Streetwise Articles

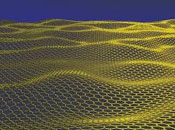

Everything You Need to Know About Graphene

Source: Michael Robinson, Money Morning (3/18/13)

"We simply cannot get to the next level in a tech-oriented world without having the new materials to help us do so."

More >

Eric Lemieux: There Will Be Winners in Quebec

Source: Brian Sylvester of The Gold Report (3/15/13)

It's been years since Quebec had a big discovery. Eric Lemieux, a mining analyst with Laurentian Bank Securities in Montreal, believes the province is overdue. Mining-friendly infrastructure policies like Plan Nord could give Quebec the push it needs, but the return to power of the Parti Quebecois has affected some projects and general market sentiment. Lemieux tells The Gold Report

about which companies he believes are positioned to prosper if the Parti Quebecois swings back to mining-positive policies as he cautiously predicts.

More >

Biotech Sector Analysis: March Madness

Source: John McCamant, Medical Technology Stock Letter (3/15/13)

"Sound sector and company fundamentals are intact, and improving in some cases. The industry gatekeeper—the U.S. Food and Drug Administration (FDA)—continues to be cooperative. The bullish stock market also bodes well—as cash flows into healthcare funds remain abundant—driving many stocks to what appear to be extended levels."

More >

The Stem Cell Revolution Can Jump-Start Your Portfolio: Jason Kolbert

Source: George S. Mack of The Life Sciences Report (3/14/13)

No single solution will emerge from the growing realm of stem cell technology and regenerative medicine. Instead, multiple innovations will succeed in a field that promises to forever change the practice of medicine—innovations generated by the recognition that living cells are capable of performing a platform of functions that present-day drugs simply cannot. In this Life Sciences Report interview, Jason Kolbert, senior vice president and biotechnology analyst with Maxim Group, provides a detailed analysis of the industry and names companies that investors should be aware of now, while valuations are remarkably low.

More >

Edward Guinness and Ian Mortimer: Timing a Roaring Return in Alternative Energy Stocks

Source: Zig Lambo of The Energy Report (3/14/13)

What will it take for alternative energy to deliver the returns investors have dreamed of? Continued global economic recovery, unsubsidized demand and prices that give customers a green incentive without added costs. Some stocks—notably in Europe and Asia—are already benefiting from favorable conditions, but the stars have yet to align on a broader scale. Portfolio Managers Edward Guinness and Ian Mortimer of London-based Guinness Atkinson Funds tell The Energy Report why they're maintaining holdings in quality solar, wind and lithium stocks and when they expect a bounce.

More >

How to Play Energy Markets Like Rockefeller

Source: Casey Energy Team (3/14/13)

"Being patient—letting the market come to us rather than chase it ourselves—will give us the best bang for our buck."

More >

These Gold Stocks Are Poised to Rebound in 2013

Source: Tony Daltorio, Money Morning (3/14/13)

"With gold prices rising year after year for much of the past decade, you might think all gold stocks have increased, too."

More >

Will We See a Silver Breakout in 2013?

Source: JT Long of The Gold Report (3/13/13)

Silver has been trading sideways so far in 2013, but what will the rest of the year bring? Will 2013 be the year silver prices break out or crash and burn? What is a sustainable silver price for mining companies and where will the metal come from to supply the next generation of industrial and investment demand? Most important, how can investors make money off this volatile sector? These were the burning questions The Gold Report took to analysts, money managers and heads of silver mining companies. The answers may surprise you.

More >

Silver has been trading sideways so far in 2013, but what will the rest of the year bring? Will 2013 be the year silver prices break out or crash and burn? What is a sustainable silver price for mining companies and where will the metal come from to supply the next generation of industrial and investment demand? Most important, how can investors make money off this volatile sector? These were the burning questions The Gold Report took to analysts, money managers and heads of silver mining companies. The answers may surprise you.

More >

Gold Prices: Don't Ignore This Bullish Trend

Source: Jeff Uscher, Money Morning (3/13/13)

"The central banks of South Korea, Russia and Kazakhstan have all reported additions to their gold reserves this year, continuing the trend of central bank gold buying."

More >

Malcolm Shaw Likes Under-Covered, Unloved Energy Stocks

Source: Zig Lambo of The Energy Report (3/12/13)

As a former analyst with a strong background in geology, Malcolm Shaw uses his technical and market experience to dig through piles of news and company data to uncover resource investment situations that often go unnoticed by mainstream analysts. In this interview with The Energy Report, Shaw discusses the disconnects he sometimes finds between a company's fundamentals and its stock price, and why uranium is his favorite unloved sector right now.

More >

Recycling, Not Mining, Is the Future for Securing Immediate Platinum Group Metal Supply

Source: JT Long of The Metals Report (3/12/13)

The biggest new source for platinum group metals just might be what Jack Lifton calls "the rubber tire mine." Noting that removing the catalytic converter from a car's emission system produces a rate of return that rivals the production rates of the South African platinum giants, Byron King agrees that recycling is the wave of the future for platinum, palladium and rhodium. Welcome to the 21st century—find out how to play it in this Metals Report interview.

More >

In Oil, Bigger Isn’t Always Better

Source: Kent Moors, Oil & Energy Investor (3/12/13)

"There is a growing recognition that how big a company is no longer automatically determines profitability."

More >

This Healthcare Fund Is Up 70%: Why I'm Not Selling

Source: Steve Sjuggerud, Steve Sjuggerud's Daily Wealth (3/12/13)

"Have your exit plan in place, but don't sell. As I've explained many times, this market has the potential to run much higher."

More >

Eight Companies Swiss Money Manager Joachim Berlenbach Gives High Grades

Source: Brian Sylvester of The Gold Report (3/11/13)

In an environment of rising capital expenses, gold producers big and small are left with little or no free cash flow. Instead of investing in exploration to maintain production, too many companies are cutting costs and high-grading their current resources. Joachim Berlenbach, fund adviser with Switzerland's Earth Resource Investment Group, believes this kind of short-term thinking will lead to decreased production and a higher gold price. In this Gold Report interview, Berlenbach shares his ideas on how to succeed in this stock-picker's market.

More >

Mining Bill Brings Iron Ore Back to Wisconsin

Source: Dorothy Kosich, Mineweb (3/11/13)

"Wisconsin Gov. Scott Walker said Thursday he will sign Senate Bill One, which sets the wheels in motion to bring back iron ore mining to the Badger State."

More >

A Focus on Gold Costs at PDAC

Source: Geoff Candy, Mineweb (3/10/13)

"The most important shift to take place within the gold sector over the last two years," says IAMGOLD CEO Stephen Letwin, "has been the recognition on the part of gold miners that sustaining capital must form part of the equation; that all-in costs are not just operating costs."

More >

Repositioning into Royalties for Richer Returns: Kwong-Mun Achong Low

Source: Brian Sylvester of The Gold Report (3/8/13)

Royalty plays may have once been strictly the domain of larger companies, but smaller names are shifting gears to enter the space. Can the smaller players make the numbers work for their shareholders? Kwong-Mun Achong Low, an analyst with Jennings Capital, believes they can. Achong Low tells The Gold Report about which juniors are making the leap into royalties.

More >

International Mining Bids a Not-so-fond Farewell to Hugo Chávez

Source: Dorothy Kosich, Mineweb (3/8/13)

"The death of President Hugo Chávez could eventually usher in a new era of foreign mining investment in Venezuela, only if the opposition wins an uphill battle for the presidency."

More >

10 Biotech Stocks Poised to Run: George Zavoico

Source: George S. Mack of The Life Sciences Report (3/7/13)

For the first time in ages, conditions for biotech investment are just right. The capital markets have loosened up, and institutional investors are ready to bid up share prices on stories that have both merit and looming catalysts. Sure, there's risk. . .but without it, there's no upside. In this Life Sciences Report interview, Senior Analyst and Managing Director George Zavoico of MLV & Co. identifies a group of biotech companies with market-moving events on their calendars. Sharpen your pencils: From cancer to coronary artery disease to vaccine technology, Zavoico names potential winners.

More >

Five Oil and Gas Companies Analyst Joel Musante Digs

Source: Zig Lambo of The Energy Report (3/7/13)

Many observers believe that the best days of domestic oil and gas production are long gone—and they may be right. But that doesn't mean there isn't a lot more petroleum product to be found right here in North America, even in fields that have been previously worked. In this interview with The Energy Report, Joel Musante, a senior research analyst at C. K. Cooper, profiles several companies that are still coming up with some impressive numbers.

More >

Leonard Melman: Are You Prepared for Hyperinflation?

Source: Brian Sylvester of The Gold Report (3/6/13)

As looming inflation, currency wars and a possible run on gold threaten to derail markets, Leonard Melman, author of The Melman Report, is setting his sights on the midtier and near-term producers that he wants to scoop up when the blood is in the streets. In this interview with The Gold Report, Melman explains why gold, silver and the companies bringing them out of the ground could do very well in the second half of 2013.

More >

Gold Prices Are Being Manipulated and Here's What to Do About It

Source: Keith Fitz-Gerald, Money Morning (3/6/13)

"If you've ever suspected gold prices are being manipulated, you're not alone--and you're right, they are."

More >

Striking a Balance with Zinc Investments: Equal Parts Infrastructure, Financing and Compromise

Source: Brian Sylvester of The Metals Report (3/5/13)

Stock picking can be an exercise in compromise, and investors who wait for a perfect zinc mining project could be sitting on the sidelines—and missing out on profits. Advanced zinc projects close to infrastructure are limited, and with zinc supply contracting in 2013, new operations are emerging both within and outside of established districts. Matthew O'Keefe, mining analyst with Mackie Research, talks with The Metals Report about his criteria for choosing investments in the zinc small-cap space and explains why he's sometimes willing to make concessions.

More >

Mansur Khan: Will the Electric Vehicle Tipping Point Transform Lithium Markets?

Source: Zig Lambo of The Energy Report (3/5/13)

The big bullish story on lithium holds that once consumers make the switch from fuel-burning cars to electric vehicles, the resulting demand for high-quality lithium batteries could make millionaires of investors exposed to lithium miners. Consumers aren't making the switch overnight, but Dundee Analyst Mansur Khan sees a tipping point on its way, along with blue sky potential. Khan has the skinny on mining companies with the goods to supply an ever-hungrier auto market and the skill to thrive in tight market conditions. Learn which names offer maximum upside in this The Energy Report interview.

More >

Eric Sprott: Central Bankers Are Gaming Gold

Source: JT Long of The Gold Report (3/4/13)

Some people may look at the stock market and see economic recovery. Eric Sprott of Sprott Asset Management and Sprott Money looks at myriad other economic indicators and sees an economy still in decline. Despite his suspicions that central banks are keeping gold prices artificially low, he tells The Gold Report that he favors gold, platinum, palladium and especially silver, over the near and long term.

More >