Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) reported progress on its 2025 exploration program at the Haldane Silver Property, located in the Keno Hill Silver District of Yukon, Canada. The company has completed six diamond drill holes, totaling 1,300 meters, at the Main Fault target. Five of the six holes have been sampled and sent for analysis, with results expected in early November.

The drilling campaign is focused on expanding the strike length and down-dip continuity of the Main Fault discovery made in 2024. Previous drill results from holes HLD24-29 and HLD24-30 confirmed high-grade silver mineralization, including 1.83 meters (true width) grading 1,088 grams per ton (g/t) silver, 3.90 g/t gold, 1.89% lead, and 0.63% zinc, as well as broader zones such as 5.8 meters (true width) at 365 g/t silver, 0.23 g/t gold, 1.80% lead, and 1.37% zinc.

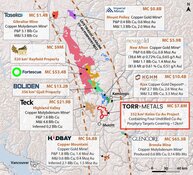

The Haldane Property covers 8,579 hectares and is road-accessible, located approximately 25 kilometers west of Keno City. It sits adjacent to Hecla Mining's producing Keno Hill Silver Mine property and features vein systems characteristic of the region, including silver-lead-zinc-bearing quartz-siderite structures.

President and CEO Jason Weber stated in the press release, "We have successfully tested the strike extension on sections to the northeast as well as to the southwest. We have yet to receive analytical results from the initial holes, but expect to have the first set of results in early November."

The 2025 program aims to continue defining the potential of three stacked high-grade silver-bearing veins intersected in 2024. The first hole of the 2025 campaign (HLD25-31) targeted mineralization approximately 80 meters down-dip from previous intercepts. Additional holes are testing areas 50 to 100 meters southwest and 50 meters northeast of the 2024 discovery section.

Silver North has engaged Paycore Diamond Drilling as the drill contractor and Hardline Exploration Services Ltd. for technical and camp support. The program is scheduled to conclude in early November.

Silver Sector Strengthens Amid Record Pricing and Tight Supply

The silver sector has entered a period of renewed focus following a historic breakout in prices and tightening global inventories. According to Peter Krauth in his October 15 article, silver reached a new all-time high of US$53 per ounce in early trading on October 14. He noted that this marked the first time since 1980 that silver has sustainably surpassed the US$50 threshold, describing the move as "the biggest technical price breakout in modern history."

Krauth attributed the rally to a combination of rising gold prices, investor concern over currency debasement, and geopolitical tensions, all layered on top of what he called an "extreme tightness in the silver market." He reported that inventories across the Comex, LBMA, and Shanghai futures markets had "shrunk dramatically," while silver lease rates had surged.

Kristie Batten of Mining echoed this sentiment in her October 16 report for Stockhead, stating that silver's breakout past US$50 per ounce in September had triggered significant interest. Blue Ocean Equities estimated that silver was up approximately 65% year-to-date, outpacing gold's 50% rise. Analyst Carlos Crowley Vazquez noted that "a lack of liquidity continues to cause issues in the silver market," while ANZ Research highlighted that increased demand from India and strong inflows into silver-backed ETFs had tightened available bar supply in London. Silver lease rates had reportedly spiked to around 30%.

The structural deficit in silver supply was also emphasized. Crowley Vazquez cited data from The Silver Institute showing silver was expected to be in deficit for the fifth straight year. He explained that major producing countries like Mexico and Peru had not become more mining-friendly, and that new supply remained limited. At the same time, silver demand was growing from both industrial sectors, and its recent designation as a critical mineral in the United States, which he believed could lead to further stockpiling.

Additional context was provided by Shad Marquitz in his October 16 update for Excelsior Prosperity. He observed that silver prices had climbed from just above US$30 to over US$50 in 2025, breaking through the long-standing resistance levels set in 1980 and 2011. Marquitz described the move as "bull market action," emphasizing that spot prices were now well above the 50-day exponential moving average of US$44.21.

He added that margin expansion among silver producers had been happening quickly, outpacing cost increases and creating what he described as "valuation arbitrages" in company valuations. Marquitz noted that the Global X Silver Miners ETF (SIL) had surged 247% from its January low to its October 15 close, with individual silver producers in the ETF showing even greater gains.

Experts Highlight Silver North's Value and Exploration Potential

Analysts and industry commentators have maintained a favorable view of Silver North Resources Ltd., noting the company's exploration potential and positioning within a strengthening silver market.

In July, Bob Moriarty of 321 Gold described Silver North as "one more example of an absurdly low-priced stock getting cashed up and preparing to generate results." He added that "silver is going to be hot this year, and the company is going to get popular," underscoring confidence in its exploration trajectory and timing within a bullish sector environment.

More recently, on August 11, Michael Ballanger of GGM Advisory Inc. offered supportive commentary on the company in his Streetwise Reports analysis. Ballanger observed that while silver prices had shown short-term consolidation, "the visionary silver miners are acting as though the physical silver price is an ordained meeting with $50-plus coming by Labor Day." He indicated continued faith in select silver equities, noting his intent to "place faith and trust in the shares and continue to hold," reflecting confidence in companies advancing exploration in this high-price environment.

Richard Mills, writing on September 18, pointed to Silver North Resources Ltd. as one of the rare pure-play silver stories in an environment of surging prices and tightening global supply. He emphasized the significance of the company's ongoing 2025 drill campaign, which began in mid-August and targeted 10 holes totaling approximately 2,500 meters at its flagship Haldane silver project in Yukon's Keno Hill Silver District. Mills highlighted that the current program builds on the Main Fault discovery made in 2024, which included three stacked silver-bearing veins in a 28.36-meter-wide structural zone. He quoted CEO Jason Weber, who said the aim of the program is "to build upon last year's results and expand beyond the discovery section."

Michael Ballanger shared an update on the company, following the above news, saying, "Encouraging news from Silver North. Despite expecting a modest pullback in silver and gold, I like the exploration potential of this company and am going to add to my holdings . . . Assays are due in early November. If they match last year's results, ("5.8 m (true width) 365 g/t silver, 0.23 g/t gold, 1.80 % lead and 1.37 % zinc") the stock will rebound sharply."

Mills noted that Silver North had already made three discoveries from only 16 holes, calling it "a phenomenal success rate for an early-stage junior."

He explained that the Main Fault appears to host multiple high-grade veins and breccias, with intersections such as 1.83 meters at 1,088 g/t silver and 5.8 meters at 365 g/t silver. Mills believed the mineralization was comparable to that being mined next door at Hecla's Keno Hill operation, where the average mine holds about 30 million ounces of silver at 1,100 g/t.

He added, "SNAG thinks drilling this year is going to, at the very least, achieve clear visibility towards attaining a 30-million-oz regular Keno deposit."

In terms of broader positioning, Mills stated that Silver North is one of the few active silver exploration plays in a district that has already produced over 200 million ounces of high-grade silver. He underscored the potential strategic value of the project, given that it sits just two kilometers from Hecla Mining's mill. "If Silver North can show they have 30, 40, 50 million ounces of silver, I'm thinking they will be looked at pretty hard by Hecla," he wrote.

Mills also noted that the company had recently raised CA$2.1 million to support the current program and closed at a share price of CA$0.38 on September 15 with a market capitalization of CA$24.2 million. He concluded by calling Silver North "cheap, with a great story and money in the bank," and emphasized that the stock was already up 375% year to date.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB)

On October 17, 2025, Michael Ballanger shared an update on the company, following the above news, saying, "Encouraging news from Silver North. Despite expecting a modest pullback in silver and gold, I like the exploration potential of this company and am going to add to my holdings . . . Assays are due in early November. If they match last year's results, ("5.8 m (true width) 365 g/t silver, 0.23 g/t gold, 1.80 % lead and 1.37 % zinc") the stock will rebound sharply."

Expanding a Blind Discovery in a Proven District

The Haldane Silver Property lies within a district that has produced over 220 million ounces of silver at an average grade of 1,137 g/t. Silver North's discovery at the Main Fault target has opened up new potential in a previously under-explored portion of the historic Keno Hill Silver District.

According to Silver North's corporate presentation, three new vein discoveries have been made from just 16 holes drilled at Haldane to date, with a 75% success rate in encountering silver mineralization. The company plans to complete 10 to 12 drill holes totaling approximately 2,500 meters in 2025, primarily focused on expanding the Main Fault zone.

Beyond Haldane, Silver North also holds the Tim Property, which is optioned to Coeur Mining. Tim has shown characteristics of a carbonate replacement deposit (CRD) system, and Coeur recently completed a 2,250-meter drill program confirming the presence of mineralization similar to its Silvertip Mine 19 kilometers south.

Ownership and Share Structure

According to the company, ownership is distributed as follows: private individuals own 19%, management owns 16%, funds own 12%, and the rest is retail.

The company has a market cap of CA$22.18 million and a 52-week range of CA$0.07–CA$0.43 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.