Streetwise Articles

Why Does the Pentagon Want to Use This Penny Stock to Cure the Flu?

Source: Michael Robinson, Money Morning (2/21/13)

"Fighting the flu is a big part of the roughly $30B vaccine industry. It's a battle that puts roughly 200,000 Americans in the hospital each year."

More >

Mark Raguz: Technical Best of Breeds Still a Value

Source: Brian Sylvester of The Gold Report (2/20/13)

The market may be turning a blind eye to value, but Mark Raguz, an analyst with Pinetree Capital in Toronto, can see just fine. Companies with cash and strong management continue to go unrecognized, Raguz tells The Gold Report. He is targeting companies that are "best in breed" technically, and waiting for an uptick in the market to sweep them into higher valuations.

More >

Where to Buy Gold in Difficult Times: Jay Taylor

Source: Sally Lowder of The Gold Report (2/20/13)

According to the calendar, it is still winter and gold markets still face some tough sledding, says Jay Taylor, host of the radio show "Turning Hard Times into Good Times." Big investors are leaving the market and small investors hesitate to reenter. But in this interview with The Gold Report, Taylor points to some spots where selective investors can find value and growth potential.

More >

Colin Healey: Will Mining Stocks Follow Iron Ore's Price Climb?

Source: Brian Sylvester of The Metals Report (2/19/13)

Last year's drop in iron ore prices made for a once-bitten, twice-shy market, but Colin Healey of Haywood Securities now sees upside opportunity in junior developers. But there's a catch: Iron ore projects often have big price tags, and investors need to be confident that a company can cover its costs. In this interview with The Metals Report, Healey discusses junior developers that look fit to reach the finish line and explains why partnerships are not financial cure-alls in the space.

More >

Survival of the Fittest in Energy Investment: Malcolm Gissen and Marshall Berol

Source: Peter Byrne of The Energy Report (2/19/13)

Times may be tough for energy commodities, but Encompass Fund Managers Malcolm Gissen and Marshall Berol are hard-core survivors. In this interview with The Energy Report, the dynamic duo share their tactics for winning in 2013 after decades of experience investing in uranium, oil and gas, coal, hydroelectric and geothermal energy.

More >

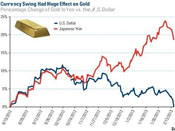

When It Comes to Gold, Stick to the Facts

Source: Frank Holmes, U.S. Global Investors (2/19/13)

"During short-term gold corrections, it's important to focus on the facts, including the fact that gold is increasingly viewed as a currency."

More >

Like Peanut Butter and Chocolate: RNA Interference's Hot Partnership with Stem Cells

Source: Severine Kirchner, The Daily Reckoning (2/19/13)

"Combining stem cell treatments with RNAi, the hottest technique in molecular biology, opens more possibilities and hopes than ever before of curing degenerative diseases."

More >

David Baker's Three Must-Haves for the New Generation of Gold Companies: Accountability, Accountability and Accountability

Source: Brian Sylvester of The Gold Report (2/18/13)

Mining companies have lost the trust of investors, says David Baker, managing partner at Baker Steel. Baker sees the gold market as at a watershed point and the miners must change to stay afloat. In this interview with The Gold Report, Baker sets out his prescription for nursing the industry back to health. Will the restrictions his company and other investors are putting on gold companies increase reporting clarity, investor trust and money earned?

More >

Gold Fails to Hold Asian Gains

Source: Ben Traynor, BullionVault (2/18/13)

U.S. dollar gold bullion prices failed to hold onto gains made in Monday's Asian session, falling to $1,611/oz by lunchtime in London, just a few dollars above Friday's six-month low, as the U.S. dollar extended recent gains.

More >

John Kaiser: Can the TSX Venture Be Saved?

Source: JT Long of The Gold Report (2/15/13)

Is the end near for the TSX Venture Exchange, the victim of "algo traders," low volume and lack of institutional investors? If newsletter writer John Kaiser is right, as many as 500 of the 1,484 resource companies listed on the Venture Exchange will go under this year due to lack of money in the bank. In this Gold Report interview, Kaiser suggests that a crowdsourced valuation system may give the investors the information they need to invest with confidence and fend off the proprietary traders.

More >

Currency 'War' or 'Revolution'?—And Gold?

Source: Julian Phillips, Gold Forecaster (2/15/13)

"The competitive devaluations of currencies, which has gone on for such a long time—many years in fact—is going to become destructive to real currency values."

More >

Why You Can Bet on Platinum Prices Going Higher

Source: Jeff Uscher, Money Morning (2/15/13)

"Platinum prices, which have been below gold prices since mid-2011, are once again higher than the yellow metal, and the spread's widening."

More >

Refinery Stocks: What I'm Buying Right Now

Source: Keith Schaefer, Oil and Gas Invesments Bulletin (2/15/13)

"There is a definite seasonality to the oil and gas stocks in Canada—and generally speaking, the top is right now."

More >

Ram Selvaraju: Fall in Love with These Nine Biotech Stocks

Source: George S. Mack of The Life Sciences Report (2/14/13)

When it comes to unearthing dynamic micro-cap biotech investment opportunities, Ram Selvaraju is a master. Selvaraju, managing director and head of healthcare equity research at Aegis Capital Corp., has selected nine names destined to attract investors willing to take calculated risks, which he shares in this interview with The Life Sciences Report. He also explains why he expects 2013 will be another good year for the biotech industry.

More >

Colin Healey: Which Uranium Stocks Will Rise on a Supply Shortfall?

Source: Brian Sylvester of The Energy Report (2/14/13)

With energy demand looking up in China and Japan, both coal and uranium are likely to experience an uptick. But which producers will move with prices? Colin Healey of Haywood Securities weighs in on some names that are leveraged to spot prices in this interview with The Energy Report, explaining why it's time for investors to get excited again.

More >

Two Reasons to Expect Greater Volatility in Oil Prices

Source: Kent Moors, Oil & Energy Investor (2/14/13)

"A combination of rising demand and tension in the Middle East means oil prices will continue to climb."

More >

Big Growth Stories in Biotech

Source: George S. Mack of The Life Sciences Report (2/14/13)

Bacteria are pure survivalists, and over billions of years they have evolved to produce ever-newer chemicals to protect themselves against other bugs. In the last 100 years they have begun to protect themselves against the antibiotics that humans have developed from those same bugs. But guess who's winning. In September 2012, the FDA said that more than 70% of the bacteria that produce hospital-associated infections (HAIs) are now resistant to at least one type of antibiotic—and in the year 2000 alone, almost 2 million (2M) cases of HAIs caused close to 99,000 deaths. Too bad the agency didn't give an updated number, because it's a certainty that things are not getting better. Unless a sustainable system is developed to counteract this tide, a catastrophe is just a matter of when, and not if. With not even a tiny bit of exaggeration, the appearance of a devastating superbug is a looming global crisis.

More >

Buy Gold Stocks Like a ROTH Capital Price Taker

Source: Sally Lowder of The Gold Report (2/13/13)

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

The Case for Silver Outpacing Gold

Source: Miguel Perez-Santalla, BullionVault (2/13/13)

"A lot of talk on the web right now says silver is significantly undervalued versus gold."

More >

Obama's Call for R&D Investment May Boost Medical Research Budgets and Job Markets

Source: Genetic Engineering and Biotechnology News (2/13/13)

"'If we want to make the best products, we also have to invest in the best ideas,' Obama contended."

More >

Chris Ecclestone: Gold Will Fall, Time to Switch to Specialty Metals?

Source: Brian Sylvester of The Metals Report (2/12/13)

The U.S. and Europe may have been skirting the edge of financial peril for years, but Christopher Ecclestone, who is the principal and mining strategist of London-based Hallgarten & Co., told The Metals Report that the gold price should drop this year as investors realize that there's no more cause for panic. However, the frank and expressive Ecclestone has plenty of other suggestions for what's "sexy" this year (zinc, copper and specialty metals), even as he rips into "business as usual" gold majors and chastises any management team with the nerve to offer a 0.5% dividend.

More >

Do the Companies You Hold Have a Backup Plan? They Should, Says Tim Murray

Source: Zig Lambo of The Energy Report (2/12/13)

Hiccups, either market- or operations-related, are the norm rather than the exception, especially in the junior oil and gas space. That's why Tim Murray, oil and gas analyst at Desjardins Securities, prefers to invest in management teams with long-term vision and a plan for worst-case scenarios. A stellar balance sheet doesn't hurt, either. In his interview with The Energy Report, Murray shares stories of capable management teams that are rolling with the punches—and rewarding investors who stick with them.

More >

Why You Can Trust Your Analyst Again: Ingrid Rico

Source: Brian Sylvester of The Gold Report (2/11/13)

Within the universe of junior mining companies, investors need to be choosy, says Ingrid Rico, mining analyst at Toronto-based investment bank M Partners. In this interview with The Gold Report, Rico explains how analysts value miners and reveals how she will be looking at junior mining companies in 2013—with a skeptical eye, preferring those funded to complete exploration plans for the year and a management track record to deliver results. She shares names of some companies whose projects stand out.

More >

Big Gains Ahead with Platinum's Neglected Cousin

Source: Byron King, Daily Reckoning (2/11/13)

"Let's cut to the chase. We've got a metal play here."

More >