Streetwise Articles

Mark Lackey: Energy Stocks Could Deliver Stealth Profits

Source: Zig Lambo of The Energy Report (1/8/13)

In the midst of a global market lull, many companies are sitting on their hands, argues Mark Lackey of CHF Investor Relations. That's why he's scoping out smart management that's keeping busy and making great progress—whether or not the markets are quick to notice. Learn who's getting a running start in the uranium, oil and natural gas spaces in this Energy Report interview.

More >

US Gold Eagle Sales Start Year Up by One-Third

Source: Lawrence Williams, Mineweb (1/8/13)

"Opening day orders for 2013 Gold Eagle coins have been one third higher than last year while the opening day of sales of Silver Eagle coins are believed to have come in at a new record for one day sales."

More >

The Pulse: Breaking News from the Life Sciences Sector

Source: Editors of The Life Sciences Report (1/7/13)

To invest wisely in the life sciences, broad-spectrum knowledge is key. Such knowledge encompasses not only the analysis of industry experts featured in Streetwise Reports interviews, but also up-to-date news on cutting-edge research and development, the latest mergers and acquisitions and the drug development process, both within companies and in the regulatory arena. Our Twitter feed links you to the information you need to profit, both intellectually and financially.

More >

To invest wisely in the life sciences, broad-spectrum knowledge is key. Such knowledge encompasses not only the analysis of industry experts featured in Streetwise Reports interviews, but also up-to-date news on cutting-edge research and development, the latest mergers and acquisitions and the drug development process, both within companies and in the regulatory arena. Our Twitter feed links you to the information you need to profit, both intellectually and financially.

More >

Mark Lackey Homes in on Golden Mining Opportunities in West Africa

Source: Zig Lambo of The Gold Report (1/7/13)

Gold has been produced in Africa for thousands of years in places like Ghana and neighboring countries whose names have changed over the centuries. One thing that has not changed is that there's still a huge amount of gold to be found and mined in West Africa. That's what Mark Lackey likes about the area and in this interview with The Gold Report, he talks about companies that are or will be producing significant amounts of the world's prized metal.

More >

Nickel: Where Form Meets Function

Source: Visual Capitalistm (1/7/13)

"While best known for its use in the five-cent coin, nickel has far more strategic uses."

More >

Brent Cook: How to Turn Rock into Money

Source: Brian Sylvester of The Gold Report (1/4/13)

What if the shockingly low valuations of some junior mining companies are really all they're worth? As the market shakes off years of exuberance, Brent Cook, co-editor of the Exploration Insights newsletter, searches for the truly undervalued—finds as rare as gold itself. In this interview with The Gold Report, Cook talks about high-margin deposits that the rest of the market can't see.

More >

Solar Stock Picks Poised for Rebound

Source: David Zeiler, Money Morning (1/4/13)

"One sure sign of better days ahead is that the solar sector has recently attracted interest from one of the world's most respected investors, Warren Buffett."

More >

The Best-Positioned Companies for 2013: Phil Weiss

Source: Zig Lambo of The Energy Report (1/3/13)

The trading ranges for oil and gas haven't changed that much since we last touched base with Phil Weiss, senior analyst at Argus Research, but the entire landscape for both North American and international oil and gas exploration has shifted dramatically. In this interview with The Energy Report, Weiss summarizes the impacts of increased production both at home onshore and in international waters, sharing some names he finds best positioned to benefit in the coming year.

More >

Josh Levine Names Three Biotech Game-Changers

Source: George S. Mack of The Life Sciences Report (1/3/13)

Micro-cap biotechs must have creative, adaptive management first and foremost, says editor Josh Levine of Josh Levine's MicroCap Investor. A second key characteristic is a technology platform that can ultimately generate a suite of products. In this interview with The Life Sciences Report, Levine shares both his investment philosophy and his best three biotech ideas, all of which he expects will return huge multiples to investors.

More >

Can the Bakken Oil Formation Reach 1 Million Barrels a Day?

Source: Keith Schaefer, Oil & Gas Investments Bulletin (1/3/13)

"If so, it would join an elite group of oil fields able to produce at that rate."

More >

Are You a Base Metal Growth Bull or a Gold Gloom-and-Doomer?

Source: Brian Sylvester of The Gold Report (1/2/13)

Gold bugs say the global economy could collapse any day now. But what about investors who see continued growth in emerging economies and a steady, if slow, U.S. recovery? Look to base metals, recommends Haywood Analyst Stefan Ioannou. He expects price runs for 2013–2015, especially for zinc, which is facing a serious supply squeeze. Do your homework now to get positioned as soon as the uptick begins. Ioannou shares his favorites in this Gold Report interview.

More >

Gold and Silver Gain Along with Stocks

Source: Ben Traynor, BullionVault (1/2/13)

"Spot market gold prices started the year by touching a two-week high above $1,680/oz Wednesday morning, as European stock markets also gained following news of a deal in Washington to avoid the so-called fiscal cliff."

More >

This Alzheimer's "Pacemaker" Could Be the Bridge to a Cure

Source: Michael Robinson, Money Morning (1/2/13)

"As high-tech investors, we need to keep an eye on this research and be ready to pounce when a medical device maker gets it to market."

More >

Is Gold Becoming More Convenient?

Source: Eric McWhinnie, Wall St. Cheat Sheet (1/2/13)

"For thousands of years, gold has satisfied the three common requirements of money."

More >

Tips for a Prosperous 2013:

The Best Investing Advice Ever

Source: Karen Roche of The Gold Report (12/31/12)

The Gold Report shares investing ideas from some of the smartest people in the precious metals mining sector—analysts, money managers and newsletter writers including Rick Rule, James Dines, Doug Casey and Porter Stansberry. That was founder Gordon Holmes' vision in 2003 when he started the publication after receiving these words of wisdom from GoldMoney Chairman James Turk: "Buy gold." As the former publisher of Buyside magazine, Holmes set out to create a publication that would interview a wide array of experts and feature in-depth stories about macro-trends and individual investing ideas, but let the readers make their own decisions. In 2008, Karen Roche joined the team as president and grew the parent company, Streetwise Reports, to four newsletters, including The Critical Metals Report, The Energy Report and The Life Sciences Report.

The Gold Report shares investing ideas from some of the smartest people in the precious metals mining sector—analysts, money managers and newsletter writers including Rick Rule, James Dines, Doug Casey and Porter Stansberry. That was founder Gordon Holmes' vision in 2003 when he started the publication after receiving these words of wisdom from GoldMoney Chairman James Turk: "Buy gold." As the former publisher of Buyside magazine, Holmes set out to create a publication that would interview a wide array of experts and feature in-depth stories about macro-trends and individual investing ideas, but let the readers make their own decisions. In 2008, Karen Roche joined the team as president and grew the parent company, Streetwise Reports, to four newsletters, including The Critical Metals Report, The Energy Report and The Life Sciences Report.

To celebrate the New Year, Roche asked some of our most popular interviewees to share The Best Investing Advice They Ever Heard. Most of it falls into a few basic areas we already know: "Buy low and sell high before the cycles start all over again." Some is contradictory: "Be cautious, but take risks." Some made us laugh out loud. Consider it our New Year's gift to you as we all get ready for an exciting 2013 in the world of junior mining investing.

Brien Lundin: Pick Up Junior Gold Mining Bargains Now

Source: Brian Sylvester of The Gold Report (12/28/12)

The past year was a very tough one for the junior gold mining sector. In this interview with The Gold Report, Brien Lundin, CEO of Jefferson Financial, says that the past year has, in fact, put many gold mining companies on the bargain basement shelf. He shares some advice on end-of-year portfolio repositions and talks about some of his favorite stocks that he believes are poised for a rebound in 2013.

More >

Your 2013 Guide to Investing in Gold

Source: William Patalon III, Money Morning (12/28/12)

"Gold bullion, gold stocks or no gold at all?"

More >

Bakken Oil Production: Can the Giant Oil Formation Reach 1 Million Barrels a Day?

Source: Keith Schaefer, Oil and Gas Investments Bulletin (12/28/12)

"If so, it would join an elite group of oil fields able to produce at that rate."

More >

US Energy Independence: The Next Big Thing for 2013?

Source: Rita Sapunor of The Energy Report (12/27/12)

Energy investment is about more than just the commodities; it's about growth. That's why, for example, the emerging economies theme has been an important one for investors who know that every business and modern home in Brazil, Russia, China or on the African continent will need to keep the lights on somehow. But the next big thing for 2013 may be in our own backyards: the drive toward U.S. energy independence. How feasible is this goal, and how can investors profit from it? With this question in mind, The Energy Report looked back at some of the most memorable interviews of 2012 for expert advice on how to get positioned.

More >

2012: A Healthy Year for the Life Sciences

Source: Editors of The Life Sciences Report (12/27/12)

What is the value of innovation? Of addressing unmet needs? Of new and "disruptive" technologies? Those are just a few of the issues that industry experts tackled in interviews with The Life Sciences Report during 2012. Among the many therapeutic focuses discussed by analysts over the last year, orphan diseases and hepatitis C were identified early on as market "sweet spots." Oncology was another big hitter: From micro caps to big pharma, companies targeted the "emperor of all maladies" with innovative pharmaceuticals and genetic technologies. And analysts also uncovered the unexpected, including a pharmaceuticalized nutraceutical designed to reduce high cholesterol.

More >

What is the value of innovation? Of addressing unmet needs? Of new and "disruptive" technologies? Those are just a few of the issues that industry experts tackled in interviews with The Life Sciences Report during 2012. Among the many therapeutic focuses discussed by analysts over the last year, orphan diseases and hepatitis C were identified early on as market "sweet spots." Oncology was another big hitter: From micro caps to big pharma, companies targeted the "emperor of all maladies" with innovative pharmaceuticals and genetic technologies. And analysts also uncovered the unexpected, including a pharmaceuticalized nutraceutical designed to reduce high cholesterol.

More >

Leonard Melman Finds the Fiscal Cliff a Boon for Precious Metals

Source: Peter Byrne of The Gold Report (12/26/12)

Surveying reality from his perch on Vancouver Island, Leonard Melman is a veritable sage in the world of metal mining analysis. In an interview with The Gold Report, the economic philosopher is troubled about the direction of the global economy. However, there are a few bright spots for eagle-eyed junior metal investors, he reports, and names some of his favorite picks.

More >

Streetwise Philanthropy Really Moves People

Source: JT Long of The Gold Report (12/24/12)

Corporate Social Responsibility has been an integral part of the mining industry for decades. Now Gordon Holmes, an avid junior mining investor and founder of Streetwise Reports/The Gold Report and Lookout Ridge Winery in California, is making it easy for companies to reach out to the most vulnerable around the world by giving the gift of mobility.

Holmes' Lookout Ridge Foundation, working with the team at Streetwise Reports and Ken Behring's Wheelchair Foundation, has delivered more than 10,000 wheelchairs in China, Mexico, Ghana, Mali and Bolivia. Holmes witnessed the needs in the countries he visited on mine tours and it inspired him to enhance his efforts to deliver relief to those who need it most.

More >

Gold Regains Some Ground

Source: Ben Traynor, BullionVault (12/24/12)

"On the final day before Christmas, gold prices edged higher Monday morning, climbing to $1,665/oz and recovering some of the ground lost last week.

More >

Rohit Savant Expects the Gold Bull Market to Pause in 2013

Source: Brian Sylvester of The Gold Report (12/21/12)

Many gold analysts are forecasting much higher gold prices in 2013. In this interview with The Gold Report, Rohit Savant, senior commodity analyst at the CPM Group, says he believes all of the positive gold fundamentals, such as global turmoil, are already factored into the gold price. So, in 2013, he sees the trend being flat to down a bit. He also discusses what roles India, China and central banks play in the gold price.

More >

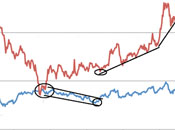

Precious Metals Decouple from Stock Market

Source: Jordan Roy-Byrne, The Daily Gold (12/21/12)

"Going forward, we have the setup for an amazing contrarian opportunity."

More >