ME2C Environmental (MEEC:OTCQB), the trade name of Midwest Energy Emissions Corp., garnered coverage by Zacks Small-Cap Research, which initiated on the pollution control company with a CA$1.09 valuation, reported analyst Steven Ralston in a Feb. 7 research note. ME2C's current share price, in comparison, is about CA$0.48 per share.

"ME2C Environmental is positioned to accelerate topline growth and achieve growing profitability by providing a patented mercury capture process," Ralston wrote. "Currently, the company commands roughly a 15% market share (CA$22 million [CA$22M] of a CA$150M market)."

Recently reported Q3/22 financials showed revenue to be up 49.1% year over year, coming in at about CA$7.5M. Revenue last year at the same time, in comparison, was about CA$5M. In Q3/22 ME2C reported a net income, of CA$569,379 whereas the year before it reported a net loss, of CA$206,648. Adjusted Q3/22 EBITDA was CA$1.165M versus CA$697,000 in Q3/21.

Three-Pronged Strategy

Company revenues are expected to keep rising, reflecting at least a 50% increase in the full-year 2022 figures when reported and in 2023, Ralston wrote. Growth is expected to come from ME2C's:

1) Patent infringement litigation. ME2C owns 40 existing and pending patents in the U.S., all pertaining to mercury removal. The Texas-based firm's suit against refined coal entities is slated for trial in November of this year.

"If successful, the potential compensation from a verdict or from a negotiated settlement would be transformational for the company," Ralston wrote.

2) License agreements and supply contracts. ME2C expects to increase sorbent product sales and licensing fees from its mercury emissions sorbent enhancement additive, or SEA, technology over the next two to three years by continuing to enforce its successful patent litigation effort against coal-fired electric generating units, Ralston explained.

"Ultimately, we expect that the organic growth of the company's sorbent product sales should result in a 40–45% market share in the U.S.," noted Ralston.

To be able to handle the anticipated boost in demand for sorbents, the company built a new manufacturing and distribution plant in Texarkana, Texas. It is slated to come online this year; commissioning is currently underway.

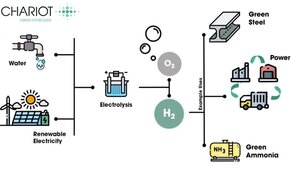

3) Rare earth extraction and remediation technologies.

"Management is pursuing research in chemisorption technology (the company's core competency) for applications related to rare earth elements extraction, coal ash cleanup, and wastewater remediation," substantial potential markets, Ralston wrote.

As for its financial position, ME2C had CA$1.26M in cash on hand and CA$2.19M in working capital as of Sept. 30, 2022.

Insider ownership of ME2C is 32%, more than double institutional ownership, which is 13%.

Regarding the outlook for the company, Ralston wrote, "We are optimistic [about] the ultimate success of ME2C Environmental."

| Want to be the first to know about interesting Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ME2C Environmental. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Midwest Energy Emissions Corp., a company mentioned in this article.

Disclosures For Zacks Small-Cap Research, Midwest Energy Emissions, February 7, 2023

ANALYST DISCLOSURES

I, Steven Ralston, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report. I believe the information used for the creation of this report has been obtained from sources I considered to be reliable, but I can neither guarantee nor represent the completeness or accuracy of the information herewith. Such information and the opinions expressed are subject to change without notice.

INVESTMENT BANKING AND FEES FOR SERVICES

Zacks SCR does not provide investment banking services nor has it received compensation for investment banking services from the issuers of the securities covered in this report or article. Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm engaged by the issuer for providing non-investment banking services to this issuer and expects to receive additional compensation for such noninvestment banking services provided to this issuer. The non-investment banking services provided to the issuer includes the preparation of this report, investor relations services, investment software, financial database analysis, organization of non-deal road shows, and attendance fees for conferences sponsored or co-sponsored by Zacks SCR. The fees for these services vary on a per-client basis and are subject to the number and types of services contracted. Fees typically range between ten thousand and fifty thousand dollars per annum. Details of fees paid by this issuer are available upon request.