Streetwise Gold Articles

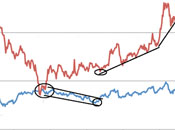

Precious Metals Decouple from Stock Market

Source: Jordan Roy-Byrne, The Daily Gold (12/21/12)

"Going forward, we have the setup for an amazing contrarian opportunity."

More >

Why the Gold Price MUST Go Higher

Source: Adrian Ash, BullionVault (12/21/12)

"There are always plenty of opinions about gold. And right now they're clearly making the market. Just not in the way you would think."

More >

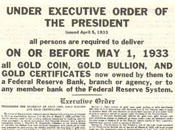

Confiscation of Gold – Then What? (Part 2/4)

Source: Julian Phillips, Gold Forecaster (12/20/12)

"Is there really a danger of gold being confiscated? We believe that there is."

More >

Byron King: How to Up Your Investing IQ with Gold

Source: Brian Sylvester of The Gold Report (12/19/12)

Have you ever actually held a bar of gold in your hands? Byron King, editor of the Outstanding Investments and Energy & Scarcity Investor newsletters, suggests that you do. But becoming a smart investor shouldn't just be about physical gold, King says. He also encourages investors to use investments in gold mining juniors to increase their exposure to precious metals. Read on in this Gold Report interview to find out about the handful of companies he's expecting to shake up the market in 2013.

More >

What on Earth's Going on in the Gold Market?

Source: Lawrence Williams, Mineweb (12/18/12)

"Virtually everything that is happening in the global economy suggests that the gold price should be rising, and probably rising fast, yet it has been unable to move out of a trading range of $1680–1750, and every time it nears the top of this range it gets knocked back again."

More >

Golden Points To Ponder

Source: Rick Mills, Ahead of the Herd (12/15/12)

"Despite increased exploration expenditures, a record US$8B in 2011, and an increasing gold price, gold ounce discovery is not keeping up to the rate needed to replace mined ounces."

More >

How to Find Success with Latin American Miners: Heiko Ihle

Source: Brian Sylvester of The Gold Report (12/14/12)

Miners in Latin America are facing both growth and challenges. Heiko Ihle, senior research analyst with Euro Pacific Capital, examines the factors behind these trends. In this Gold Report interview, Ihle urges investors to evaluate mining companies based on three important features rather than on the performance of others in the region.

More >

Confiscation of Gold - Then What? Part 1

Source: Julian Phillips, Gold Forecaster (12/14/12)

"If gold is re-rated to a level I asset, as is proposed by Basel III (U.S. bankers are in on the discussions) then there is not enough readily-available gold to provide both the central banks of the world and the banking system with sufficient for gold to play this role."

More >

Gold: A Look Back and a Look Forward

Source: Peter Degraaf, Itiswell (12/14/12)

"The average gold correction of 10% or more has resulted in a delay of 12–19 months before a new record high was established."

More >

Gold Prices: Where to Now After the Sell-Off?

Source: Deborah Baratz, Money Morning (12/14/12)

"Investors are expected to come back and buy gold since it's a hedge for inflation and uncertainty."

More >

Fear Versus Fundamentals in the Platinum Market

Source: Louis James, Casey Research (12/13/12)

Although the platinum market is now estimated to end the year in deficit, unless there's a new and even greater supply disruption, the existing recycling output will likely adapt and fill in the 2012 supply gap rather quickly, especially if prices move up.

More >

Porter Stansberry: Gold and Real Estate Are My Hedges for the Fiscal Cliff

Source: Karen Roche of The Gold Report (12/12/12)

With nary a glimmer of hope that economic sense will supplant political expedience, Stansberry & Associates Investment Research Founder Porter Stansberry expects rampant inflation to roar in once the cost of capital rises. How is he preparing himself? Stansberry tells The Gold Report he continues to buy and hold gold and also discusses how real estate can cushion against the fiscal cliff.

More >

With nary a glimmer of hope that economic sense will supplant political expedience, Stansberry & Associates Investment Research Founder Porter Stansberry expects rampant inflation to roar in once the cost of capital rises. How is he preparing himself? Stansberry tells The Gold Report he continues to buy and hold gold and also discusses how real estate can cushion against the fiscal cliff.

More >

How Gold Miners Can Leverage the Price of Gold

Source: Frank Holmes, Frank Talk (12/12/12)

"Gazing into their crystal balls last week, Wall Street firms interpreted differing futures for gold next year. Morgan Stanley awarded gold the 'best commodity for 2013' while Goldman Sachs called the end of the metal’s hot streak."

More >

Peter Grandich: What a Turnaround in Junior Gold Mining Stocks Will Look Like

Source: Brian Sylvester of The Gold Report (12/10/12)

The fundamentals at many junior mining companies have improved, yet their stock prices continue to languish. In this interview with The Gold Report, market guru Peter Grandich gives his thoughts on when this may end and where gold is headed in 2013, and names some of his picks in unlikely jurisdictions.

More >

Secondary Bottom Coming in Gold Stocks

Source: Jordan Roy-Byrne, The Daily Gold (12/10/12)

"We think the current probabilities favor a secondary bottom in the gold stocks and very soon the risk/reward dynamic will be heavily in favor of longs."

More >

Gold Confiscation: Lessons from the 20th Century

Source: Adrian Ash, Bullion Vault (12/10/12)

"Because gold is no longer central to the world's monetary system, so-called 'confiscation' looks a very 20th century phenomenon today. But that may well change."

More >

Sprott's Michael Kosowan on Surviving Death by Paper Cut in Today's Mining Equity Market

Source: Sally Lowder of The Gold Report (12/7/12)

An investment executive at Sprott Global Resource Investments Ltd., Michael Kosowan is working by three sayings these days: "Well bought is half sold," "Small is beautiful" and "Necessity is the mother of invention." In this Gold Report interview, Kosowan talks about the challenges mining companies face and shares some jurisdictions that offer outsized returns.

More >

Junior Gold-Mining Sector Distressing for Investors

Source: Bob Kirtley, SK Options Trading (12/7/12)

"We will take a quick look at the GDXJ to see if we can discern any trends that may help us position our hard-earned cash for future growth."

More >

Can Gold Keep Its Luster in 2013?

Source: Clif Droke, Gold & Silver Stock Report (12/6/12)

"Gold is currently showing a net gain for the year-to-date."

More >

Pent-Up Potential for Precious Metals in 2013: Jason Hamlin

Source: Brian Sylvester of The Gold Report (12/5/12)

Debt, not the fiscal cliff, is what concerns Jason Hamlin, publisher of the Gold Stock Bull newsletter, and if his prediction of a split in the EU comes to pass, it will bolster the case for gold equities. In this Gold Report interview Hamlin shares his preference for royalty streamers and prospect generators in the gold space and explains his attraction to graphite.

More >

Is a Global Gold Supply Crunch Forming?

Source: Jeff Clark, Casey Research (12/5/12)

"Our advice is simple: make sure your personal gold reserves are in place."

More >

Why Gold Prices Will Soar After Dec. 12

Source: David Zeiler, Money Morning (12/4/12)

"Deutsche Bank set a target of $2,000/oz for the first half of 2013, while Bank of America has projected gold prices at $2,400/oz by the end of 2014."

More >

Profiting from the Dismal State of Gold Miners and Explorers

Source: Brent Cook, Exploration Insights (12/4/12)

"Grassroots exploration by the juniors will be virtually dead next year (tough to raise money on concepts and soil anomalies) and aggressive drilling will be seriously curtailed (tough to raise money if you miss)."

More >

Gold Remains in Long Run Uptrend

Source: Ben Traynor, BullionVault (12/3/12)

"Gold prices fell back below $1,715/oz Monday morning in London, more-or-less in line with where they were two weeks ago after failing to hold gains made during Asian trading."

More >

Rick Mills: Low-Cost Producers Trump Larger Mines in Costly Market

Source: Sally Lowder of The Gold Report (12/3/12)

Rick Mills isn't looking for huge producers with so much overhead that they can't profitably mine an ounce of gold. Instead, Mills, the publisher, editor and president of Aheadoftheherd.com, seeks out the smaller mines with low capital costs. That's where the money will be made in the next two years, he tells The Gold Report.

More >