Founded in 2007, Smith Weekly Research is an independent market research firm, with a focus on the natural resource sector.

Smith Weekly prides itself on research with a focus "characterized by terms including cyclical, volatile, contrarian, high-risk high reward, illiquid, underappreciated, small capitalization, overlooked, complex, material moat, and network critical market focus."

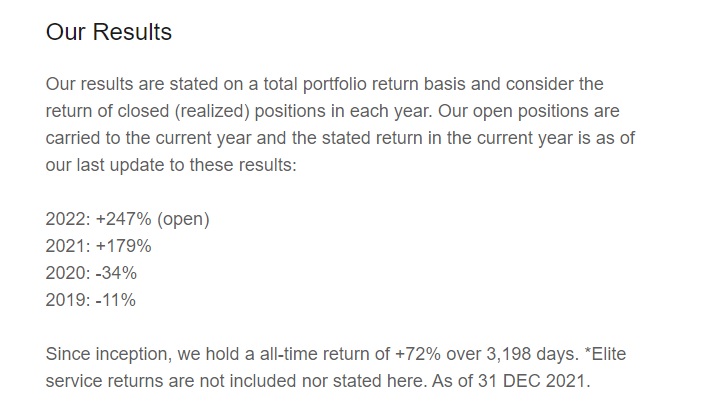

While this may seem like a tall order, Smith Weekly has been reporting on stocks in the natural resource sector with impressive results.

According to the company, since inception, the company holds an all-time return of +72% over 3,198 days.

In light of these results, we sat down with Andrew Weekly, the founder, and CEO of the company to go over his method and what companies he believes will be worth your while in 2023.

Andrew Weekly has 17 years of experience in the investment space and nine years in analysis.

While Weekly's experience is eclectic, for the past seven years, he has put his time and energy into the natural resource market, specifically uranium.

Uranium is Compelling

Weekly told Streetwise Reports, that Smith Weekly began research on the uranium sector in late 2015/early 2016, not sending out an official report on the sector until 2017. They prided themselves on doing a year of prep before making any decisions and have been bullish on the sector ever since.

Regarding uranium, Weekly said, "it is one of the most compelling areas in the market to look at. It has quite a wide moat. It's a very small sector compared to places like the gold or copper sector, precious metals, and even a lot of base metals." This is one of the reasons Smith Weekly has centered itself within the sector for so long.

When asked what companies, Weekly would recommend he said, "Our model portfolio entered these companies via investments many years ago. I think it's important for your audience to understand that some of these companies that we've been following and been a part of for a number of years, we own at a level much lower than today's prices. That doesn't mean you still can't consider them. But people need to understand that, where we are in this sector is quite a bit different from people who are looking at the sector for the first time. There are obviously a number of companies out there people can choose from. There are your juniors in terms of pure-play exploration companies, globally in the various uranium jurisdictions. There are your development companies, and then there's also your restarts and producing companies that you can look at, and all of these of course, have various market caps anywhere from a million dollar market cap to a few billion. And so within that, today, our count is about 111 companies are in the sector, probably of those 111, I would say less than 25 of them are probably investable. And then from there, you're going to further consolidate that list even lower, probably to half of that 25 number I just provided. So with that understanding, again, people need to understand their tolerance risk for the sector. They need to also understand the volatility of the natural resource sector, and if you're new to this sector, I would just caution people to understand that they're better off looking at publications like yours, and actually just studying the sector before taking action."

With that in mind, Weekly did share a few companies that are currently investible in the sector.

Deep Yellow Ltd.

The first Weekly touched on was Deep Yellow Ltd. (DYL:ASX). Deep yellow Ltd. is a uranium exploration company, focused on developing one of the largest global inventories to establish a +10Mlb per annum, multi-mine producer and provide security and certainty of long-term supply into a growing market. Deep Yellow has two projects. One is in Namibia and one is in Western Australia. Weekly said that while they are a development-focused company, it is very likely they could be a producer in the future.

According to Reuters, 13.38% of the company's stock is with management and insiders. CEO John Borshoff has the most out of management at 2%, with 15.01 million shares, and Executive Director Gillian Swaby has 1.30%, with 9.76 million.

32.93% is with institutions and strategic investors. Paradice Investment Management Pty. Ltd. has the most at 6.79%, with 51.14 million shares. Alps Advisors Inc. has 4.65%, with 35.03 million. Mirae Asset Global Investments (USA) LLC has 4.24%, with 31.97 million. Collines Investments Ltd. has 3.84%, with 28.94 million. Lexband Pty. Ltd. has 2.52%, with 18.96 million. Commonwealth Superannuation Corporation has 1.38%, with 10.41 million, and Sumico (WA) Pty. Ltd. has 0.76%, with 5.75 million.

The rest is in retail.

Deep Yellow has a market cap of AU$516.06 million and 753.37 million shares outstanding. It trades in the 52-week range between AU$0.550 and AU$1.255.

You can view Deep Yellow's corporate presentation here.

enCore Energy

Next, Weekly recommended enCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX). enCore is a uranium development company based in the United States. According to the company, "enCore is focused on becoming the next uranium producer from its licensed and past-producing South Texas Rosita Processing Plant by 2023."

Weekly explained, "enCore energy is a U.S.-focused ISR company and has our meeting in situ recovery. So they have 100% Focus on United States ISR production and development. And they have projects both in Texas and Wyoming and some other jurisdictions as well."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

EnCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX)

According to Reuters, 5.42% of the company's stock is held by management and insiders. Executive Chairman William M. Sheriff. MSc has 1.86%, with 2.03 million, and Advisory Committee Chair Nathan A. Tewalt, BSc has 0.35%, with 0.39 million.

20.33% is with institutions and strategic investors. Mirae Asset Global Investments (USA) LLC has 5.04%, with 5.5 million shares. Alps Advisors Inc. has 4.67%, with 5.09 million. Exchange Traded Concepts LLC 3.57%, with 3.9 million, and Incrementum AG has 0.78%, with 0.85 million.

The rest is in retail.

EnCore Energy has a market cap of CA$343.41 million and 109.02 million shares outstanding. It trades in the 52-week range between CA$2.84 and CA$5.91.

You can view EnCore Energy's corporate presentation here.

Denison Mines

While Weekly has companies on his list all over the world, he did specify a specific country. He said, "we do like Canada as a jurisdiction for incumbent producers, that incumbent producer primarily being chemical, and orano. Also, there are some development companies in Canada you might be aware of. One of those that we do like is a company called Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT)."

Denison is a uranium exploration and development company, with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. Weekly stated, "We like Denison because we believe that Denison has the best shot at an earlier production with respect to their development project that's in progress here. We think it's the most advanced from a timeline standpoint."

Streetwise Ownership Overview*

Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT)

According to Reuters, 1.02% of Denison Mines is owned by management and insiders.

36.32% is held by institutions and strategic investors. Mirae Asset Global Investments (USA) LLC has 5.21%, with 42.94 million shares. Sprott Asset Management LP has 4.46%, with 38.35 million. Alps Advisors Inc. 4.24%, with 34.95 million. MMCAP Asset Management has 2.97%, with 24.48 million. Segra Capital Management LLC 2.91%, with 24 million. Hood River Capital Management LLC has 2.62%, with 21.59 million. Beutel, Goodman & Company Ltd. has 1.35%, with 11.1 million. Graticule Asia Macro Advisors LLC has 0.72%, with 5.91 million. BlackRock Institutional Trust Company, N.A. has 0.71%, with 5.82 million, and Goldman Sachs & Company, Inc. has 0.64%, with 5.27 million.

The rest is in retail.

Denison Mines has a market cap of CA$1.37 billion and 822.6 million shares outstanding. It trades in the 52-week range between CA$1.19 and CA$2.32.

You can view Denison Mines' corporate presentation here.

ISO Energy

Last but not least, Weekly recommended investors look into ISO Energy Ltd. (ISENF:OTCMKTS). ISO Energy is a uranium exploration and development company. Weekly noted that "ISO Energy was an exploration-focused company, and now it has a discovery. So again, ISO was a much different company a number of years ago prior to this discovery. Now it's a company that's essentially advancing a deposit that's existing now."

Insert ownership and share structure

You can view ISO Energy's corporate presentation here.