults on its debt, but it may just be that the debt ceiling debate which is nothing more than a "How much more can we print?" debate is taking a back seat to "How can we ever pay off US$32 trillion in debt?".

The bankers around the globe have learned how to craft narratives that frighten the electorate to the point of beseeching their elected officials to keep the printing presses on overdrive, at least until they have sold their last house or last share of stock into (yet another) Q/E recovery.

This is precisely how the Mountain of Debt took thirty years from 1981 to 2011 to grow from US$1 trillion to US$15 trillion but only eleven additional years to double again to over US$30 trillion. Debt-to-GDP in the U.S. was 31% in 1982 versus 125% today, so debt serviceability questions are starting to creep into the narrative as debt-to-GDP moves north of 100%.

I suspect that the current bullish configuration for stocks is based upon inflation — the replacement value of equities — in a manner not unlike 1921 - 1923 Weimar Germany, where stocks were the preferred asset of choice over cash or bonds as savings vehicles.

I suspect that the current bullish configuration for stocks is based upon inflation — the replacement value of equities — in a manner not unlike 1921 - 1923 Weimar Germany, where stocks were the preferred asset of choice over cash or bonds as savings vehicles. Again, economic growth takes a subordinate role in stock price valuation when the underlying currency is in freefall.

The U.S. Bureau(s) of Labor Statistics and Economic Analysis would have us all believe that debt is deflationary, but where the debt that is created is injected directly into the economy by way of cash deposits to citizens, it is absolutely inflationary, especially when the supply chain is cut off by government ineptitude.

These are difficult times for traders and investors alike, but what seems to be working is accumulating gold (and silver) into downside reactions. Trying to replicate the wonderment of the 2009-2022 period where everyone had the Fed "at their backs," assuming stock exchanges are still limitless ATM's is today, like 1966, a flawed strategy. With evidence of a recessionary hard landing growing and market breadth as bad as I have seen it in decades, the safety of precious metals would seem at once both logical and simple.

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.