Streetwise Gold Articles

How Will Gold Respond to Declining Discovery?

Source: Henry Bonner, Daily Reckoning (4/23/14)

"At $1,900 per ounce of gold, even mediocre finds could make money."

More >

Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management

Source: JT Long of The Gold Report (4/21/14)

Willem Middelkoop and Terence van der Hout of the Netherlands-based Commodity Discovery Fund believe that when the world's reserve currency is reset away from the U.S. dollar in the next decade, gold prices will rise and mining equities will follow. Van der Hout and Middelkoop tell The Gold Report that by focusing on producers, near-producers and turnaround stories, they plan to capitalize on the opportunities in North America, Africa and beyond.

More >

Latest GFMS Gold Survey Reports Record 2013 Gold Production

Source: Lawrence Williams, Mineweb (4/17/14)

"GFMS puts 2013 new mine production of gold at a record 3,022 tonnes, a 6% gain over 2012."

More >

Salman Partners' Raymond Goldie: Copper Is Pathological and Suffers from SAD, but It Has Value

Source: JT Long of The Gold Report (4/16/14)

Dr. Copper may be in a supercycle, but there are serious problems. In this interview with The Gold Report, Salman Partners' Vice President of Commodity Economics Raymond Goldie explains why even though the base metal acts pathologically and has a bad case of seasonal affective disorder, these six equities are priced below their intrinsic value.

More >

Three Key Metrics to Identify a Superstar Investment

Source: Brian Sylvester of The Mining Report (4/15/14)

Etienne Moshevich, editor of Alphastox.com, looks at three things before he decides to get excited about a company: people, projects and structure. In this interview with The Mining Report, Moshevich explains his ground-up approach to evaluating junior resource companies and names the names that are set to rake in the profits.

More >

When the Major Equity Market Bubble Crashes, Michael Berry Will Take Refuge in These Gold Stocks

Source: JT Long of The Gold Report (4/14/14)

An overinflated equities market could be good news for metals and mining stocks. In this interview with The Gold Report, Morning Notes Publisher Michael Berry shares two scenarios that could follow an imminent crash and four gold companies that could be perfectly positioned to take advantage of a reset credit market.

More >

Gold Moving on Ukraine Crisis Escalation

Source: Lawrence Williams, Mineweb (4/14/14)

"New Ukrainian tensions have seen the gold price rise in trading today as the West remains nervous about further escalation and the possible imposition of more rigorous economic sanctions."

More >

Puerto Rico's Tax Benefits—More than 'The Better Florida'

Source: Editors, The Gold Report (4/9/14)

Puerto Rico promises to do for Americans what Singapore and Hong Kong have done for bankers and businessmen from London. In this interview with The Gold Report, three experts with in-depth knowledge of the pros and cons of living and investing in Puerto Rico share what it is like on the ground for investors. InternationalMan.com Senior Editor Nick Giambruno and Casey Research Chief Technology Investor and Puerto Rico resident Alex Daley join Sterne Agee's Managing Director of Equity Research Todd Hagerman in clearing up some of the confusion about this "misunderstood" island and why the tax benefits for Americans make it "The Better Florida."

More >

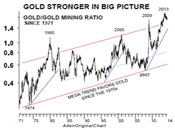

Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

Source: Kevin Michael Grace of The Gold Report (4/9/14)

Jay Taylor understands why investors in gold and gold equities are consumed with caution. But the publisher and editor of J. Taylor's Gold, Energy & Tech Stocks and host of the radio show "Turning Hard Times into Good Times" urges them not to lose sight of the big picture. The big, bull-market picture. Gold juniors with cash and good projects are trading at tiny fractions of their worth. But not for long. In this interview with The Gold Report, Taylor argues that we are on the cusp of a bull market for the ages and suggests eight junior candidates for mind-blowing multiples.

More >

Gold: Unearthing the World's Supply

Source: Visual Capitalist (4/8/14)

"Within the earth's crust, there is only 1 gram of gold for every 550,000 pounds of earth."

More >

Ted Dixon: What Gold Stock Insider Trading Tells Us

Source: Kevin Michael Grace of The Gold Report (4/7/14)

Despite the recent big gains in gold stocks, company insiders and institutional investors are still 2.5 times more likely to be buyers than sellers. According to Ted Dixon, cofounder and CEO of INK Research, this shows that those in the know are still quite bullish, despite the pullback in March. In this interview with The Gold Report, Dixon names the top insider buyers by dollar amount and by volume, and explains how investors should interpret this data.

More >

What's Abuzz About Gold?

Source: Frank Holmes, U.S. Global Investors (4/7/14)

"A key driver in gold prices is the real interest rate environment—the real rate of return taking into account the level of inflation."

More >

Looking for 1,000% Gains? Resource Investor Oliver Gross Has Some Junior Mining Names for You

Source: Kevin Michael Grace of The Gold Report (4/2/14)

The bottom is in, declares Oliver Gross of Der Rohstoff-Anleger (The Resource Investor), and the bulls are ready to charge. In this interview with The Gold Report, Gross says that the woefully undervalued juniors will exploit their leverage advantage, with best-in-class companies gaining as much as 500% to 1,000%—or more. And he lists more than a dozen gold, silver and copper companies most likely to soar.

More >

Stephan Bogner and the Rise of a Euro-Sino-Russian Superpower

Source: Brian Sylvester of The Mining Report (4/1/14)

Stephan Bogner, mining analyst with Rockstone Research and CEO of Elementum International, views the crisis in Crimea as the beginning of a larger global power shift east of the Atlantic. In this interview with The Mining Report, Bogner details what these shifting power dynamics will mean for the commodities market. And take heed—gold and silver may continue to make gains, but uranium, potash and rare earths are the true wave of the future.

More >

Robert Cohen's Three Drivers for the Gold Price in 2014

Source: Brian Sylvester of The Gold Report (3/31/14)

Like the rest of the market, Dynamic Funds is being choosy as it shifts cautiously from bullion to equities, in what Vice President and Portfolio Manager Robert Cohen describes as "baby steps." In this interview with The Gold Report, Cohen explains his method of analyzing miners and discusses companies that offer good prospects.

More >

Jeff Killeen: A Picky Player's Guide to a Cautiously Optimistic Mining Market

Source: Kevin Michael Grace of The Gold Report (3/26/14)

The price of gold may be enjoying a double-digit increase so far this year and some equities may even have doubled their value, but Jeff Killeen of CIBC World Markets says it's not time to jump into metals with both feet. Be selective, he counsels. In this interview with The Gold Report, Killeen shares the higher-quality names that have prospects for development.

More >

CPM Yearbook Says Interest in Gold Equities Reviving as Bear Market Wanes

Source: Dorothy Kosich, Mineweb (3/26/14)

"While CPM does not expect the gold price to drop significantly from current levels, nor anticipates sharp increases in prices over 2014 and 2015, it does expect that gold equities would be expected to turn higher before the price of gold."

More >

Brien Lundin: East Meets West in Junior Market Rebound

Source: Brian Sylvester of The Gold Report (3/24/14)

Can you hear it? Brien Lundin can. It's the sound of the junior resource market mounting a comeback. Lundin, editor of Gold Newsletter, president and CEO of Jefferson Financial and the man behind the New Orleans Investment Conference, traces the rebound to Western speculators coming to the market at the same time that Asian buyers are maintaining a strong level of demand. In this interview with The Gold Report, Lundin pinpoints the fastest horses in his stable of top picks.

More >

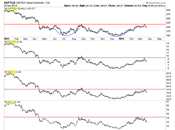

Is Gold at an Interim Top?

Source: Jordan Roy-Byrne, The Daily Gold (3/21/14)

"False breakouts usually mark a key turning point."

More >

Michael Gray: Is Goldcorp's Bid for Osisko a Harbinger of a Gold Renaissance?

Source: Brian Sylvester of The Gold Report (3/19/14)

Optimism. Momentum. Buoyancy. Call it what you will, a positive current is running through the gold space. Macquarie Capital Markets' Canadian Mining Equity Research Team Head Michael Gray deconstructs some of the factors contributing to that newfound energy. Calling out merger & acquisition activity as a nascent trend, he shares with The Gold Report some of the names that could be on a senior gold producer's shopping list.

More >

Jeb Handwerger: China Isn't Slowing Down, It's Buying Up (Resources, that Is)

Source: Tom Armistead of The Energy Report (3/18/14)

Headlines about a Chinese economic slowdown may get good web traffic, but the real story is that China is buying up uranium and other resources around the world, says Gold Stock Trades writer Jeb Handwerger. Meanwhile, tensions in Russia highlight the massive country's resource dominance in natural gas, oil, uranium, platinum group metals, rare earths and nickel. Handwerger tells The Mining Report that North America is already acting to develop resources that can meet both domestic and international demand—and this global geopolitical uncertainty is an investment opportunity.

More >

Feelin’ the Fire, Investors are Hot for Gold

Source: Frank Holmes, U.S. Global Investors (3/18/14)

"When real interest rates go above the positive 2% mark, you can expect the gold price to drop."

More >

Rick Rule: Which Companies Will Bring in the Green?

Source: Karen Roche of The Gold Report (3/17/14)

Thoughts turn to green on St. Patrick's Day. Rick Rule of Sprott US Holdings believes the resources bull market is about 18 months from arriving and there could be multiple promising entry points in the market this summer. But in this interview with The Gold Report, he says that this rebound may not look like the one investors are expecting and shares tips on how to spot companies that may have pots of gold at the end of the rainbow.

More >

In Need of Financial Safety? Here's Your Safe Haven

Source: Mary Anne and Pamela Aden, The Aden Forecast (3/14/14)

"Clearly, the world has plenty of uncertainty. From Russia, Ukraine, Venezuela, emerging currency devaluations, the sluggish U.S economy, as well as the slowdown in China, the world has hot spots. With this backdrop it's easy to understand why demand continues to grow. The world wants gold."

More >

Derek Macpherson: Is It a Love Affair or a Tryst?

Source: Brian Sylvester of The Gold Report (3/12/14)

Investors have again begun flirting with the junior mining sector. Will it lead to a love affair or is it just a tryst? Derek Macpherson, a mining analyst with M Partners, believes it is still too early to be taking on high-risk, high-leverage names. In this interview with The Gold Report, he advises investors to carefully choose low-risk companies, even in this early stage of a rising gold price environment, and names a handful that investors could fall in love with.

More >

.jpg)