DroneShield Ltd. (DRO:ASX; DRSHF:OTC) has recently announced that it completed the delivery of an AU$11-million purchase order for a government agency, an all-time sales record for the company when it was announced last year.

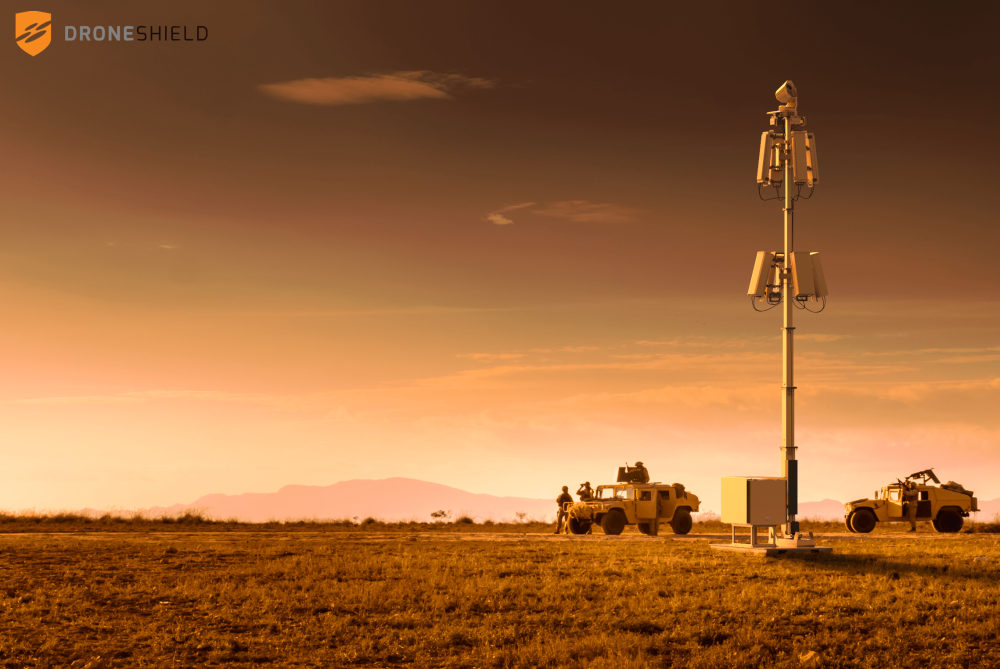

The company is in the business of developing technologies such as radio frequency sensing, artificial intelligence and machine learning, sensor fusion, electronic warfare countermeasures, rapid prototyping, and MIL-SPEC manufacturing.

The delivery fulfilled the order for the contract that was announced last December 2022. The order included different types of DroneShield counterdrone/C-UAS equipment. The deposit was received in January and was already reflected in the company's first-quarter cash receipts. The balance, which was payable 30 days after the completed delivery, will be reflected in its second-quarter receipts.

With these two contracts alone, DroneShield secured US$16.5 million in contracted cash receipts for 2023, which is already around 50% higher than the approx. US$12 million in the company's cash receipts for the entire of 2022.

DroneShield CEO Oleg Vomik said it is continuing to scale up its operations to meet the delivery expectations of its clients as the company moves into a repeat of orders beyond AU$10 million.

"On-time delivery of this order demonstrates DroneShield's ability to rapidly scale its operations. With the recent AU$40 million record capital raise and the resulting proceeds into both inventory and further strengthening of operations and engineering side of the business, we are well placed to deliver on rapidly rising demand for counterdrone systems," he said.

DroneShield is a company based in Sydney, New South Wales, developing technologies to protect people, vehicles, and installations from unmanned aerial threats. With offices in Sydney and Virginia, it offers bespoke counter-drone and electronic warfare solutions, including AI-based platforms for protection against drone threats and other hostile autonomous systems.

DroneShield Protects IRONMAN Texas 2023

In other news, on April 28, DroneShield announced that after placing a follow-on order, the Montgomery County Office of Homeland Security and Emergency Management (MCOHSEM) deployed DroneShield's DroneSentry System for the IRONMAN Triathlon Championships 2023 in Woodlands, Texas, for the second year in a row.

The IRONMAN Championship is a major athletic event in Texas, that brings in athletes from around the world. Through this event, "the 140.6-mile journey will present the ultimate test of body, mind, and spirit."

Of the event, DroneShield Sales Executive Jaybe Wilkes said, "Through repeat orders from early adopters, like the Montgomery County Office of Homeland Security and Emergency Management, it is evident that the need for cutting-edge counter-drone detection technology remains crucial for public events and critical infrastructure facilities."

The Catalyst: More Deals in the Horizon and New Product Releases

In January, it received another AU$11 million order from another government agency for different types of counterdrone/C-UAS equipment. Full delivery of this order was expected in the middle of 2023.

With these two contracts alone, DroneShield secured US$16.5 million in contracted cash receipts for 2023, which is already around 50% higher than the approx. US$12 million in the company's cash receipts for the entire of 2022.

Other than these two deals, Peloton Capital analyst Darren Odell commented that DroneShield would seal more contracts by the end of the year — at least three larger and several smaller deals, and potentially more as the year progresses.

Peloton Capital analyst Darren Odell commented that DroneShield would seal more contracts by the end of the year.

This was echoed by technical analyst Clive Maund, saying that DroneShield is well-positioned to do well with recent developments such as the Ukraine-Russia war and is seen to win some big orders soon.

DroneShield is also continuously improving its line of product releases and offerings, with the recent launch of its DroneGun Mk4 and last year's upgrade of its DroneSentry-C2 Command-and-Control System.

DroneGun Mk4 is a handheld pistol-shape anti-drone device, while the DroneSentry-C2 Command-and-Control System is an AI-based software platform that provides counter-UAS awareness and reporting capability. Counter-UAS (Unmanned Aircraft System) is a military term for solutions that are designed to detect, track, and ultimately disrupt and destroy unmanned airborne vehicles.

The impact of drones on global security has been coming to light in recent years, with unmanned aerial vehicles being used by over 100 countries and even non-state actors.

Recommended by the U.S. Department of Defense, DroneShield is at the forefront of the burgeoning counter-defense industry.

Continued Military Unrest in Russian-Ukrainian Territory Fuels Demand and Global Military Spending

Global defense spending continues to accelerate as the war in Russia and Ukraine continues and has already reached a 1-year mark, according to MRP. The assistance of Ukranian allies in the west in the 12-month period has already surpassed the US$50-billion mark, with no limit on future expenditures in sight.

"The rising military spending in North America and Europe will be driven by both regions' need to re-fill weapons and equipment stockpiles that have been heavily drained by their support for the Ukrainian war effort," MRP said.

Member countries of the North Atlantic Treaty Organization or NATO have helped Ukraine, providing material assistance to the Ukrainian military effort. Combined North American support is close to the US$34 billion level when Canada's CA$4 billion military contributions are included. The top three European countries also providing military assistance to Ukraine were the United Kingdom, Germany, and Poland.

Pentagon Comptroller Mike McCord said that this could be a "watershed moment" as the U.S. already moves into a US$886.3 billion budget for national defense in 2025.

Defense spending could be at an all-time high, with the United States eyeing a US$1 trillion defense budget within a few years. Pentagon Comptroller Mike McCord said that this could be a "watershed moment" as the U.S. already moves into a US$886.3 billion budget for national defense in 2025.

According to the Stockholm International Peace Research Institute, total military expenditures reached US$2.11 billion last year, the seventh consecutive year that spending had increased. The five largest spenders, accounting for 62% of expenditure, included the U.S., China, India, the United Kingdom, and Russia.

Investors are also starting to look out for firms that offer solutions in drone security, detection systems, and identifications due to various drone attacks, particularly during the COVID-19 pandemic.

The industry experienced higher than anticipated demand over the pandemic due to a sudden rise in the use of unauthorized drones from government regulations that limited movement, such as social distancing and other measures to contain the virus.

Fortune Business Insights noted that the global anti-drone market was valued at US$1.34 billion in 2021 and was forecast to grow into a US$6.95 billion industry by 2029 from US$1.58 billion in 2022, with a CAGR of 23.55%.

This growth will be driven by technological advancements in countering drones while also minimizing threats as governments are seen to also increase defense spending following the war in Ukraine.

Why DroneShield?

On March 2, 2022, The National Inflation Association reported of DroneShield's stock closed its one-month high at AU$0.37 per share.

Since then, the company has received a series of big-ticket contracts demonstrating its growth potential, with Darren Odell of Peloton Capital endorsing a Buy stance on the stock.

Peloton Capital increased its DroneShield stock valuation to AU$1, citing the two major government deals it landed earlier in the year, as well as more prospective sales to be done for the rest of the year.

Technical analyst Clive Maund said that the company finds itself in a position of expected uptrend considering the ongoing Russian-Ukranian war resulting in more orders and a recently conducted major funding that will enable the company to deliver on large orders.

The company currently has a sales pipeline of about AU$200 million and is expected to be operating cash flow positive this year, Odell said.

For his part, technical analyst Clive Maund said in a research note that the company finds itself in a position of expected uptrend considering the ongoing Russian-Ukranian war resulting in more orders and a recently conducted major funding that will enable the company to deliver on large orders.

Maund regarded the company as a "strong Buy" at AU$0.30 per stock and that any short-term drop below this level is an opportunity to buy or add to positions.

"DroneShield just did a big funding at AU$0.30, which not surprisingly caused the stock to drop back to the AU$0.30 area. It is understood that this funding was oversubscribed and that the proceeds will be used to enable the company to meet its big order commitments. With business set to continue to grow, this looks like a good point to buy the stock ahead of a renewed advance," Maund said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

DroneShield Ltd. (DRO:ASX; DRSHF:OTC)

He noted that the company is well-positioned to do well with recent developments such as the Ukraine-Russia war and is seen to win some big orders soon.

Ownership and Share Structure

DroneShield's management and insiders hold 11% of the company's share. Vornik holds 1.40% or 8.18 million shares, according to Reuters. CFO Carla Balanco maintains 1.44%, with 8.45 million. CTO Angus Bean has 1.26%, with 7.39 million, and Board member Peter James has 1.09%, with 6.40 million.

Strategic investors hold 13.99%, while the remaining shareholdings are in retail.

The company currently has introduced ten institutional investors as part of its February placement. No further details have been released to the public at this time.

By the end of 2022, the company's cash and cash equivalents, or cash in the bank, were at AU$10.26 million. The company completed a US$40-million fundraising last March, which will be used to keep up with demands and orders. The monthly burn rate was not disclosed.

According to Marketwatch, DroneShield has a market capitalization of US$178.48 million, with 585.18-million shares outstanding. The stock trades from US$0.155 to US$0.420 each within a 52-week range.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Nika Catalado wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: DroneShield Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield Ltd., a company mentioned in this article.