Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced that through low-cost staking it has acquired new prospective uranium exploration claims in northern Saskatchewan, adding an additional 64,267 hectares to its Athabasca Basin holdings.

The company now has ownership interest in 587,364 hectares (over 1.45 million acres) across 29 projects in and around the Basin, which Skyharbour said in a release is host to the "highest-grade uranium deposits in the world."

Red Cloud Securities analyst David Talbot, in a research note earlier this month, predicted increased uranium prices as the nuclear power industry benefits from "proactive government policies, public acceptance, better economics, climate change impacts, and security of supply."

"We are starting to see the much-needed uranium price incentive, leading to exploration and mining projects being taken off the shelf, new exploration companies are emerging, and equity investment into uranium stocks continues at a torrid pace," wrote Talbot, who noted Skyharbour is one of Red Cloud's top picks in the space.

Red Cloud currently has a Buy rating on the stock, with a CA$0.65 per share target price.

The Catalyst: Five New Claims, Re-staked Claims

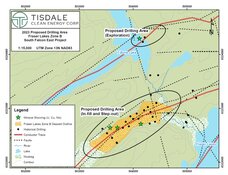

Skyharbour's new 100%-owned claims are located in Wollaston Domain, just outside of the Athabasca sandstone, the company said. The claims are underlain by prospective Wollaston Supergroup metasedimentary gneisses, including lower Wollaston pelitic gneisses.

The new properties include:

- Bend Project: Two mineral claims covering 9,114 hectares.

- Compulsion Project: Two mineral claims covering 10,451 hectares.

- Genie Project: Five mineral claims covering 16,930 hectares.

- Hartle Project: Ten mineral claims covering 52,518 hectares.

- Regambal Project: Five mineral claims covering 24,208 hectares.

Several other claims were re-staked during competitive staking rushes in the Usam and Riou River areas, Skyharbour noted. The newly re-staked Usam project consists of 40,041 hectares over 12 claims, covering a large portion of prospective Wollaston Supergroup metasedimentary gneisses northeast of Cameco Corp.'s (CCO:TSX; CCJ:NYSE) Rabbit Lake Operation.

Riou River now consists of 8,620 hectares over six claims in the north-central portion of the Athabasca Basin and is underlain by Athabasca Supergroup sandstone and conglomerate.

Three new claims non-contiguous with the original claim were added at the company's Highway project, adding 8,155 hectares to the project and increasing its size to 9,339 hectares. These new claims are also located in close proximity to Highway 905.

'The World Needs Nuclear Power'

Uranium is in demand as countries around the world attempt to step up their nuclear power production in the shift away from fossil fuels.

On February 7, 2024, Katusa Research highlighted uranium's rise to US$106 per pound, calling the mineral "the poster child for dramatic market shifts." According to Business Insights, the price was US$95 per pound on Tuesday.

Red Cloud currently has a Buy rating on the stock, with a CA$0.65 per share target price.

"The world needs nuclear power, yet it hasn't invested enough in uranium; there are supply shortages, and these are made even worse by the fact that the world's largest producer, Kazakhstan, surrounded by Russia, is struggling to get its production to market," Dominic Frisby of The Flying Frisby wrote.

According to the report, Kazatomprom and Cameco have both struggled to meet production goals, setting the world up for a uranium shortage.

Drilling Underway at Flagship Projects

Earlier in February, Skyharbour announced it had started its winter drill program on its flagship projects, the Russell Lake and Moore uranium projects, also in the Athabasca Basin.

The company is drilling 18 to 22 holes for a total of 8,000 meters, 5,000 meters of that at Russell Lake, which is intended to focus on the Fork, Grayling East, and M-Zone Extension zones.

Technical Analyst Clive Maund reviewed the uranium market on January 17, 2024, and rated Skyharbour positively.

A total of 3,000 meters of drilling is planned on the Moore project to expand the high-grade Maverick zone and test targets on the Grid Nineteen area.

Technical Analyst Clive Maund reviewed the uranium market on January 17, 2024, and rated Skyharbour positively. Maund said the stock, "which we bought again at correction lows about a week ago, have since taken off strongly higher. No action is required on our part."

Siddharth Rajeev with Fundamental Research Corp. rated the company as a "Buy" with a target share price of CA$0.97, citing several factors in his assessment of the company, including upcoming drilling and a highly favorable market.

Ownership and Share Structure

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

The company said management and insiders own approximately 2.5% of the company. According to Reuters, President and CEO Jordan P. Trimble owns 1.54% of the company with 2.79 million shares, Director David Daniel Cates owns 0.70% of the company with 1.27 million shares, and Chairman of the Board James Gaydon Pettit owns 0.23% of the company with 0.42 million shares.

Skyharbour said institutional, corporate, and strategic investors own approximately 55% of the company, as Alps Advisors, Inc., owns 8.28% of the company with 14.99 million shares, Mirae Asset Global Investments (U.S.A) L.L.C. owns 4.83% of the company with 8.76 million shares, Sprott Asset Management L.P. owns 2.74% of the company with 4.96 million shares, M.M.C.A.P. Asset Management owns 2.02% of the company with 3.66 million shares, Incrementum AG owns 1.30% of the company with 2.36 million shares, Vident Investment Advisory, L.L.C. owns 0.34% of the company with 0.61 million shares, and DWS Investment GmbH owns 0.33% of the company with 0.60 million shares.

According to Reuters, there are 181.16 million shares outstanding with 176.36 million free float traded shares, while the company has a market cap of CA$83.3 million and trades in the 52-week period between CA$0.32 and CA$0.64.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd. and Cameco Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.