In early March, fresh off finding high-grade silver samples in new trenches at its La Tigra project, Sierra Madre Gold and Silver Ltd. (SM:TSX.V) added another drill rig to its flagship project, 100%-owned Tepic. Both projects are in Nayarit state, Mexico, 148 km apart.

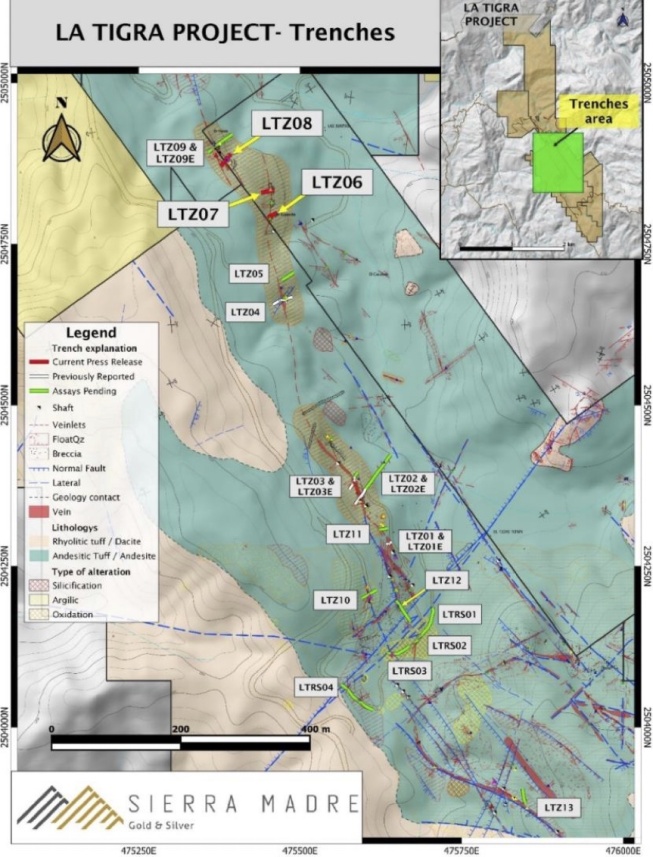

Trenching results on the El Camino, El Tigre, and El Verde structures at La Tigra, reported in early March and mid-February, returned 4.7 meters grading 5.58 grams per tonne gold (5.58 g/t Au), 6.6 meters grading 3.42 grams per tonne gold (3.42 g/t Au), and 4.5 meters grading 6.94 grams per tonne gold (6.94 g/t Au).

With La Tigra drill permits in hand as of late February, Sierra Madre is planning to transition from trenching to its Phase 1 drill program at its second acquisition once target testing at Tepic is complete.

Analyst Oliver O’Donnell covers Sierra Madre for VSA Capital in London. He believes it is only a matter of time before the company moves well beyond its CA$39-million market cap.

“The current (exploration) work programs are fully funded and should produce results soon,” O’Donnell told Streetwise. “In terms of valuation, (Sierra Madre) doesn't have a compliant resource yet, so we can't compare that relatively. But there are silver juniors without resources that have valuations in the hundreds of millions. It would only take a few drill holes to confirm the scale potential (of the district) and you could start to see that valuation move up very quickly.”

Access to Le Tigre to Crucial at Le Tigra

Beyond the trenches, the Sierra Madre exploration team now has access to the 100 and 200 levels of the past-producing El Tigre mine at La Tigra, which produced on both levels before it was mothballed during the Mexican Revolution (1910–20).

After mining by different groups following the revolution, reports from Servico Geológico Mexicano (Mexico’s equivalent of the U.S. Geological Survey) suggest that most recent mining at La Tigra took place between 1983 and 1991 by Compañia Minera Nayoro S.A.

Agency reports say the grade of material taken from the La Tigre mine averaged over 10 g/t Au and 300 g/t Ag.

Sierra Madre is using its access to the underground workings at the former La Tigre mine to create a three-dimensional model of the mineralized structures. The model will be used to identify targets for the first phase of drilling.

Meanwhile, the second core rig that arrived at the silver-gold Tepic project in March will focus on targets found during recent trenching. The rig is portable and — despite its small size — it has the same depth capacity and large core diameter that the company prefers.

In September, Sierra Madre published promising drill results from confirmation drilling (twinning previously drilled holes) at Tepic.

Hole TRC012 hit 15.2 meters grading 2.23 g/t Au and 263 g/t Ag or 419 g/t silver-equivalent (AgEq), while hole TRC013 returned 22.9 meters at 1.47 g/t Au and 119 g/t Ag or 222 g/t AgEq.

Once Sierra Madre is done at Tepic, the portable drill will be moved some 150 kilometers northwest to start drilling at La Tigra.

Sierra Does Deal With Grupo Mexico

Sierra Madre acquired La Tigra in July 2021 through an option agreement with Industrial Minera Mexico S.A. (IMMSA), a subsidiary of Mexican mining titan Grupo México (GMEXICOB:MXN).

The junior must pay $1.5 million over three years and submit an official resource estimate to complete the earn-in. Once Sierra Madre options the property, IMMSA will get a 2.5% royalty on net metals production.

If Sierra Madre outlines at least a 1-million-ounce resource, IMMSA has back-in rights to become Sierra’s joint-venture (JV) partner to put La Tigra into production. The JV would be 51% owned by IMMSA.

If IMMSA passes on forming a JV for La Tigra, Sierra Madre becomes the project’s sole owner, subject to the royalty. But the big news is that Grupo Mexico signed on with a junior exploration company.

“Grupo Mexico doesn't tend to partner with juniors. I think that speaks a lot to the experience of the (management) team,” O’Donnell said.

He added: “The other side of that is because it's a project that's been held by Grupo Mexico, it hasn't been worked previously. This isn't a story that the market has seen before. So this is the first time that this project is really getting focused attention from a single management team.”

The Spanish started mining near-surface veins in the Nayarit region in the 1540s.

Some artisanal miners once mined opal, a valuable gemstone, in surface pits near mountain tops. Their work exposed some mineralized structures that Sierra Madre geologists are seeing well below the peaks.

Sierra Madre has identified 10 linear km of mineralized silver veins, yet more than half of the area remains unexplored.

“The idea is to have several production centers feeding a central processing facility, kind of the ‘hub and spoke’ concept. Pretty confident that Tepic could be a major contribution to that idea,” Executive chairman and COO Gregory Liller said during a company presentation. “I have very high hopes for this project.”

Management Knows Mexico

Sierra Madre management is no stranger to Mexico.

In April 2019, along with Andrew Bowering, Liller and current Sierra Madre CEO Alex Langer rebranded ePower Metals into Prime Mining Corp. (PRYM:TSX.V) with the Los Reyes gold-silver project in Sinaloa state as its flagship asset.

Miners worked near-surface veins at Los Reyes in the 1700s, and it continued to produce gold and silver until the 1950s. Modern drilling began in the area in the 1990s, and geological consultant Tetra Tech completed a resource estimate on the project in 2013, well before it was rolled into Prime.

With Liller as director and COO and Langer as VP of capital markets, Prime set out to systematically explore, expand, and further de-risk Los Reyes. The plan was well executed. Prime went from CA$0.35 in mid-April 2019 to CA$3.79 in late March 2022 — a classic example of junior mining upside — in three years.

With Sierra Madre, Langer and Liller have reassembled key elements of the Prime Mining team and are making moves using the same playbook.

Tepic also has a resource estimate from 2013 at similar grades to Los Reyes.

Sierra Madre hired Luis Saenz as director of exploration and development. Saenz worked closely with Liller on the exploration and development of the Magistral mine, now part of McEwen Mining Inc.'s (MUX:TSX; MUX:NYSE ) El Gallo mine complex in Sinaloa state.

Saenz was also part of the team that developed and built both the open pit and underground mines at Ocampo, later bought by billionaire Carlos Slim’s Minera Frisco SAB de CV (formerly AuRico) for $750 million.

“The management team, and their systematic approach, has been shown to be very effective in demonstrating scale at these types of projects, and they're very good at identifying projects with potential and working them up to show there's far more mineralization across the project,” O’Donnell told Streetwise.

O’Donnell gives Sierra Madre a “speculative buy” recommendation.

Sierra Madre trades in a 52-week range of CA$0.39 and CA$1.07 with about 64 million shares outstanding. Institutions only own about 7.5%, while management and founders own 37.7%.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Sierra Madre Gold and Silver Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver Ltd., a company mentioned in this story.