Streetwise Articles

Three Mega Forces of the Energy Trade

Source: Kevin Cook, Zacks Investment Research (9/27/12)

"There are very few sure things in markets and investing. So I don't say this lightly: The price of a barrel of crude oil will average over $125/bbl this decade."

More >

What is Energy Efficiency Doing to Power Demand?

Source: Kathy Larsen, Platts (9/27/12)

"Macquarie Equities Research said in a client note several days ago that energy efficiency measures really do seem to be having an impact on electricity demand, and the effect is likely to continue."

More >

Can Stem Cells Regenerate Your Portfolio? Stephen Dunn Says Yes

Source: George S. Mack of The Life Sciences Report (9/27/12)

Once the subject of intense political debate, stem cell therapies may soon be a therapeutic mainstay of healthcare. In this exclusive interview with The Life Sciences Report, LifeTech Capital's President and Senior Managing Director of Research Stephen Dunn explores the history of stem cell therapy and discusses companies that are reviving this "old" technique for profit.

More >

The Case of the Missing 200 Million Barrels of Oil: Marshall Adkins

Source: George S. Mack of The Energy Report (9/27/12)

Supply threats in the Middle East have governments around the world hoarding oil, largely in secret. But it didn't get past Raymond James Director for Energy Research Marshall Adkins, who noticed the 200 million-barrel discrepancy between what was pumped and reported global oil reserves. Where did the missing oil go, and why don't prices reflect this substantial surplus? More importantly, what happens once the reality of an oversupply sets in?—A tough six months, Adkins expects. Read on to find out where you can hide when prices plummet.

More >

South African Mine Strikes to Have Limited Impact on Gold Prices

Source: Kitco News, Alex LĂ©tourneau (9/27/12)

"Gold prices are likely to receive only limited support from the labor unrest in South Africa, as the yellow metal's price is being underpinned by other factors, metals analysts said Thursday."

More >

Silk-Based Electronics Dissolve on Cue for Vanishing Medical Implants

Source: Scientific American, Katherine Harmon (9/27/12)

"A flexible device that is just nanometers thick can fight post-surgical infections or even capture images—until its work is done, when it vanishes."

More >

Steve Cochrane Finds Value in Far-Flung Locales

Source: Brian Sylvester of The Gold Report (9/26/12)

There's a point in a country's emergence where the perceived risk by investors doesn't correspond with the real risk, says Steve Cochrane, an investment adviser with Macquarie Private Wealth Inc. When that divergence occurs, it's the best opportunity to invest. Cochrane sees such a divergence right now in Cambodia, a land with vast untapped resources. In this exclusive interview with The Gold Report, he talks about how investors can profit from Cambodia's entrance onto the world economic stage, as well as promising companies in far-flung locales.

More >

Gold Will Break Previous High in Near Term: Brien Lundin

Source: JT Long and Brian Sylvester of The Gold Report (9/26/12)

Brien Lundin expects money printing by the Federal Reserve to raise gold above its $1,920/oz high, and as editor and publisher of Gold Newsletter, he considers it his job to show people how to profit. In this exclusive Gold Report interview, Lundin explains why he believes it is time to be aggressive in equity positions and names companies that could benefit the most from the coming leg up.

More >

Silver Prices: Much More to This Rise Than a QE3 Rally

Source: Deborah Baratz, Money Morning (9/26/12)

"Here's why the silver bull party is still going strong. . ."

More >

How Gold Has Measured Currency Performance Since 1971, When It Became a 'Barbarous Relic'

Source: Julian Phillips, Gold Forecaster (9/26/12)

"Currency market changes leave room for gold and silver to act as that measure of value, as currencies fall against them."

More >

Advice from Bank Analysts: Buy the Dips in Gold and Silver

Source: Adrian Ash, BullionVault (9/26/12)

"Gold dipped beneath $1,760/oz for the third time this week in London on Wednesday morning, gaining against the euro and sterling as those currencies fell faster and rising back towards last week's new all-time high versus the Swiss franc."

More >

Can Shale Oil & Gas Bring the US Energy Independence?

Source: Keith Schaefer, Oil & Gas Investments Bulletin (9/26/12)

"The short answer is no, says Credit Suiss."

More >

Unfreezing Arctic Oil

Source: Breaking News, Christopher Swann (9/26/12)

"Don't write off the Arctic as a boon for oil companies just yet."

More >

Orbite to Milk Fly Ash for Rare Earth

Source: Kip Keen, Mineweb (9/26/12)

"Orbite Aluminae takes aim at fly ash with a process that can extract aluminum and rare earths from atypical sources--economically."

More >

China Crackdown to Support Rare Earths Prices

Source: Reuters, Eric Onstad (9/26/12)

"A crackdown on small, inefficient rare earth producers in China is likely to further restrict supply from the world's biggest producer of the minerals and support weak prices."

More >

The Great Graphite Supply Shakeup: Simon Moores

Source: Alec Gimurtu of The Critical Metals Report (9/25/12)

Investors who remember the lithium boom (and bust) a few years ago may be twice shy to enter a space with big upside potential tied to electric vehicles. But the parallels between graphite and lithium are superficial, insists Simon Moores, analyst with Industrial Minerals. Graphite, unlike lithium, supplies layers of demand, with reliable end-users in the steel industry. Meanwhile, China's production lull is making way for market entrants. In this exclusive interview with The Critical Metals Report, Moores profiles graphite miners around the world competing for the market's attention.

More >

Cutting-Edge Technologies Will 'Green' Fracking: Keith Schaefer

Source: Peter Byrne of The Energy Report (9/25/12)

Fracking in the U.S. is here to stay, affirms Keith Schaefer, editor of the Oil & Gas Investments Bulletin. North American business is dependent on cheap energy, and even energy utilities are switching from coal to natural gas. Although environmental concerns remain, the industry has incentive to do the right thing, says Schaefer. In this exclusive interview with The Energy Report, Schaefer profiles service companies that are using cutting-edge technology to make fracking safer, greener and cheaper.

More >

Venture Capital Firm Aims to Match Up Clean-Tech Start-Ups and Energy Companies

Source: Technology Review, Martin Lamonica (9/25/12)

"The idea is to make it more efficient for corporate investors to evaluate outside firms and to give smaller companies access to the manufacturing, marketing and distribution expertise of established businesses."

More >

This U.S. Lab Just Hit a Nuclear Fusion Milestone

Source: Martin Hutchinson, Money Morning (9/25/12)

"If just a fraction of all these new findings live up to their promise, we're still looking at a very bright future indeed."

More >

Investors Add Nearly $3B to Gold ETFs in September

Source: ETF Trends, John Spence (9/25/12)

"SPDR Gold Shares has seen net inflows of $2.1B in September, while iShares Gold Trust has gathered $615M, according to ETF flow data from IndexUniverse."

More >

Citi Raises Gold Price Forecasts for 2012–13

Source: Reuters, Naveen Arul (9/25/12)

"The bank increased its 2012 price forecasts for gold, silver and platinum by about 2%, 5% and 1.5%, respectively, while it cut its earlier forecast for palladium prices by about 1.7%."

More >

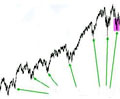

Two Key Rules for Avoiding Stock Bubbles

Source: Dan Steinhart, Casey Research (9/25/12)

"Sky-high stock prices can't persist without sky-high profit margins."

More >

How Gold and Silver Act as Safe Havens in Today's Troubled World

Source: The Market Oracle, Jeff Lewis (9/25/12)

"Physical gold and silver investments can take up a core position in an investment portfolio because they offer an easy way to have some wealth stashed out of dollar-denominated assets."

More >

For Most Biotechs, the Tough Times Continue

Source: Pharmalot, Ed Silverman (9/25/12)

"The overall assumption continues to be that many biotech companies are finding it difficult to raise money, generate revenue and simply keep the lights on. But what is the reality? In some respects, the hard times continue, but the picture is a bit mixed."

More >

Malaysia Court Puts Lynas Rare Earth Plant Licence on Hold

Source: Reuters, Siva Sithraputhran (9/25/12)

"Activists and opponents of the controversial rare earth plant in Kuantan say the high court has put Lynas' temporary operating license on hold."

More >