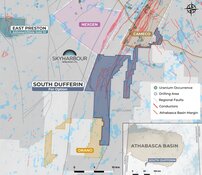

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) has added seven new prospective uranium exploration claims located in Northern Saskatchewan to its portfolio. The company's total land package has expanded to 518,302 hectares across 24 projects. The new claims are 100% owned and make up 13,945 hectares in and around the Athabasca basin.

The company remains focused on its Russell Lake and Moore projects, with the newly acquired claims becoming a part of Skyharbour's prospect generator business as the company will seek strategic partners to advance these assets.

The claims added to Skyharbour's portfolio are the CBX project, which includes an additional five new contiguous claims totaling 6,804 ha linking the company's former CBX and Snow projects, the Karin project, which includes one additional claim totaling 5,882 ha, and the 914W project, which includes a new claim totaling 1,260 ha.

Jordan Trimble, President and CEO of Skyharbour, remarked that " We continue to add to our dominant uranium project portfolio in the Athabasca basin with this recent staking while advancing our core projects through ongoing drilling and exploration. These new mineral claims bolster existing properties and provide additional ground to option or joint venture out to new partner companies as a part of our prospect generator business."

A Bullish Market

The G-7 summit earlier this year led to member nations pledging to take steps to mitigate Russia's dominance of the nuclear fuel market. The effort to dislodge Russia from global supply chains will necessitate increased supplies from elsewhere.

The technical analyst Clive Maund commented, that Skyharbour "looks like it is shaping up for an advance" Maund rates Skyharbour as a good Buy for investors.

According to Richard Mills of Ahead of the Herd, the market for uranium is bullish: "Uranium has found itself in a solid upward trajectory after years of downtrend following the 2011 Fukushima nuclear disaster. Governments are continuing to recognize nuclear power as a crucial solution for decarbonizing the economy, which will further tighten the uranium market that is already undersupplied."

Analysts have maintained a bullish market for uranium. According to analysts with Bank of America, "After a decade of underinvestment, a shortage is visible; our strategists forecast 20-40% upside. Global demand is also rising, with 60 new reactors being built & 100 more approved. Resource nationalism, energy security, war, and inflation echo the nuclear build-out of the 1970s/80s."

Catalyst: Advancing Project and Continued Drilling

The technical analyst Clive Maund commented on the recent updates at Skyharbour: "Although Skyharbour didn't move much on the positive news out of the company yesterday that it had acquired by staking seven new prospective uranium exploration claims in Saskatchewan, it still looks like it is shaping up for an advance" Maund rates Skyharbour as a good Buy for investors.

Skyharbour is currently completing a 10,000-meter drill program at the Russell Lake Project, with assays pending from the first initial phases. The Company is already planning for an additional exploration program to commence later this year at the project, adding to the news flow over the next few months. Skyharbour is also planning for an NI 43-101 Mineral Resource Estimate at the 100% owned Moore Lake Project before year-end, along with several of its partners to be carrying out exploration and drill programs at their secondary assets as part of their growing prospect generator business.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Management and insiders own 2.31% of the company.

President and CEO Jordan Trimble owns 1.73% of the company with 2.78 million shares, and director David Cates owns 0.77% of the company with 1.25 million shares.

The following institutions own 20.51% of the company. Alps Advisors, Inc., owns 5.74% of the company with 9.28 million shares, Mirae Asset Global Investments (USA) LLC owns 4.63% with 7.48 million shares, Sprott Asset Management LP owns 3.07% with 4.96 million shares, Exchange Traded Concepts, LLC owns 2.62% with 4.24 million shares, MMCAP Asset Management owns 2.26% with 3.66 million shares, Incrementum AG owns 1.44% with 2.32 million shares, Vident Investment Advisory, LLC owns 0.38% with 0.61 million shares, and DWS Investment GmbH owns 0.37% with 0.60 million shares.

Skyharbour has two strategic investors, with Denison Mines owning 11.5 million shares and Rio Tinto owning 3.6 million shares.

The company has approximately CA$4 million in the bank with a burn rate of about CA$125k.

There are 161.59 million shares outstanding, with 157.13 free-float traded shares. The company has a market cap of CA$56 million. It trades in the 52-week period between CA$0.32 and CA$0.56.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.