Regency Silver Corp. (RSMX:TSXV; RSMXF:OTCQB) is a Canadian resource company focused on high-grade silver, gold, and copper exploration in Mexico. Its flagship asset is the Dios Padre Silver Project in Sonora, one of the country's most established mining jurisdictions with reliable road access, power, and a skilled local workforce. The company's strategy is straightforward: acquire and advance high-potential projects that can deliver value through development, sale, or spinout.

At Dios Padre, recent drilling has expanded a gold-rich breccia zone north of the historic mine, with standout results including 36 m of 6.84 g/t gold, 0.88% copper, and 21.8 g/t silver (REG-22-01), 29.4 m of 6.32 g/t gold (REG-23-14), and 38 m of 7.36 g/t gold within 54.65 m grading 5.34 g/t gold (REG-23-21). Importantly, this zone remains open in multiple directions. Dios Padre is a high sulfidation/porphyry mineralized system which has the potential for significant size.

The project also benefits from a NI 43-101 resource covering the historic mine area, outlining an inferred resource of 1.384 Mt grading 255.64 g/t Ag Eq for 11.375 Moz Ag Eq.

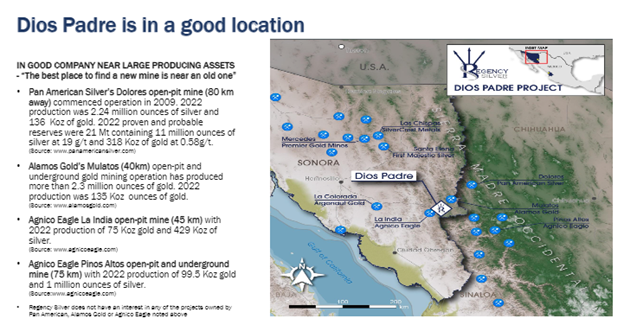

The Dios Padre Project sits in Sonora, Mexico, along the same mineral belt that hosts some of the country's most prolific gold and silver mines. The project lies within sight of producing headframes operated by major companies, a reminder that "the best place to find a new mine is near an old one."

Within an 80 km radius are Pan American Silver Corp.'s (PAAS:TSX; PAAS:NASDAQ) Dolores mine, Alamos Gold Inc.'s (AGI:TSX; AGI:NYSE) Mulatos mine, and Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) La India and Pinos Altos operations, all long-life producers with multi-million-ounce gold and silver endowments.

Dios Padre's position in this proven district underscores its potential: it shares the same regional structures, geologic setting, and infrastructure that have already supported large-scale discoveries and operating mines. Being in the "shadow of the headframe" provides a strategic advantage, both geologically and commercially, as majors continue to seek new ounces close to their existing mills and mines.

Why Regency Silver?

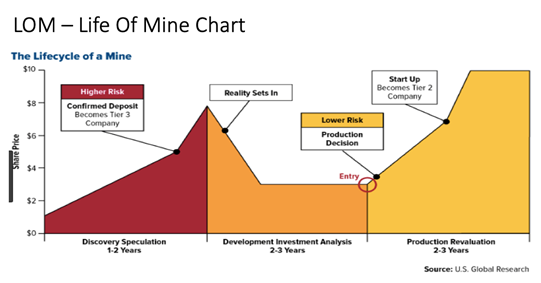

The Life of Mine (LOM) cycle shows how junior explorers create the most value during the discovery stage.

This is the point where share prices often move sharply higher as new mineralized zones are defined, well before the long and capital-intensive path toward development and production.

For most projects, the timeline from discovery to mine can stretch five to seven years, and share prices often stagnate during the permitting and build phases. Even in a mining-friendly jurisdiction like Mexico, advancing through development takes patience and significant capital.

Regency Silver's strategy is to stay focused on discovery. The company drills promising prospects, advances them to an NI 43-101 resource, and positions them as attractive acquisition targets for mid-tier and major producers looking to replenish their pipelines. Operating in Mexico allows year-round exploration, which accelerates this process.

By concentrating on new discoveries, Regency aims to shorten the investment cycle for shareholders, capturing the value spike seen at the discovery stage rather than waiting years for production. If building a mine proves the best way to deliver value, management has the experience and track record to finance and construct one, but the focus today is firmly on discovery, where the potential for outsized returns is strongest.

Management

Regency Silver's management team brings deep experience in Mexico and a proven record of creating shareholder value.

Executive Chairman and CEO Mr. Bruce Bragagnolo has spent more than two decades building and financing mining companies in the country. He is best known as the co-founder and former CEO of Timmins Gold Corp., where he took the company through its IPO in 2006, into commercial production in 2010, and onto the NYSE-MKT in 2011. Under his leadership, Timmins Gold built the San Francisco Mine in Sonora on time and on budget, growing from a CA$7M IPO to a US$475M market cap by 2012, and reaching peak production of more than 120,000 ounces of gold in 2014. During that time, he raised over CA$75M in equity and CA$18M in debt to fund growth.

Mr. Bragagnolo also co-founded Silvermex Resources Ltd., taking it from a CA$7M IPO to its eventual sale to First Majestic for CA$175M. Earlier in his career, he served as a director of Continuum Resources Ltd., which acquired the San Jose Mine in Oaxaca, today Fortuna Silver's flagship operation, producing over 5.7M ounces of silver and 34,000 ounces of gold in 2022.

Supporting him is a board and technical team with equally strong credentials. Mr. Patrick Elliott, an economic geologist and CEO of Forte Minerals, brings capital markets and exploration expertise. Mr. Michael Tucker, P.Geo., acts as Qualified Person and director, contributing years of field experience. Mr. Frank Córdova leads Mexican operations, with longstanding relationships across government and industry that help move projects forward.

Simply put, this is the kind of team that knows how to find, finance, and build mines in Mexico.

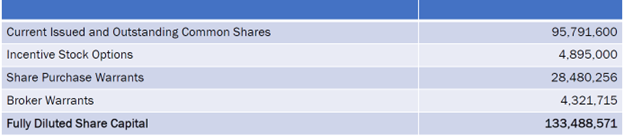

Market Capitalization and Share Structure

As of the latest update, Regency Silver has 95.7 million shares outstanding, giving it a market capitalization of approximately CA$21 million at CA$0.22 per share.

On a fully diluted basis, including 4.89 million options, 28.5 million warrants, and 28.5 million broker warrants, the company would have 133.45 million shares outstanding.

Technical Analysis

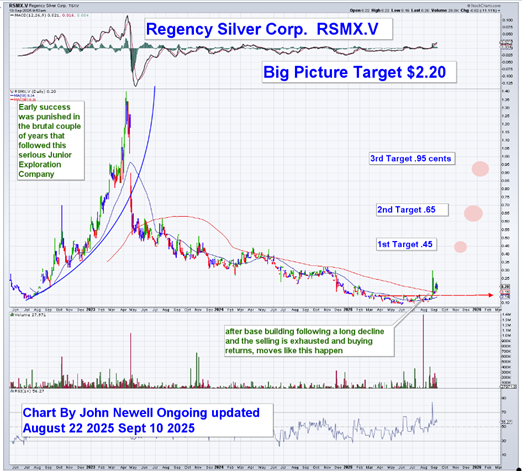

The chart shows a long decline during the relentless bear market the junior explorers faced for the last 10 years, but particularly cruel was the last two, until this dramatic turnaround. The shares have been base building through 2024–2025, and then a surge on expanding volume as the price pushed through a flat base. Momentum has turned up from oversold, and the MACD has turned higher. My targets are as follows:

- First Target: CA$0.45

- Second Target: CA$0.65

- Third Target: CA$0.95

- Big-Picture Target: CA$2.20

I would keep risk tight against the recent breakout area until we see a clean close and hold above the base and the 200-day moving average. If volume continues to expand on up days, the odds of a measured move toward the first target improve.

Conclusion

Regency Silver offers a discovery story with clear catalysts: high-grade intercepts in a growing breccia body, a historic silver resource beside existing workings, and a management team that has built mines and created value in Mexico before. The system remains open, and continued drilling has the potential to significantly expand the scale of the project.

With experienced leadership advancing a gold-silver discovery during a historic precious metals bull market, Regency Silver stands out as a compelling exploration play. For these reasons, we view the company as a Speculative Buy at the current price of CA$ 0.14.

Investors can find more information at: www.regency-silver.com.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Regency Silver Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver Corp. and Agnico Eagle Gold Mines Ltd.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.