Canadian mining firm Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) has completed its first reverse circulation (RC) drilling program in the first quarter of 2023 in its Philadelphia epithermal gold-silver project in Mohave County, Arizona.

The company drilled a total of 12 holes, amounting to 1,256 meters. They are awaiting assay results as samples will be prepared in Tucson, Arizona, and shipped to Vancouver, British Columbia for assaying.

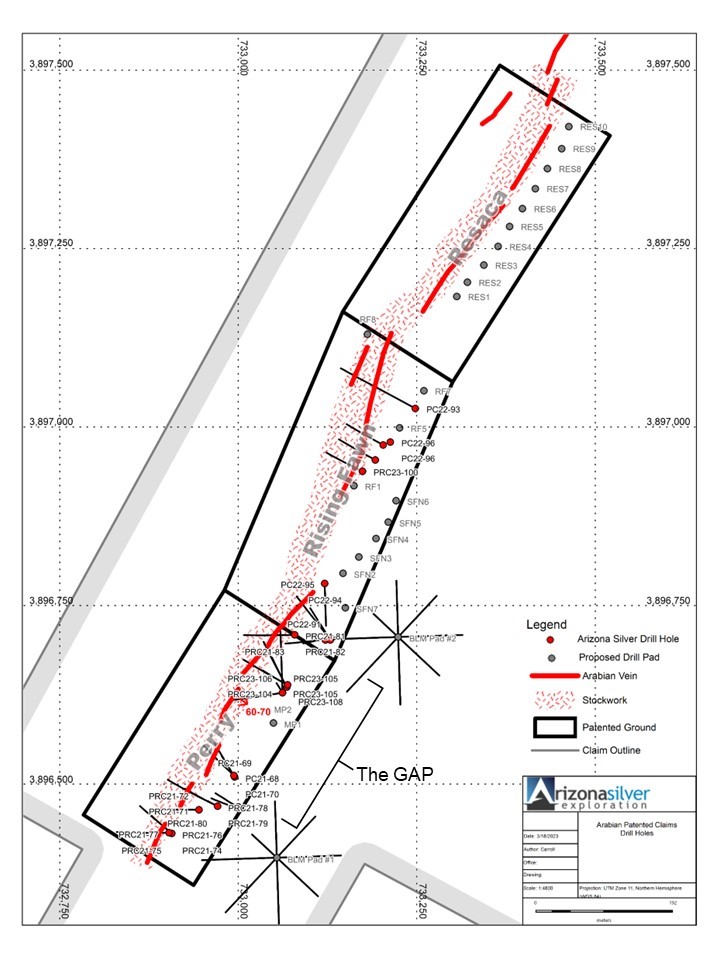

Five holes were completed on one of the three patented claims known as the Rising Fawn Zone, while the remaining seven holes were drilled in the GAP located in the Perry Zone, which is a newly established drill pad in the central Perry claim.

Drilled holes in the Rising Fawn Zone had stockwork quartz mineralization as anticipated in a rhyolite dike and footwall granite, while the GAP holes in the Perry Zone intersected green to gray quartz and had good intervals of silicification and stockwork quartz.

Upon observation, the cuttings from all 12 holes revealed visible gold and quartz veining.

"We have drilled 1.7 kilometers of strike length and up to 250 meters of dip to date on this impressive mineral system. Some gaps remain to be drilled but overall, the system is well mineralized throughout the area drilled to date and remains open along strike in both directions and down dip," Greg Hahn, Arizona Silver Vice President for Exploration, said.

He noted that "outcrops" — or visible bedrock with deposits seen on the surface of the ground -- of the main vein system continue south for another 1.4 km and have never been drilled. This presents the potential for more drilling activity and production.

Arizona Silver is a young exploration company focused on gold and silver properties in Arizona and Nevada. Its gold and silver projects include the Philadelphia property, Silverton Gold Project in Nye County, Nevada, the Ramsey Silver Project in western Arizona, and the Sycamore Canyon Project in southern Arizona.

The Catalyst: More Drilling, Awaiting BLM Drill Permits

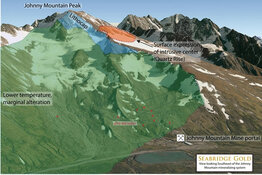

Arizona Silver further identified 10 drill sites in the Resaca Zone on patented claims in an upcoming drilling campaign. The Resaca Zone has never been drilled but shows excellent silver-gold geochemistry from outcropping stockwork quartz in the host rhyolite dike.

Chris Temple of The National Investor said Arizona Silver is an "uber-encouraging" company showing bright prospects.

VP Hahn said the company had previously drilled 60 holes at unpatented claims located around 500 meters north of Resaca Zone. More than half of these holes saw high-grade veins and adjacent stockwork quartz mineralization.

The company is currently permitting 40 additional holes from several drill sites on claims within the lands of the Bureau of Land Management. These holes will test the down dip continuation of the Perry Zone and the recently identified strong CSAMT anomaly beneath the Red Hills bulk tonnage target.

Why Gold?

Gold has been showing signs of strength so far in 2023. The National Inflation Association pointed out that gold prices have increased by 13.4% in three and a half months to their current price levels.

This rally shows that gold has the potential to hit the National Inflation Associations' forecast of US$2,670 per ounce by the end of 2023.

On the other hand, Future Trends Digest also sees gold prices further improving in the next three months, as "recession fears will intensify and the whole economy will move from pricing in a recession to pricing in the recovery."

"Gold will benefit from this, and we're already seeing the rally get underway," FTD said.

Why Arizona Silver?

Chris Temple of The National Investor said Arizona Silver is an "uber-encouraging" company showing bright prospects due to the continuously expanding area or size of mineralization, and the very positive sighting of visible gold on the surface of its mining site even before assay results come out.

Clive Maund noted, "With moving averages in bullish alignment and the Accumulation line strong, this is a chart that promises a breakout soon above the resistance toward the CA$0.40 level that will probably usher in a period of accelerating advance."

"There indeed could be hidden under that big rhyolite dome, a gold-silver resource far in excess of what anyone ever thought existed. Secondly, notwithstanding the need for official assay results still to come, when free, visible gold can be panned out of grindings from a few of these holes, that's an attention-getter," Temple said.

Even before this news, he said that AZS shares have already been better-than-average performers among other junior mining companies that haven't been able to explore in the past few months "despite the occasional — and current — spike in gold's price especially."

Earlier, Temple pointed out in September last year that Arizona Silver could be sitting on 3 to 4 million ounces of high-grade gold resources just at the Philadelphia property alone.

Now, he observed that AZS shares are being held by "stronger-than-average" investors who are drawn to the company's positive progress toward possibly a "big breakout story" and therefore will not sell the stock anytime soon.

Arizona Silver, for its part, enumerated three key factors that make its stock worthwhile: a tight share structure, low monthly cash burn rate, and continuous expansion of its Philadelphia project.

"We have one of the tightest share structures not blown up, management has a big stake as well, (and) never selling a share either. The company has an extremely low burn rate money goes into the ground advancing the property for higher shareholder value. Philadelphia is becoming larger by every single drill hole," the company said.

On March 19, 2023, Clive Maund shared this chart on Arizona Silver.

He noted, "With moving averages in bullish alignment and the Accumulation line strong, this is a chart that promises a breakout soon above the resistance toward the CA$0.40 level that will probably usher in a period of accelerating advance."

Ownership and Share Structure

Streetwise Ownership Overview*

Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC)

Company management and advisors hold over 28% of the company. According to Reuters, Advisor Brandy Stiles has 14.11% at 9.77 million shares. VP of Exploration Greg Hahn has 4.68%, with 3.24 million. President and CEO Mike Stark has 3.79%, with 2.62 million. CFO Dong H. Shim has 1.16%, with 0.80 million, and Director Eugene ("Gene") Spiering has 0.09%, with 0.06 million.

9.9% of Arizona Silver is held by institutions. Wealth Management AG has 8.11% with 5.62 million shares, and Moloney Securities Asset Management LLC. has 0.01%, with 0.01 million.

The rest is held by retail investors.

Arizona Silver has not disclosed the amount of money it currently has in the bank. However, it has stated a monthly burn rate of CA$24,000, with a monthly drilling cost of CA$50 per foot in the core, or roughly CA$35 per foot in RC all-in costs.

Arizona Silver reports no sellers or warrants overhang, but that there is good potential to exercise warrants in 2023 with a higher share price.

According to Market Watch, Arizona Silver has a market cap of CA$30.14 million, with 68.92 million shares outstanding trades in the 52-week range between CA$0.17 and CA$0.54.

Sign up for our FREE newsletter

Disclosures:

1) Nika Catalado wrote this article for Streetwise Reports LLC as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Arizona Silver Exploration Inc. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Silver Exploration commas between company name and legal entity. , a company mentioned in this article.