Well, we are in the middle of the dog days of summer, and I am back on the keyboard after taking my first four-week hiatus from writing about stocks, bonds, gold, silver, and all of the weird and wonderful characters that dominate the world of high (and low) finance.

In the past six weeks, I have cruised the Rhine River Valley of Germany on one of those decadent long ships that provide you with all the luxuries of a five-star hotel but with breathtaking views and wonderful excursions every morning and afternoon. I have toured the Swiss Alps, including a ride on the incredible mountain railway constructed by the Swiss through the Jungfrau, one of the main summits of the Bernese Alps, located between the northern canton of Bern and the southern canton of Valais, halfway between Interlaken and Fiesch.

Together with the Eiger and Mönch, the Jungfrau forms a massive wall of mountains overlooking the Bernese Oberland and the Swiss Plateau, one of the most distinctive sights of the Swiss Alps. I also lost one of my truly dear friends, a boating buddy with whom I spent most of the last 12 summers exploring the wonders of northern Georgian Bay.

All in all, the summer of 2025 had been one gigantic epiphany, a series of events and experiences that leave a man in a constant state of flux, unsure of what it all means and how one should react. The world is at once a wonderful, beautiful, and many times cruel place to inhabit where nature's beauty and man-made feats of wonder are numbed by the agony of loss. It is even more impactful when you encounter such events in the twilight of one's life, when even a Great Lakes sunset can bring on retrospection and regret.

Carpe diem!

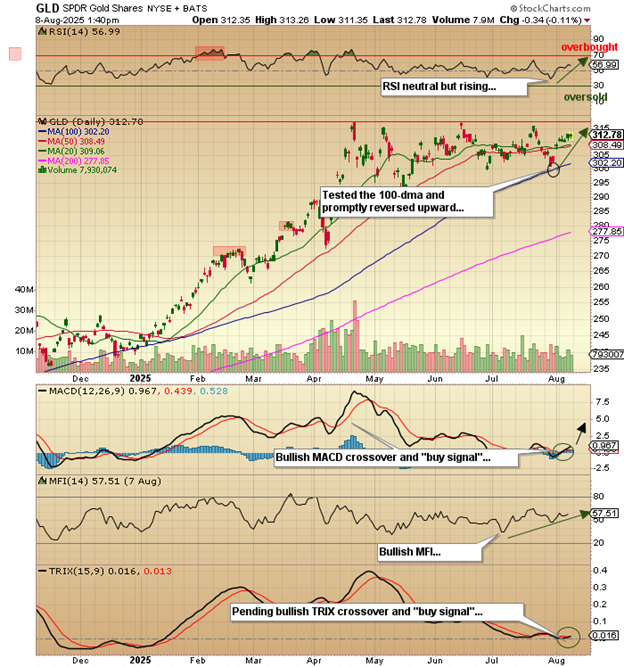

Gold

This past week saw the tumbling of $3,509 as the registered record gold price after tariffs were proposed on gold imports into the United States by the Trump administration, sending the December gold contract to $3,534.10. This followed new multi-year highs for the HUI, the XAU, and the TGD, as well as the junior and senior gold miner ETFs (GDX:US and GDXJ:US). As if following the baton of a world-class orchestra leader, physical gold responded as usual to the record highs in the gold mining shares, once again cementing the miners' lead indicator status when it comes to the precious metals.

The junior miners have also started to respond, and no better place to look than Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), the Nevada-based developer/explorer whose moribund share price performance since 2020 has driven me to darkness, depression, and drink on more than one occasion.

When I first launched the GGM Advisory in January 2020, gold was trading at US$1,525 per ounce. Getchell was put on the list of recommended gold developers at a price of CA$0.15 / US$0.12 per share and within two years was trading over CA$0.80 / US$0.62 for a gain of over 600%. This was all during a period in which the gold price exceeded $2,000/oz., while GTCH/GGLDF reported two new gold-bearing zones, including 25 meters of 10.4 g/t Au at the North Fork Zone.

Since I was convinced that gold would continue to advance, I kept looking at the results of the drill program and concluded that the stock was still cheap, not recognizing that junior developers were about to enter a three-year period of what the pundits call "consolidation." In the world of trading and investing, the term "consolidation" is synonymous with "decline," and that is exactly what we were forced to endure until early 2024 when Getchell pulled a rabbit out of its posterior region and raised the minimum US$1.6m, representing the final installment in the 100% purchase of Fondaway Canyon. The move this week to CA$0.34 is a multi-year high and the highest print since April 2023.

Now, I am not going to prattle on about the absurd pricing of Getchell's Fondaway Canyon asset nor about the street's continued obsession over metallurgy, which was clarified in full with the release of the January 2025 Preliminary Economic Assessment for the project, in which they fully put to bed any notion of metallurgical issues. In fact, that PEA demonstrated a robust outcome for Fondaway , including a 46.7% IRR, DNPV of US$474 million over a ten-year Life of Mine. So, with the stock tapping the CA$0.34 / US$0.27 level yesterday, it is capped at a mere US$76 million or a value per in-ground ounces of $32. For an asset of this calibre and potential magnitude (wide open in all directions and to depth), that $32/ounce number should be a great deal higher.

Getchell Gold is one of many junior developers suffering the same plight with assets just big or rich enough to tempt feasibility studies but not quite big enough to attract major capital markets coverage or corporate M&A activity. In time and with further drilling, the shortfalls can be minimized, but until then, it is like fingernails on a blackboard.

As a group, the developers are poised to take the lead in terms of expected returns and the senior and intermediate producers have now had huge advances for the fiscal year and may be set on the back burner while the junior developers play "catch-up."

Silver

September silver has been trading sideways between the old resistance band in the $35-36 range and the overhead resistance at $40. I flattened all leveraged positions a few sessions ago on the assumption that there would be a retest of that old band of resistance, which, with help from the trading gods, can hold even during an equity market correction, which is surely coming through the tunnel and directly at us.

I type this with very frail and feeble conviction because the visionary silver miners are acting as though the physical silver price is an ordained meeting with $50-plus coming by Labor Day.

Hence, I am placing my faith and trust in the shares and continue to hold Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) and Carlton Precious Inc (CPI:TSXV; NBRFF:OTCMKTS), both having completed financings in the past few weeks.

Copper

September copper futures crashed while I was enjoying the final two days of our Swiss adventure, and while it underscored the volatile nature of the Trump presidency, I want to repost the quote from the July 14 weekly missive in which I wrote:

"The spike in copper prices yesterday to $5.8845 in response to the "50% tariff on all imported copper products' threatened by the White House is what I consider a "tail event" and therefore will not have a lasting bullish effect on prices."

Two weeks later, copper had the biggest one-day decline in its Comex history dating back to 1969, all thanks to an about-face by the White House exempting raw copper from tariff treatment which led to a 20% crash. As I discussed before I departed for Europe, the LME price at $4.40 was trading a full $1.50 lower than the tariff-induced U.S. price, so chasing the U.S. domestic appeared to be a high-risk venture, while basing decisions on copper by following the LME (i.e., "international") price for copper seemed far more prudent.

As we probe further and further into the seasonally-weakest two months of the trading year, I fear that the near-perfect correlation between the S&P 500 and the price of copper will ultimately bring copper back below US$4.00 per pound and favorites like Freeport-McMoRan Inc. (FCX:NYSE), which I exited before the Rhine cruise above $45 will see the $35-36 range before finding a bottom. I also stepped aside from Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX) in the US$9.00 range and think that US$7.25 will be a great re-entry level.

Copper remains my top pick for the decade and expect to see $6.80/lb. ($15k / metric tonne) at a minimum before any new supply shows up. Junior copper developers like Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) are perfectly-positioned to benefit from their dual projects in Chile.

The company is developing a copper-bearing oxide deposit at Buen Retiro and a new and very impressive discovery at Caballos.

Results are pending. . .

Stocks

Thus far, few are heeding the warnings of noted market strategists like Warren Buffett, whose Berkshire Hathaway is sitting on over US$360 billion in cash. I am also in the bear camp because as far as the eye can see, there are no bears left anywhere in today's markets. Short interest is at generational lows; put premiums are absurdly cheap; and the lust for portfolio insurance has been thrown under a busload of cheerleading crypto-junkies. Whenever the markets are as overpopulated with male bovine DNA, a correction is rarely that far away.

While it has been an elusive trade, I am flying in the face of an advancing storm in expecting Tesla Inc. (TSLA:NASDAQ) to crash and test the April 7 lows at $220. It has dipped under $300 a couple of times is closing out the week with a 10% advance. Nevertheless, I consider TSLA a bubble in search of a pin because as an EV manufacturer, they are failing and as a robotics manufacturer, they are unproven and as an "AI developer", they are sadly lagging.

All of these rather fundamental issues, while the Chinese EV manufacturer BYD ("Build Your Dreams") is rapidly taking market share from TSLA. However, it remains both elevated and a favorite of the social media crowd, so it is definitely "caveat emptor" when it comes to betting against Elon.

This week I opened a second tranche in the TSLA September $270 puts and a fourth tranche in the volatility trade buying the VIX October $20 calls. I consider TSLA:US as a laser-beamed proxy for a 15-20% correction in the S&P and NASDAQ with it all happening by October.

Rabbit's feet, four-leaf clovers, salt over the shoulder, and a Haitian voodoo doll are in order. . .

| Want to be the first to know about interesting Gold, Copper and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Silver North Resources Ltd., Carlton Precious Inc., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp., Silver North Resources Ltd., Carlton Precious Inc., Fitzroy Minerals Inc., and Tesla Inc. My company has a financial relationship with: None.My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.