Yesterday morning, there was a raft of economic data, including retail sales, producer prices, and initial jobless claims, causing the USD index to move higher along with bond yields and stock futures.

The PPI came in "hot" and retail sales were slightly lower than expected, but the revisions were all over the place, making the government data completely irrelevant as a forecasting tool.

What was surprising was that stocks were rallying. Even the CNBC commentators are aghast that stocks are called higher despite data that will certainly not prompt the Fed to move to lower rates any time soon.

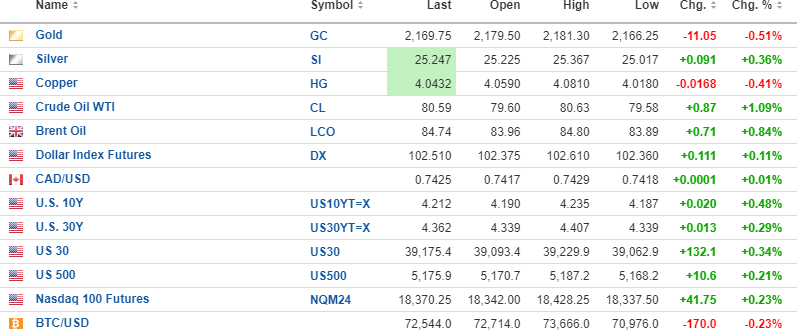

The good news is that both silver and the miners held their gains yesterday morning, and despite the pullback in gold (from overbought conditions and completely normal), it bodes well for the entire metals complex when silver outperforms gold, and the HUI outperforms them both.

The action in silver is nothing unusual, and as I have repeated for over a year, the only way I even glance at silver is after a two-day close above $26.50/ounce, and even then, I will expect only a $3.50 move to test $30.

However, if I get a two-day close above $30, I will go "ALL-IN" with an expectation for sharply higher prices.

That said, I do not believe that silver exceeds $30 until gold gets through $2,300, which implies a plunge in the gold-to-silver ratio (GSR) to 76-77, now at 86.69. If you look back to the March-August post-Covid-Crash period of 2020, the GSR spiked to over 125 before settling down to under 70 by the summer.

Silver was a doggy performer during a massive upthrust in all risk assets, especially the "hard" ones. That is the reason that I am staying with copper and gold until silver proves its mettle and shows me a settlement price above $30, which has been the ceiling since the "#SilverSqueeze" kiddies tried to break the bullion banks with disastrous results.

Silver is acting well, as are the miners, with homage to one of my favorite companies — Freeport-McMoRan Inc. (FCX:NYSE) — which hit a new rally high yesterday and has $50 written all over it. This publication tends to focus on the highly leveraged junior explorers and developers, but the last two big names I have picked have worked nicely.

One subscriber actually suggested I pay closer attention to the bigger, more liquid names, and I must confess that the thought had crossed my mind more than a few times.

Cameco Corp. (CCO:TSX; CCJ:NYSE) was a $38 stock in October when they reported earnings, prompting me to buy it and ride it all the way to early January, where I exited perfectly above $51 (25% gain in three months) amidst all of the pompom-waving and cymbal- crashing of the legions of fuzzy-cheeked "Uraniumites."

I think that FCX will be an even better trade and that the move this week is merely the sound of the starter's pistol sending the runners off. I am going to add to FCX next week.

The chart on the next page is about as perfect as one can get for a breakout move. That big green candle taking out the December highs and now challenging the $46.30 top of January 2023 is setting up a continuation move to all-time highs before the summer arrives, especially if copper can get through the March 2022 peak around $4.95/lb.

FCX has the unbeatable combo of large generational assets in both copper and gold, which positions it perfectly for the structural deficit in copper supplies expected in 2024 and the multi-year break-out in gold prices. It is an ideal holding for believers in the "Electrification Movement" as well as for those who believe that a 70's-style Stagflation is about to grip the world economies.

Either outcome takes FCX to all-time highs, so for conservative investors and subscribers, it is an ideal holding, especially for RRSP or 401K accounts.

| Want to be the first to know about interesting Critical Metals, Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMo Ran Inc.. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.