After a boom and bust cycle — with Fobi AI Inc.'s (FOBI:TSX) stock, not the company — it is tempting to think that because the stock price is back very near to its 2020 lows, Fobi AI has made no progress toward its objectives, yet nothing could be further from the truth. It's true that the number of shares in issue has expanded greatly to the current 176.6 million, which partly explains the current low stock price, but only a small proportion of this has been due to stock dilution — most of these new shares have been issued in relation to important strategic acquisitions by the company, examples being the Spanish digital wallet agency Wallett-Com last Fall and Passworks S. A. about a year ago.

Fobi AI Inc.'s presence in the rapidly expanding digital wallet arena has grown to the point that it is number three behind Apple at number one and Google at number two in terms of the number of wallets it has developed, but you certainly wouldn't think so to look at its stock price and, like it or not, these wallets look set to be the future and to be introduced rapidly.

The importance of mobile wallets going forward can be easily gauged from the following stats lifted from the company's investor deck: - $15 trillion in revenue is projected to be generated from AI technology by 2030, 40% increase in business efficiency can be generated through AI, four out of five companies deem AI to be a top priority in business strategy, 5.2 billion mobile wallet passes are projected to be in use by 2026, 85% of wallet passes are never deleted (71% of apps are) and four out of five customers abandon transactions requiring apps.

So it is clear that, even if the market does not grow to the extent that these projections indicate, this is still a huge growth market, and with Fobi at number three, it is in a position to grab a huge slice of the pie.

So it is clear that, even if the market does not grow to the extent that these projections indicate, this is still a huge growth market, and with Fobi at number three, it is in a position to grab a huge slice of the pie.

So why has the stock fallen so much over the past couple of years?

Capital markets reasons, which we will not waste time going into here, beyond mentioning again the acquisitions that have put the company in such an enviable position, which clearly investors fail to appreciate — but they will increasingly move forward.

There have also been other important deals, such as the signing of a 5-year $10 million licensing agreement with Canadian beverage manufacturing company BevWorks Brands Inc.

The company's key customers and partners include. . .

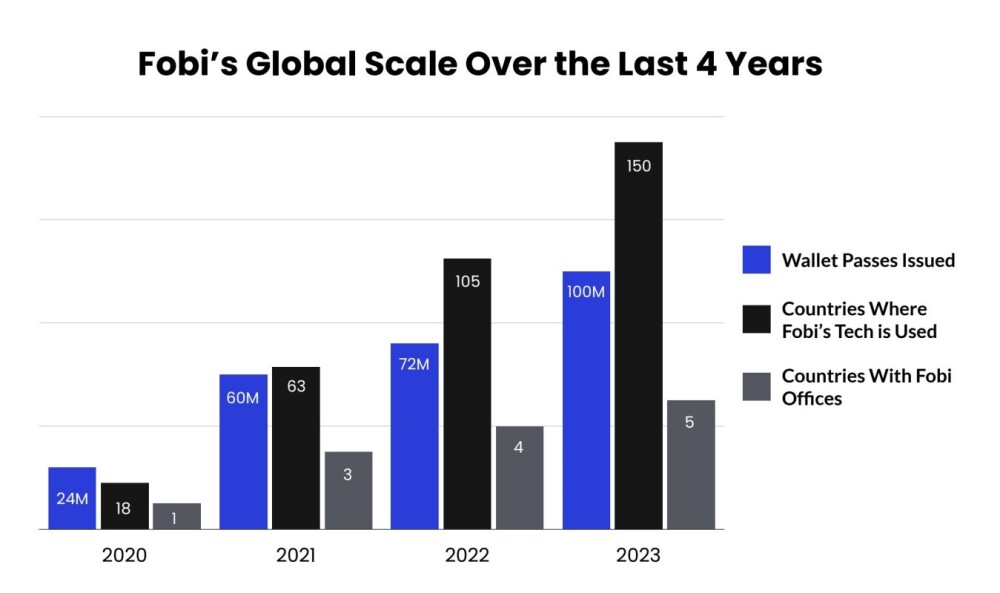

The following graphic shows Fobi's growing presence in the market over the past four years.

With respect to the 183.6 million shares in issue, it is crucial to understand that of these, about 70% are owned by management and a group of high net worth investors, with the CEO, who has an impressive track record and following, owning approximately 31 million shares.

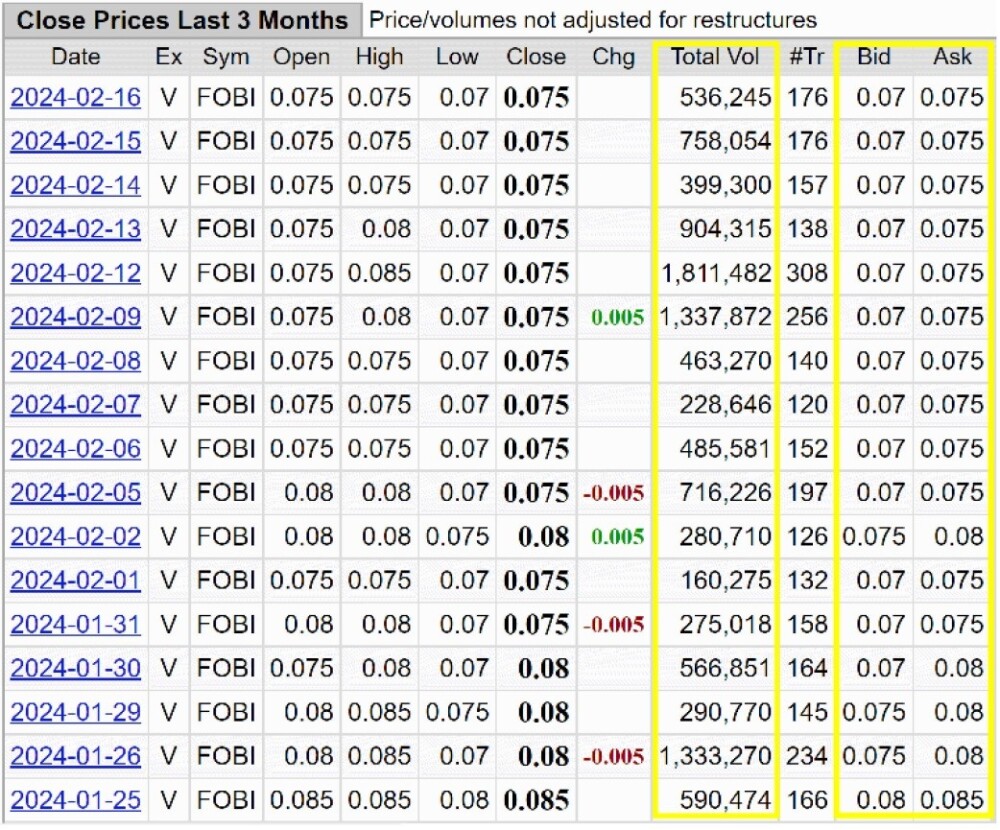

So there is a relatively small float, which is however highly liquid, as evidenced by the following graphic showing trading volume over a range of days and the (narrow) bid-ask spread.

Now, we will proceed to examine a range of charts for the stock that together provide a complete picture of where it's been, where it's at, where it's believed to be headed, and why.

We will start with the 5-year arithmetic chart showing that the stock has already been through a complete lifecycle. It started with a Stage 1 base in 2019 – 2020 that took the form of a large Bowl or Cup pattern. This led to a breakout into a powerful and dramatic Stage 2 bull market that ended with a wild spike top in September of 2021, after which the stock cratered in a Stage 3 bear market that has continued right up to the present.

It is also worth us taking a look at the 5-year log chart, which "opens out" recent action so that we can see more clearly what has been going on. The way that log charts are valuable to investors is illustrated by the fact that if you buy the stock at, say, 60 cents and it drops to 30 cents, you have lost half your money; if you buy it at 30 cents and it drops to 15 cents you have also lost half your money and these measured distances are the same on the log chart.

There are important fundamental and technical factors in play that suggest that it will probably not drop any further and instead will start higher from here, a persuasive fundamental factor being that the company is understood to be about to do a financing at 7 cents, i.e., at the price it is at now, which is oversubscribed.

Note that, although the downtrend channel is drawn as parallel, it could be converging so that the lower rail of the channel is less steep than shown, in which case the price could be at it already and therefore ready to start higher, this setup thus presenting a compelling buying opportunity. Strong fundamental and technical factors suggest a potential upward trend from this point.

A key fundamental driver is the current financing at 7 cents, aligning with the current price and signaling a positive outlook for the company's growth. For financing details, see slide 15 in the company's investor deck.

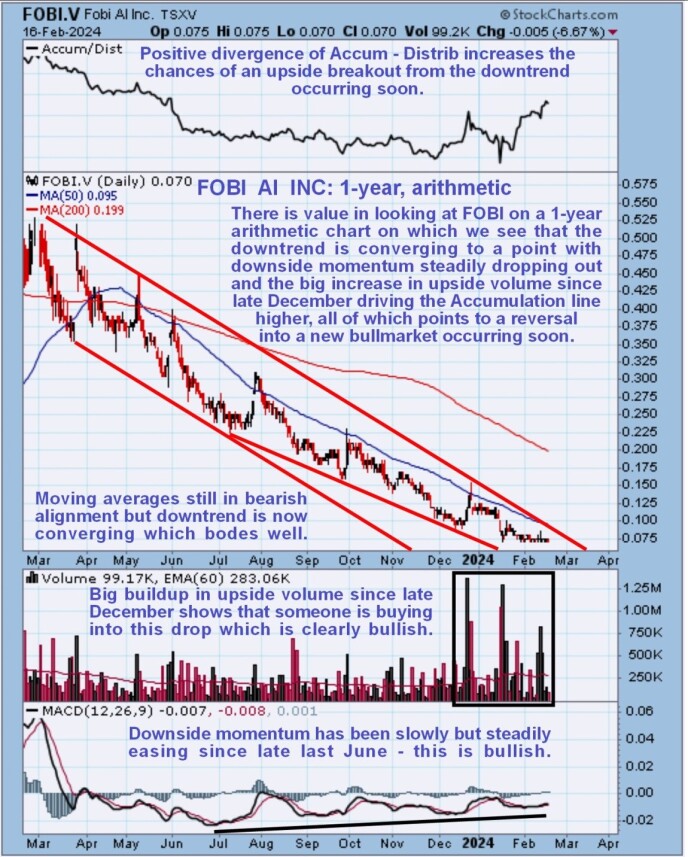

It is, therefore, most interesting to observe on the 1-year arithmetic chart that various positive technical factors have been in play for many weeks, suggesting that a breakout into a new bullmarket is incubating and, furthermore, that it is likely to happen soon. The first of these is that the downtrend has been converging since July, which means that it has morphed into a bullish Falling Wedge.

The second bullish factor has been the easing of downside momentum during this period, as shown by the MACD indicator trending higher. The third bullish factor is the marked buildup in upside volume since late December — clearly, the buyers are on to something brighter than the sellers, who, for the most part, are selling at a heavy loss. This quite aggressive and persistent buying has been draining off supply at these levels at quite a rapid rate, setting the stage for an upside breakout soon.

Lastly, the tilt towards more and more upside volume has driven the Accumulation line higher in recent weeks. These factors together make a strong case for an upside breakout soon, especially given the aforementioned oversubscribed financing at 7 cents.

There is an additional positive development that we can observe much more clearly on a 6-month log chart, which is that someone or something appears to have been buying all the stock that has become available at the 7-cent level for a month now hence the clear line of support that we can see at this level on the chart and there was persistent strong buying at this level last week.

We have seen the stock tracking sideways for weeks at the current financing level, which historically acts as a springboard.

The conclusion is that, whilst we are aware that technically, the downtrend in Fobi remains in force, there is a battery of technical evidence suggesting that it has run its course and that a reversal to the upside is imminent, even if we see a brief "head fake" breach of the support at 7 cents first.

The upside for this stock is viewed as MASSIVE, especially in percentage terms and especially given that the fundamental outlook for both the AI sector, generally, and FOBI, in particular, is way better than before FOBI did its earlier massive double spike in 2020 and 2021.

It is, therefore, rated a Strong Buy for all timeframes.

Fobi AI Inc. closed at CA$0.07, $0.053 on February 16, 2024. The stock currently trades in rather light but acceptable volumes on the US OTC market, where volumes should improve once the expected uptrend takes hold.

| Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fobi AI Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.