An independent third-party firm has rated Jericho Energy Ventures Inc.'s (JEV:TSX.V; JROOF:OTCMKTS) zero-emissions hydrogen boiler technology as nearly 100% fuel efficient.

The company’s Dynamic Combustion Chamber™ boiler was tested by Process Engineering Associates LLC.

“All off-gas samples taken during the test did not detect hydrogen in the sample,” said Chris Muntean, a senior process engineer with Process Engineering Associates. “This data suggests that the burners are combusting the vast majority (or all) of the H2 (hydrogen) gas being supplied to the boiler. Based on these performance results, little to no fuel is left unburned.”

As technical analyst Clive Maund wrote for Streetwise Reports, hydrogen “is a fuel of the future.”

As companies shift toward greener energy sources and look to lower their carbon footprint, Jericho hopes its boiler technology will be there for commercial heating, hot water, and industrial steam boilers.

Hydrogen Technologies, a fully owned subsidiary of Jericho, has patented its method for burning hydrogen and oxygen in a vacuum chamber to create high-temperature water and steam with no greenhouse gases or other pollutants.

The only by-product is water, which is recycled. It’s meant to replace existing boilers that burn coal, natural gas, diesel, or fuel oil.

“Our system is more efficient than traditional steam systems,” Jericho Executive Officer Brian Williamson told Streetwise Reports. “They did a whole battery of tests on our system and validated that it is, in fact, 95% cost-efficient, which is . . . 20% plus more efficient than anything else that’s out there in the market in conventional fossil fuels. There’s also 100% hydrogen burn in the system, meaning that there’s no waste.”

The Catalyst

The test backs up Jericho’s own research on the technology, and the company hopes to use the data to attract investors and customers.

Hydrogen Technologies held a demo week at the end of September in Modesto, Calif., for possible commercial and industrial clients. The company said it was so successful it plans to hold another demo week November 14-18.

The U.S. Department of Energy said the hydrogen market “is in its infancy” but that it has the “potential for near-zero greenhouse gas emissions.”

“Hydrogen generates electrical power in a fuel cell, emitting only water vapor and warm air,” the agency wrote. “It holds promise for growth in both the stationary and transportation energy sectors.”

The element is abundant in our environment and the most abundant element in the universe. It’s stored in water, hydrocarbons (such as methane), and other organic matter.

As technical analyst Clive Maund wrote for Streetwise Reports, hydrogen “is a fuel of the future.”

‘Quite a Few’ Companies Interested

Last summer, Jericho announced it was joining with Australia’s LINE Hydrogen Pty Ltd. to bring the boilers to that country. The companies are creating a distribution “hub” that will allow a constant supply of hydrogen fuel.

Jericho said additional industrial partners will be announced in the coming months, and the first DCC™ boiler is expected to be installed in Tasmania, Australia, in 2023.

Williamson said Jericho has “quite a few” companies that have already expressed interest in the boiler system. Jericho said it will target everything from large industrial plants to schools and hopes to create other duplicate hubs in other places in the world, like the United States, Canada, and Europe.

Each boiler removes the equivalent carbon dioxide of 2,500 cars a year (or about 4,400 tons of carbon dioxide), according to the company.

Jericho was once an oil and gas business. It still has interests in those sectors and has been using money from rising fossil fuel prices to help fund its push toward hydrogen.

The company began transitioning to green energy in June 2020. In January 2021, it announced the acquisition of Hydrogen Technologies. Also, last year, it announced a collaboration with Rémy Cointreau’s Bruichladdich Distillery in Scotland to install a boiler to run its stills that produce Scotch and artisanal gin.

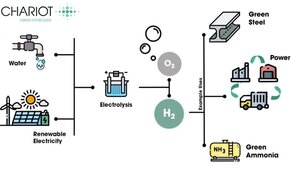

Other green investments include in H2U Technologies Inc., which is developing an electrocatalyst discovery process for electrolyzer and fuel cell applications, and Supercritical Solutions Ltd., which is developing a new class of water electrolyzer that will allow low-cost hydrogen production. Jericho led the seed series funding round for SuperCritical and was joined by Chris Sacca’s Lowercarbon Capital as a co-investor.

Ownership and Share Structure

Top shareholders include Michael L. Graves Inter Vivos Trust with 16.43% or 37.13 million shares, McKenna & Associates LLC with 10.78% or 24.36 million shares, the CEO Williamson with 0.87% or 1.97 million shares, company Director Allen Wilson with 0.87% or 1.97 million shares, and Nicholas W. Baxter with 0.5% or 1.14 million shares.

Jericho has a market cap of CA$81.38 million with 226 million shares outstanding, 158.3 million of them free-floating. It trades in a 52-week range of CA$0.84 and CA$0.31.

| Want to be the first to know about interesting Clean Energy, Technology, Alternative - Cleantech and Alternative Energy investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Jericho Energy Ventures. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures, a company mentioned in this article.