Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB) has given new updates on its direct lithium extraction (DLE) selection process. Per two news releases on March 13 and March 21, the company selected two preferred technology firms to perform tests on Kindersley lithium project brine (KLP brine): Koch Technology Solutions and a second, anonymous, testing company.

The testing, which began simultaneously as Grounded Lithium shipped large quantities of KLP brine earlier in the month to both companies, involved checking the KLP brine for qualities and impurities in order to achieve a baseline assessment and characterization.

Both sets of testing found that concentrations of lithium either met or exceeded previously thought totals — 74 to 81 milligrams per liter of lithium (mg/l) — which supported Grounded Lithium conducting extraction technology testing, which is now almost complete. For characterization purposes, lithium concentration averaged at 80 mg/l.

The samples given to both testing companies came from Grounded Lithium's first test well at 4-15-32-23W3 (the 4-15 well), from the open hole section from 966 to 1,145 meters.

As part of the testing, Grounded Lithium also sent samples of KLP brine to a third independent lab located in Alberta. Isobrine Solutions found the concentration of lithium in the samples to be 78 mg/l, indicating a 5% increase from concentrations previously included in the company's National Instrument 43-101 technical report.

Grounded Lithium

According to its website, Grounded Lithium is a "publicly-traded lithium resource company focused on supplying lithium to the rapidly developing electricity-powered economy." The company focuses its efforts on "lithium extraction from subsurface brine production, where Western Canada's potential remains undeveloped."

The company said it focuses on environmentally friendly exploration techniques with lower environmental impact than solar evaporation ponds or conventional hard rock mining. According to its website, the company believes that "lithium from brine has [the] potential to dramatically reduce [the] carbon footprint for battery manufacturing as compared to alternative sources of battery metals."

As reported in March, the company recently purchased a large extension to its existing holdings at its Kindersley Lithium Project. These recent results, taken with proven well deliverability, support a potential economic project.

Mark Zaret, of Spartan Fund Management, said he is "particularly interested in Grounded Lithium's exploration efforts in Canada."

In a research report, Dave Storms of Stonegate Capital Partners, referred to Grounded Lithium as having "untapped potential in the market." He also said that "it is noticeable that the Company does not have any liens on their property, nor have they engaged in any royalty agreements. Additionally, there is no debt on the balance sheet, putting GLC in a strong position going forward."

The company has a "strong management team" that is willing and able to grow the company's land base, which resulted in the total land growing fourfold during 2022.

Mark Zaret, of Spartan Fund Management, said he is "particularly interested in Grounded Lithium's exploration efforts in Canada." This is because the majority of companies in the sector are based in South America, where they "rely on evaporation ponds to extract lithium," and Grounded Lithium is instead planning on using an emerging technology called Direct Lithium Extraction (DLE).

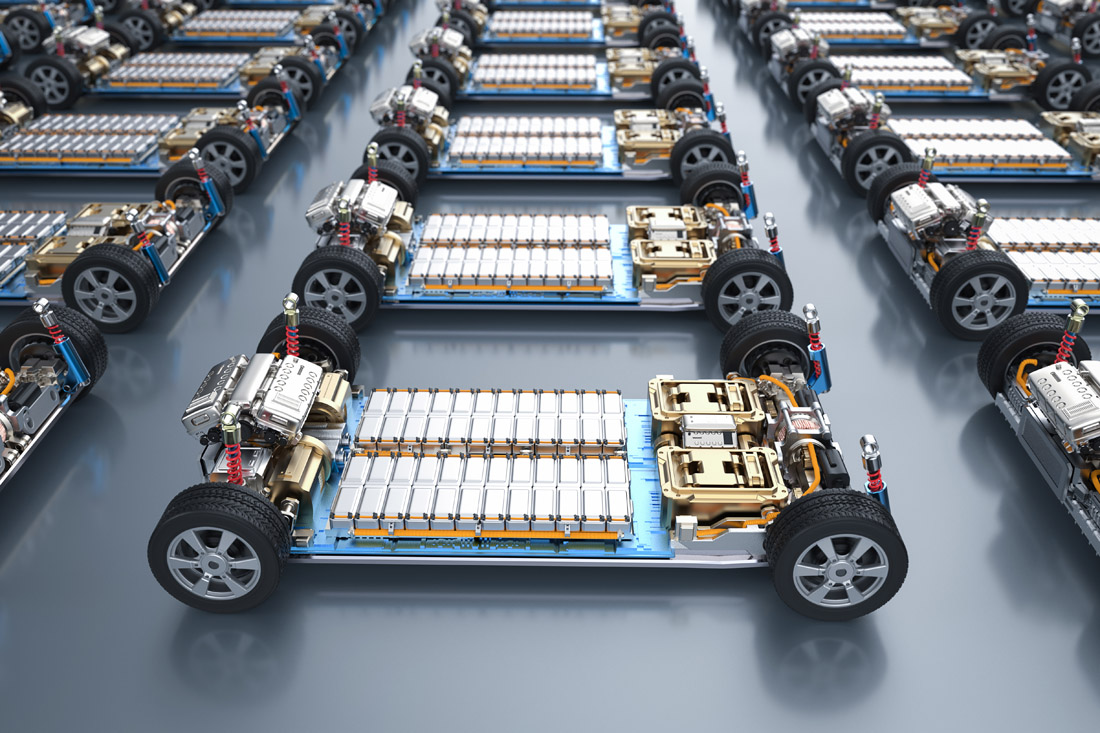

DLE allows lithium to be separated from brine without the need for evaporation. It instead involves ion exchange, a process that offers higher recoveries, lower impurities, and extraction times of minutes rather than months.

Zaret also said that "Grounded Lithium's land acquisition strategy is geared toward maximizing commercial viability." Canada's proposed 2023 Federal budget features a 30% refundable investment tax credit for critical mineral extraction and processing in addition to approving flow-through shares for companies developing lithium brine resources, he said.

Why Lithium?

Lithium is critical in the development and building of electric vehicle (EV) batteries. Lithium-ion (Li-ion) batteries are a type of rechargeable battery, used predominantly in EVs and portable electronics.

Benchmark Mineral Intelligence reported that demand for lithium is forecast to reach 900,000 tonnes in 2023, a 27% increase year-over-year, according to the Benchmark Lithium Forecast. It predicts a demand of 1.5 million tonnes by 2026.

It predicts that 85% of all lithium will be used in the production of Li-ion batteries. Previously used primarily in the glass, ceramic, and grease industries, the battery industry first accounted for 51% of lithium demand in 2018.

Multiple Upcoming Catalysts

Grounded Lithium is expected to complete its Preliminary Economic Assessment (PEA) before the end of Q2 2023, which will also offer more insight into the Kindersley Lithium Project's potential.

Streetwise Ownership Overview*

Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB)

The company will also soon be able to share the results from the Hatch Ltd. report, which will help decide the DLE method that will be used at the Kindersley Project.

Ownership and Share Structure

Headquartered in Calgary, Alberta, Grounded Lithium has 69,656,423 shares outstanding.

According to the company, about 14% is owned by management and insiders, institutions own 17%, and the rest, 69%, is retail. President and Chief Executive Officer Gregg Smith owns 2,130,426 shares, and Senior Vice President of Corporate Development and Chief Financial Officer Greg Phaneuf owns 1,447,433 shares.

It trades in the 52-week range between CA$0.22 and CA$0.50 and has a market cap of CA$17.4 million, the company said.

Sign up for our FREE newsletter

Important Disclosures:

- Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee.

- The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Grounded Lithium Corp. Click here for important disclosures about sponsor fees.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.