After spending years developing his craft as a pianist, Mark Zaret of Spartan Fund Management decided to bring his talents to the stock market. He started taking investing seriously in the early 90s, mostly investing in small and micro-cap equities.

Mark Zaret explained, "Investing in the junior sector runs in my family; my grandparents and father had a history of it. I was exposed to it at an early age, which laid the foundation for my interest in the stock market. Once I had some equity in my house, I did something that is generally not advisable — I secured a line of credit against my home to invest in the market. I viewed it as an opportunity to generate income through a different means."

Mark Zaret's investment philosophy was greatly influenced by John Kaiser, who was behind Kaiser Research Online. The publication's "Bottom Fishing" report caught his attention, highlighting junior stocks worth considering. This further piqued Mark's interest in small and micro-cap equities and played a significant role in shaping his investment strategy.

Following years of successful independent investing, Mark Zaret was appointed as Chief Strategist of the Teraz Fund at Spartan Fund Management in 2011.

The Teraz Fund is a long-biased fund specializing in investing in early-stage Canadian companies helmed by accomplished entrepreneurs. Its investments include resource companies, start-ups, listed cash-rich shells, companies that are ripe for mergers and acquisitions, as well as undervalued companies that offer strong potential for a turnaround.

Spartan Fund Management is an investment management firm managing a number of pooled funds with aggregate assets under management of over US$1 billion, encompassing a broad range of alternative investment strategies.

Fox River Resources

The first company Mark discussed was Fox River Resources Corp. (FOX:CNSX). The company holds a 100% stake in the Martison phosphate project located near Hearst, Ontario. The project is anticipated to produce high-grade, low-impurity phosphate rock, which is in high demand for use in fertilizer and other applications, including the production of electric-vehicle batteries.

Mark highlighted the significance of the Martison phosphate project, stating that "It's a substantial project that has already undergone a considerable de-risking process due to significant investment in a prior agricultural cycle."

The Martison phosphate project was PhosCan Chemical Corp's main focus during the last agriculture cycle from 2006-2009. With CA$90 million raised over 14 months, the project received a final financing round of CA$55 million at a market capitalization of CA$350 million. In 2016, Fox River Resources was spun out of PhosCan Chemical Corp while retaining ownership of the Martison project.

Mark explained that there was a substantial rise in phosphate prices, but they subsequently plummeted along with the Great Financial Crisis. As a result, the Martison project was eventually shelved.

Mark emphasized, "The project's potential is significant, as evidenced by its preliminary economic assessment (PEA)."

"Fast forward to today. There have been huge changes in the world, as we all know, in terms of countries needing to onshore critical metals and products, and phosphate is one of them," Mark continued. "With phosphate prices edging higher, interest is flowing back into the project."

Mark emphasized, "The project's potential is significant, as evidenced by its preliminary economic assessment (PEA) that was completed in 2022, which estimates the net present value of the Martison project to be approximately US$2.5 billion. When you consider that Fox River's market cap is only around US$16 million, it means the company is trading at less than 1% of the project's estimated net present value if fully developed." He added that "This presents a unique opportunity for investors to enter at an attractive valuation."

According to Mark, global events will also play a crucial role in determining the value of the Martison project. He pointed out that "Russia has recently announced plans to limit exports of certain fertilizers and grains, which has created pressure on countries to have access to local sources of these commodities. This has led to an increased focus on Canada's own phosphate developments."

Mark also highlighted the growing usage of phosphate in the production of batteries for electric vehicles. According to Fortune Business Insights, the global lithium phosphate (LFP) battery market is projected to grow from US$10.12 billion in 2021 to US$49.96 billion by 2028.

Phosphate is being used as a key component in the cathode of lithium phosphate batteries. This type of battery, also known as an LFP battery, has a high energy density, making it ideal for use in electric vehicles and other applications. Using phosphate in LFP batteries also provides several benefits, including increased safety, longer cycle life, and improved thermal stability.

Recently, Ontario's Minister of Mines, George Pirie, met with Fox River's Chief Executive Officer, Stephen Case, to discuss the Martison project and how phosphate is vital to the electric vehicle revolution.

Car companies, including Ford and Tesla, have started to adopt LFP batteries in their electric vehicles due to the benefits they offer over traditional lithium-ion batteries. For instance, Ford recently announced its plan to use LFP batteries in its F-150 Lightning electric truck, citing safety and cost benefits. Similarly, Tesla has been using LFP batteries in its Model 3 vehicles produced in China.

"I think Fox River is a sleeper story in the fact that it has a very small market cap, especially considering the moves the world is making in the phosphate space," said Mark.

Since the beginning of 2023, Fox River's Non-Executive Chairman, David Lotan, has acquired over CA$300,000 worth of the company's stock. With this purchase, David's total ownership in Fox River has increased to 5,963,600 shares. At current prices (CA$0.35), this position is worth just over CA$2 million.

Mark emphasized that when insiders buy shares in small and micro-cap companies, it is usually a positive indicator of a company's potential for growth. Such an act demonstrates a strong alignment of interests between insiders and shareholders.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Fox River Resources Corp. (FOX:CNSX)

Fox River Resources is primarily owned by insiders and institutions, with these groups holding approximately 53% of the company's outstanding shares, as noted in their investor presentation. At present, Fox River has a total of 63,963,175 outstanding shares.

According to Reuters, 17.9% of Fox River's stock is held by management and insiders. President, CEO, and Director Stephan Case has the most out of management at 14.28%, with 9.18 million shares. CFO Fraser Laschinger has 1.77%, with 1.14 million. Director John D. Yokley has 0.93%, with 0.60 million, and Director Elizabeth Leonard has 0.91%, with 0.59 million.

5.57% is held by institutional investors. Mackenzie Financial Corp. has 3.61%, with 2.32 million. U.S. Global Investors Inc. has 1.56%, with 1 million. IG Wealth Management has 0.21%, with 0.14 million. AGF Investments Inc. has 0.10%, with 0.07 million, and GWL Wealth Management Ltd. has 0.09%, with 0.06 million.

8.90% is with strategic investors. Lotan Holdings Inc. has 8.90%, with 5.72 million shares. The rest is held by retail investors.

Fox River currently has a market cap of CA$22 million with 63 million shares outstanding and trades in the 52-week range of CA$0.15 and CA$0.82.

Data Communications Management

Next, Mark touched on Data Communications Management Corp. (DCM:TSX; DCMDF:OTCQX).

Founded in 1955, Data Communications Management is a leading provider of marketing and business communications solutions. DCM's offerings include workflow management services, digital asset management solutions, conventional commercial printing solutions, and brand strategies.

Although it began as a print company, new management at DCM has transformed the business by (a) streamlining operations, reducing headcount, and closing redundant facilities, and (b) focusing on its "digital first" strategy. DCM now boasts a range of impressive software offerings, such as workflow management tools.

Thanks to these changes, DCM has become profitable, consistently earning around CA$0.08/share per quarter and CA$0.30/share last year. At the current share price, this puts the company at a price-to-earnings ratio of around eight.

Mark is particularly drawn to the company due to the rapid expansion of its higher-margin digital segment. DCM's "digital first" strategy includes two digital products: DCMFlex and ASMBL. DCMFlex is a workflow management platform for marketing tasks, including ordering, approvals, compliance, and campaign management. ASMBL is a digital asset management platform that centralizes and shares digital files with authorized users. These digital products enhance DCM's traditional paper-based business by efficiently managing digital assets that often connect to the paper products DCM sells.

"We end up with a company that's projected to have sales of more than CA$500 million a year. And its list of clients includes virtually every large company in Canada," Mark said. "It would be harder to find a company it doesn't doesn't deal with."

For example, product labeling plays a crucial role in marketing products such as cannabis in regulated markets. DCMFlex offers companies a single point of access for their cannabis marketing and production needs.

It is configurable based on their business rules, enabling quick and easy configuration of packaging and labels while maintaining their branding and ensuring compliance with state or provincial-level regulations. This streamlined process helps ensure that changes are cascaded to all relevant assets, making the process faster and more efficient. Once the labeling design process is complete, DCM handles the printing of these labels, providing a complete end-to-end solution for their clients.

In February 2023, DCM announced that it had entered into an agreement to acquire the Canadian operations of R.R. Donnelley & Sons (RRD) one of its main competitors. RRD Canada generated revenue of approximately CA$250 million in 2022 and has 1,000 employees. The merger of these two firms brings together their complementary operating models, product portfolios, and customer networks across a diverse range of industries.

"We end up with a company that's projected to have sales of more than CA$500 million a year. And its list of clients includes virtually every large company in Canada," Mark said. "It would be harder to find a company it doesn't deal with."

And the company isn't letting print die, either. As Mark told Streetwise, "Print is far from dead." He pointed out that banks, which are ubiquitous in every city, continue to display a wide range of print materials, including brochures, posters, and stationery promoting mortgage rates, interest rates, and other products.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Data Communications Management Corp. (DCM:TSX; DCMDF:OTCQX)

Additionally, Mark noted that starting in 2018, Amazon surprised many industry observers by releasing its first-ever print catalog, which featured a curated selection of products across a range of categories. The decision to produce a print catalog was a departure for Amazon, which had previously relied primarily on digital marketing channels. However, the move likely helped Amazon target customers who prefer to browse offline. The catalog was well-received by many customers, highlighting the power of print media in reaching customers and promoting products in the digital age. Wayfair has now followed, further demonstrating the continuing importance of print.

Management and insiders own about 45% of DCM, including a share program that gives employees close to 4% ownership.

Top insider shareholders include Director Michael Sifton with 10.2% or 4.5 million shares, Board Vice Chairman Greg Cochrane with 7.43% or 3.28 million shares, Chairman of the Board J.R. Kingsley Ward with 5.54% or 2.44 million shares, and the CEO Kellam with 1.67% or 0.74 million shares, according to Reuters.

According to the company, the rest, 55%, is retail. Reuters lists KST Industries Inc. as the top shareholder in the company overall, with 11.69% or 5.15 million shares.

It has a market cap of CA$105.75 million with 44 million shares outstanding, with 27.3 million shares free-floating. It trades in the 52-week range of CA$2.45 and CA$1.01.

Aurion Resources

Mark moved back to the resources sector to talk about Aurion Resources Ltd. (AU:TSX.V).

Aurion Resources Ltd. began operating in Finland in 2014 and has interests in mineral tenements covering over 100,000 hectares in the Central Lapland Greenstone Belt (CLGB) of the Fennoscandian Shield. The CLGB region is known for its rich reserves of gold and base metals, featuring major deposits such as Kittilä Underground Gold Mine (Agnico Eagle), Ikkari Gold deposit (Rupert Resources), and the Sakatti Ni-Cu-PGE deposit (Anglo American).

Aurion is currently focused on exploring its Risti and Launi projects, along with advancing its joint ventures with B2Gold and Kinross in Finland. The Risti and Launi Projects cover approximately 30,626 hectares of the Central Lapland Greenstone Belt along the Sirkka Shear Zone, a tectonostratigraphic boundary spanning over 125 kilometers and hosting numerous gold prospects and occurrences. Aurion's land claims stretch approximately 80 kilometers along this zone.

Before joining the EEA in 1994 and the EU in 1995, mineral exploration and mining in Finland were restricted to domestic companies, which were mainly state-owned. Finland had a long history of mining, and the social acceptance of the mining industry was wide. This, among other factors, makes Finland an attractive location for businesses in the sector, according to Mark.

Before joining the EEA in 1994 and the EU in 1995, mineral exploration and mining in Finland were restricted to domestic companies, which were mainly state-owned. Finland had a long history of mining, and the social acceptance of the mining industry was wide. This, among other factors, makes Finland an attractive location for businesses in the sector, according to Mark.

Finland consistently ranks in the top 10 most attractive jurisdictions for mining investment according to the Fraser Institute's annual survey of mining companies due to its abundant mineral potential, transparent regulatory guidelines, favorable regime, and well-educated labor market.

As a mining destination, Finland is relatively new to the game," says Mark Zaret. "It's only been open for business for under 30 years, which is a stark contrast to countries like Canada or the United States, where you'd have to look back 100 years or more. This means that there's still a tremendous amount of unexplored territory in Finland, making it one of the last frontiers for discovery in the world."

"As I see it, it's very unusual for this kind of belt to have only one producing gold mine," says Mark. "The prevailing theory is that there will be many more producers emerging over the coming years as exploration continues."

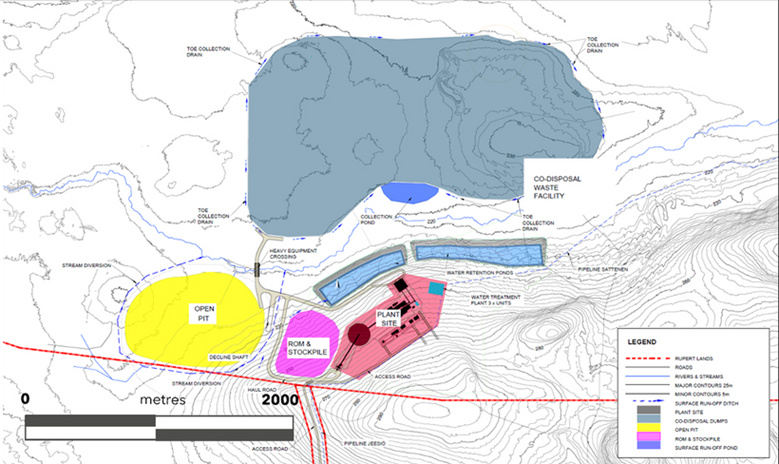

Mark also highlighted that one of Aurion's neighbors, Rupert Resources Ltd. (RUP:TSX.V), had made a noteworthy discovery in the region, which is currently in an advanced stage. "Rupert Resources is located right on the border of its property, and it appears that mineralization extends into Aurion's land," he explained.

Mark also highlighted that one of Aurion's neighbors, Rupert Resources Ltd. (RUP:TSX.V), had made a noteworthy discovery in the region, which is currently in an advanced stage. "Rupert Resources is located right on the border of its property, and it appears that mineralization extends into Aurion's land," he explained.

He further noted that Rupert Resources had released a pit design for its deposit, which may be impacted due to the shared border.

He said, "It appears that the deposit not only crosses the border but, more importantly, that its pit design is compromised. Therefore, one has to think that there will be some form of M&A in the area before Rupert will be able to develop its mine."

Rupert's 43-101 report indicates that lifting constraints on the open pit limit could increase the pit size and depth, changing the transition point to underground mining and offering potential upside for the project's net present value and resource recovery.

Mark is also impressed by the management team's commitment to Aurion's success. "The company has a strong share structure, with nearly 75% of shares owned by either management, insiders, or institutions," he noted.

As of March 2022, the company reported that management and insiders held 13.4% of Aurion Resources' stock. 44.5% is held by institutional investors.

16.3% is with strategic investors.

The rest is held by retail investors.

Aurion's market cap is CA$95 million. It has 117.8 million shares outstanding and trades in the 52-week range between CA$0.38 and CA$1.04.

Grounded Lithium

Last but not least, Mark touched on Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB). Grounded Lithium (GRD) is a lithium brine exploration and development company that controls approximately 4.2 million metric tonnes of inferred lithium carbonate equivalent resource over its landholdings in southwest Saskatchewan.

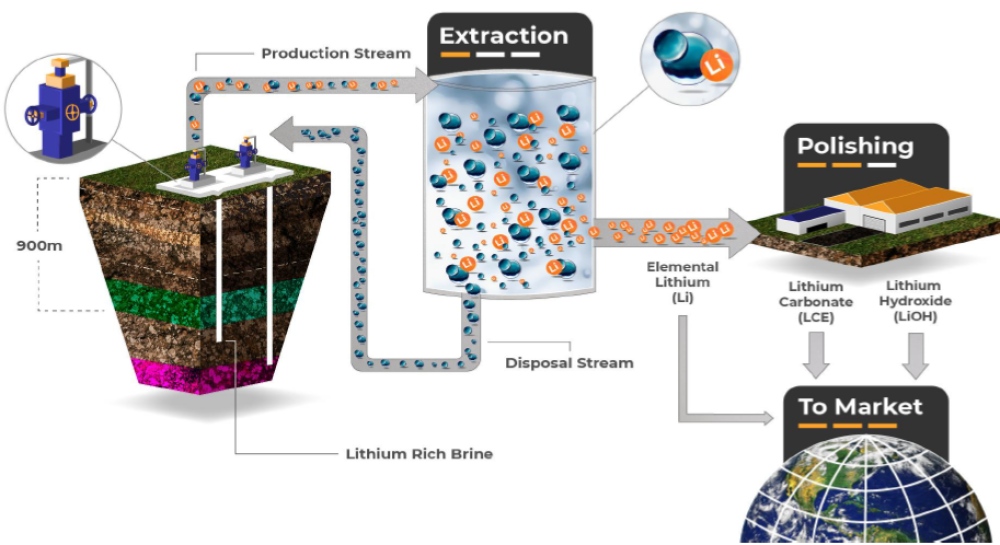

Mark is particularly interested in Grounded Lithium's exploration efforts in Canada. This is because most companies operating in this sector are based in South America and rely on evaporation ponds to extract lithium, whereas Grounded Lithium plans on utilizing an emerging technology called Direct Lithium Extraction (DLE).

In South America, companies pump salt-rich water to the surface where it is then directed to a series of evaporation ponds. The process takes several months, during which time the water gradually evaporates, leaving behind a brine with an increasingly concentrated amount of lithium. However, this approach is not feasible in Canada due to the absence of sufficient sunlight and heat for most of the year.

To overcome this challenge, Grounded Lithium plans on utilizing a technology called DLE, which is currently being developed by numerous technology companies. What sets Grounded Lithium apart is its focus solely on resource exploration and not on technology development. It is currently evaluating multiple vendors for DLE technology to incorporate into its operations.

DLE allows for the separation of lithium from brines without relying on evaporation. The process involves ion exchange, which has a long-standing history in the water softening and uranium sectors. Compared to traditional methods, DLE offers numerous benefits, such as higher recoveries, lower impurities, and faster extraction times (minutes instead of months).

He also pointed out Canada's proposed 2023 Federal budget, which features a 30% refundable investment tax credit for critical mineral extraction and processing in addition to approving flow-through shares for companies developing lithium brine resources.

While traditional evaporation methods require high-grade lithium brines, DLE is less dependent on the grade of the brine, enabling the development of lower-grade lithium deposits in regions that lack desert climates. DLE also presents economic benefits and a more sustainable approach to lithium extraction, with minimal environmental impact, reduced ground disturbance, lower freshwater, and energy usage, and fewer carbon emissions.

Grounded Lithium's land acquisition strategy is geared toward maximizing commercial viability. To offset the lower grade of the Leduc/Duperow aquifer, the company is focused on acquiring land that offers efficient and cost-effective brine extraction. Their acquisition criteria prioritize shallow reservoir depths (900m as opposed to 2,300m), thicker and highly porous reservoir units (with a thickness of 265m and up to 34% porosity with a 3% effective cut-off), and favorable geology (dolomitized rock for greater permeability).

Based on IPR (inflow performance relationship) results obtained during the company’s production testing in Q4 2022 on its first lithium well, together with industry-accepted simulation practices and software, the company determined a properly optimized well deploying such equipment as an electric submersible pump, could reliably sustain daily production rates of 3,100 m3/day. In addition, Grounded Lithium seeks to acquire land with minimal hydrocarbons and sour gas to prevent interference with their DLE process.

He also pointed out Canada's proposed 2023 Federal budget, which features a 30% refundable investment tax credit for critical mineral extraction and processing in addition to approving flow-through shares for companies developing lithium brine resources.

According to GRD's investor presentation, the company aims to launch its brine lab pilot in Q2 of 2023 to test its chosen DLE technology. Additionally, the company plans to release its preliminary economic assessment (PEA) for the Kindersley project in the same quarter.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB)

Insiders own 14% of the company with about 9.6 million shares. According to Reuters, President and CEO Gregg Smith is the largest shareholder in management at 3.06%, with 2.13 million shares. SVP Corporate Development and CFO Greg Phaneuf has 1.76%, with 1.23 million. VP Land and Regulatory Lawrence Fisher has1.27%, with 0.88 million, and VP Geophysics and IT Wayne Gaskin has 0.77%, with 0.53 million.

Institutions own approximately 17% of the company, though none own more than 10%, so names are not publicized. Grounded Lithium reports no strategic investors, and the rest is in retail.

GRD's market cap is CA$26 million. It has 69.7 million shares outstanding and trades in the 52-week range between CA$0.18 and CA$0.50.

Closing Note

As our discussion neared its end, Mark Zaret stressed the crucial importance of understanding the nature of investing in small and micro-cap equities.

"Investing in speculative stories carries significant risks, and diversification is strongly recommended. It's impossible to predict which investments will ultimately succeed, so it's important to be prepared for losses and to maintain enough diversification to benefit from the few that do generate capital and create wealth."

Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold, Technology and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Mark Zaret Disclaimers:

Investing in small and micro-cap equities is highly speculative in nature and involves substantial risk of loss. Any action a reader takes as a result of information presented herein is his, her or their own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

This article does not constitute investment advice. While Mark Zaret is registered as a dealing representative with Spartan Fund Management Inc. (Spartan), the views set out herein are for informational purposes only, are not a recommendation to buy or sell any security, and should not be relied upon by the reader as investment advice from Mr. Zaret or Spartan and should not be construed or interpreted by the reader to mean that an investment in any of these securities would be suitable for them in their particular circumstances. Mr. Zaret and Spartan each expressly disclaim owing any responsibility to the reader, and each reader is encouraged to consult with his or her individual investment advisor and other financial professionals.

In his capacity as an investment dealer with Spartan, Mr. Zaret (or other representatives of Spartan) may be buying or selling for clients of Spartan securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein.

Certain of the information provided herein is based on the views held by Mr. Zaret at this time, but these views are personal to him as at this date and are subject to change. Mr. Zaret and Spartan disclaim any obligation to update any of the information set out herein going-forward.

Mark Zaret: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: {FOX.C, DCM.T, AU.V}. Neither I or any members of my immediate household or family are paid by any of the companies mentioned in this article. Neither I, or any members of my immediate household or family have a financial relationship with any of the companies mentioned in this article. I determined which companies would be included in this article based on my research and understanding of the sector.

Spartan: Spartan, or accounts or funds managed or controlled by Spartan, own securities of the following companies mentioned in this article: {FOX.C, AU.V, DCM.T, GRD.V}. Spartan, or accounts or funds managed or controlled by Spartan, are NOT paid by any of the companies mentioned in this article. Spartan, or accounts or funds managed or controlled by Spartan, have NO financial relationship with any of the companies mentioned in this article.

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Data Communications Management Corp. and Grounded Lithium Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Corp., a company mentioned in this article.