NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) has announced assay results from its Nutmeg Mountain project in Idaho. The company has promising results from its efforts regarding heap-leach gold that indicate significant mineralization beginning nearly directly from the surface.

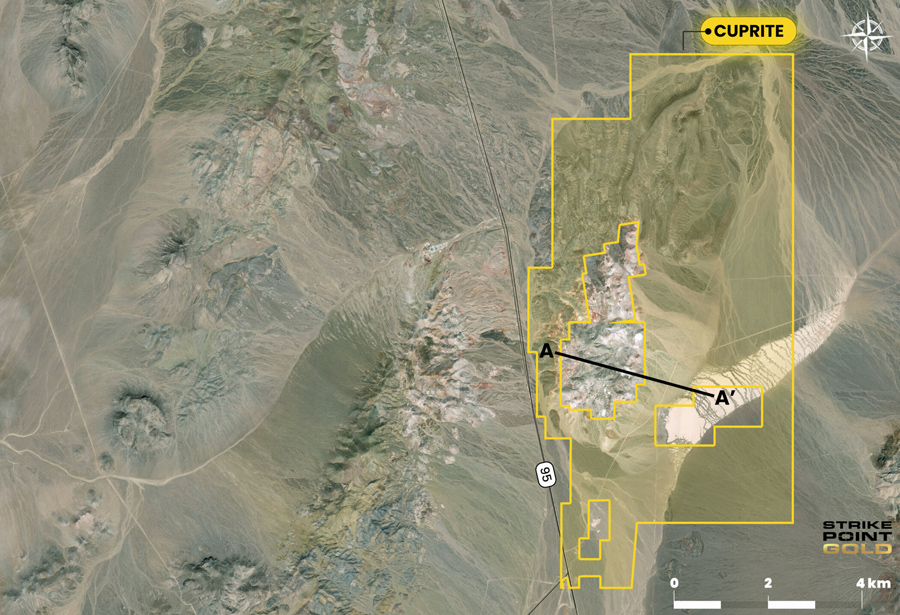

NevGold is a Canadian-based mineral exploration and development company with four properties: Nutmeg Mountain in Idaho, Limousine Butte and Cedar Wash in Nevada, and Ptarmigan in British Columbia.

Assay Results

NevGold has announced assay results from its high-grade, heap-leach gold Nutmeg Mountain project in Idaho. In 2020, the site was estimated to contain 910,000 indicated ounces of gold, as well as 160,000 inferred ounces of gold. These initial results are promising, as they may indicate growth potential for the Nutmeg Mountain project.

According to Derick Unger, the vice president of exploration, the "first drill holes at Nutmeg Mountain exceeded our expectations and demonstrate that the project hosts a strong, continuous gold system that starts essentially at surface." The highlights of the results are as follows:

- At Hole NDM003, the company found high-grade, heap-leachable gold intercepted from the surface. The company found 0.72 g/t gold (Au) over 79.3m at 10.4m of depth (heap leachable). This includes 2.32 g/t Au over 13.4m at 25.6m of depth (heap leachable). At Hole NMD001, it found 0.56 g/t Au over 23.9m from 24.1m of depth, including 0.89 g/t Au over 11.4m from 25.6m of depth, with 4.33 g/t Au found at the bottom of the hole. The company reports that mineralization started at the surface.

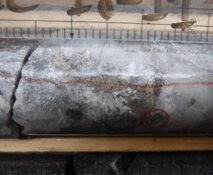

- At Hole NMD003, the company discovered high-grade potential at depth. The hole intercepted large vein/breccia zones at 251m and 469m of depth in a previously untested area of Nutmeg Mountain. NevGold reports that the type of quartz found indicates a potential high-grade feeder structure at depth. Assay results are still pending.

- Hole NMD002 indicates open, near-surface mineralization along strike. A step-out at a distance of 140m away from the nearest drill collar intercepted anomalous mineralization at 4.6 meters depth, and continued to 93.6m depth, with 0.43 g/t Au. Mineralization is open in all directions, and the company plans for further drilling in this area of the project.

- The drill program is running on schedule and according to budget. More drill results will be released over the coming months.

According to Unger, "It is also noteworthy that this is the first drill program on the project to use oriented core, a technology that is essential to understanding the structures that control the gold mineralization. We are excited to leverage this new oriented core data and our understanding of the stratigraphy to continue to quickly add gold resource ounces."

Why Gold?

Gold has long been regarded as a safe haven for investors in times when confidence in the economy is unstable.

Analyst James Turk of Goldmoney said, "Gold preserves purchasing power over the long term. It does this because gold is natural money. The quantity of the aboveground stock of gold increases at approximately the same rate as the world's population and new wealth creation."

Analyst James Turk of Goldmoney, when speaking on his career during the financial crisis of the 1970s, said, "Gold preserves purchasing power over the long term. It does this because gold is natural money. The quantity of the aboveground stock of gold increases at approximately the same rate as the world's population and new wealth creation."

According to Reuben Adams with Stockhead, the collapse of several banks earlier this year has caused a net inflow for physically backed ETFs. Investors have turned to gold as a solution to the unstable market, though these recent inflows are not yet enough to overpower negative flows for the quarter.

Central banks are also continuing to buy up gold as the economy wobbles.

Catalysts

NevGold has a number of short-term catalysts to report. On January 12, 2022, the company moved a drill rig to Nutmeg Mountain and started its drilling program. In the same month, the company received a Notice of Intent permit to drill the federal BLM claims on Nutmeg Mountain.

Technical analyst Clive Maund rated NevGold an immediate strong Buy for all timeframes.

NevGold expects the drill results from Nutmeg Mountain to be released in three to four news releases between March 1 to June 1. It also expects to move a drill rig to Limo Butte in Nevada to start the Phase 2 drill program.

In Q2 of 2022, they expect the Limo Butte Plan of Operations permit to be approved. In Q4 of 2022, they expect to deliver resource estimates from Nutmeg Mountain and Limo Butte after the drill programs have finished with a targeted resource base of over 3 million ounces of gold.

On March 3, 2023, technical analyst Clive Maund rated NevGold an immediate strong Buy for all timeframes.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE)

Management and insiders own around 30% of NevGold. President, CEO, and Director Brandon Bonifacio has 6.02%, with 4.08 million shares, according to Reuters. Non-Executive Chair Giulio T. Bonifacio has 5.97%, with 4.05 million. Independent Director Greg French has 1.62%, with 1.10 million. Independent Director Victor Bradley has 1.33%, with 0.90 million, and Independent Director Timothy Dyhr has 1.30%, with 0.88 million.

26% is with strategic investors. GoldMining Inc. holds 17.5%, with 12.56 million shares, and McEwen Mining owns 7%.

The rest is in retail.

NevGold reports that it has CA$3.3 million in the bank, with a monthly burn rate of CA$50k. Its drilling costs are CA$300 per meter for core and CA$125 per meter for reverse circulation.

NevGold has a market cap of CA$25 million, with 71,418,219 shares, 16,947,558 warrants, and 5,266,000 options. As for warrants, a large batch of 10,303,127 priced at CA$0.60 that expire on June 24, 2023.

According to Market Watch, the company currently has 63.5 outstanding shares and trades in the 52-week range between CA$0.30 and CA$0.85.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: none. She or members of her household are paid by the following companies mentioned in this article: none. Her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: NevGold. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with none. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of none. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold, a company mentioned in this article.