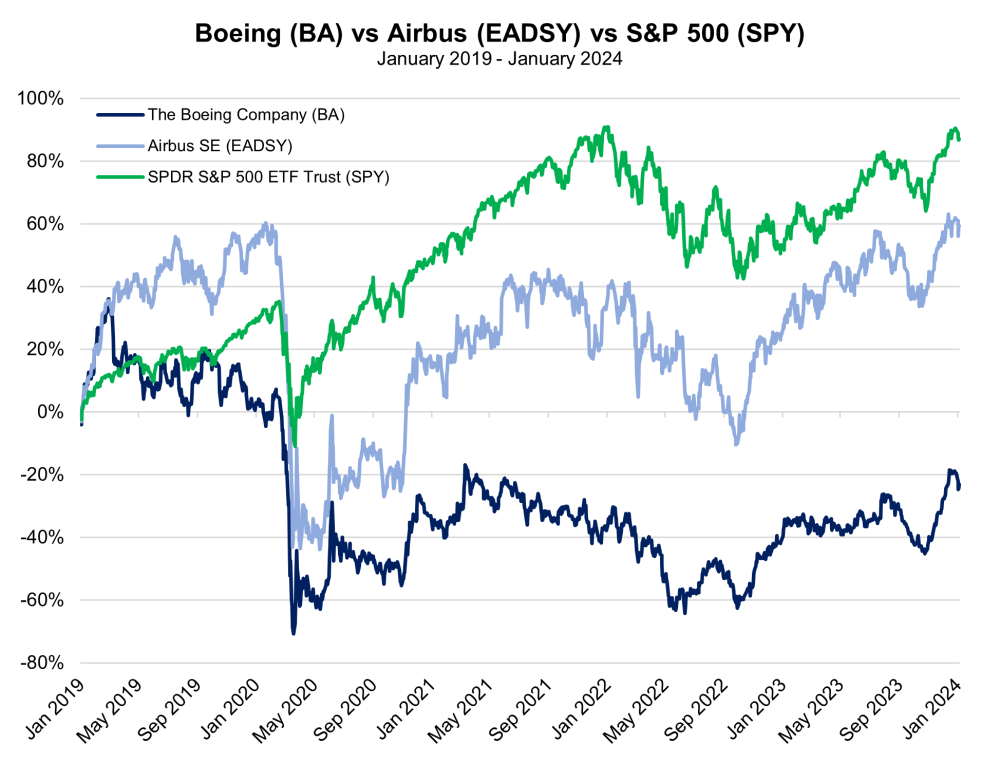

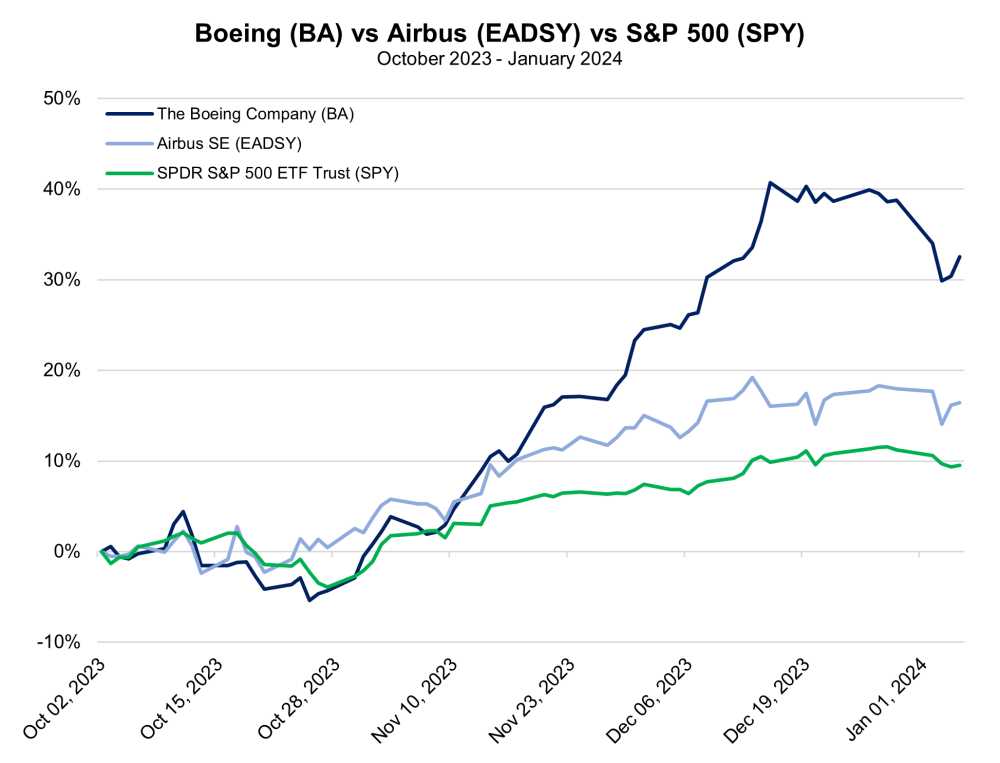

Prior to last Friday, Boeing Co (BA:NYSE) appeared ready to start the new year on steady footing, building on a wave of momentum it had built up throughout a relatively successful Q4 2023. Deliveries for the month of November reached a five-month high and put the American aviation giant on track to reach full-year targets related to its 737 and 787 jets. Though Boeing’s tally of new orders will certainly lag European rival Airbus SE's (EADSY:US-OTC) pace for a fifth straight year, with the former trailing by roughly 800 aircraft through the first 11 months of the year reported, 2023 will still be the best annual period for Boeing’s order book since 2014. All of this helped Boeing shares surge by 39% throughout the fourth quarter.

However, Boeing’s recent run has collided with another round of safety and production issues, following the mid-air blowout of a panel aboard Alaska Airlines Flight 1282 on January 5. A door plug, meant to seal unused exits on certain flight configurations where they’re not in use, apparently fell off of the 737 MAX 9 jet, leaving a gaping hole in the plane’s fuselage. Reuters notes that the specific MAX 9 in question entered service just eight weeks ago. Though no passengers or crew were injured in the malfunction and the Alaska Airlines flight landed safely, Boeing’s stock price sunk by more than 8% at the start of trading this morning.

The Federal Aviation Administration (FAA) has grounded 171 of the 215 MAX 9 jets currently in service until inspections can be done to assess their airworthiness. With such inspections taking four to eight hours per aircraft, that could mean as many as 1,368 hours of flight time could be impacted before the MAX 9 jets can return to US air space. For Alaska Airlines, which operates a fleet of 65 MAX 9s, the grounding meant a fifth of all the carrier's flights were cancelled on Monday. United Airlines is the world’s leading operator of MAX 9s, with 79 in service, and was forced to cancel 7% of all planned departures on Monday, according to data from FlightAware.

Though the door plugs are manufactured by key Boeing supplier Spirit AeroSystems, both companies could share the blame for the mid-flight failure of the component. Though Spirit builds fuselages for 737s with the extra door assembly "semi-rigged," Reuters sources have indicated that Boeing completes the installation of door plugs and is supposed to conduct testing under pressurization to ensure all pieces of the plane are properly fastened. Though Spirit could potentially be vindicated if it is uncovered that Boeing did not properly undertake the installation of the door plug, a manufacturing issue at Spirit would likely still implicate Boeing since it is responsible for testing the safety of the fuselage and its components.

Despite its growing backlog, which MRP highlighted in depth last October, the largest portion of Boeing’s order book is comprised of its 737 NG/MAX narrowbody jets. Though the MAX is still the company’s top-selling jet and likely to be define Boeing’s product line for many years to come, virtually all of the company’s underperformance since 2019 can be chalked up to issues they’ve had with the design and manufacturing of the MAX model, compounded by negligence and lacking oversight by executives. Over the course of several years, MRP has covered the fallout from two disastrous 2019 crashes of Boeing 737 MAX jets within a 5-month span, culminating in the death of all 346 passengers and airline crew on board each flight. We were quick to recognize the severity of this situation, despite Boeing’s attempts to downplay their planes’ issues.

At the outset of a global grounding of all 737 MAX jets, Boeing led investors and airlines to believe that a fix of the faulty MCAS software present in the jet, along with re-certification would come as soon as mid-May 2019. When no progress on re-certification was present by that June, MRP expressed skepticism about the simplicity of the repairs that would be needed, noting that, in addition to software problems, almost 150 parts inside the wings of 312 Boeing 737 jets were potentially defective and had to be replaced. On June 4, 2019, we initiated SHORT Aviation and Airlines themes (closed on January 8, 2020 and March 30, 2020, respectively), largely focused on Boeing and the fallout that would be felt by suppliers and commercial airline operators. It would take 20 months before the 737 MAX could be re-certified in the US on November 2020. Total direct costs to Boeing as a result of the MAX disasters were equivalent to more than $20 billion. As of last Friday’s close, the aviation manufacturer’s share price remained more than -27% below its price at the start of June 2019. That gap will likely grow when trading concludes on Monday evening.

Though Boeing was able to escape more severe SEC scrutiny related to the 737 MAX debacle by paying a $200 million fine to settle civil charges claiming that it misled investors, along with a $2.5 billion Justice Department agreement that saved company executives from prosecution, the company has had to reckon with a myriad of other scandals and aircraft malfunctions — some of which were related to other jet models, including the 787 Dreamliner.

Though Jeffries reports that the 737 MAX 9 represents just 2% of Boeing’s MAX backlog of 4,500, which is composed of several variants, the malfunction of yet another aircraft component will further damage Boeing’s already faded reputation among investors and raise further alarm among regulators. Just last week, Boeing had asked the FAA for an exemption from key safety standards on its 737 MAX 7 — a currently uncertified model of the MAX family. Customers like Southwest Airlines expected the MAX 7 to be given the green light by April, but that timetable will be thrown into question without the requested exemption, which may now be thrown further into question following this latest debacle.

Boeing’s request stems from a pre-existing defect in the MAX’s jet’s engine anti-ice system, which many jets are already flying with. The Seattle Times notes that the system is liable to overheat and damage the nacelle at the front of the plane. This could eventually cause a breakup of the nacelle, sending debris through the fuselage, as well as toward the wings or tail of the aircraft.

Even with an exemption, the system would need to be overhauled to address the vulnerability by 2026 and then retrofitted to all MAX jets in service at that time. Boeing hopes that the required fix can be developed while the MAX 7 begins service, considering other MAX variants using the anti-ice system have continued to carry flights without interruption. This issue is unrelated to the door bolt flaw that played out last week, but consistent episodes of Boeing jet malfunctions have continued to raise broader questions about what is happening within company management, procurement, safety testing, and production.

Charts

| Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.