Gold's upward direction is confirmed.

Bonds breaking 3-year downtrend.

Stock markets are heading higher globally.

What WWIII was that again?

Gold stocks are resilient and ready for the next move higher

Bonds

- 3-year downtrend broken

- Massive volume in reversal of downtrend

- EO13848 working

Gold

- Upward momentum re-attained

- Should move to US$2450 again

- AU$ gold above AU$3500 and heading to a new high

Gold Stocks

- XAU back above 145 symmetry box

- The selloff was sharp but is finished

- Next stop 165

ASX Gold Stocks

- Getting ready to break through its symmetry box

- Smaller golds recovering

Stock Markets

- US Indices higher

- DOW 30

- S&P 500

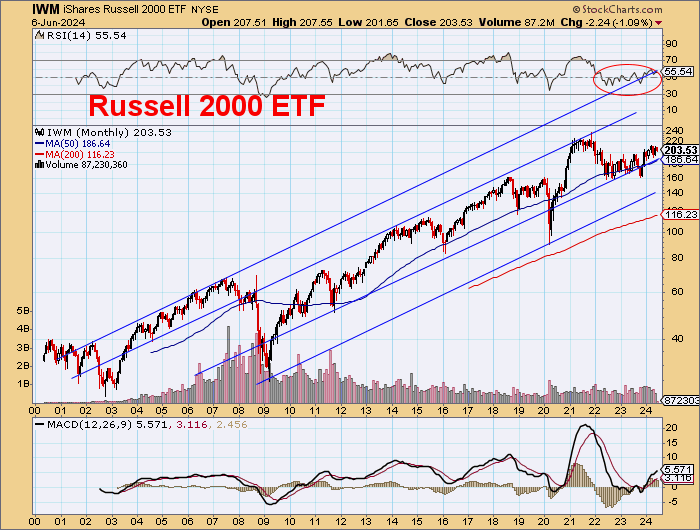

- Russel 2000

- S&P600 advance/decline ready to break out

- European stocks heading parabolic

- Germany

- France

- Italy

- Clearly, I am not worried about a WWIII

The U.S. treasury bond market is the largest single market outside of the currencies and it determines the risk free rate for interest rates.

Bond prices peaked in a mania in 2020 over COVID-19 but then proceeded to fall by 50% in one of the greatest market disasters in bonds ever experienced.

The T-bond market determines all interest rates and, from there, the price of all assets.

The background of government spending, deficits, and inflation increases risks in the bond market for increasing supply of bonds and declining real returns.

A reasonable person would expect that with the current level of debt in the world and continuing budget deficits that the supply of bonds would overwhelm the demand and that bond prices would fall and yields would rise.

In a normal market, but these are not normal times.

The decline in bonds was expected after the irrational exuberance in 2020, and the decline broke 30 and 40-year uptrends in bond prices.

What we're seeing now is a reaction to that four year bear market in bonds and the downtrend of the last three years has now been broken. We can expect a big bond rally now but whether it's simply a bear market rally or fundamental change in trend is yet to be resolved.

The net effect of course is that lower interest rates mean higher stock prices and along with the growth in money supply that has been presented here recently the expectation would be that economic activity will pick up and commodity prices will rise.

That should be good for gold. Or not.

Gold seems to be on its own track and it's all that reappraisal and re-evaluation and now we're getting the revaluation. Gold seems to have renewed its upward momentum and it seems it should soon test US$2450 for the third time.

We then should see that very strong move much higher.

That is what the markets are telling us, and so we must heed them!

Look first at bonds.

3-year downtrend is broken.

The bigger picture suggests a big rally to about 115 (+~20% rise).

Gold

Gold seems to be sensing this.

Resumption of upward momentum.

The short term is always cloudy, but the bigger picture is very clear.

Gold Stocks

Gold stocks are back above 145 — 165 quite soon.

Short-term sell-off ignored.

Strength recovered.

Look at Newmont Corp. (NEM:NYSE).

Northern Star Resources Ltd. (NST:ASX) is a global leader.

This one is a leader for Tolu Minerals Ltd. (TOK :ASX).

Small resource stocks are a go!

Gold in AU$

Slow parabola but heading soon for new highs.

Stocks

The U.S. is looking strong.

Small stocks heading higher.

This suggests a strong move higher by small stocks.

European Stocks

As with North Korea and Taiwan war threats, the locals don't seem too concerned.

AU$

The AU$ is looking strong versus US$.

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.