This morning, Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) announced that it had made significant progress on a previously undrilled section of the Philadelphia Project known as the GAP. Arizona Silver has established seven drill holes on the GAP and five in the Rising Fawn Zone, both of which intersected gold.

Mike Stark, the CEO of Arizona Silver, said of the project, "we are in the process of drilling out one of the most exciting new gold discoveries in Arizona and anticipate having a large gold-silver resource defined in 2023-2024. "

The company is still awaiting assay results for this most recent drilling, which will reveal precisely how much gold and silver the drill holes intersected.

Arizona Silver Company is a junior mining exploration group with four properties in the Western United States: the Philadelphia Project, the Ramsey Silver Project, the Sycamore Canyon Project in Arizona, and the Silverton Gold Project.

Bridging the GAP

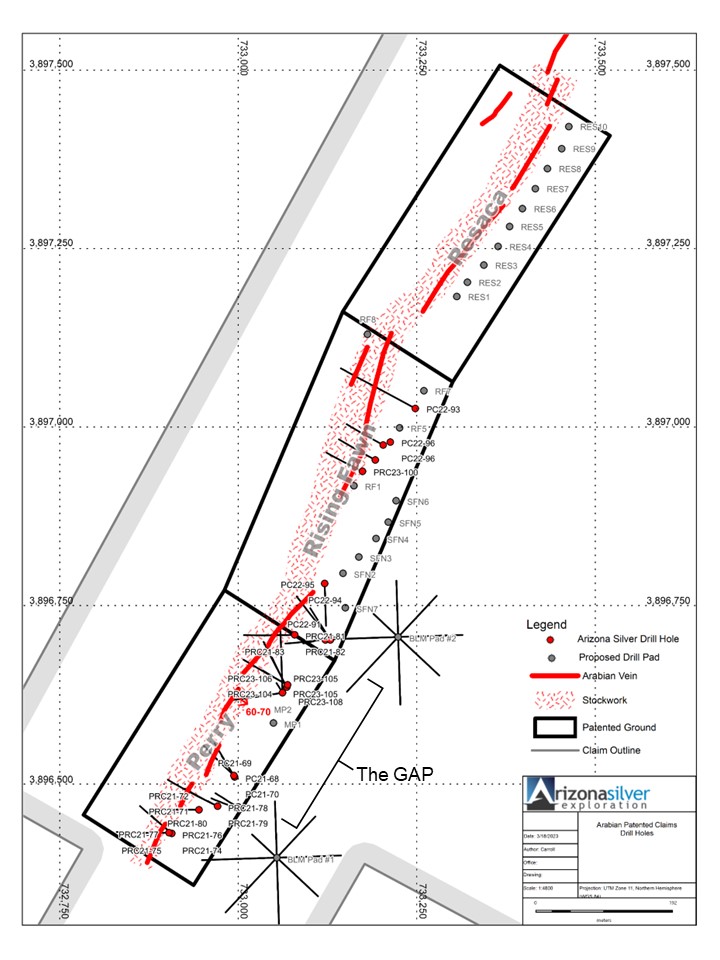

Arizona Silver established seven drill holes in a previously untapped area of the Perry Zone, known as the GAP. The drill holes intersected a vein of mineralization, and "gold panning of drill cutting rejects from the hanging wall vein zone from two of the drill holes in the GAP revealed visible gold, " according to Arizona Silver.

According to Greg Hahn, VP-Exploration, " We have drilled 1.7 kilometers of strike length and up to 250 meters of dip to date on this impressive mineral system. Some gaps remain to be drilled, but overall, the system is well mineralized throughout the area drilled to date and remains open along strike in both directions and down dip. Outcrops of the main vein system continue south for another 1.4 kilometers but have never been drilled. "

Chris Template continued, "when free, visible gold can be panned out of grindings from a few of these holes, that's an attention-getter!"

In addition to the GAP, five drill holes were established in the Rising Fawn Zone, where drill cuttings also revealed visible gold.

In light of this news, Chris Temple from The National Investor touched on the company. He said, while he typically discards news if assays are still pending, "this morning's news [was] an outlier" and "uber-encouraging" to him for two reasons. First, he was impressed by the expansion of the area and the size of the mineralization.

He said, "As I hope you'll recall from my initial recommendation, the geological thesis here continues to be ratified bit by bit: and today's news is that there indeed could be hidden under that big rhyolite dome a gold-silver resource FAR in excess of what anyone ever thought existed."

Next, he pointed out that official assays are not needed. He continued, "when free, visible gold can be panned out of grindings from a few of these holes, that's an attention-getter!"

Why Gold and Silver?

When confidence in the economy is low, gold becomes more attractive as an investment. " gold is back in favor this week as a banking crisis that started with the failure of Silicon Valley Bank (SVB), had investors flocking to safe-haven assets, including the U.S. dollar, Treasuries, and bullion, " said Rick Mills of Ahead of the Herd.

While the value of gold is on the upswing (seeing a 39% gain earlier in the year, according to Rick Mills), silver may outpace it. Silver, at US$30, rose by 147%, says Mills. In addition to interest as a safe-haven investment, the value of silver is being driven up by industrial applications.

In an article on the applications of silver, Mills said, " one projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade. "

Nichola Groom and Richard Valdmanis of Reuters reported that imports of such solar panels to the U.S. were on the rise due to a greater understanding of new overseas labor policies: “a White House official confirmed the thaw in shipments at an energy conference on Monday, attributing it to clearer rules around complying with the Uyghur Forced Labor Protection Act (UFLPA). "

The Catalyst: More Drilling on the Horizon

According to Greg Hahn, the Vice President of Exploration, " the Philadelphia Property is one of the few gold systems remaining in the Western USA that has never been evaluated using modern exploration concepts. Our recent discoveries using the model of ‘Boiling Zones’ resulted in an immediate discovery… All this project needs is drilling to demonstrate its real potential. "

Arizona Silver reports that they are permitting 40 holes from drill sites on land belonging to the Bureau of Land Management. These holes will provide more information on the mineralization present as they test the down-dip continuation of the Perry Zone and the Red Hills CSAMT anomaly.

Technical analyst Clive Maund said, "Now, thanks to it reacting back a little more than expected, as it is at an even better entry point, especially as its technical setup is even more positive."

For its upcoming drilling campaign, the company established ten drill sights that will test the Resaca Zone on patented claims. This zone has not been drilled in the past, but outcropping stockwork quartz in the host rhyolite dike has presented silver and gold geochemistry.

On unpatented claims north of the Resaca Zone, Arizona Silver has already completed 60 drill holes for a distance of at least another 500 meters north of the patented claim boundary.

Over half of the holes in question have been shown to intersect high-grade veins and adjacent stockwork quartz mineralization.

In a recent posting, technical analyst Clive Maund shared the above chart and spoke on the company, saying, “We bought Arizona Silver Exploration late last month at what was thought to be a good entry point . . . but now, thanks to it reacting back a little more than expected, as it is at an even better entry point, especially as its technical setup is even more positive."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC)

Clive Maund cited the MACD indicator, which indicates that its value is about to be on the upswing.

Ownership and Share Structure

Company insiders hold over 28% of the company. According to Reuters, Advisor Brandy Stiles has 14.11% at 9.77 million shares. VP of Exploration Greg Hahn has 4.68%, with 3.24 million. President and CEO Mike Stark has 3.79%, with 2.62 million. CFO Dong H. Shim has 1.16%, with 0.80 million, and Director Eugene (“Gene") Spiering has 0.09%, with 0.06 million.

9.9% of Arizona Silver is held by institutions. Wealth Management AG has 8.11% with 5.62 million shares, and Moloney Securities Asset Management LLC. has 0.01%, with 0.01 million. A following of family and friends hold 42% of the company.

The rest is in retail.

Arizona Silver has not disclosed the amount of money it currently has in the bank. However, it has stated a monthly burn rate of CA$24,000, with a monthly drilling cost of CA$50 per foot in the core, or roughly CA$35 per foot in RC all in costs.

Arizona Silver reports no sellers or warrants overhang, but that there is good potential to exercise warrants in 2023 with a higher share price.

Arizona Silver has a market cap of CA$25.6 million, with 69,201,075 shares, 8,521,426 warrants, and 5,487,250 options. According to Market Watch, the company has 69.28 million shares outstanding and trades in the 52-week range between CA$ 0.1277 and CA$0.4772.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Arizona Silver. Please click here for more information.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Silver, a company mentioned in this article.