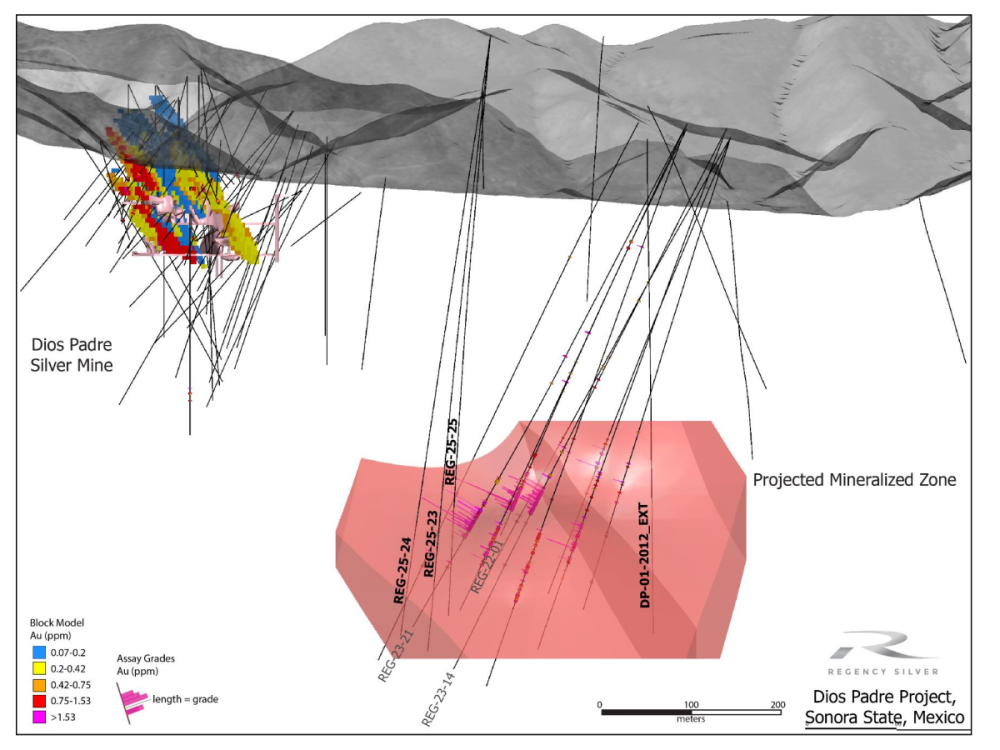

Regency Silver Corp.'s (RSMX:TSX.V; RSMXF:OTCQB) follow-up hole REG-25-25, drilled recently at its flagship, past-producing Dios Padre project in Sonora, Mexico, intersected 23.7 meters (23.7m) of sulphide-specularite-supported breccia about 35m updip and along strike to the southeast from a previously reported highlight hole, REG-23-21, a news release noted.

1"Dios Padre is a high-sulfidation/porphyry mineralized system which has the potential for significant size," John Newell of John Newell & Associates wrote in an article about why he likes this exploration company.

According to the release, the breccia encountered in new hole REG-25-25 is similar in nature to the breccia hosting high-grade gold-copper-silver (Au-Cu-Ag) mineralization intersected not only in hole REG 23-21 but also in two other previously reported standout holes, REG-22-01 and REG-23-14:

- REG-23-21: 38m of 7.36 grams per ton (7.36 g/t) Au

- REG-22-01: 35.8m of 6.84 g/t Au, 0.88% Cu, and 21.82 g/t Ag

- REG-23-14: 29.4m of 6.32 g/t Au

REG-25-25 is part of the Canadian explorer's 6- to 8-hole, 4,500m drill program currently in progress and begun on Oct. 10, reported by Streetwise Reports in October. Thus far, four holes over 2,476m have been drilled, for which assays are pending.

The campaign was designed to follow the lower, high-grade, gold-rich breccia zone along strike, targeting extensions of high-grade mineralization previously intercepted in the three noted significant holes. The ultimate goal is to determine the depth and true scale of the mineralized system in the vicinity of the past-producing mine and open in multiple directions.

Visually, the geology, alteration, mineral species, and abundance observed in REG-25-25 appear to compare favorably to those of the three key holes, according to the release. Further, a new geological development is seen with this hole, that the mineralized shingle breccia that typically hosts mineralization is found on both sides of a new intersection of quartz-feldspar porphyry, the release explained. Regency intends to follow this new intersection updip toward the historical Dios Padre silver mine. It is likely, management said, that the extension of this new quartz-feldspar porphyry is at the bottom of the mineralized zone in REG-23-21.

Regency also reported on three other holes, which hit significant mineralization but not the high-sulphidation breccia

Soon, Regency will start drilling the fifth hole of the program.

'Compelling Exploration Play'

Headquartered in Vancouver, British Columbia, Regency Silver is a metals exploration company that is pioneering a new Au-Cu-Ag porphyry district in Sonora, Mexico.

"With experienced leadership advancing a gold-silver discovery during a historic precious metals bull market, Regency Silver stands out as a compelling exploration play," Newell wrote.

Regency has many paths to value, given the trio of metals (gold, silver, and copper) at Dios Padre. The company's founder, chief executive officer (CEO), and director Bruce Bragagnolo said in a Nov. 20 video that Regency's current focus is gold. Already, there is an abundance of silver at the project, evidenced by the 2023 NI 43-101-compliant estimate showing an Inferred resource of 11,375,000 ounces of silver equivalent (Au eq), represented by 1,384,000 tons of 255.64 g/t of Ag eq. According to Regency's Investor Presentation, historical drilling at Dios Padre intercepted multiple zones of wide, high-grade silver mineralization. For instance, hole FMR 12-06 showed 32.5m of 408 g/t Ag, including 1.9m of 3,220 g/t Ag. Hole FMR 15-06 returned 28.8m of 467.8 g/t silver.

When copper is also in the mix, it typically means the mineralized system is large, noted the CEO.

"And this is a type of system that becomes a mine just because of the sheer size and grade of it," Bragagnolo added. That is exactly what we're pursuing at Dios Padre. We believe this system could host a multimillion-ounce gold, silver, copper deposit."

Regency now has a financial partner, Centurion One Capital, the lead underwriter on and investor in a CA$4 million (CA$4M) oversubscribed private placement that closed in late August 2025, a news release announced.

Regency Silver's management team boasts "deep experience in Mexico and a proven record of creating shareholder value," Newell wrote. As its founder and CEO, Bragagnolo took Timmins Gold Corp., a gold producer in Mexico, from a CA$7M initial public offering (IPO) to a US$475M market cap and peak production of 120,000 ounces of gold. Also in the role of CEO, Bragagnolo took Silvermex Resources Inc. from a CA$7M IPO to its sale to First Majestic Silver Corp. (AG:TSX; AG:NYSE; FMV:FSE) for CA$175M.

Regency's head geologist, Michael Tucker, is the CEO of Perseverance Nickel Corp., a private nickel explorer. Previously, he was the vice president of exploration at Karus Gold Corp. and the exploration manager at Balmoral Resources Ltd. (BAR:TSX; BALMF:OTCQX).

Frank Cordova is Regency's president of Mexican operations. He had an extensive career in the Mexican government for 20-plus years, in part as secretary of security and secretary of tourism for Sinaloa. He has been a director of several private and public international and Mexican companies, including Timmins Gold. He earned a Doctor of Law from Arizona State University in 1992.

"I've been fortunate to build successful mining companies in Mexico before," Bragagnolo said. "With Regency, we now have the funding, the people, and the project to do it again."

The exploration work that Regency is doing at Dios Padre has the support of the local town of Santa Rosa and the municipal government in the next large town of Yecora, noted Bragagnolo. They recognize the benefits, from jobs and training to social programs and new opportunities for commerce.

"Mining must create lasting value for both investors and communities," he added. "We always strive to be a good corporate citizen and make sure that value stays in the community."

Dios Padre is located in the Laramide Porphyry Belt, known for hosting major porphyry deposits, including Resolution, Buenavista, La Caridad, and Orisyvo. Regency's project is close to large producing assets such as Pan American Silver Corp.'s (PAAS:TSX; PAAS:NYSE) Dolores mine, Alamos Gold Inc.'s (AGI:TSX; AGI:NYSE) Mulatos mining operation, and Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) La India and Pinos Altos mines. Sonora is one of Mexico's most established mining jurisdictions with existing infrastructure and a skilled local workforce.

According to Bragagnolo, the timing is right for Regency Silver and Dios Padre.

"With gold at record highs, silver undervalued, exploration companies extremely undervalued and drilling starting, this is the right time and the right place for a breakthrough," Bragagnolo said.

Bull Market to Continue

Gold is trading at about US$4,216 per ounce, and silver, at about US$58. The outlook for both precious metals in both the short- and long-term is favorable.

A Goldman Sachs survey of institutional investor clients showed most of them believe gold will hit somewhere between US$4,500 and US$5,000/oz next year, reported CNBC on Nov. 28. Goldman Sachs' own Daan Struyven expects bullish gold trends to continue into 2026, with gold possibly reaching US$4,900 by year-end, he said in a recent Bloomberg interview, according to The Street on Dec. 7. Van Eck, the money manager behind the VanEck Gold Miners Exchange-Traded Fund (ETF) (GDX:NYSEARCA) predicts US$5,000/oz gold by 2030, supported by central bank buying, investors adding gold to portfolios and ongoing uncertainty.

James West wrote in his Dec. 4 Midas Letter, "This bull market has legs that will carry well into 2026 and beyond. Gold above US$5,000 isn't a question of if — it's a question of when." He pointed to ongoing, persistent central bank gold purchasing, sharp acceleration of ETF inflows, and the increasing dominance of gold market buyers not concerned about price and willing to accumulate on strength, generally, monetary authorities and high-conviction investors.

"That means any future macro shock — whether from weaker global growth, renewed tariff escalation, or a sharper-than-expected Fed easing path — is likely to trigger a demand spike into an already tight physical pipeline," West wrote. "I'm convinced there is a date in the future where gold trades at US$100,000/oz."

As for the rest of 2025, Brien Lundin of Gold Newsletter expects gold to experience its usual seasonal bottom in the middle to end of this month, he wrote in the Dec. 4 edition. However, he added the caveat, "But again, no one knows, as the metal has been giving precious little in the way of signals lately."

Technical Analyst Clive Maund wrote on Nov. 29 that the precious metals bull market has much further to run, as evidenced by the very low silver:gold ratio, still much lower than at the 2011 peak, showing that retail and speculative interest in gold and silver remains.

He pointed out that the day before, silver busted out of its "gigantic, epochal" cup and handle pattern, making Nov. 28 the metal's biggest day in 45 years, perhaps many more.

Silver has a lot of catching up [to gold] to do, and having broken out of its huge cup and handle, it is now getting on with it," Maund wrote.

The silver price should move to at least the height of the cup and handle pattern on the long-term log chart for silver, equivalent to US$400–600/oz silver, he noted.

"The implications of all this for silver ETFs and silver stocks are, of course, obvious," added Maund. "They will moonshot, rising to many multiples of their current prices. This means huge dividends for shareholders."

Escalating the situation is the shortage of physical silver to buy amid increasing demand, "a very rare situation that looks set to trigger a melt-up of astounding proportions," Maund described. This means silver would "rise steeply and relentlessly, getting overbought and staying overbought as it ascends to levels that few now believe possible."

In the short term, US$50/oz is "becoming the new price floor" for silver, Peter Krauth of Silver Stock Investor wrote on Dec. 3. He expects some more consolidating and even near-term weakness, particularly since tax-loss season is approaching.

"If that plays out, it could make for another great opportunity to initiate or gain exposure to the sector," Krauth added.

The Catalysts

Bragagnolo, in his recent video, pointed out the next steps for Regency and Dios Padre. Continuing to execute the current drill program is the priority to gain a clear picture of the breccia zone and its potential. Next is highlighting the strength of the company's silver resource at the project.

"We are hopeful that in this drill program, we can find the flow of mineralization from the lower breccia zone up to the breccia zone in the silver mine," the CEO said.

Third, he added, the company will build momentum as the drill results become available, "positioning Regency for growth in both gold and silver."

Expert Likes the Story

John Newell has a Speculative Buy rating and a target price on Regency (CA$0.45), implying 114% upside from the explorer's Dec. 5 closing price.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Regency Silver Corp. (RSMX:TSX.V; RSMXF:OTCQB)

"Regency Silver offers a discovery story with clear catalysts: high-grade intercepts in a growing breccia body, a historic silver resource beside existing workings, and a management team that has built mines and created value in Mexico before," he wrote.

In his article, Newell emphasized Regency's recent positive drill results and the potential of the mineralized system at Dios Padre.

"Continued drilling has the potential to significantly expand the scale of the project," he added.

Ownership and Share Structure2

Members of Regency Silver's management team and its board own 5.6% of the company. Of this total, CEO Bragagnolo, the largest shareholder overall, owns 4.05%. One institution, Palos Management Inc., has 0.44%. Retail investors hold the rest.

Regency Silver has 112.56 million shares outstanding. Its market cap is CA$16.13M. Its 52-week range is CA$0.09–0.30 per share.

| Want to be the first to know about interesting Gold, Copper and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Regency Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Regency Silver Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Regency Silver Corp., Pan American Silver Corp., First Majestic Silver Corp., and Agnico Eagle Gold Mines Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on September 10, 2025

- For the quoted article (published on September 10, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.