After spending years developing his craft as a pianist, Mark Zaret of Spartan Fund Management decided to bring his talents to the stock market. He started taking investing seriously in the late 90s, mostly investing in junior stocks. Growing up, the foundation was always there.

Zaret said, "It was something that ran through the family, my grandparents and my father. There was a history of investing in the sector. And so some of that had been planted at a very early age, but I didn't really follow up on it in any very serious manner. And then, when I had some equity in a house, I actually did what no one should do. And that is like, I took advantage of that through arranging a line of credit, feeling that it was my opportunity to create some, some wealth in a different way."

In his earliest years in the stock market, Zaret came across John Kaiser of Kaiser Research Online. At the time, Kaiser was publishing his "Bottom Fishing" report in which he detailed stocks to buy that was unpopular within the market, which sparked Zaret's interest in the junior sector as a whole.

Then in 2011, Spartan Fund Management sought help within its microcaps, and the company grabbed Mark Zaret.

Alternative Investments

Founded in 2006, Spartan Fund Management is an investment management company that offers hedge fund strategies, risk management and compliance, and financial planning. It is headed by Gary Ostoich and specializes in providing, through pooled funds, a broad selection of alternative investment solutions that meet various investment needs. It likes to walk to the beat of its own drum, as it says on its website that Spartan believes "that alternative investment strategies provide better risk-return opportunities for investors than do conventional strategies."

Spartan currently manages over US$1 Billion in funds worldwide. You can see its performance recap of all funds here.

They saw him as a good fit due to his history of investing in the space. Zaret is not a registered portfolio manager. He is officially touted as the chief strategist for microcap funds.

Still, while not registered, Zaret holds over a decade of experience and a wealth of knowledge in the industry that we thought our readers would benefit from, which is why we at Streetwise sat down to speak with him about Spartan and what stocks have him excited.

Fox River Resources

The first company Zaret spoke about was Fox River Resources Corp. (FOX:CNSX). Fox River Resources is a Canadian-based resource exploration and development company that focuses on the discovery and development of high-quality mineral deposits. The company was founded in 1995 and is headquartered in Vancouver, British Columbia.

One of the company's flagship projects is the Martison project, which is located in the Abitibi greenstone belt in Ontario. The project is a joint venture between Fox River and Kirkland Lake Gold Ltd. According to a press release from Kirkland Lake Gold Ltd., the project has significant potential for gold and silver deposits.

In addition to its exploration projects, Fox River Resources Corporation also has a royalty portfolio that includes interests in several mining projects in Canada and the United States. According to a press release from the company, its royalty portfolio includes interests in the Hemlo gold mine in Ontario and the Golden Sunlight mine in Montana.

Fox River also owns the Hearts, Ontario, phosphate mine.

"It's a very substantial project," Zaret said, "which has largely been de-risked through an earlier agricultural cycle." Zaret touched on how in 2007, phosphate prices went up significantly. However, soon the price of phosphate fell dramatically, followed by the 2008 market crash, leading to the project being shelved.

"Fast forward to today. There have been huge changes in the world, as we all know, in terms of countries needing to find their own supply of various metals and products, and phosphate is one of them," Zaret continued. With the price of phosphate getting higher, interest is flowing back into the project.

It's a very substantial project," Zaret said, "which has largely been de-risked through an earlier agricultural cycle."

Zaret told us, "A PEA has already been done on this thing. And it came out with a net present value using current prices of US$2.5 billion dollars. So it's a very large project. I just did a little figuring on this. And, if you take US$2.5 billion, the market cap currently of Fox River is about US$25 million. So it's literally trading for 1% of the project's net present value."

This value will also be impacted by global events, Zaret said. "As you know, Russia is now saying that they're going to limit exports of various grains. So there's more and more pressure for countries to have local production . . . There's an increased focus on Canada having its own phosphate developments" for both agricultural purposes and battery metals.

Phosphate is continually being used more and more in battery metals. Zaret estimated the current market in this area to be US$10 billion, with an estimated growth of US$50 billion over the next three years.

"I think this is it's a sleeper story in the fact that it has this very small market cap," he said, especially considering the moves the world is making in the phosphate space. For example, recently Minister of Mines in Ontario recognized phosphate as a vital component in the elective vehicle (EV) revolution, and the EU denoted it as a critical metal. Ford is also primarily using lithium phosphate batteries for its EVs.

According to Reuters, 17.9% of Fox River's stock is held by management and insiders. President, CEO, and Director Stephan Case has the most out of management at 14.28%, with 9.18 million shares. CFO Fraser Laschinger has 1.77%, with 1.14 million. Director John D. Yokley has 0.93%, with 0.60 million, and Director Elizabeth Leonard has 0.91%, with 0.59 million.

5.57% is held by institutional investors. Mackenzie Financial Corp. has 3.61%, with 2.32 million. U.S. Global Investors Inc. has 1.56%, with 1 million. IG Wealth Management has 0.21%, with 0.14 million. AGF Investments Inc. has 0.10%, with 0.07 million, and GWL Wealth Management Ltd. has 0.09%, with 0.06 million.

8.90% is with strategic investors. Lotan Holdings Inc. has 8.90%, with 5.72 million shares.

The rest is retail.

According to Google Finance, Fox River has a market cap of CA$22.18 million. Market Watch reports that the company has 52.41 million shares outstanding and trades in the 52-week range between CA$0.15 and CA$0.82.

Data Communications Management

Next, Zaret touched on Data Communications Management Corp. (DCM:TSX; DCMDF:OTCQX).

Data Communications Management is a leading marketing and business communication solution provider to companies across North America. The company was founded in 1955 and is headquartered in Brampton, Ontario, Canada. DCM specializes in helping businesses simplify their communication and operations, allowing them to accomplish more with fewer steps and less effort.

DCM offers a wide range of communication solutions, including marketing and advertising services, direct mail, printing, and digital communications. The company's services help businesses connect with customers and improve communication strategies.

While starting as primarily a printing company, new management "cleaned up operations. They lowered their headcount substantially. They closed various facilities, and, more recently, have changed the focus to become more of a digital company."

Zaret stated that Data Communications offers "some significant digital offerings," including its digital workflow management tools.

"DCM is now highly profitable," he continued, "earning something around the last number of quarters have been fairly consistent around CA$0.08 a quarter and CA$0.30 a share last year, which put them even at the current share price at around eight times earnings."

"DCM dominates in that industry," Zaret said.

However, what Zaret finds most compelling about the stock is that the digital side is a key focus of management and is expected to grow rapidly

"We end up with a company that's going to have sales of about CA$500 million a year. And its list of clients includes virtually every large company in Canada," Zaret said. "It would be harder to find a company it doesn't doesn't deal with."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Data Communications Management Corp. (DCM:TSX; DCMDF:OTCQX)

And the company isn't letting print die, either. As Zaret told Streetwise, "Print is far from dead."

"There's a bank on every street corner across all the major cities . . . Anytime you pass your bank, there are going to be a large number of things on display about mortgage rates and interest rates, etc."

Those are printed, but they aren't disappearing, as some people might think. There currently isn't a better way to digitize them. So, those aren't going away. And they're not going to be digitized.

"DCM dominates in that industry," Zaret said.

Management and insiders own about 45% of DCM, including a share program that gives employees close to 4% ownership.

Top insider shareholders include Director Michael Sifton with 10.2% or 4.5 million shares, Board Vice Chairman Greg Cochrane with 7.43% or 3.28 million shares, Chairman of the Board J.R. Kingsley Ward with 5.54% or 2.44 million shares, and the CEO Kellam with 1.67% or 0.74 million shares, according to Reuters.

According to the company, the rest, 55%, is retail. Reuters lists KST Industries Inc. as the top shareholder in the company overall, with 11.69% or 5.15 million shares.

It has a market cap of CA$105.75 million with 44 million shares outstanding, with 27.3 million shares free-floating. It trades in the 52-week range of CA$2.45 and CA$1.01.

Aurion Resources

Zaret moved back to the resources sector to talk about Aurion Resources Ltd. (AU:TSX.V). Aurion Resources is a Canadian exploration company that aims to generate or acquire early-stage precious metals properties and advance them through exploration to discovery. The company was founded in 2006 and is headquartered in Vancouver, British Columbia.

One of the significant focuses of the company is gold exploration, and it has a strong presence in Finland, where it operates several projects. The company's flagship project is the Risti Gold Project, located along the Sirkka Shear Zone in Northern Finland. The Risti Gold Project includes the Aamurusko target, which is the primary focus of the company's exploration program.

Previously, Finland was closed to foreigners until 1995, when they joined the United Nations, which is one of the reasons Zaret finds this a compelling business location.

"It's only been opened to for business for under 30 years . . . If you think of Canada or the United States, you'd have to think back to something like 100 years ago. There's been such little development in Finland that you could consider it one of the last frontiers for discovery in the world."

"The share structure is excellent in that virtually 75% of the shares are owned either by management or institutions," Zaret said.

The Fraser Institute concurred, naming Finland as one of the top ten most attractive jurisdictions for mining investment in the world.

Aurion has an area known as the Central Lapland Greenstone Belt, which is highly prospective for gold, and includes the Kittilä Underground Gold Mine owned by Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE).

"It is very unusual for this kind of belt only to have one producing mine. And so the theory is that there will be more similar belts over the coming years in that there will be many more producers as more exploration gets done," Zaret added.

He also pointed out that one of Aurion's neighbors, Rupert Resources (RUP:TSX.V), had recently made a significant discovery, which it's currently in the early stages of.

"It is very interesting because that company is directly on the border. And in fact, there's so much on the border that that it appears that the deposit actually goes into Aurion's land."

Zaret pointed out that Rupert Resources has published a pit design for its deposit that may be compromised due to it being on Aurion's border.

He said, "It appears that the deposit actually not only crosses the border but more importantly, that its pit design is compromised. Therefore, one has to think that there will be some form of M&A in the area before Rupert will be able to develop its mine."

Zaret believes this possible M&A could be the top catalyst for Aurion. He also likes that management has faith in the company. "The share structure is excellent in that virtually 75% of the shares are owned either by management or institutions," he said.

As of March 2022, the company reported that management and insiders held 13.4% of Aurion Resources' stock. 44.5% is held by institutional investors.

16.3% is with strategic investors.

The rest is retail.

Market Watch reports Aurion's market cap as CA$94.28 million. It has 117.85 million shares outstanding and trades in the 52-week range between CA$0.38 and CA$1.06.

Grounded Lithium

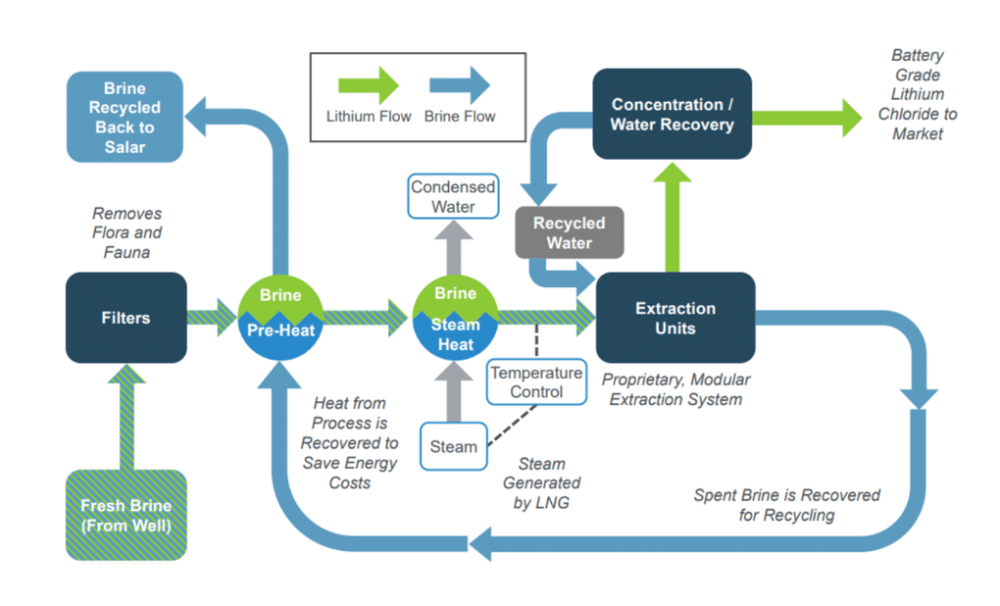

Last but not least, Zaret touched on Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB). Grounded Lithium is a publicly traded lithium resource company based in Alberta, Canada. The company is focused on supplying lithium to the rapidly developing electricity-powered economy and is involved in all levels of lithium extraction through subsurface brine production.

GLC controls approximately 4.2 million tonnes of inferred lithium carbonate equivalent resources. The company has recently expanded its land holdings in the region to meet the growing demand for lithium.

One of the things Zaret finds most intriguing about Grounded Lithium is that it is involved in lithium brine in Canada, when most lithium brines are in South America.

Storage and Transfer Technologies states, "Salt-rich water is pumped to the surface and into a series of evaporation ponds. Over a period of months, the water slowly evaporates, and a variety of salts precipitate out, leaving a brine with an ever-increasing concentration of lithium."

Grounded is currently working on direct lithium extraction (DLE).

According to International Battery Metals, DLE "involves a highly selective absorbent to extract lithium from brine water. The solution extracted from the brine water is then polished of impurities to yield high-grade Lithium Carbonate and Lithium Hydroxide."

Zaret believes DLE is worth looking into as it has higher recoveries and lower emissions than the evaporation method."

"It has very little investor awareness, high insider ownership. 8,080 hectares of land owned. What else can I say?" Zaret added.

He also pointed out the possibility that Canada might soon allow flow through investing if a company is working on a lithium brine. Lithium is also considered a critical metal in Canada, leading to a 30% tax break.

In terms of what distinguishes Grounded Lithium from other companies, Zaret said, "Lithium brine is more like an oil than hard rock mining, and the people that are running this company have deep experience in the oil business and have good reputations historically . . . They've created value in the oil patch. And so, they have a more intimate knowledge of the process." He said others may get hung up on lithium grade. However, regarding extraction in a brine operation, grade becomes less important, and flow rates become king.

"It has very little investor awareness, high insider ownership. 8,080 hectares of land owned. What else can I say?" Zaret added.

Streetwise Ownership Overview*

Grounded Lithium Corp. (GRD:TSX.V; GRDAF:OTCQB)

Grounded Lithium has CA$3 million in the bank, as per its last financing in the fall of 2022, and says that the company has the financial resources to address its short-term catalysts. They report no set monthly drilling costs.

Insiders own 14% of the company with about 9.6 million shares. According to Reuters, President and CEO Gregg Smith is the largest shareholder in management at 3.06%, with 2.13 million shares. SVP Corporate Development and CFO Greg Phaneuf has 1.76%, with 1.23 million. VP Land and Regulatory Lawrence Fisher has1.27%, with 0.88 million, and VP Geophysics and IT Wayne Gaskin has 0.77%, with 0.53 million.

Institutions own approximately 17% of the company, though none own more than 10%, so names are not publicized. Grounded Lithium reports no strategic investors, and the rest is in retail.

Grounded Lithium has 12,000,000 public warrants at CA$0.50, and 2.3 million finder warrants from previous financings at an effective price of CA$0.19.

Grounded Lithium has a market cap of US$17 million. There are 69,656,423 shares, 14,351,862 warrants, and 8,883,100 options. According to Market Watch, Grounded Lithium trades in the 52-week range between CA$0.22 and CA$0.50.

Risky Business

As our conversation came to a close, Mark Zaret hammered in the importance of understanding what business the stock market is.

"It's a risky business buying into these kinds of speculative stories, but diversification is always strongly encouraged. And because you never know, which one will ultimately, you know, work out. Always be prepared to have losses and have enough diversification that you're exposed to. The few that will will work out and create capital create wealth."

Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold, Technology and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Mark Zaret Disclaimers:

Investing in small and micro-cap equities is highly speculative in nature and involves substantial risk of loss. Any action a reader takes as a result of information presented herein is his, her or their own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer

This article does not constitute investment advice. While Mark Zaret is registered as a dealing representative with Spartan Fund Management Inc. (Spartan), the views set out herein are for informational purposes only, are not a recommendation to buy or sell any security, and should not be relied upon by the reader as investment advice from Mr. Zaret or Spartan and should not be construed or interpreted by the reader to mean that an investment in any of these securities would be suitable for them in their particular circumstances. Mr. Zaret and Spartan each expressly disclaim owing any responsibility to the reader, and each reader is encouraged to consult with his or her individual investment advisor and other financial professionals.

In his capacity as an investment dealer with Spartan, Mr. Zaret (or other representatives of Spartan) may be buying or selling for clients of Spartan securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein.

Certain of the information provided herein is based on the views held by Mr. Zaret at this time, but these views are personal to him as at this date and are subject to change. Mr. Zaret and Spartan disclaim any obligation to update any of the information set out herein going-forward.

Mark Zaret: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: {FOX.C, DCM.T, AU.V}. Neither I or any members of my immediate household or family are paid by any of the companies mentioned in this article. Neither I, or any members of my immediate household or family have a financial relationship with any of the companies mentioned in this article. I determined which companies would be included in this article based on my research and understanding of the sector.

Spartan: Spartan, or accounts or funds managed or controlled by Spartan, own securities of the following companies mentioned in this article: {FOX.C, AU.V, DCM.T, GRD.V}. Spartan, or accounts or funds managed or controlled by Spartan, are NOT paid by any of the companies mentioned in this article. Spartan, or accounts or funds managed or controlled by Spartan, have NO financial relationship with any of the companies mentioned in this article.

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Data Communications Management Corp. and Grounded Lithium Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Grounded Lithium and Agnico Eagle Corp., companies mentioned in this article.