The U.S. Department of Energy has announced grant funding of up to 80% for businesses interested in deploying hydrogen boilers like those developed by Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC PINK: JLM:FRA) subsidiary Hydrogen Technologies to decarbonize their operations.

The DOE is offering US$156 million to drive industrial decarbonization, including in industrial heat applications, and US$6 billion in funding to accelerate projects decarbonizing energy-intensive industries.

Hydrogen Technologies' Dynamic Combustion Chamber™, or DCC, boiler burns hydrogen and oxygen in a vacuum chamber to create high-temperature water and steam with no greenhouse gases or other pollutants.

The only by-product is water, which is recycled. It's meant to replace existing boilers that burn coal, natural gas, diesel, or fuel oil.

The world needs more hydrogen technology and projects if it wants to meet a net-zero emissions scenario by 2050, the International Energy Agency wrote.

"Faster action is required on creating demand for low-emission hydrogen and unlocking investment that can accelerate production scale-up and deployment of infrastructure," the agency wrote.

The US$156 million from the DOE's Office of Energy Efficiency and Renewable Energy is meant to spread across 37 to 62 projects with projected sizes of US$750,000 to US$10 million, Hydrogen Technologies said. Concept papers are due soon — April 17. Full applications are due June 23.

Newsletter writer Clive Maund wrote for Streetwise Reports that hydrogen "is a fuel of the future" and that Jericho is "moving with the times."

The grants will cover several other topics besides decarbonizing industrial heat, including decarbonizing chemicals, iron and steel, and food and beverage products, the DOE said.

The US$6 billion is funded by U.S. President Joe Biden's Bipartisan Infrastructure Law and Inflation Reduction Act and focuses on accelerating decarbonization projects in energy-intensive industries.

That money will be spread across 22 to 65 projects with projected sizes of US$35 million to US$500 million. Concept papers are due April 21, and full applications are August 4.

Companies interested in more information on applying for the grants can click the "Funding Opportunities" tab on Hydrogen Technologies' website.

The Catalyst: Potential for 'Near-Zero' Emissions

While in its infancy, the DOE said the hydrogen market has the “potential for near-zero greenhouse gas emissions.”

“Hydrogen generates electrical power in a fuel cell, emitting only water vapor and warm air,” the agency wrote. “It holds promise for growth in both the stationary and transportation energy sectors.”

The National Inflation Association predicted Jericho would be one of the market's largest percentage gainers of 2023, reaching "levels that are many times higher than today."

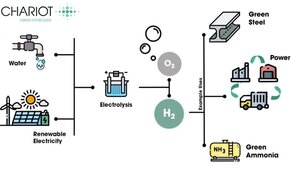

Hydrogen is the most abundant molecule in the universe, but it doesn't occur by itself naturally on Earth and must be separated from water or hydrocarbon carbons using electrolyzers.

It's also a "uniquely versatile energy carrier," according to a report by the Hydrogen Council. "It can be produced using different energy inputs and different production technologies. It can also be converted to different forms and distributed through different routes — from compressed gas hydrogen in pipelines through liquid hydrogen on ships, trains or trucks, to synthesized fuel routes."

Policies like the recently announced grants have made the U.S. a hub for this green-fuel revolution, according to a report by S&P Global on clean tech trends in 2023.

"Accommodating federal policy has shifted the United States from laggard to leader in the development of low-carbon hydrogen production," the report said. "The combination of the IRA's multiple tax credits and the Bipartisan Infrastructure Law's Hydrogen Hubs has set off a race for project development across North America."

Analyst: Co. Is 'Moving With the Times'

Hydrogen Technologies' DCC boilers are being considered for deployment at major facilities around the world, the company has said. Feasibility studies are being conducted or considered at 34 locations across seven industries and five continents.

Another portfolio company of Jericho, H2U Technologies, recently announced it is partnering with a Japanese gas company to develop low-cost electrolyzers for making "green" hydrogen from renewable energy sources like wind and solar.

H2U and Tokyo Gas Co. Ltd. (TKGSY:OTCMKTS) have signed a multiyear joint development agreement to discover new materials that can be used to help extract the element.

Jericho started in 2014 as an oil company, but in 2020 began to pivot toward green energy. The company continues to use profits from remaining oil and gas assets to fund its investments in zero-admission hydrogen technologies.

Newsletter writer Clive Maund of CliveMaund.com wrote for Streetwise Reports that hydrogen "is a fuel of the future" and that Jericho is "moving with the times."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC PINK: JLM:FRA)

The National Inflation Association predicted Jericho would be one of the market's largest percentage gainers of 2023, reaching "levels that are many times higher than today."

Jericho was also awarded the Solar Impulse Foundation's "Solar Impulse Efficient Solution" label for the DCC boiler. The label seeks to identify solutions that hit high standards in profitability and sustainability.

Ownership and Share Structure

Around 35% of Jericho's shares are held by management, insiders, and insider institutional investors, the company said. They include CEO Brian Williamson, who owns 1.26% or about 2.85 million shares; founder Allen William Wilson, who owns 0.87% or about 1.97 million shares; and board member Nicholas Baxter, who owns 0.5%, or about 1.1 million shares, according to Reuters.

Around 10% of shares are held by non-insider institutions, and 65% are in retail, the company said.

JEV's market cap is CA$65.72 million, and it trades in a 52-week range of CA$0.63 and CA$0.26. It has 226.3 million shares outstanding, 158.8 million of them floating.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Jericho Energy Ventures. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures, a company mentioned in this article.