Streetwise Articles

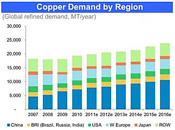

What Global Copper Reserve Estimates Don't Reveal

Source: Richard Mills, Ahead of the Herd (11/11/13)

"World copper reserves are currently placed at around 630 million tons. When considered as just a single consolidated global num¬ber, copper reserves seem large and adequate for several decades of production at 2012 levels. Unfortunately most people do not take into consideration that these reserves are made up of many separate deposits, each of which has to be considered as a standalone and on its own merits."

More >

Why Gold Prices Are Down Right Now

Source: Charles Rice, Money Morning (11/8/13)

"The reasons for gold's continued fall, in spite of the apparent decay of the world, just might surprise you. . ."

More >

Four International O&G Juniors for a Globe-Sweeping Shale Revolution: Christopher Brown

Source: Tom Armistead of The Energy Report (11/7/13)

Shhh! The market is sleeping. Meanwhile, international juniors are stealing into old oil and gas basins with the same equipment and technical expertise that forever changed the oil and gas landscape in North America. In this interview with The Energy Report, Canaccord Genuity Research Director Christopher Brown and Research Associate Kimberly Thompson name some promising junior companies that are poised to tempt majors back into these basins or simply clean up on premium international pricing. For investors, it's a case of massive potential upside for practically nothing—at least until the market wakes up.

More >

Global Expansion and Affordable Care Act Boost Life Science Tools and Diagnostics: Bryan Brokmeier

Source: George S. Mack of The Life Sciences Report (11/7/13)

Two years ago, medtech was thought to be waning. Investors were deserting companies perceived to be short on margins and sure to be demolished by the Affordable Care Act. Today the landscape is transformed: Medtech companies are embracing international markets, preparing for increased volumes of procedures and enjoying new, rich valuations. Do they have what it takes to woo investors back? In this interview with The Life Sciences Report, Bryan Brokmeier of the Maxim Group picks a small group of names that have performed brilliantly over the past year and that he expects will treat investors very well.

More >

Six Opportunities in the Specialty Pharmaceutical Space: Scott Henry

Source: Peter Byrne of The Life Sciences Report (11/7/13)

The specialty pharmaceuticals universe encompasses a variety of technologies, among them innovative drug delivery systems and unique pain management and orphan disease treatments. In this interview with The Life Sciences Report, Scott Henry of ROTH Capital Markets touts the value of "sound business models" in the specialty pharma space, and names six companies with interesting prospects and/or stock-moving catalysts on the horizon.

More >

The Dollar, the Euro and their Influence on Gold Prices

Source: Bob Kirtley, Gold-Prices.biz (11/6/13)

"We may well see both gold and dollar rise in tandem in the future, but for now they are tending to move in opposite directions."

More >

Leonard Melman: Put Your Trust in Precious Metals, Not Governments

Source: Kevin Michael Grace of The Gold Report (11/6/13)

Continued fiscal stimulus, high debt levels and loss of confidence in governments will lead to the return of big inflation and a consequent big run-up in precious and other metals, says Leonard Melman, author of The Melman Report. In this interview with The Gold Report, Melman examines six companies he believes are well positioned to generate stock-price multiples when the bull market returns.

More >

Play the Market Bottom and Focus on Energy Commodities: Chris Berry

Source: J. Alec Gimurtu of The Mining Report (11/5/13)

Commodities are and always will be a cyclical market, asserts Chris Berry of House Mountain Partners. That's why he's not sweating disappointing stock performance and flat pricing environments. But the self-described long-term bull on energy materials has big plans on how to play growth in the developing world, and he insists that now is the time for investors to position themselves ahead of an upswing. Find out about companies that have the cash, the assets and the strategy to create long-term shareholder value in this interview with The Mining Report.

More >

Here's How Pharma Stocks Are Outperforming the S&P 500

Source: Ryan Allway, Wall St. Cheat Sheet (11/5/13)

"While a lot of uncertainties remain within the healthcare system, the innovation coming out of the pharmaceutical sector continues to drive financial results and equity valuations higher."

More >

The Visual Capitalist's Guide to Precious Metals Stock Picking

Source: Brian Sylvester of The Gold Report (11/4/13)

With more than 1,700 precious metals mining companies listed on the Toronto exchanges, separating the wheat from the chaff is no easy task. Visual Capitalist has developed Tickerscores, an empirical approach to scoring gold explorers, developers and producers. In this interview with The Gold Report, Jeff Desjardins, president of Visual Capitalist, and Rob Fuhrman, lead analyst, walk readers through their methodology and reveal which companies in Canada, Mexico and the U.S. measure up as high-potential investments.

More >

Gold Versus Wall Street's Program Traders

Source: Clif Droke (11/4/13)

"As long as gold and the gold ETFs remain below the 150-day moving average the bears can claim control over the intermediate-term trend. A close above the 150-day moving average, however, would set up a retest of the late August high and would be an inviting target for the bulls to complete a bottoming pattern that was begun four months ago."

More >

Don't Miss This Golden Cross in Energy Resources

Source: Frank Holmes, U.S. Global Investors (11/4/13)

"We believe great value in today's energy market lies in selectively choosing companies that own high-quality assets in the core basin areas of Eagle Ford, Permian, Marcellus and Bakken. What's important to our process is finding oil and gas companies that are growing their reserves, production and cash flows on a per share basis."

More >

3 Promising Biotech Stocks with Upcoming Catalysts

Source: Tom Meyer, Wall St. Cheat Sheet (11/4/13)

"Biotechnology stocks are some of the most volatile investments around. They are hard to analyze because, unlike almost all other stocks, the fundamentals aren't typically as important as the potential. And the potential is usually based on upcoming catalysts that the company will face."

More >

Sulliden Gold's Low-Cost Shahuindo Project Validated by Agnico-Eagle Investment

Source: Dan Lonkevich of The Gold Report (11/1/13)

Sulliden Gold Corporation Ltd.'s Shahuindo gold project in Peru was validated as a low-cost, high-return project by a strategic investment of $24 million by Agnico-Eagle Mines Ltd. last April. Sulliden's president and director, Justin Reid, tells The Gold Report about the factors that have led to the company being one of the top performing mining stocks on the Toronto Stock Exchange this year. Sulliden has a balance sheet of $70 million, including a recently completed $40 million bought-deal financing, and Reid says the company is close to finalizing the funding package needed to complete the construction phase of the project in 2014 and begin the first full year of production in 2015.

More >

2013 Biotech Watchlist Update: Companies Climb and Crumble on Catalysts

Source: George S. Mack of The Life Sciences Report (10/31/13)

The Life Sciences Report's Biotech Watchlist, introduced in January 2013, is composed of 17 companies that industry analysts felt showed promise for the coming year—companies with productive pipelines, good management and stock-moving catalysts on the horizon. The new year presented legitimate prospects for portfolio growth and, indeed, that has been the case. In this update, we summarize the current status of Watchlist companies and introduce our Portfolio Tracker, showing the status of each company in real time.

More >

The Life Sciences Report's Biotech Watchlist, introduced in January 2013, is composed of 17 companies that industry analysts felt showed promise for the coming year—companies with productive pipelines, good management and stock-moving catalysts on the horizon. The new year presented legitimate prospects for portfolio growth and, indeed, that has been the case. In this update, we summarize the current status of Watchlist companies and introduce our Portfolio Tracker, showing the status of each company in real time.

More >

Why Chen Lin Is Buying Fracking Stocks and Selling Gold Holdings

Source: Tom Armistead of The Energy Report (10/31/13)

Chen Lin, author of What is Chen Buying? What Is Chen Selling?, goes wherever he sees returns. In the summer, he bought mining stocks when the yellow metal hit $1,200 per ounce. Now, he's trading in his gold names and moving into the fracking space after a three-year hiatus. In this interview with The Energy Report, Lin names the companies he's buying to play a likely energy sector bottom and tells investors to actively manage their portfolios in the coming stock-picker's market.

More >

Carbon Is the Problem: Is Graphene the Solution?

Source: Christine Hertzog, The Energy Collective (10/31/13)

"The search is on to find a better material than silicon—one that is much more energy-efficient and less likely to produce waste heat."

More >

Gissen and Berol's Gold Stock Tricks and Treats

Source: Brian Sylvester of The Gold Report (10/30/13)

No matter how elaborate an investor's Halloween costume is, the gold space isn't handing out much in the way of treats this year. While Encompass Fund Managers Malcolm Gissen and Marshall Berol don't agree on the timeline for gold's recovery, they have faith that it will come. In the meantime, their focus is on companies that are in production, generate cash flow and have top-notch management teams. They also dig into their treat bag for names in the energy sector and other metals in this interview with The Gold Report.

More >

What Not to Do When Investing in Miners

Source: Eric Angeli, Sprott Global Resource Investments (10/30/13)

"Precious metals miners are the most volatile stocks on earth. They're so volatile that investors often forget that underneath those whipsawing stock prices lie real businesses. But even many of those who consider themselves old pros in natural resource investing tend to get one thing wrong. Eric Angeli, an investment executive with Sprott Global Resources and protégé of legendary resource broker Rick Rule, explains how not to fall into the 'top-down' trap. . ."

More >

Does Thorium Deserve a Role in Next-Generation Nuclear Energy?

Source: Jim Pierobon, The Energy Collective (10/30/13)

"The world is still using the raw materials and components with one of the basic designs that built the first commercial nuclear power reactor more than a half-century ago."

More >

Uranium Investors, Ignore the Noise! Fundamentals Are Compelling

Source: Tom Armistead of The Mining Report (10/29/13)

Uranium prices and mining stocks are low, but market forces will push them both higher in the next 12–24 months, says David Sadowski. Miners are jockeying for position and the Raymond James mining analyst tells The Mining Report to expect mergers and acquisitions as they prepare for the good times to come. The market's supply glut will be gone by mid-decade, and mining will have to ramp up to head off a deficit by 2020. The time to buy is now.

More >

Jordan Roy-Byrne: When Stalking Juniors, Follow the Leaders

Source: Kevin Michael Grace of The Gold Report (10/28/13)

The bear market in precious metals equities will end soon, says Jordan Roy-Byrne, editor and publisher of The Daily Gold Premium, perhaps even by the end of the year. But the rising tide will not lift all juniors equally. In this interview with The Gold Report, Roy-Byrne explains why bottom-fishing is a bad idea and why the savvy investor must find companies that will not just survive but thrive when the bears become bulls.

More >

Investors Are Holding Gold as Fed Turns Dovish

Source: Adrian Ash, BullionVault (10/28/13)

"Gold last week enjoyed its strongest rise in almost three months, adding 2.6% as silver rose 2.9%."

More >

When Nuclear Energy Lights Every Home on Earth

Source: Josh Grasmick, Daily Reckoning (10/28/13)

"Sooner than you think, biology will be reprogrammed to 'grow' new energy."

More >

Categorizing LifeSci Investments + 2 Niche Market Picks

Source: Brian Wilson, BioMedReports (10/28/13)

"This is not to say that investors should necessarily avoid small or medium-sized clinical life science companies. The high risk comes with a high potential for return, although investors will probably have to spend a lot more time with their due diligence. Also required is a strong stomach for the volatility of these stocks."

More >