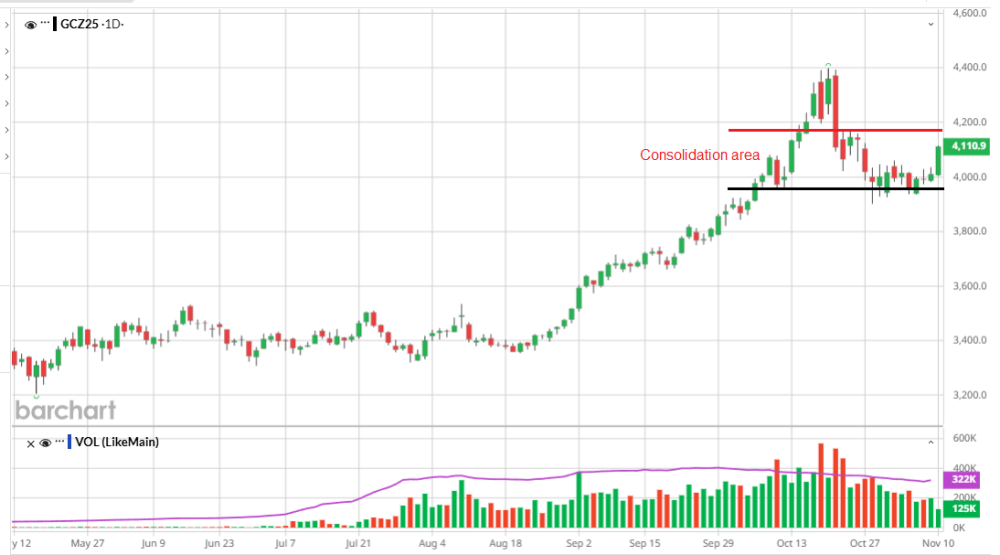

Gold has been bouncing around the bottom of my predicted consolidation range for almost two weeks and finally broke out above that on Monday.

I expect we will soon see a move to the top of this range. Whether we break out above $4,200 near term is hard to call. However, it is just a matter of time before we test $4,400 area and new highs.

All the drives of this bull market are still in place.

A lot of our gold picks reported strong Q3 results, but not so much. . .

B2Gold

Recent Price - $5.80

Entry Price - $4.45

Opinion - Buy

B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) dropped more than most gold producers in the correction. I was back and forth to go with a buy or hold, but I believe all the not-so-good news is priced in. The stock is oversold. First off, their Q3 results were disappointing and not as strong as others due to a few factors.

The big jump in gold prices occurred in Q3 and was near the peak of that move at the end of September. As a result, there was a loss in derivative instruments of $106 million in Q3, primarily consisting of unrealized losses on the company's gold collars.

In January 2024, B2Gold entered into the Gold Prepay with a number of its existing lenders. The company received an upfront payment of $500 million, based on gold forward curve prices averaging approximately $2,191 per ounce, in exchange for equal monthly deliveries of gold from July 2025 to June 2026, totaling 264,768 ounces, representing approximately 12% of expected annual gold production in each of 2025 and 2026. This is not a lot, but still about 12% of production will get a much lower gold price than current prices.

Derivatives are used quite often with new mine start-ups (Goose Mine) to manage risk. However, with the big increase in gold prices, the negative aspect of these derivatives can be seen.

The Goose Mine start-up was slower than anticipated, and B2Gold only sold about 8,000 or 9,000 ounces of gold in Q3 from Goose. Also, capital expenditures were still high at Goose.

Their CFO, Michael Cinnamond, addressed this in the Q&A: "Yes. So I'd say if you look at the budget that we put out for half 2, it was $176 million. And we didn't give a split, but it was heavily weighted to Q3. So the budget was roughly $130 million for Q3 and then $45 million, $46 million for Q4. So in Q3, the recorded CapEx in the financials was $157 million."

The biggest negative factor, or should we say investor fears, comes from media news that al-Qaeda might take over Mali. This is exaggerated as the media likes to promote a headline. The consensus I see is that al-Qaeda would like to see a government change (no interest in mines), but they don't have the military strength to take the capital, Bamako. However, they have been effective in a fuel blockade on the city. B2Gold's mine is 500 km away, and I don't think it will be affected, but nevertheless, the market is putting a significant risk of this on the share price. B2Gold's CEO addressed this in the Q3 conference call.

Clive Johnson: "I think what I think are some responsible headlines from some of the media talking about that it's imminent that a terrorist group organization is going to take over Bamako in the country of Mali. We think that is completely erroneous, and it's a great exaggeration of the situation. Yes, there have been some fuel challenges, particularly in Bamako, but we continue to run the mine as we have for many years now and haven't missed any mining due to any kind of political situation or turmoil associated with that. So the mine continues to run well. We're 500 kilometers from Bamako. And we look at the situation that the government still enjoys popular support from the population.

The U.S. came out and posted — they supported Mali military and said they're looking forward to closer collaboration, working on intelligence together. There's no Western company that wants to see Mali fall into other hands, and there's a lot of international support gathering. So we're very confident of our ability to continue to produce in Mali and work very closely with the Mali government."

In Q4, B2Gold will see much stronger production at the Goose mine, and capital expenditures will be much lower. The derivative losses won't be nearly as much unless gold goes up another $800 to $5,000 per ounce, but that will far outweigh the derivatives' effect.

And finally, I believe their Fekola mine in Mali will continue with strong results.

On the chart, a correction comparable to other gold stocks would have been a drop to around $6.90, but Q3 results and the Mali fear factor drove it much lower. I had a stop/loss at $6.00. If you got stopped out, I would buy back.

In contrast, here are a couple of our gold picks that have good Q3 Results. . .

Equinox Gold

Recent Price - $17.08

Entry Price - $5.35

Opinion - Hold

Equinox Gold Corp.'s (EQX:TSX; EQX:NYSE.A) stock is almost back up to recent highs around $18.

In Q3 they reported:

- Sold 239,311 ounces of gold at an average realized gold price of $3,397 per oz

- Total cash costs of $1,434 per oz and all-in sustaining costs ("AISC") of $1,833 per oz

- Cash flow from operations before changes in non-cash working capital of $322.1 million ($240.8 million after changes in non-cash working capital)

- Mine-site free cash flow before changes in non-cash working capital of $304.3 million ($223.0 million after changes in non-cash working capital)

- Revenue of $819.0 million

- Adjusted EBITDA of $420.0 million

- Income from mine operations of $280.1 million

Darren Hall, CEO of Equinox Gold, commented: "Equinox Gold delivered another solid quarter with record production of 236,382 ounces and all-in sustaining costs of $1,833 per oz. With Greenstone continuing to improve, Valentine ramping up well, and Nicaragua and Brazil reliably contributing to production and cash flow, we expect a strong finish to the year. The Company remains on track to deliver the mid-point of our 2025 consolidated production guidance, after the divestment of our Nevada assets, and before considering any production from Valentine."

IAMGOLD

Recent Price -$18.56

Entry Price -$3.51

Opinion - Hold

IAMGOLD Corp. (IMG:TSX; IAG:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE) are among the higher gains on our gold stock list, but still well below Discovery's 650% gain.

In Q3, IamGold produced 190,000 ounces of gold:

- Revenues were $706.7 million from sales of 203,000 ounces at an average realized gold price 1 of $3,492 per ounce for the quarter and $1,764.7 million YTD from sales of 559,000 ounces at an average realized gold price of $3,153 per ounce

- Cost of sales per ounce sold was $1,593 ($1,542 YTD), cash cost per ounce sold was $1,588 ($1,537 YTD), and all-in-sustaining cost ("AISC") per ounce sold was $1,956 ($1,969 YTD). The Company expects to achieve the top end of the revised annual attributable cash cost guidance of $1,375 to $1,475 per ounce sold and AISC guidance of $1,830 to $1,930 per ounce sold.

- Net earnings and adjusted net earnings attributable to equity holders1 for the third quarter of $139.4 million ($257.8 million YTD) and $170.9 million ($303.4 million YTD), respectively.

- Net earnings and adjusted net earnings per share attributable to equity holders1 for the third quarter of $0.24 ($0.45 YTD) and $0.30 ($0.53 YTD), respectively.

- Net cash from operating activities was $280.8 million for the third quarter ($440.9 million YTD). Net cash from operating activities, before movements in working capital and non-current ore stockpiles1, was $280.6 million for the third quarter ($512.8 million YTD), net of the impact of delivering 75,000 ounces into the gold prepay obligations.

"The third quarter of 2025 marks a pivotal moment for IAMGOLD as we continue to deliver on our commitment to operational excellence, financial discipline, and responsible growth," said Renaud Adams, President and Chief Executive Officer of IAMGOLD. "Attributable gold production for the quarter was 190,000 ounces, bringing our year-to-date total to 524,000 ounces. Our flagship Côté Gold Mine produced a record 106,000 ounces in the quarter, marking the second consecutive quarter averaging over 30,000 ounces per month. Operating costs continue to see pressure in this strong gold price environment, and while it is important to realize the current gold prices today, we understand the importance of implementing diligent cost controls, particularly ahead of the next stage of organic growth."

"Financially, with a strong third quarter and rising gold prices, the Company has been able to accelerate our strategic initiatives. Our trailing twelve-month EBITDA now exceeds $1 billion, and we have repaid approximately $270 million of our second lien notes, further strengthening our balance sheet and financial flexibility."

Conclusion

The gold market correction is healthy price action. I am looking forward to more big record high gains with our gold stocks. I believe it is still very early days in this bull market.

The recent correction shook out the weak hands and 'Johnny come Lately'. They will be jumping back in at higher prices.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.